Energy Price Reform and Energy Efficiency in Iran

advertisement

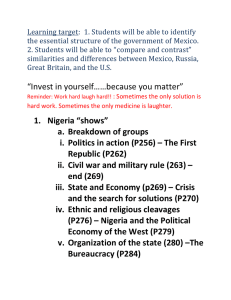

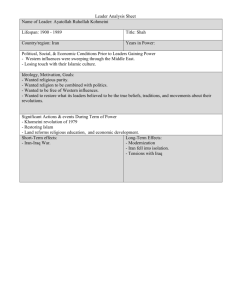

International Association for Energy Economics | 33 Energy Price Reform and Energy Efficiency in Iran By Saeed Moshiri* Introduction Iran is an energy-rich country possessing 11 percent of global oil reserves and 15.3 percent of global natural gas reserves. Ranked 2nd among OPEC and with a potential for natural gas exports to Europe and Asia, Iran also plays a significant role in the world energy market and the global economy. However, Iran’s rapidly growing own energy consumption (about 6 percent per year for the past 30 years) has raised concerns about the country’s ability to continue to export oil in the next decade. The main driving forces behind the rising trend of energy consumption are economic growth (5 percent for the past 40 years) and population growth (about 2 percent), and heavily subsidized energy markets (12 percent of the GDP) (Iran Energy Balance, 2010; Central Bank of Iran Economic Indicators, 2011). The latter, along with other factors such as poor management, lack of investment, and structure of the economy with a lion’s share of economic activities controlled by government, have led to an inefficient use of energy. The energy intensity index in Iran is one of the highest in the world (twice as much as the world average) and has been increasing on average by about 3.4 percent per year over the past 40 years (Iran Energy Balance, 2010; EIA, 2011). The substantial subsidizing of energy prices over the years has also led to low productivity in the energy-intensive industries, deterioration of environment in urban areas, and a huge burden on the government budget leading to macroeconomic disturbances. To address the increasing economic and social problems associated with high energy subsidies, Iran implemented an aggressive and wide-ranging energy price reform through which energy subsidies were to be removed in 2010. The main objectives of the reform plan were twofold: to bring the government budget in control and to cut energy consumption. In this article, I review the energy market and the energy price reform in Iran with a focus on energy efficiency. Energy Market in Iran The energy market in Iran is highly centralized, with the government owning the oil and natural gas reserves, operating the processing plants, setting production and trade levels, the distribution mechanism, and prices. Iran produces about 1551 Mboe total primary energy including 4 bbl/day of oil and 85 bcm of natural gas (7th in the world). Iran exports about 2.5 bbl/d of oil (4th in the world and 2nd in OPEC) and 3.6 bcm of natural gas (to Turkey) and imports about 5 bcm natural gas (mostly in a form of swap with northern neighboring countries). Iran also has about 38 GW of electricity generation capacity and produces about 190 TWh electricity. The final energy consumption is approximately 1166 mboe with the following sectoral breakdown: household, public, and commercial 37%, industry 22%, transport 27%, agriculture 4%, and nonenergy use 11% (Iran Energy Balance, 2010). Figure 1 shows the total primary energy consumption and energy Figure 1. Total Primary Energy Consumption and Energy intensity trend in Iran. A scenario study by Moshiri et al. (2012) shows that Intensity in Iran Notes: Total Primary Energy Consumption (TPEC) is in Quadrillion BTU under the Business-As-Usual (BAU) scenario, total de(right axis) and the energy intensity in the TPEC (BTU) per 2005 US dollar mand for final energy will double by 2030, increasing on of GDP (market exchange rates). Source:The Titi Tudorancea Bulletin, Global average 2.8 percent per year. Manufacturing industries Edition (http://www.tititudorancea.com/) will have the highest growth in demand for energy with an average growth of 3.4 percent per year followed by the residential and transport sectors with 3.2 and 2 percent annual growth, respectively. Demand for energy in other sectors (commercial, agricultural, public) will grow on average 1.7 percent. In the BAU scenario, natural gas demand will have the highest growth rate with about 4 percent growth per year on average. The demand for oil products (fuel oil, gas oil, and gasoline) will grow on average between 1 and *Saeed Moshiri is with STM College, University of Saskatchewan, Saskatoon, SK, Canada. 2.2 percent, and demand for kerosene will decrease on average 4.7 percent per He may be reached at moshiri.s@usask.ca year. The study also projects that the CO2 emissions will double under the BAU See footnotes at end of text. scenario over the next 25 years. 