Quantitative assessment for an European Capacity Market

advertisement

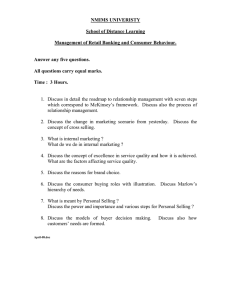

Quantitative assessment for a European Capacity Market 19 June 2012 Johan Linnarsson Head of Long term Market Analysis, Fortum Trading and Industrial Intelligence 1 Purpose of capacity markets: Three simplified reasons for the capacity mechanism debate identified • Back-up for RES generation – Increasing amount of intermittent RES capacity is lowering profitability of thermal generation, which is needed as back up when RES capacity is not available • Demand response – Through capacity mechanisms industrial users and aggregators can find funding for load reductions in peak situations • Support long term carbon free investments – Capacity markets could give incentives for investments in new (back-up) capacity. 2 Source: Fortum Industrial Intelligence Feb’2012 Source: Red Electrica Espana Capacity mechanisms planned in some major markets SE&FI: Capacity reserves for spot market deficits only RU: capacity market with price restrictions. Long-term capacity supply agreements for obligatory investments GB: developing full-scale capacity auctions, legislation to be ready in 2013 Partial capacity mechanisms IE&NI: Capacity payments since 2005 PL: Nodal pricing and capacity market may be implemented in 2014 FR: capacity purchase obligations planned to be implemented by 2016, but new government could change the NOME law PT: same as in Spain for new units Energy-only market *) Major capacity mechanism DE: Study 3/2012 for the government proposes fullscale mechanism, but political opinion still open ES: Capacity payments for new units and to existing coal, gas, oil and hydro capacity 3 Source: Fortum Industrial Intelligence, May 2012 GR: Capacity obligation mechanism since 2005 IT: Minor payments. New capacity market mechanism to be implemented by 2017 Proposals for new capacity elements Regulated market restrictions *) No capacity payments to power plants in the dayahead and intraday markets, but balancing market reserve capacity is contracted in advance. Starting point for the modeling exercise • Capacity remuneration debate in Europe has so far been based merely on qualitative analysis. Fortum wanted to provide quantitative input for the debate. • In this simplified exercise we have modeled three alternative case examples for European Power Markets up to 2020: Base case and two alternative capacity market options (introduction assumed in 2014) • Modeling has been done with Plexos European power market model • Modeling and basic assumptions were provided by McKinsey & Company in order to secure neutrality and any compliance issues. Disclaimer note: The quantitative modeling work, including figures, are carried out by McKinsey & Company and does not present any Fortum market view or forecast on price developments. Commodity prices and underlying assumptions on demand, transmission, etc are provided by McKinsey. Hence, the figures used in the modeling exercise do not necessarily represent Fortum's own long-term market view. 4 Three different cases has been modelled Base Case EU-wide capacity market • No capacity markets • Capacity market in EU for all firm dispatchable generation assets • Active retirements of capacity by European utilities in order to overcome today’s missing money problem (individual power plants making losses in the energy only market). • Early retirements of plants possible* • regulatory target of 5% reserve margin in every European country as defined by ENTSO-E**. • Capacity market clearing is done on a national level in order to reduce complexity. Capacity market only in Germany • Capacity market in Germany for all firm dispatchable generation assets. All other countries continue with energy-only schemes. • Regulatory target of 10% reserve margin. • No early retirement of German power plants • No early retirement of power plants * Plants can be taken out of the market due to poor economics 10 years before the end of their technical lifetime; excluding CHP must-runs ** ENTSO-E defines reserve margin of 5% as sufficient in interconnected systems, isolated systems would need 10% of capacity reserve margin. 