Canada Research Lumenpulse Inc.

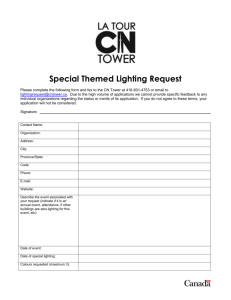

advertisement