34 | Second Quarter 2013 The price of energy in Iran has been heavily subsidized. The subsidies are as high as 12 percent of GDP, depending on the definition of the subsidy (direct or indirect) and world energy prices. The gasoline subsidy, resulting in a price of 10 cents per liter in 2010, has been one of the most egregious cases. The very low gas prices, along with an increase in population, urbanization, and increasing domestic car production, has increased gas consumption to 70 million liters per day, much higher than domestic production. In 2010, the government drew on the Foreign Reserve Fund to import gasoline to catch up with the increasing demand at subsidized prices. Overall, the energy price index has increased on average by 13 percent per year and the non-energy price index by 16 percent per year for the period 2001-2008. The energy expenditures share of total expenditures by household has declined from 4 percent to 2.7 percent for the same period (IEA/WI, 2010). The Energy Price Reform To bring the budget deficit under control and to manage the increasing trend of energy consumption, the government embarked on an aggressive and ambitious energy price reform in February 2010. According to the reform passed by the parliament, the so-called Targeted Subsidies Law, energy (petrol, oil, liquefied gas and kerosene) prices would increase up to 90 percent of the border prices in five years (at least 75 percent of the export prices for natural gas). Electricity prices would also increase to cover production cost. The prices would increase in the first year of the plan so as to bring in between $10 billion to $20 billion in revenues. The allocation of the proceedings was also specified in the law as follows: 50% to be distributed in the form of cash handouts to households, 30% to support industries affected by the energy price hikes, public transportation, and infrastructure, and 20% to cover discretionary expenses. Gasoline prices quadrupled (from 1000 rials per liter to 4000 rials per liter) for the monthly quota of 60 liters per passenger car and increased by a factor of 7 for over–the–quota consumption1. The price of natural gas increased by a factor of 7 (from 100–130 rials per cm to 700 rials) for households and by a factor of 15 (from 50 rials per cm to 800 rials) for power plants. The price of electricity almost tripled from an average 160 rials (1.6 cents) per kWh to 450 rials (4.5 cents) per kWh (Figure 2). The price increases were progressive, and the rates varied among different sectors and regions (Organization for Support of Consumer and Producers, 2012). The parliament passed a budget of 54,000 billion rials for 15 months (44,000 billion rials for 12 months). To reduce the impact of the subsidy removal on low-income households, government distributed 455,000 rials (about $45 given the exchange rate then) per month to individuals who had already registered in a government site online. The energy price reform was an unprecedented step to increase all energy prices dramatically with short notice. Such Figure 2. Energy Prices in Iran (rial/unit of energy) huge price changes in energy, which has a low price elasticity of demand, does not usually take place without major soNotes: Gasoline price is on right-axes. The exchange rate in 2010 was US $1=10,000 rial. The electricity and natural gas prices are for residential cial and political unrest, particularly in developing countries, consumption and the gasoline prices are for the regular gas for the 60 liter where a significant number of people live below or close to monthly quota. Sources: Energy balance (2010) and Ministry or Oil and the poverty line and will be adversely affected by sudden Ministry of Energy Reports. price hikes. However, the first stage of the reform was successfully implemented without serious social or economic disruption. The main objectives of the plan were to decrease government spending on energy subsidies, particularly direct subsidies on gasoline, and to lower energy consumption. Both objectives were partially met: • Government revenue from increasing energy prices was 44000 billion rials, 90 percent of which was distributed to households in the form of monthly cash handouts. The successful administration of the reform through the online self-registration system, the automatic cash payments, and the design of the smart cards for monitoring gasoline consumption on such a large scale was critical in the general acceptance of the reform. • The energy consumption trend was stabilized after the reform. For instance, gasoline consumption decreased from about 64 million liters per day to 59 million liters per day, despite the fact that about 1 million cars per year were added to Iran’s fleet. It is not yet clear how much of this consumption cut was due to a reduction in smuggling and