The pendulum is - Jones Lang LaSalle

advertisement

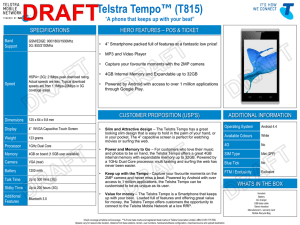

Latest in Corporate Real Estate News Introduction The last few years have born witness to a higher frequency of large earthquakes in Oceania –such as the one experienced in Christchurch, New Zealand, on 22 February 2011. These natural disasters have devastated surrounding communities. The magnitude 6.3-tremor earthquake in Christchurch destroyed 21% of 2nd Edition commercial buildings in the City Business District (CBD), crippled the city’s infrastructure affecting the essential services, and ultimately claimed t lives of 181 people. The February disaster was the second earthqu to impact Christchurch within six months. On 4 September 2010, Christchurch experienced a magnitude 7.1 tremor, which undermined the integrity of the city’s buildings and infrastructur The February earthquake further impaired Christchurch’s structures. Experts estimate the Christchurch disaster is the world’s third most expensive reconstruction project as a result of earthquake. The unpredictability of natural disasters makes contingency planning for all scenarios and leve of catastrophes a challenge. Companies must have the ability to react swiftly with effective resolutions. This involves assembling a team Inside this issue The pendulum is Stuck Partnership profile: Will momentum swing back in favour of landlords? Corporate Solutions News with diverse expertise required to deliver the ri solution. In the wake of the Christchurch traged to restore business operations as quickly as possible, Telstra Clear partnered with Jones La LaSalle to source and construct a temporary s The Telstra Clear Situation: Christchurch’s February earthquake damaged all (six) of Christchurch Telstra Clear’s building which were evaluated and given risk ratings by the New Zealand Civil Defence. The Civil Defe gave four sites a RED ranking, meaning the buildings had structural damage and were uns to enter. The two remaining buildings received AMBER label, which meant the buildings were considered structurally sound but in need of serious repairs. One of the AMBER buildings w Telstra Clear’s main office building occupied by 140 staff members. As a telecommunications company, Telstra Clear is considered a critical service for the city. The community needed Telstra Clear operational as quickly as possible. The lack of safe accommodation for the Christchurch staff affected Telstra Clear’s ability to provide servic to the Christchurch area. The property team wa charged with securing and fitting out approxima 1,700sqm of office space(s). The pendulum is Stuck In 2009 most building owners were banking on a swing back to a landlord favourable market in 2011-2012. A market where rents would climb steeply and incentives would fall sharply. In 2010 building owners had adjusted the predicted swing back to 2012-2013. In 2011 it has still failed to materialise with transaction volumes low and rental growth tempered. What is now apparent is that the swing back to a strong landlord favourable market is not going to happen anytime soon. But things are not all going in the tenants’ favour either with less than favourable profit results, volatile global stock markets and difficult trading conditions. It seems the pendulum is stuck. on cost has also stifled the number of lease transactions, particularly in premium assets. The exception to this are the two states in high gear – Queensland and Western Australia driven by the mining boom. In Perth virtually everything is leasing and in Brisbane the new premium 111 Eagle Street has taken an aggressive stance to attract tenants with generous incentives. The continued demand and shortage of space will push up rental levels in these cities ahead of other Australian markets. On the flip side, the Sydney CBD is heavily weighted to banking, finance and insurance companies – all sectors in the eye of the global financial market storm, and activity levels are generally down. The recent spate of negative economic shocks to reverberate around the world economy has meant corporates are opting for wherever possible to minimise expenditure and do nothing. Opting to delay the decision to move and instead showing preference to restructure the lease for longer terms and re-size as required. This is clearly evident in the volume of lease transactions to date (September) in 2011 which is 25% lower than the same period in 2010. The table on page 2 shows the most significant transactions in each CBD market over the course of 2011. Whilst the rental levels at which most of these deals have been struck appear unaffected by the global turmoil, landlords have structured the deals to protect their headline rents, preferring to offer attractive incentives to tenants willing to enter into a negotiation. These incentives typically either involve assisting with the initial fitout or in the case of a renewal, a refresh of the fitout and/or a rent free period or rental rebate. Corporates continue to be ferociously bottom-line focussed as the threat of a double-dip recession refuses to go away and the European Union scrambles to avoid sovereign debt defaults. This stringent focus (Continued on page 2) The pendulum is Stuck Significant Reported Transactions YTD October 2011 Tenant Address SQM Melbourne Marsh Mercer 555 Lonsdale Street / 11 Exhibition Street 23,461 Minter Ellison 525 Collins