Proceedings of 29th International Business Research Conference

advertisement

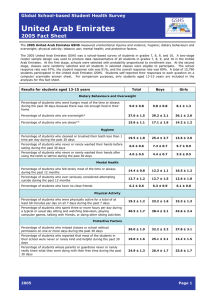

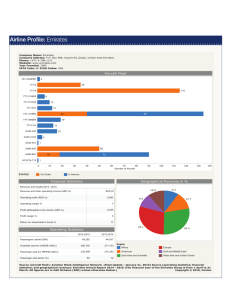

Proceedings of 29th International Business Research Conference 24 - 25 November 2014, Novotel Hotel Sydney Central, Sydney, Australia, ISBN: 978-1-922069-64-1 Are Costs Really Sticky? Evidence from Publicly Listed Companies in the UAE Fernando Zanella, Peter Oyelere and Shahadut Hossain The paper measures the degree of adjustment between operating revenues and costs for publicly listed companies in the United Arab Emirates (UAE). Traditional cost models assume that variable costs change proportionally in response to an upward or downward fluctuation in demand. However, in recent years such an assumption has been questioned by a variety of papers from the economics and accounting fields. Typically, cost stickiness is defined when costs decrease by less than 1% when sales decrease by 1%, while reacting closer to the proportion change when sales increase. This study, unlike the vast majority of the literature, did not find cost stickiness in the UAE after using panel data regression analysis. The main explanation is that UAE has mostly expatriate labor force that does not have the typical benefits of the employment protection legislation (EPL). EPL is a main reason that costs adjustments during decreasing sales is curbed due to the associated costs of firing employees. Field of Research: Accounting Keywords: Cost Stickiness, Employment Protection Legislation, United Arab Emirates __________________________________________________________________________________ Dr. Peter Oyelere; (Corresponding Author), Department of Accounting; United Arab Emirates University; PO Box 15551, Al Ain, UAE; Tel: +971-503598399; Email: poyelere@uaeu.ac.ae Dr. Fernando Zanella, Department of Economics and Finance, United Arab Emirates University Dr. MD Shahadut Hossain, Department of Statistics, United Arab Emirates University