how much was due to a change in con- International Association for Energy Economics sumption behavior. Electricity consumption also declined, but rebounded after few months of the reform, perhaps due to the income effect of the cash hand out. (ISNA, 25 May 2012). Although the reform has been relatively successful in removing energy subsidies, stabilizing energy consumption, and managing regular cash handouts, its effects on energy efficiency are not clear due to the lack of efficiency programs, inflationary effects of the reform, the lack of support for industry in the transition period, and the lack of a plan for structural changes in the energy market and the economy. The main problem with the reform program is the lack of a plan for energy efficiency. The energy price reform is necessary, but is by no means a sufficient policy to address the energy problems in Iran. The reform needs to lay out explicitly a program with a specific timeline and measures to achieve energy efficiency. In fact, energy efficiency should be the most important objective of energy reform, as it will ensure lower consumption and more national savings and higher growth in the long-run. Evidence suggests that government efforts at energy efficiency have even declined as policy makers and officials thought price changes would automatically solve the inefficiency problem in the energy market. A scenario study by Moshiri et al. (2012) shows that the energy saving potential is more than 50 percent in the household sector, and 41 percent in the industry sector over the next 25 years. The removal of subsidies is a prerequisite for instituting energy efficiency measures, but it should be accompanied by a series of non-price policies before it can improve the efficiency level. For instance, the revenue from the subsidy removal can be allocated by offering monetary and non-monetary incentives to producers who adopt energy efficiency measures, such as tax rebates, long term subsidized loans, flexible output pricing, access to foreign exchange at preferred rates, education of know-how, on-the-job training programs, research and development. The subsidy removal revenues can also be allocated to increase demand for high efficiency products through programs such as providing small loans to households for purchasing new efficient appliances,2 buying back old, inefficient appliances, distributing cheap, low-consumption lamps, providing loans and technical assistance for retrofitting old buildings, and raising public awareness about energy efficiency.3 For example, one of the policies to promote the use of more efficient appliances is to subsidize the producers of high-efficiency refrigerators and freezers. The policy can provide subsidies to domestic producers based on efficiency increases. A benefit-cost analysis shows that the net benefit of subsidizing high-efficiency refrigerator/freezer production is positive. The amount of subsidy will be equal to the energy savings by higher efficiency refrigerators/freezers for five years4 (Ismaielnia, 2010). Energy price reform is a golden opportunity to raise awareness and educate people and businesses about the importance of energy conservation and efficiency measures. It is also a great opportunity to embark on a long-term investment plan for CHP and alternative renewable energies, which are abundant in Iran. The second problem with the plan is the lack of support for industry. Government did not honour its commitment to support industries as 90 percent of the proceedings of subsidy removal were allocated to the household cash rebate program. Most of the Iranian industries were established long ago, based on the import-substitution strategy in the 1970s and, therefore, relied heavily on government protection through high tariffs and subsidies on capital, taxes, and energy. The removal of energy subsidies placed a huge burden on energy-intensive industries, such as steel and car manufacturing, food and beverages, power plants, and petrochemicals. Although the energy price reform was necessary to revitalize inefficient and non-competitive industries, a sudden energy price shock led to disruption in production and higher unemployment in many industries. Furthermore, the price control policy did not allow industries to raise prices to cover their increasing costs.5 The price reform should have laid out a detailed plan to support industries during the transition to a high-efficiency stage to avoid the high social and economic costs of increasing inflation and unemployment. The third concern is the inflationary effects of the reform. The energy price reform is a one-time change in prices, but if the cash rebate encourages higher consumption by low-income households due to higher