UNITED ARAB EMIRATES

advertisement

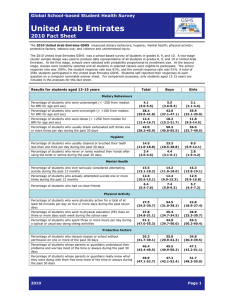

COUNTRY: Name & Address: NAME INQUIRED UNDER: Correct Registered Name: UNITED ARAB EMIRATES ARAB HEAVY INDUSTRIES PJSC AHI ARAB HEAVY INDUSTRIES P.J.S.C. Other Trading name: AHI Address: Near Ajman Old Fish Market, Close by Ajman Port, Opposite Ras Al Khaimah Highway - Al Zora Yard Road AJMAN Ajman UNITED ARAB EMIRATES P.O.Box: 529 Telephone: +971-6-5263232 Fax: +971-6-5263233 Email: ahiaeme@emirates.net.ae Web: www.ahi-uae.com Business address: Near Ajman Old Fish Market, Close by Ajman Port, Opposite Ras Al Khaimah Highway - Al Zora Yard Road AJMAN Ajman UNITED ARAB EMIRATES Summary of Ratings: Maximum Credit: EUR 177,239.00 Payment Records: Comment: A check against all available information sources of Mecos Infocredit revealed that no late payment incidents against subject company exist. Credit Rating: Without Rating Nil Rating N Rating X Rating Credit Rating Low Risk Normal Risk Average Risk Above Average Risk High Risk Normal Risk Indicates normal credit risk of default and is assigned to companies of particularly good credit quality. Commercial Morality: Good Financial Strength: Good Normal Risk Credit Rating: Legal Status: Legal Form: Joint Stock Company Date of foundation: 30.06.1975 Registration number 2324 Ajman and city: Registration date: 30.06.1975 Name Registered ARAB HEAVY INDUSTRIES LTD. S.A. Under: Present Style Adopted on: 27.12.2006 Commercial Registration No.: Refused Chamber’s Membership No.: Refused Trading License No.: Refused Municipality No.: Not Available Former registration name: ARAB HEAVY INDUSTRIES LTD. S.A. MECOS number: 181150 National ID: NEM006003 Former company names: ARAB HEAVY INDUSTRIES LTD. S.A. Company Status: Registration status: 30.06.1975 - registered company Activity status: 30.06.1975 - Company is active Principals: Shareholders Full Name Function M/s. Keppel Group Shareholder M/s. Futtaim Holding Shareholder M/s. Government Of Shareholder Ajman M/s. Mashreq Bank PSC Shareholder M/s. Mitsui Engg. And Shareholder Shipbuilding Co. Ltd. Others Shareholder Nationality UNITED ARAB EMIRATES UNITED ARAB EMIRATES UNITED ARAB EMIRATES Equity Address 33.32% UNITED ARAB EMIRATES 27.78% UNITED ARAB EMIRATES 24.99% UNITED ARAB EMIRATES UNITED ARAB EMIRATES UNITED ARAB EMIRATES 8.33% UNITED ARAB EMIRATES 3.57% UNITED ARAB EMIRATES UNITED ARAB EMIRATES 2.01% UNITED ARAB EMIRATES Management Full Name Age Function Mr. Obaid Ali Al Muhairi Chairman / Director Nationality Qualification Experience Not disclosed Member of the Federal National Council. Mr. Ali Abdullah Al Hamrani Vice-Chairman (Deputy) Not disclosed Mr. Leong Yew Kong Director (/ Member of the Board) Not disclosed Mr. Keith S. Stack Director (/ Member of the Board) Director (/ Member of the Board) Director (/ Member of the Board) Not disclosed Mr. Rashid Humaid Al Mazroei Mr. Salem Abdullah Al Ghurair Not disclosed Not disclosed Address UNITED ARAB EMIRATES Director of Ajman UNITED Municipality and Member of ARAB the Federal National Council EMIRATES General Manager of Arab UNITED Heavy Industries PJSC. ARAB Seconded from Keppel EMIRATES Limited, Singapore Group Director - Industries, UNITED Al-Futtaim Industries (PVT) ARAB Ltd., Dubai EMIRATES Managing Director of Bahra UNITED & Mazroei Trading ARAB Company, Dubai EMIRATES Director of Technical UNITED Business Management LLC., ARAB Leasing Manager for Al EMIRATES Ghurair Investment LLC Mr. Saleh Said Al Matrooshi Mr. Abdulla Ali Bushager Director (/ Member of the Board) Member Of the Board Mr. Nelson Yeo Chien Sheng Member Of the Board Not Mr. Salem Abdulla Al Ghurair Member Of the Board UNITED ARAB Not EMIRATES Mr. Khalid Abdulla Al Futtaim Member Of the Board Not Mr. Ahmed Zaki Haroon Member Of the Board Not His Excellency Abdul Rahman Mohammed Al-Owais Dr. Foo Kok Seng Member Of the Board Not Member Of the Board Not Mr. Charles Foo Chee Lee Director Not Mr. Abdulla Ali Abu Shaqer Director Not Mr. Goh Boon Kiat Director Not Mr. Chan Lim Hong General Manager Not Administrative & SINGAPORE Financial Manager Not Mr. Laufook Wengondy Asss General Manager Not Mr. Emil