Street 14,148 CBA 357 Collins Street 8,489 Service Stream 357 Collins Street 7,000 Sydney Allen & Overy 85 Castlereagh Street 4,500 Vero 60 Margaret Street 5,223 Optiver 33-39 Hunter Street 6,500 ABS 44 Market Street 5,000 ACCC 175 Pitt Street 3,000 Energy Australia 321 Kent Street 2,200 Goodman 60 Castlereagh Street 1,800 Heidrick & Struggles 1 Farrer Place 1,425 Department of Innovation 20 Allara Street 2,000 Department of Education, Employment and Workplace Relations 10 & 12 Mort Street 20,500 Questacon 60 Denison Street 3,000 St George Bank 167 St George’s Terrace 3,018 Fluor 167 St George’s Terrace 2,582 TWP 503 Murray Street 1,100 Liberty 77 St George’s Terrace 1,728 Urbis 123 Albert Street 1,513 Microsoft 400 George Street 1,458 Norton Rose 111 Eagle Street 5,000 Rio Tinto 150 Charlotte Street 10,500 Canberra Perth Brisbane Source: Jones Lang LaSalle SydNEy vAcANcy Q3 2011 - 8.4% | PRImE gRoSS EffEctIvE RENtS - $597.00 | SEcoNdARy gRoSS EffEctIvE RENtS - $346.00 It is pretty evident that the two-speed economy is being personified in a two-tiered property market around Australia – led by West Australia and Queensland. Perth and Brisbane, despite being buoyed by the mining and exploration boom, have seen the emergence of a twotiered property market in their CBDs. Newer stock in these markets is being snapped up by companies who are committing to long-term leases. Whereas the secondary stock is being used as project space on a short-term basis by some of the mining companies and ancillary services including engineers and surveyors. This two-tiered market also exists between existing office space and new developments. New developments that are coming out of the ground are setting a new benchmark, particularly in the premium sector, where headline rental levels are lower than their existing equivalent space. Effectively corporates who are able to act quickly can relocate into a new building at a lower rental level than an existing asset. This is particularly the case in Brisbane and Perth where rental levels in existing premium buildings have exceeded the economic rental level due to the strong demand experienced from the resources sector. In Brisbane new supply is tempering rental growth for the time being, whilst in Perth rental levels are holding up. In Sydney and Melbourne rental levels in A-grade space are closer to parity with the economic rent, however still ahead. An example of this is the Norton Rose deal in 111 Eagle Street in Brisbane where their headline rent was reported to be struck at $790 per sqm however pre-GFC levels for neighbouring premium buildings would have been closer to $1000 per sqm. With the jitters in the global economy likely to stay for the foreseeable future, the pendulum is likely to stay where it is – stuck. A spike in rentals is not likely in Australian property markets anytime soon as corporates take a more cautious view of the future. In the current climate, by and large, if at all possible, a tenant will stay in their current space rather than go to another building. Unless of course there are strong drivers such as a strategic imperative to create profile in the market or a cultural integration agenda, a significantly ageing fit-out and building or in some lucky cases, a healthy growth outlook. It should not be forgotten that cost savings and efficiencies continue to be the theme underpinning all of these drivers. We have seen drivers such as cultural integration and alignment fly in the face of the GFC and play a strong role in driving lease transactions in recent years. Goodman’s transaction highlighted in the table opposite is an example in 2011 of a corporate signing into new space to accommodate an ABW model. Macquarie and CBA have been the early adopters seeking space that can accommodate activity-based working (ABW) and foster the cultural and business objectives of these organisations. National Australia Bank are adopting ABW principals in their new 65,000 sqm building under construction in the Melbourne Docklands. Jones Lang LaSalle is also implementing this in their new Sydney headquarters. Suncorp’s active requirement for 30,000sqm in Brisbane will be an ABW showcase. Many other organisations are trialling ABW on a limited scale to determine its suitability for wider use across their organisations. The model also meets the dual objective of cost efficiencies, with all these transactions set to yield significant real estate savings over the longer-term. The future for ABW looks bright, with the principles becoming more mainstream than they were five years ago. As occupiers seek to do more with less and leverage efficiencies from their space, this will also put pressure on landlords. As corporates emerge from the global economic turmoil, those who have adopted ABW work practices will be able to grow their headcount without taking additional space. For advice on creating the greatest leverage in your negotiation, please contact: Tony Wyllie Head of Tenant Representation & Corporate Consulting P 02 9220 8729 E tony.wyllie@ap.jll.com Peter Walsh Head of Tenant Representation, VIC P 03 9672 6560 E peter.walsh@ap.jll.com Michael Greene Head of Tenant Representation, Australia P 07 3231 1311 E michael.greene@ap.jll.com Andrew Campbell Head of Tenant Representation, WA P 08 9483 8478 E andrew.campbell@ap.jll.com Gavin Martin Head of Tenant Representation, NSW P 02 9220 8458 E