marginal propensity to consume, and higher wages and inflationary expectations, it may cause a spiral effect. The inflationary effects of the energy subsidy removal started with a lag of about eight months, particularly in energy-intensive products such as food and beverages. Furthermore, a huge depreciation of rial (more than 80 percent) in January 2011 and later in September 2012 spurred inflationary expectations.6 Although the exchange rate depreciation was good news to exporters of manufacturing and agricultural products, it placed downward pressure on the imports of intermediate goods for those exporting enterprises.7 The higher inflation will have two major effects on the reform. First, the relative price of energy will decline, weakening its original effects on energy consumption. Therefore, to ensure the desired effect of the reform on energy consumption, the reform should constantly revise energy | 35 36 | Second Quarter 2013 prices so the targeted relative prices will be met. This may trigger a spiral effect which would have an adverse effect on the entire economy. Second, the real value of cash handouts will decline, and the distributional effect of the plan will be neutralized. The equal payment of the cash rebate to all individuals was intended to ensure that low-income households would benefit more than high-income households, alleviating the overall impacts of rising prices on the poor. The inflationary effect of the reform will erode the distributional effect of the reform, and with it its general acceptance among the people who are affected the most. Government needs to either raise the cash handouts constantly to keep up with inflation rates, or find alternative ways to support the poor. In any case, the revenue requirement for such social net programs will be significant. Finally, the fourth issue is the lack of a program for structural changes in the energy market and the economy. The energy market and many industries in Iran are fully controlled by the public sector which does not necessarily allocate resources efficiently. It seems that without serious structural changes in industry and the energy market, through which the private sector will be allowed to play a meaningful role in the economy, energy efficiency will be very hard to achieve. Overall, the energy price reform in Iran was necessary to control the increasing trend of energy consumption and increase energy efficiency. Although the policy is still in the beginning of its second phase and its overall impact on energy consumption and efficiency is yet to be determined, it was a major prerequisite for any energy efficiency policy in Iran. The cash handout system was also a smart design and helpful in the successful implementation and the public acceptance of the reform. However, to achieve energy efficiency targets, the reform should take steps beyond price reform. It is true that higher energy prices will partly induce energy efficiency, but it will take a long time for energy efficiency measures to materialize because of the required capital and change in habits. However, the relative price of energy must remain high for a relatively long period before its full effects on energy efficiency will be felt. Furthermore, a series of non-price efficiency policies and regulations is needed to facilitate the transition to high efficiency stages. One of the main weaknesses of the reform was that it did not specify clearly the efficiency measures and did not support industry during the transition period. Footnotes Given the exchange rate in 2010, the gas price was about US $0.10 per liter, which increased to US $0.40 per liter. 2 A case study on refrigerator and freezer shows that 44 percent of the refrigerators/freezers in Iran do not have efficiency ranking, that is, their ranks are G below. About 37 percent of the refrigerators/freezers are between D-G and only 0.29 percent A (most efficient). The high share of the low ranking refrigerators/freezers in Iran reflects a high potential for energy saving in this market (Ismaielnia, 2010). 1 Energy use in household and commercial sector comprises 37 percent of the total energy use in Iran (Energy Balance, 2009). The average energy use in building is 310 kWh per square meter per year, which is 2.6 times more than the energy use in developed countries (120 kWh). 40 percent of the energy use in building is in public sector. 3 If the average life-time of refrigerators/freezers in Iran is assumed 10 years and electricity price 1010 rials/ kWh, with the 12 percent interest rate, the net discounted presented value of the subsidies would be 5,242 billion rials. The benefit-cost ratio would be 3.42 and the internal rate of return 117.8 percent. The project will take 48 month to breakeven. 