5 Source: McKinsey power market model Jan’2012, Forum Industrial Intelligence Feb’2012 Market price for firm capacity would be around 50 EUR/kW in Germany in 2020 Coal Oil Gas Pumped storage Capacity bid cost curve in Germany1 EUR/kW 50 45 40 35 30 25 20 15 10 5 0 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 Firm capacity MW 6 1 Only including bids >0 Source: McKinsey power market model Jan’2012 Capacity price in Europe would vary significantly by country Capacity clearing price in EUR/kW – colour indicates firm capacity under pressure Netherlands 27 UK Denmark Norway Germany Sweden 49 34 33 <30% 30-50% Finland 49 33 17 Belgium Czech 52 49 Austria Poland 48 24 Switzerland Hungary 17 13 Portugal Romania 59 37 Spain 37 France 36 7 Source: McKinsey power market model Jan’2012 Italy Slovenia 33 60 Slovakia 33 Greece 22 Bulgaria 59 >50% EU-wide capacity markets EU would see a major increase of gas and hard coal generation capacity compared to the base case due to capacity payments by 2020. New capacity as well as late retirements Installed Capacity in EU 20+2 1000 800 322 GW, 2020 322 Renewables Gas and Oil 600 248 400 200 193 Hard Coal Lignite Nuclear 67 40 96 44 121 121 117 117 Base Case Capacity market in EU 0 8 Source: McKinsey power market model Jan’2012 Hydro EU-wide capacity markets There would be significant new investments in the EU capacity market case vs. the base case by 2020 New built capacity in EU 20+2 60 50 40 GW, 2020 At an average investment cost of EUR 750/kW for gas and EUR 1500/kW for coal and lignite, the difference amounts to up to EUR 40 billion between the base case and the highest investment case 30 44 20 10 4 0 4 0 3 Base Case Capacity market in EU Lignite 9 Source: McKinsey power market model Jan’2012 Hard Coal Gas EU-wide capacity markets EU-wide capacity market would not completely change import and export patterns by 2020 40 X Base case Y Capacity market in EU 30 7.4 7.2 5.8 3.9 Imports 20 Poland Czech Republic 10 9.5 -2.4 Austria TWh/a -0.8 2.4 Swizerland 0 France Netherlands 2.3 5.1 -11.2 -12.8 5.6 6.0 -10 Sweden Exports -12.8 -14.3 Denmark -20 -30 -40 Base 10 Negative numbers: exports from Germany Positive numbers: imports to Germany Source: McKinsey power market model Jan’2012 Capacity EU Capacity market only in Germany Oversupply situation in Germany would lead to significant increase in exports by 2020 40 X Base case Y Capacity market in DE 30 7.4 4.8 5.8 1.4 20 Imports 10 Poland Czech Republic 0 9.5 -5.8 2.3 -10.9 -11.2 -13.7 TWh/a -0.8 -5.2 Swizerland -10 France Netherlands -20 5.6 0.3 Denmark Sweden -30 Exports -12.8 -14.9 Austria -40 -50 -60 Base 11 Negative numbers: exports from Germany Positive numbers: imports to Germany Source: McKinsey power market model Jan’2012 Capacity DE In summary capacity markets/payments will: • lead to more firm capacity – As intended • impact cross border flows – Especially if implemented in only one country • the volume and cost level will differ between countries – Large risk that national priorities will lead to different national schemes 12 Thank you 13 Backup 14 Capacity market only in Germany Germany would see a significant increase of capacity compared to the base case by 2020. New capacity as well as late retirements Installed Capacity Germany 2020 200 180 160 100 GW, 2020 140 120 100 Hard Coal Lignite 100 29 80 60 14 40 18 20 18 8 9 21 8 9 Base Case Capacity market in Germany 0 Renewables Gas and Oil 15 Source: McKinsey power market model Jan’2012 28 Nuclear Hydro Fundamental assumptions are the same across all scenarios 2020 – 3,390 TWh in EU20+21 Demand Commodity prices – Oil price of USD 80/bbl leads to coal price of 103 USD/t and gas price of 22.6 EUR/MWh – CO2 price of EUR 25 EUR/t (all real 2011) Renewables – 196 GW of wind, thereof 35.5 GW offshore – 86 GW of solar – 40 GW of biomass – 121 GW of nuclear Nuclear 1 EU27+2 excluding Estonia, Ireland, Latvia, Lithuania, Luxembourg, Malta and Cyprus 16 Source: McKinsey power market model Jan’2012 Power demand only expected to increase slowly on European level Power demand, TWh 3,458 3,523 3,308 3,389 1,280 1,302 1,215 1,235 1,258 512 538 548 556 France 526 Germany 562 565 567 566 566 355 332 320 307 U.K. 345 Italy 323 344 375 402 429 Spain 278 292 319 341 363 2011 2015 2020 2025 2030 3,244 Other • Overall modest demand change over time –Overall demand increase of 0.4% per year –Highest increase in Spain and Italy (1.4 1.5% p.a.) –UK demand goes down by 0.8% per year 17 Source: McKinsey power market model Jan’2012 17