Hydro One Ltd. - Raymond James Ltd.

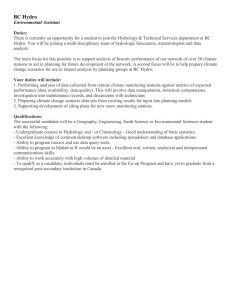

advertisement