Central banking in Latin America: changes, achievements, challenges

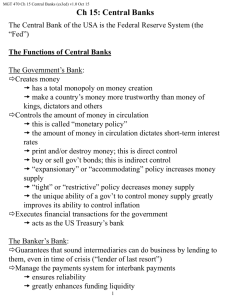

advertisement