Kerchev Mateev Production Manager (Assistant) Commercial Manager Not Mr. Yang Nang Tang Mr. Kamal Ahmed 55 Not disclosed Protocol Manager, Ruler's Court, Ajman UNITED ARAB Not EMIRATES Not Mr. Mohammad Azam Executive (Public INDIA Relations Officer) Not Mrs. Vijaya S. Secretary (Managing Director) Not Activities: Activities: Operations: INDIA UNITED ARAB EMIRATES disclosed Not disclosed UNITED ARAB EMIRATES disclosed Not disclosed UNITED ARAB EMIRATES disclosed Not disclosed UNITED ARAB EMIRATES disclosed Not disclosed UNITED ARAB EMIRATES disclosed Not disclosed UNITED ARAB EMIRATES disclosed Not disclosed UNITED ARAB EMIRATES disclosed Not disclosed UNITED ARAB EMIRATES disclosed Managing Director of Keppel UNITED Hitachi Zosen Limited and ARAB Keppel Tuas PTE Ltd. EMIRATES disclosed Public Relations Manager of UNITED Al-Futtaim Wimpey (PVT) ARAB Ltd, Dubai EMIRATES disclosed General Manager (Group UNITED Business Development & ARAB Special Projects) of Keppel EMIRATES Hitachi Zosen Ltd. disclosed Not disclosed UNITED ARAB EMIRATES disclosed Keppel Group for 12 years, UNITED Joined AHI in july 2006 ARAB EMIRATES disclosed Not disclosed UNITED ARAB EMIRATES disclosed Not disclosed UNITED ARAB EMIRATES disclosed Not disclosed UNITED ARAB EMIRATES disclosed Not disclosed UNITED ARAB EMIRATES disclosed Not disclosed UNITED ARAB EMIRATES Importers NACE 3011 Building of ships and floating structures SIC main activity 3441 Fabricated Structural Metal 3731 Ship Building and Repairing (except floating dry docks not associated with shipyards) Analysis: Services: This Ajman industry comprises establishments primarily undertakes ship repairs, ship building and steel fabrication works. Briefing: A. Shiprepair and conversions Dry-docking for annual and special surveys by leading classification societies; Cleaning, blasting and painting of hulls and tank internals; Damage and emergency repairs; Ship conversions and modifications; Overhauling and installation of main and auxiliary diesel engines and deck machinery, Electrical repairs and installations; and Afloat repairs along the wharf or offshore running repairs. B. Shipbuilding Tug boats Oil, water and deck cargo barges Oil skimming pontoons Multi-purpose work barges Split-Hopper barges; and Naval jetties C. Steel Fabrication and Engineering Platforms, jackets, dolphins, piers; Barges, pontoons, floaters, buoys; Rolling and fabrication of pipes; Stacks, ducts, silos, kilns; Tanks, pressure vessels; Monopoles for telecommunication industry; and RTGs D. Offshore- Repair and Modifications to MODUS The comprehensive steel fabrication shop and the large fabrication areas are specially catered for construction of modules, jackets, legs and other steel structures. More than 500 meters of repair berths are available for alongside work. A 5000T load out facility also allows efficient load out of heavy structures safely and efficiently. With the skilled workforce and the effective project management teams, AHI is able to undertake offshore projects quickly and economically. Supported by the extensive experience and technical expertise of the Keppel Group, AHI offers complete solutions to all repair, refurbishment, modification and upgrading of Mobile Offshore Drilling Units. E. Afloat and anchorage repairs Docking repairs to vessels up to 115 meters Steel repairs. Engine and other mechanical equipment. Electrical repairs, trouble shooting and rewinding. Blasting and painting. Piping renewals. Business Activities Ship Building / Repair Industry Classifications - NAICS » Ship Building and Repairing Ship Building and Repairing NAICS #336611 | This U.A.E. industry comprises establishments primarily engaged in operating a shipyard. Shipyards are fixed facilities with drydocks and fabrication equipment capable of building a ship, defined as watercraft typically suitable or intended for other than personal or recreational use. Activities of shipyards include the construction of ships, their repair, conversion and alteration, the production of prefabricated ship and barge sections, and specialized services, such as ship scaling. Fabricating structural assemblies or