gavin.martin@ap.jll.com Jordan Berryman Head of Tenant Representation Non-CBD P 02 9220 8566 E jordan.berryman@ap.jll.com mELBoURNE vAcANcy Q3 2011 - 5.9% | PRImE gRoSS EffEctIvE RENtS - $413.00 | SEcoNdARy gRoSS EffEctIvE RENtS - $306.00 Partnership profile: An Interview with Vito Chiodo “Jones Lang LaSalle & Telstra Property have developed a strong working relationship, evidenced by the fact that those external to the combined property team find it difficult to differentiate who works for which company when walking through our workplace”. - Craig Armstrong Operations Manager, Telstra Property Services Vito Chiodo Director, Telstra Property Australia & International What is the nature of relationship? What has the team delivered over the past 12 months? For more than a year Jones Lang LaSalle has assisted Telstra Property achieve its goals across all sites Australia wide and assisted our team with their goal of extending into international properties. Jones Lang LaSalle has provided Telstra with various services including facilities management, leasing, sustainability, real estate transaction and property management services. Over the past 12 months, the team has delivered significant savings through capital works projects, supply chain management, rental negotiations, make-good cost avoidance, improved car parking management and more efficient energy management. All of this has positively impacted on Telstra’s bottom line. The successful integration of Jones Lang LaSalle into the Telstra team is confirmed by the following comment from Craig Armstrong, Telstra’s Operations Manager, Property Services: “Jones Lang LaSalle & Telstra Property have developed a strong working relationship, evidenced by the fact that those external to the combined property team find it difficult to differentiate who works for which company when walking through our workplace”. Some of the major projects delivered by the combined efforts of Jones Lang LaSalle and the Telstra Property include the reconstruction of the Telstra Conference Centre, the Telstra Experience Centre at 242 Exhibition Street (in conjunction with Lend Lease) and the remodelling of all floors on 242 Exhibition Street. The opening of the Experience Centre was a major highlight for Telstra, and this development means the Victorian business can experience first hand how technology solutions will help them connect with customers and industry. PERTH vacancy Q3 2011 - 3.2% | Prime gross effective rents - $749.00 | SECONDARY gross effective rents - $518.00 The Jones Lang LaSalle team was the main source of assistance in the recovery of our facilities after the recent natural disasters affecting Australia and New Zealand. The actions taken by the Jones Lang LaSalle teams were able to assist Telstra Property in minimising downtime, cost and anxiety. Following the devastating earthquake that struck Christchurch on the 22nd February 2011, Jones Lang LaSalle were able to source emergency space for Telstra, fit-out the space and have it operational within five weeks. During the Queensland flood and cyclone crisis of December 2010 / January 2011, Jones Lang LaSalle managed impacted Telstra sites ranging from retail stores to operational sites and the Brisbane head office, having them all made safe and operational within five business days. Looking Ahead We have achieved a lot in the past 18 months, but we have some important focus areas for the Jones Lang LaSalle and Telstra Property teams. We will look to improve the efficiency of our workplaces, continue to optimise our portfolio, dispose of non-core assets and develop strategies to enhance the experience of customers in our retail outlets and our business in our corporate offices. The Last Word Jones Lang LaSalle has developed and secured a collaborative and strong relationship with Telstra Property’s key alliance partners. Their involvement in major projects and continued contact with our alliance partners has assisted Telstra in becoming “one team” with one vision. Telstra Property look forward to continuing to work with Jones Lang LaSalle and building on our strong foundation to ensure our team make a real impact in the industry and bring real value to our company as a whole. BRISBANE vacancy Q3 2011 - 7.0% | Prime gross effective rents - $457.00 | secondary gross effective rents - $330.00 Corporate Solutions News Victorian Teachers Credit Union Queensland Floods & Disaster Recovery Paper 4 Advance Drawing on Jones Lang LaSalle’s experience managing more than 150 affected sites during the Queensland flood and cyclone crisis of late 2010/early 2011, this paper examines best practices and lessons learnt in disaster recovery. Some of the critical procedures discussed include communication strategy, placing essential services on standby, incorporating short-term flexibility into long-term real estate strategy, a post-flood check-list and conducting pre-lease due diligence in flood (or bushfire) prone areas. time and money. CRE teams should develop a short-term tactical plan for each 12 month period under their long-term strategic plan that will allow for flexibility when unforese en circumstances arise. Jones Lang LaSalle was able to leverage knowledge across our portfolio of client sites, to share ideas on how to ensure operational readiness as quickly as possible , as well as sharing resources where available . For example inspections that were carried