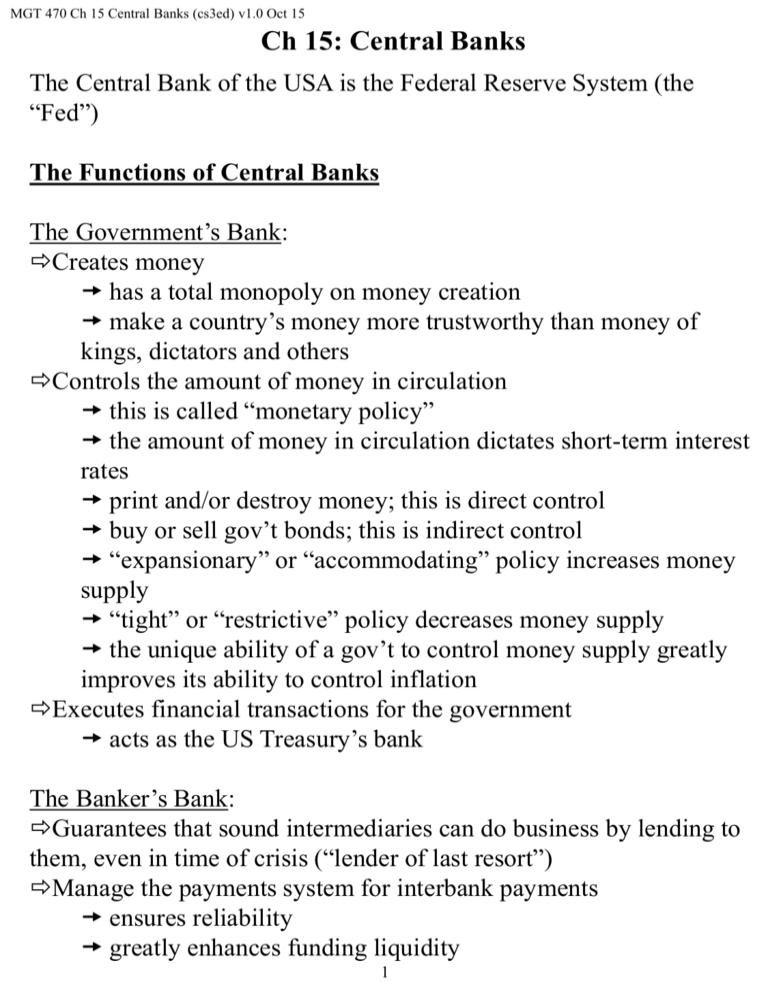

Chapter 15

advertisement

MGT 470 Ch 15 Central Banks (cs3ed) v1.0 Oct 15 Ch 15: Central Banks The Central Bank of the USA is the Federal Reserve System (the “Fed”) The Functions of Central Banks The Government’s Bank: Creates money has a total monopoly on money creation make a country’s money more trustworthy than money of kings, dictators and others Controls the amount of money in circulation this is called “monetary policy” the amount of money in circulation dictates short-term interest rates print and/or destroy money; this is direct control buy or sell gov’t bonds; this is indirect control “expansionary” or “accommodating” policy increases money supply “tight” or “restrictive” policy decreases money supply the unique ability of a gov’t to control money supply greatly improves its ability to control inflation Executes financial transactions for the government acts as the US Treasury’s bank The Banker’s Bank: Guarantees that sound intermediaries can do business by lending to them, even in time of crisis (“lender of last resort”) Manage the payments system for interbank payments ensures reliability greatly enhances funding liquidity 1 MGT 470 Ch 15 Central Banks (cs3ed) v1.0 Oct 15 The Functions of Central Banks (continued) The Banker’s Bank: (continued) Oversees financial institutions ensures savers & depositors can be confident in the soundness of their financial institutions gov’t examiners & supervisors are the only ones who can be trusted to handle sensitive info without conflict of interest Objectives of Central Banks Central banks work to reduce the volatility of economic and financial systems by: 1. Maintain low and stable inflation (preserve price stability): Volatile inflation degrades the information content of prices, (i.e. price movements caused by inflation mask price movements caused by changing supply or demand. High inflation is detrimental to economic growth; people are reluctant to invest their money for fear of not receiving adequate compensation for inflation 2. Promote high, stable in output and employment: The “sustainable” growth rate is one that allows an economy to grow while producing minimal negative effects Growth lower than the sustainable rate means recession which produces higher underemployment Growth higher than the sustainable rate means an “over heated” economy and can lead to increased inflation growth In the long run, stability leads to higher sustainable growth rates 2 MGT 470 Ch 15 Central Banks (cs3ed) v1.0 Oct 15 Objectives of Central Banks (continued) 3. Maintain financial system stability: Minimize the occurrence of bank runs, stock market panics and other financial crisis Primarily attempted through regulation and oversight to ensure that markets run smoothly 4. Maintain interest rate and exchange rate stability: Stable interest rates are crucial for stable economic growth; interest rate volatility discourages investment Stable exchange rates are crucial to doing business internationally Since interest rates and exchange rates are greatly influenced by inflation, this task is a byproduct of Objective 1. How successful was the “Fed” in achieving these objectives since 2006? The Need for Independence of Central Banks Successful monetary policy requires a long time horizon; longer than a term in congress Monetary policy makers must be free to control their own budgets. If politicians can starve the central bank of funding, then they can control the bank’s decisions The central bank’s policies must not be reversible by people outside the bank 3