2015 IBM Annual Report

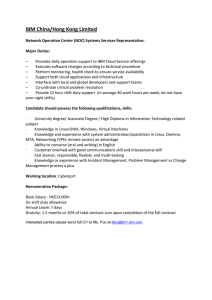

advertisement