DPU 15-37

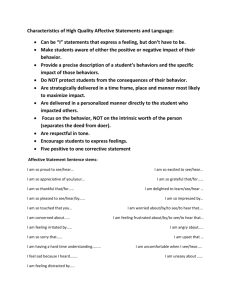

advertisement