components for ships, or subcontractors engaged in ship painting, joinery, carpentry work, and electrical wiring installation--are classified based on the production process used; and Ship repairs performed in floating drydocks--are classified in Industry 488390, Other Support Activities for Water Transportation. Motor Vehicles: This information was not disclosed. Imports: AUSTRALIA, SINGAPORE, OMAN, UNITED STATES, JAPAN, NETHERLANDS Payment terms: L/C Base (Letter of Credit) Other Term: Open Credit 60 days Exports: KUWAIT, INDIA, OMAN, UNITED STATES: 15% Payment terms: L/C Base (Letter of Credit) Prepayment / Advance Payment Trade Suppliers: Name Country Product Admiral Industrial UNITED STATES Ship spares CMR (Far East) Pte Ltd. SINGAPORE Ship spares Keppel - Sea Scan International SINGAPORE Ship spares and steel materials. Rikisi Trading JAPAN Ship spares Payment Term: Letter of Credit MAJOR CUSTOMERS: AHI's extensive list of prestigious clients include: A. Ship repair and conversions I. Boskalis Westminister Middle East, Abu Dhabi, UAE. II. Doha Marine Services W.L.L, Doha, Qatar. III. E-Marine(ETISALAT), Abu Dhabi IV. FAL Shipping Company LTD, Sharjah, UAE. V. Global Offshore International / Subtec Middle East Ltd., Sharjah. VI. Great Eastern Shipping Company, Mumbai, India. VII. Gulf Cobla (Pvt) LTD., Dubai, UAE. VIII. National Iran Tanker Company, Tehran, Iran. IX. National Petroleum Construction Company, Abu Dhabi, UAE. X. Seabulk Offshore International Inc., Sharjah, UAE (Hvide Marine, U.S.A). XI. Seacor Marine Middle East, Dubai, UAE. XII. Sevenseas Maritime , U K. XIII. Swire Pacific Offshore, Dubai, UAE. XIV. Tidewater Marine International Inc., Dubai, UAE. XV. Van Oord Acz. Overseas BV, Abu Dhabi, UAE. XVI. Pacific International Lines, Singapore. B. Shipbuilding I. Bibby Line, UK 52m Self-propelled jack up service vessel. II. Gulf Cobla, Dubai 70m Split hopper dredger. III. NPCC, Abu Dhabi 250' x 70' Launch Barge. 180' x 50' Deck Cargo Barge. 200' x 60' x 15' Deck Cargo Barge. IV. Modec, Tokyo Pontoon Barges. Workforce: Number Of Employees: 540 Description Of Premises: Address: Near Ajman City Center, Opposite Ras Al Khaimah Highway - Al Zora Yard Road AJMAN Ajman UNITED ARAB EMIRATES Type of premises: Premises Size: 27 Hectares Type of ownership: unknown Area: Good Area Condition: Good Headquarters: The subject operates from premises of 27 hectares area located on an island off the Ajman Souk in Ajman, comprising of the yard and office. Related Companies: Subsidiary Company Arab Eagle Marine Engineering LLC.-(AEME) , UNITED ARAB EMIRATES PLEASE NOTE THE FOLLOWING ADDITIONAL INFORMATION ON RELATED COMPANY Subsidiary Company: Arab Eagle Marine Engineering LLC.-(AEME) Dubai Ship Docking Yard Al Outeyat Road Al Jaddaf - 1 Dubai, UAE P O Box 8238 Tel: 00971 4 3341020 Fax: 00971 4 3241683 Trade License No: 300920 Chamber No: 55742 Expiry Date: 29/03/2011 Activity: Engaged in the activity of afloat repair. Bankers: Commercial Bank of Dubai P O Box: 2668, Dubai Tel: 00971 4 2121000 Standard Chartered Bank P O Box: 66, Dubai Tel: 00971 4 3535000 HSBC Bank Middle East P O Box: 25, Sharjah Tel: 00971 6 5537222 Mashreq Bank P O Box: 2082, Sharjah Tel: 00971 6 5118216 The subject did not wish to disclose banking facilities and account numbers. Press: 02.01.2011, http://www.asmainfo.com/DUBAI/En/news/shownews.asp Results for Fiscal Year 2010 Arab Heavy Industries (DFM) Arab Heavy Industries announced its results for its Fiscal Year 2010 ended on 31-12-2010 as follows: Net Profit AED 21,454,737 Earnings per share AED 31.91 Net Profit last year AED 90,895,256 Earnings per share last year AED 135.21 The Board of Directors recommended a dividend payout of 16,806,475 AED. 17.01.2011, http://www.mubasher.info/portal/dfm/getDetailsStor Arab Heavy Industries board discusses FY10 financials The board of Arab Heavy Industries (AHI) will convene today, Monday, Jan. 17, 2011, at 11:00 a.m. to look into FY10 financial statements. Auditors / Accountants: Auditor: Mr. Samir Madbak - Registration No. 380 Date: 31.12.2010 Financials have been audited Company: Deloitte & Touche (M.E.), Sharjah, UAE Share