out in flood-affected areas were shared with other occupiers that also had facilities in the location. Similarly, companies could have the same results working with major contractors, achieving not only economies of scale, but also sharing informat ion and services with other organisations in the disaster zone. Lessons Learnt One of the clearest lessons learnt through the recent disasters is the need to incorporate short-term flexibility and tactical plans into the long-term real estate strategy. This is also something that was witnesse d during the Global Financial Crisis. Given the nature of the assets they manage, CRE executiv es have historically been very good at preparin g long-term, strategic real estate plans – generall y having a three-year plus planning horizon. But many were caught short and not able to implement tactical responses in the face of a crisis, either econom ic or a natural disaster. Whether it be a requirem ent to dispose of space quickly or in the case of a natural disaster, acquire new space, having a short-term contingency already in place can save significant Introduction witness to a higher The last few years have born kes in Oceania frequency of large earthqua ced in Christchurch, –such as the one experien y 2011. These New Zealand, on 22 Februar ted surrounding natural disasters have devasta de 6.3-tremor communities. The magnitu destroyed 21% of earthquake in Christchurch City Business District commercial buildings in the cture affecting (CBD), crippled the city’s infrastru ultimately claimed the essential services, and lives of 181 people. In any situation where commun ities and businesses are impacted by disaster, there is a desire to return to normalit y as soon as possible. We experienced a number of situations where pressure was applied from the business to the real estate team to declare the site fit for occupancy. It is critical that the in-hous e real estate team (or their outsourced provider ) have the final say on declaring a site operatio nal again, ensuring that all items on the pre-occu pation checklist are completed prior to anyone accessing the site. However, it is noted that these checklists need to be practical and focus principa lly on restoring essential services, where some other works can be undertaken once the business has resumed occupancy. Making them too cumbersome will frustrate both landlord and tenant. Similarly, immediately following a disaster, it should be the sole respons ibility of the real estate team to liaise with emergen cy services to undertake an inspection of the site prior to clean-up. Here liaison with the landlord is critical to making this happen as quickly as possible. Having an agreement with preferred suppliers that they will have dedicate d resources in the event of a disaster was shown to significantly reduce site closure time. This is something that organisations should consider putting in place with their suppliers, it saves a lot of time and negotiation at the time of the event. Building working relationships across different property disciplines (for example between our facility managers and project mangers ) ensured that sites were habitable faster after the flood event. Social media proved to be a powerful communications tool. As organisa tions lost power, their servers and IT systems failed in many instances and social media networks such as Facebook and Twitter allowed them to post the the second earthquake The February disaster was six months. On 4 to impact Christchurch within experienced a September 2010, Christchurch ned the undermi which tremor, 7.1 magnitude and infrastructure. integrity of the city’s buildings impaired The February earthquake further estimate the Christchurch’s structures. Experts world’s third most Christchurch disaster is the as a result of an expensive reconstruction project earthquake. disasters makes The unpredictability of natural scenarios and levels contingency planning for all e. Companies must of catastrophes a challeng with effective have the ability to react swiftly ling a team resolutions. This involves assemb to deliver the right with diverse expertise required Christchurch tragedy, solution. In the wake of the ns as quickly as to restore business operatio d with Jones Lang possible, Telstra Clear partnere t a temporary site. construc and source to LaSalle The Telstra Clear Situation: ke damaged Christchurch’s February earthqua Clear’s buildings, all (six) of Christchurch Telstra ratings by risk given and d which were evaluate . The Civil Defence the New Zealand Civil Defence meaning the gave four sites a RED ranking, and were unsafe buildings had structural damage buildings received an to enter. The two remaining the buildings were AMBER label, which meant but in need of considered structurally sound AMBER buildings was serious repairs. One of the building occupied by Telstra Clear’s main office 140 staff members. y, Telstra As a telecommunications compan service for the Clear is considered a critical Telstra Clear needed ity commun The city. . The lack of operational as quickly as possible Christchurch staff safe accommodation for the to provide service affected Telstra Clear’s ability property team was to the Christchurch area. The fitting out approximately charged with securing and ). 