The New Banks in Town - Inter

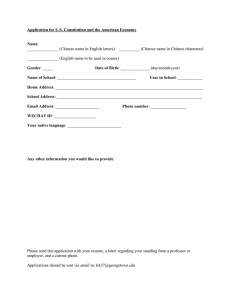

advertisement