Capital: Registered capital: AED 67,225,900.00 since 27.12.2006 Issued capital: AED 672,259.00 Charges: Please note that this information is not available. Finance: Amounts shown in UAE Dirham (AED) 2010 2009 2008 2007 83,087,529.00 220,263,573.00 227,044,533.00 6,864,815.00 195,099,399.00 3,092,133.00 PROFIT & LOSS Sales Turnover Other Operating Income Other Operating Expenses Operational Profit Net Profit -145,264,681.00 -147,209,450.00 47,889,949.00 53,014,344.00 21,454,737.00 90,895,256.00 81,779,852.00 90,966,180.00 113,267,552.00 107,664,220.00 105,917,298.00 108,073,944.00 2,773,497.00 8,770,817.00 28,079,768.00 2,773,497.00 12,238,889.00 45,730,712.00 2,773,497.00 27,378,530.00 45,560,012.00 2,773,497.00 11,495,539.00 29,736,812.00 77,881,239.00 114,731,824.00 230,772,873.00 84,855,558.00 131,649,663.00 189,619,264.00 300,056,981.00 132,605,761.00 120,807,259.00 193,746,856.00 302,437,651.00 118,493,901.00 84,017,370.00 125,249,721.00 236,097,162.00 75,084,789.00 192,416,998.00 31,496,763.00 240,167,201.00 52,847,926.00 225,303,635.00 70,366,442.00 173,047,700.00 56,461,900.00 31,876,753.00 230,772,873.00 38,355,875.00 53,142,804.00 300,056,981.00 59,889,780.00 70,661,271.00 302,437,651.00 77,134,016.00 56,620,289.00 236,097,162.00 63,049,462.00 BALANCE SHEET Property, Plant & Equipment Goodwill Inventory / Stock Trade Debtors (receivables from customer) Cash in Hand & at Bank Total Current Assets Total Assets Retained Profit / Earnings) for the year Total Equity Trade Creditors (accounts payable) Total Current Liabilities Total Equity & Liabilities Total Liabilities Book Closes on 31st Dec. Profit/Loss: Trading in Profit Economic Result: Positive Note: The above financials are consolidated figures from the dubai stock exchange. Comments: Please note that the subject declined to release any further financial information neither such data was found being officially published. Credit Risk Management: ( Auditor's Report) -------------------------------------------The Group has adopted a policy of dealing with creditworthy counterparties as a means of mitigating the risk of financial loss from defaults. The Group’s exposure and the credit quality of its counterparties are continuously monitored and the aggregate value of transactions concluded is spread amongst approved counterparties. Credit exposure is controlled by counterparty limits that are reviewed and approved by management. Trade receivables consist of a large number of customers. Ongoing credit evaluation is performed on the financial condition of receivables. The Group does not have any significant credit risk exposure to any single counterparty or any group of counterparties having similar characteristics. The Group defines counterparties as having similar characteristics if they are related entities. Concentration of Credit Risk did not exceed 26% (2009: 35%) of gross monetary assets at any time during the year. The credit risk on liquid funds is limited because the counterparties are banks registered in the United Arab Emirates. The carrying amount of financial assets recorded in the consolidated financial statements, which is net of impairment losses, represents the Group’s maximum exposure to credit risk. Ratios: Current ratio - 2 is an acceptable result, but even 1,8 is considered excellent in bank practice 2010 3.60 2009 3.57 2008 2.74 2007 2.21 3.60 3.57 2.74 2.21 0.17 0.20 0.26 0.27 0.09 0.30 0.30 0.22 0.11 0.38 0.40 0.31 25.82 41.27 40.07 27.17 9.47 18.00 8.29 16.97 123.35 75.78 73.24 55.63 244.32 247.73 170.97 148.39 88.09 86.05 64.48 52.52 359.92 356.81 274.19 221.21 Current Assets / Current Liabilities Quick ratio (QR ) - 1 is an excellent result, but anything above 0,8 is considered good (Current Assets - Inventory) / Current Liabilities Debt ratio (%) (Total Liabilities / Total Assets) x 100 Return on assets ( ROA ) Net Profit After Tax / Total assets Return on equity ( ROE ) Net Profit After Tax / Total Equity Return on sales ( ROS ) Net Profit x 100 / Sales Turnover Day's supply in inventory Sales Turnover / Inventory Collection Period Ratio (in days) Accounts Receivable x 365 / Sales Turnover Cash