View PDF Report

advertisement

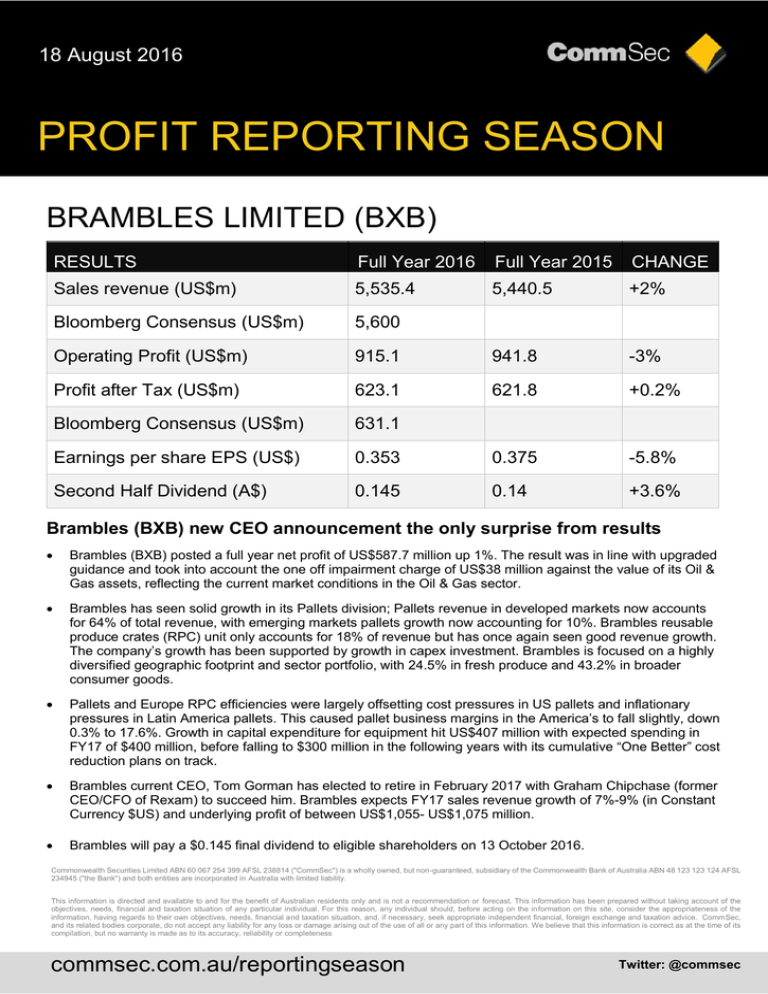

18 August 2016 PROFIT REPORTING SEASON BRAMBLES LIMITED (BXB) RESULTS Full Year 2016 Full Year 2015 CHANGE Sales revenue (US$m) 5,535.4 5,440.5 +2% Bloomberg Consensus (US$m) 5,600 Operating Profit (US$m) 915.1 941.8 -3% Profit after Tax (US$m) 623.1 621.8 +0.2% Bloomberg Consensus (US$m) 631.1 Earnings per share EPS (US$) 0.353 0.375 -5.8% Second Half Dividend (A$) 0.145 0.14 +3.6% Brambles (BXB) new CEO announcement the only surprise from results Brambles (BXB) posted a full year net profit of US$587.7 million up 1%. The result was in line with upgraded guidance and took into account the one off impairment charge of US$38 million against the value of its Oil & Gas assets, reflecting the current market conditions in the Oil & Gas sector. Brambles has seen solid growth in its Pallets division; Pallets revenue in developed markets now accounts for 64% of total revenue, with emerging markets pallets growth now accounting for 10%. Brambles reusable produce crates (RPC) unit only accounts for 18% of revenue but has once again seen good revenue growth. The company’s growth has been supported by growth in capex investment. Brambles is focused on a highly diversified geographic footprint and sector portfolio, with 24.5% in fresh produce and 43.2% in broader consumer goods. Pallets and Europe RPC efficiencies were largely offsetting cost pressures in US pallets and inflationary pressures in Latin America pallets. This caused pallet business margins in the America’s to fall slightly, down 0.3% to 17.6%. Growth in capital expenditure for equipment hit US$407 million with expected spending in FY17 of $400 million, before falling to $300 million in the following years with its cumulative “One Better” cost reduction plans on track. Brambles current CEO, Tom Gorman has elected to retire in February 2017 with Graham Chipchase (former CEO/CFO of Rexam) to succeed him. Brambles expects FY17 sales revenue growth of 7%-9% (in Constant Currency $US) and underlying profit of between US$1,055- US$1,075 million. Brambles will pay a $0.145 final dividend to eligible shareholders on 13 October 2016. Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 ("CommSec") is a wholly owned, but non-guaranteed, subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 ("the Bank") and both entities are incorporated in Australia with limited liability. This information is directed and available to and for the benefit of Australian residents only and is not a recommendation or forecast. This information has been prepared without taking account of the objectives, needs, financial and taxation situation of any particular individual. For this reason, any individual should, before acting on the information on this site, consider the appropriateness of the information, having regards to their own objectives, needs, financial and taxation situation, and, if necessary, seek appropriate independent financial, foreign exchange and taxation advice. CommSec, and its related bodies corporate, do not accept any liability for any loss or damage arising out of the use of all or any part of this information. We believe that this information is correct as at the time of its compilation, but no warranty is made as to its accuracy, reliability or completeness commsec.com.au/reportingseason Twitter: @commsec