Kitchen Culture Holdings Ltd Annual Report 2011 - Out

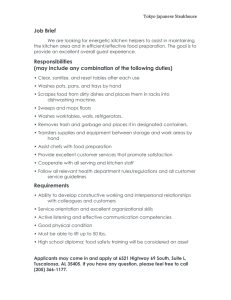

advertisement