Liquidity Ratio Liquid Assests / Current Liabilities x 100 Receivables Ratio (%) Accounts Receivable / Current Liabilities x 100 Current Assets Ratio (%) (Current Assets - Accounts Receivable) / Current Liabilities x 100 GENERAL COMMENTS: The suejct company was established in 1975. The company, Arab Heavy Industries (AHI) is a public joint stock company listed on 27.12.2006 (Dubai Stock Exchane) which is jointly owned by The Ajman Government, Al-Futtaim Group, Keppel Group of Singapore and other investors. It provides an entire spectrum of ship repair, conversion, shipbuilding and steel fabrication services to the marine, offshore and engineering industries. The company is managed by the Keppel Group, Singapore. The ship repair and shipbuilding division of the group has one of the largest shipyard operations in Singapore and an international network of shipyards in Asia, Middle East AND North America. INDUSTRIAL ANALYSIS: --------------------TRANSPORT & INFRASTRUCTURE With a population currently growing at 18% per year and real estate investments worth more than Dh80bn ($21.78bn), current projects to improve the emirate's transport and infrastructure are increasingly important. Most of the current focus has been on the Ajman Port, improved road links to neighbouring emirates and a new state-of-the-art sewage and wastewater treatment plant anticipated to come online in 2009. The plant is a public-private partnership being constructed on a build-operate-transfer basis. The government initially owns 20% of the plant, gaining full ownership after 25 years. Because air conditioning is a necessity and places a heavy burden on the electricity supply, the introduction of district cooling that provides cooling from a central location to various locations has been introduced as an alternative. It initially met with some resistance due to high start up costs. However with electricity becoming an ever more precious commodity as greater demands are placed on the system, the technology is starting to catch on in Ajman, as well as throughout the rest of the UAE. Additionally, the municipality's planning department is making efforts to systemise and rationalise land use in the emirate for maximum economic benefit with an eye towards environmental sustainability. Despite recent updates to the Port of Ajman, which can now handle 3000 twenty foot equivalent units each month, competition with other, much larger, regional ports has left officials looking to relocate the port to a more advantageous location within the emirate. CREDIT RISK EVALUATION A credit rating assesses the credit worthiness of a company. A poor credit rating indicates a high risk of defaulting on a loan. A Credit rating is estimated based on an analysis of commercial, financial and trading data. MAXIMUM CREDIT RECOMMENDED The amount advised is a recommended maximum credit exposure at any one time. SCALES Low Risk Rating Indicates specifically low risk of credit defaulting and is assigned to companies of exceptional credit quality. Normal Risk Rating Indicates normal credit risk of default and is assigned to companies of particularly good credit quality. Average Risk Rating Indicates average risk of credit defaulting and is assigned to companies of moderate credit quality. Above Average Risk Rating Indicates increased risk of credit defaulting and is assigned to companies of low credit quality. High Risk Rating Indicates possibility of very high risk of credit defaulting and is assigned to companies of very low credit quality. N Risk Rating This is a recently established company. Unable to provide credit risk rating due to lack of historical data. X Risk Rating Indicates the highest risk of credit defaulting and is assigned to companies of extremely low credit quality. (adverse press information, dissolved, bankruptcy procedures, termination of activities, detrimental information) Nil Risk Rating Lack of sufficient data. (financial statements overdue or dormant). UNITED ARAB EMIRATES – FACTS AND FIGURES Population: 4,798,491 Area: 83,600 SQ KM Capital: Abu Dhabi Currency: Emirati dirham Currency Code: AED GDP (Purchasing Power Parity): $200.4 