5 The recent US - European and UN sanctions on Iran, which have made imports of raw materials and intermediate goods as well as exports difficult, have had additional dampening effect on the industry. 6 Official statistics by the Central Bank indicate that inflation has increased from 10 percent before the reform to 23 percent one year after the reform. However, prices of some items, such as food and housing, increased more than 50 percent. The price increases after the October exchange rate shock have been much higher. 7 A firm level study by Moshiri and Darvishi (2012) shows that depreciation of rial has had a negative effect on exports in Iran in 2001-2007, mainly due to the heavy reliance of exporters on imports of raw materials and intermediate goods. 4 References Central Bank of Iran, Statistics, http://www.cbi.ir/section/1372.aspx (Retrieved Nov. 4, 2012) Energy Balance, Ministry of Energy, 2010. Energy Scenario for Iran (2009), Iranian Energy Association (IEA)/Wuppertal Institute for Climate, Environment and Energy, Wuppertal, March. Energy Price Reform in Iran (2010), Iranian Energy Association (IEA)/Wuppertal Institute for Climate, Envi- International Association for Energy Economics | 37 ronment and Energy, Wuppertal, February. Ismaielnia, A.A. (2010), Economic Analysis of Subsidizing High-Efficient Fridge Producers, SABA, http:// www.saba.org.ir/saba_content/media/image/2012/04/3588_orig.pdf ISNA (2012), Iranian Student News Agency, http://old.isna.ir (Retrieved 10, July, 2012) The Organization for Support of Consumer and Producers, Ministry of Commerce, http://yaraneh.cppo.ir/pages/frontEnd/main.aspx (Retrieved May 20, 2012) Moshiri, S., F. Atabi, M. H. Panjeshahi, and S. lechtenboehmer (2012), Long Run Energy Demand in Iran: A Scenario Analysis, International Journal of Energy Sector Management, 6, 1, 120-144. Moshiri, S. and B. Darvishi (2012), Determinants of Entry and Exit of Firms in the Exports Markets, The Case of Iran, unpublished paper. Member-Get-A-Member Campaign IAEE’s Member-Get-A-Member campaign continues in 2013. IAEE believes you know quite well the value of membership in our organization. Furthermore, membership growth is one of the Association’s top strategic initiatives. With your knowledge of our organization’s products/services, publications and conferences, we know that you are in the ideal position to help us grow. The process to win rewards for yourself is quick and easy! Here’s How the Program Works: • For each new IAEE member you recruit, you receive THREE months of membership free of charge. • New Members must complete the online IAEE membership application form at https://www.iaee.org/en/membership/ application.aspx Make sure the member(s) you refer mentions your name in the “Referred By” box located on the online membership application form. • The more new members you recruit the more free months of membership you will receive. There is no limit to the number of new members you may refer. Membership Recruitment Period and Additional Incentive: • This special program will run from February 1, 2013 – June 1, 2013. • The Member that refers the most new members to IAEE during this timeframe will receive a complimentary registration to attend the 32nd USAEE/IAEE North American Conference in Anchorage, Alaska (this prize may be assigned by the winner to another member, yet must be used for complimentary registration to attend the Anchorage conference only). IAEE Tips for Success: • Promote the benefits of IAEE membership - Share your IAEE passion with others! Visit https://www.iaee.org/en/in- side/index.aspx for a brief overview of IAEE. • Connect with colleagues – Invite your co-workers, colleagues and friends to IAEE conferences. • Keep IAEE membership applications at your fingertips - Please contact David Williams at iaee@iaee.org and request that membership applications are mailed to your attention. Feel free to hand these out on your travels. • Let IAEE do the work for you – Send us an email at iaee@iaee.org letting us know who should be invited to join IAEE (we need full name and email address) and we will contact who you refer to see if they have an interest in joining IAEE. If the member joins during the timeframe above you will be given three months of membership free per member you recruit! We encourage all members to help our organization grow. At the same time, you will be rewarded with free membership months and an opportunity to have your conference registration fee waived at a coming IAEE conference. Thank you for making IAEE the great organization it is!

![-----Original Message----- From: D'Ann Grimmett [ ]](http://s2.studylib.net/store/data/015587774_1-b8b0167afe0c6fb42038c4518a661b2a-300x300.png)