Spin-offs beat IPOs - Cadence Capital Limited

advertisement

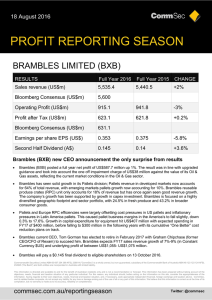

Spin-offs beat IPOs Karl Siegling 7 February 2014 Summary: With initial public offerigs hogging much of the investment limelight recently, several major corporate spin-offs have had to settle for limited coverage. Their respective successes are a reminder that well-run, established businesses – when sold by their parent companies – can deliver impressive returns that often are better than those achieved from IPOs. Key take-out: Demergers by Amcor and Brambles during December have delivered returns of more than 12% each to investors, which compares with the 3.1% fall of the All Ordinaries Index over the same period. Key beneficiaries: General investors. Category: Shares. The last quarter of 2013 was characterised by a large number of capital raisings and, in particular, a large number of initial public offerings (IPOs). An IPO is the process of a seller advertising and trying to convince buyers that what they have to sell is worth buying. These offers have featured prominently in the financial media. Contrast this with the limited coverage of the Amcor (ASX Code: AMC) spin-off Orora (ASX Code: ORA), and the Brambles (ASX Code: BXB) spin-off Recall (ASX Code: REC). These transactions received nowhere near the same amount of coverage. In fact, you could be forgiven for not having heard about these spin-offs at all. In the cases of Amcor and Brambles, the boards and managements of the existing companies were presenting the transactions largely to existing shareholders, and not really selling the ‘spun-off’ business, as the best alternatives for the companies. When ORA demerged from AMC, holders of each AMC share became entitled to one new ORA share. The demerger was implemented on December 31, 2013. AMC shares traded at $10.55 on December 31, and as of Wednesday’s closing price were still trading at $10.55. However, since that date each AMC shareholder owns one ORA share for each AMC share held. ORA shares closed on Wednesday at $1.34. A quick calculation indicates a return of 12.7% per AMC share when including the ‘free’ ORA share. This compares favourably with the All Ordinaries Index, which is down 3.1% over the same period. When REC demerged from BXB, holders of BXB shares were entitled to one REC share for every five of their shares. BXB shares traded at $8.86 per share on December 10, 2013 (when REC commenced trading on the ASX) and closed the day at $4.50 (or $0.90 per BXB share when you divide the REC price by five). At the time of writing BXB shares are $9.01 and one-fifth of a REC share is worth $0.90. The $8.86 invested in BXB a few days before the demerger has now become $9.91, a 12% return in approximately six weeks. The boards and managements of Amcor and Brambles are to be commended on implementing valueadded demergers and have correctly identified that the assets would be worth more separately than together. All too often in large conglomerates a focus on creating shareholder value can be lost in favour of expanding ‘an empire’ or chasing increased profits at all costs. The AMC and BXB boards and managements have spent some considerable time and effort restructuring the respective businesses. This time and effort has paid off and both entities are performing very well. Generally speaking demergers tend to progress well. Why is that? You are dealing largely with a group of people who know the businesses well and, over time, would have developed a good understanding of how best to run a particular business, or division, within a company. In addition, post the demerger the existing seller (existing board) are to some extent still ‘responsible’ for how the demerged entity performs. Should the transaction perform poorly, shareholders would still look to existing management for an explanation as to why. This is a very different proposition to an acquisition or IPO, when the seller of the business in many instances exits the register and ‘sails into the sunset’. Early this year brokers began researching the newly formed Orora and Recall and, in comparison to the multiples on which many companies were floated in late 2014, these businesses look to be on very attractive multiples. How ironic then that the spin-offs have performed so well, whilst many IPOs in the last quarter of 2014, generally speaking, have not. Sometimes the profitable Investments are right under our nose and we just need to take some extra time and effort to identify them! Karl Siegling is a portfolio manager at Cadence Capital Limited (ASX: CDM). For more information visit www.cadencecapital.com.au