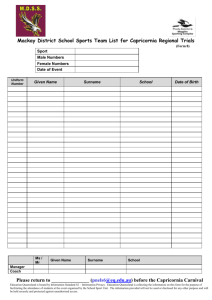

Hansard - Queensland Parliament

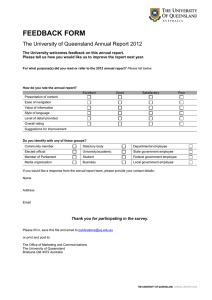

advertisement