1,700sqm of office space(s Christchurch Earthquake: Telstra & Jones Lang LaSalle Experience The magnitude 6.3-tremor earthquake in Christchurch in February 2011 destroyed 21% of commercial buildings in the city, crippled the city’s infrastructure affecting the essential services, and ultimately claimed the lives of 181 people. This paper explores the Telstra Clear and Jones Lang LaSalle disaster recovery experience, sharing best practice and innovative strategies to minimise site downtime and restore operations as quickly as possible. The team efficiently and successfully sourced and constructed 1,670sqm of office space within five weeks of the earthquake. To download a copy of the reports visit www.joneslanglasalle.com.au AdELAIdE vAcANcy Q3 2011 - 7.2% | PRImE gRoSS EffEctIvE RENtS - $358.00 | SEcoNdARy gRoSS EffEctIvE RENtS - $247.00 Our Tenant Representation and Investment Sales teams in Melbourne were appointed to consolidate the operations of Victorian Teachers Credit Union (VTCU) in either a leased or owned property. We conducted an extensive search of the Boorandara area to identify new premises that would meet their requirements for the next 10 to 20 years. Following a lengthy review of the financials and benefits of lease vs. buy, VTCU opted for complete control as an owner occupier and have purchased a vacant new 5,300sqm office development at 117 Camberwell Road which offers long term expansion potential. The consolidation of VTCU’s office and retail buildings into one location will lead to significant efficiencies, improved security and provide the opportunity to update the standard of accommodation for staff in a location that is very convenient for customers. Halliburton Our Project & Development Services team have been engaged to provide project management and superintendent services on Halliburton’s new build industrial facility in Perth. The purpose of this new facility is to consolidate Halliburton’s existing WA facilities locations into a purpose facility at Jandakot Airport, Perth. This new $37 million facility is a fast track project with phased client handover. Halliburton will be operational from the new facility by November 2011. This will enable greater efficiencies amongst their product services, improved access to transportation links and drive their brand reputation in the local and international resources sector. New Appointments Our Integrated Facilities Management group has won a number of new appointments in the communications and digital media sectors. We have secured the management of the new Facebook premises at 77 King Street, above the high-profile Apple store in Sydney. We won this business in Sydney after the successful transition of Jones Lang LaSalle’s facilities management teams into their Hyderabad and Singapore locations. eBay Inc has appointed us on a two year contract to manage their facilities at 1 York Street in Sydney, covering the eBay, Paypal, Shopping.com and Gumtree brands, again based on success globally for this client. We have also recently secured a two year contract for Lenovo which includes two properties in Australia and one in New Zealand. This appointment was secured following our Tenant Representation and Project & Development Services teams assisting Lenovo with the expansion of the Sydney facility. Jones Lang LaSalle and Lenovo have a global facilities management contract to support their many locations across the world. cANBERRA vAcANcy Q3 2011 - 12.2% | PRImE gRoSS EffEctIvE RENtS - $333.00 | SEcoNdARy gRoSS EffEctIvE RENtS - $276.00 For further information or comments on the The Wrap, please contact: Anna Town Director Strategic Marketing, Corporate Solutions Phone: 02 9220 8445 Email: anna.town@ap.jll.com Michael Greene Regional Director Head of Tenant Representation, Australia Phone: 07 3231 1311 Email: michael.greene@ap.jll.com For further information on Corporate Solutions, please contact: Tony Wyllie Head of Tenant Representation & Consulting Corporate Solutions Phone: 02 9220 8729 Email: tony.wyllie@ap.jll.com Chris Hunt Head of Integrated Facilities Management Corporate Solutions Phone: 02 9220 8389 Email: chris.hunt@ap.jll.com Kevin Hastings Head of Project & Development Services Corporate Solutions Phone: 02 9220 8655 Email: kevin.hastings@ap.jll.com Our office locations: Adelaide • Brisbane • Brookvale • Canberra • Glen Waverley • Liverpool Mascot • Melbourne • North Sydney • Parramatta • Perth • Sydney Disclaimer COPYRIGHT © Jones Lang LaSale IP, INC. 2011 This publication is the sole property of Jones Lang LaSalle IP, Inc. and must not be copied, reproduced or transmitted in any form or by any means, either in whole or in part, without the prior written consent of Jones Lang LaSalle IP, Inc. The information contained in this publication has been obtained from sources generally regarded to be reliable. However, no representation is made, or warranty given, in respect of the accuracy of this information. We would like to be informed of any inaccuracies so that we may correct them. Jones Lang LaSalle does not accept any liability in negligence or otherwise for any loss or damage suffered by any party resulting from reliance on this publication. JS007643 Any Thoughts? We are interested in hearing your feedback on this edition of The Wrap. Are there any other topics you would like to see covered? Would you prefer to receive this in a hard copy or via email? Are there any colleagues who would like to receive a copy? Please email your comments to thewrap@ap.jll.com