Billion GDP - Composition by Sector: GDP (Official Exchange Rate): $228.6 Billion Agriculture: 1.1% GDP - Real Growth Rate: 1.4% Industry: 48.6% GDP - Per Capita (PPP): $41,800 Services: 50.2% Industries: Petroleum and Petrochemicals; Fishing, Aluminium, Cement, Fertilizers, Commercial Ship Repair, Construction Materials, Some Boat Building, Handicrafts, Textiles The UAE has an open economy with a high per capita income and a sizable annual trade surplus. Successful efforts at economic diversification have reduced the portion of GDP based on oil and gas output to 25%. The economy is still dependent on Abu Dhabi’s oil revenues. With high debt, public companies in Dubai were severely affected by the financial crisis. Payment defaults have accelerated. Many projects have been put on hold. As there is no sovereign guarantee on the debt of Dubai World and its main real estate subsidiary (Nakheel), a failure of the debt restructuring that is required could lead to bankruptcies. Last Updated: March 2010 GETTING CREDIT (Source Doing Business – The World Bank Group DATE UPDATED: JULY 2009) Getting Credit DB09 rank: 68 Getting Credit DB08 rank: 116 Change in rank: +48 Measures on credit information sharing and the legal rights of borrowers and lenders are shown below. The Legal Rights Index ranges from 0-10, with higher scores indicating that those laws are better designed to expand access to credit. The Credit Information Index measures the scope, access and quality of credit information available through public registries or private bureaus. It ranges from 0-6, with higher values indicating that more credit information is available from a public registry or private bureau. Legal Rights Index United Arab Emirates 4 Legal Rights Index Region 3.3 Legal Rights Index OECD 6.8 Credit Information Index United Arab Emirates 5 Credit Information Index Region 2.9 Credit Information Index OECD 4.8 Public registry coverage (% adults) United Arab Emirates 6.5 Public registry coverage (% adults) Region 4.8 Public registry coverage (% adults) OECD 8.4 Private bureau coverage (% adults) United Arab Emirates 7.7 Private bureau coverage (% adults) Region 9.7 Private bureau coverage (% adults) OECD 58.4 PROTECTING INVESTORS (Source Doing Business – The World Bank Group) Protecting Investors DB09 rank: 113 Protecting Investors DB08 rank: 110 Change in rank: -3 The indicators below describe three dimensions of investor protection: transparency of transactions (Extent of Disclosure Index), liability for self-dealing (Extent of Director Liability Index), shareholders’ ability to sue officers and directors for misconduct (Ease of Shareholder Suits Index) and Strength of Investor Protection Index. The indexes vary between 0 and 10, with higher values indicating greater disclosure, greater liability of directors, greater powers of shareholders to challenge the transaction, and better investor protection. Disclosure Index United Arab Emirates 4 Disclosure Index Region 5.9 Disclosure Index OECD 5.9 Director Liability Index United Arab Emirates 7 Director Liability Index Region 4.8 Director Liability Index OECD 5 Shareholder Suits Index United Arab Emirates 2 Shareholder Suits Index Region 3.7 Shareholder Suits Index OECD 6.6 Investor Protection Index United Arab Emirates 4.3 Investor Protection Index Region 4.8 Investor Protection Index OECD 5.8 DISCLAIMER This document is forwarded to the client in strict confidence for the use by the client. This document is based on information obtained by us from sources believed to be true but not controlled by the provider; therefore we do not make any representation as to its accuracy. Any advice or recommendation in this document has been given without regard to the specific investment objectives, financial situation and the particular needs of any specific client. This document is for the information of the client only and is not to be reproduced in whole or in parts in any form or manner whatsoever. The provider accepts no liability whatsoever for any direct or consequential loss arising from any use of this document or further communication given in relation to this document.