This report is for distribution only to Australian resident clients of Morgan Stanley.

GICS - Commercial Serv/Supp

Brambles Limited (BXB.AX)

Price: $13.15

Business Summary

Snapshot

Brambles Limited (BXB) is a supply-chain logistics company operating in

more than 50 countries, primarily through the CHEP and IFCO brands. BXB

specializes in the pooling of unit-load equipment and the provision of

associated services. BXB is focusing on the outsourced management of

returnable pallets, crates and containers.

Date

Market Cap.

Shares on issue

12 Month High

12 Month Low

Pallets: The business, carried out under the name CHEP, focusses on the

outsourced management of returnable pallets, which it issues, collects and

reissues through a network of service centres in multiple countries.

Manufacturers, producers, distributors and retailers use the pallets and

containers to transport their products safely and efficiently through the supply

chain. In addition, Pallets provides supply chain optimisation and transport

management services. In the USA Pallet provides a national network of pallet

management services, to sort, repair and reissue pallets.

Reusable Plastic Crates: The business is carried out under the name IFCO

in Europe, North and South America and CHEP in Australia, New Zealand

and South Africa with focus on the outsourced management of reusable

plastic containers which are used primarily to transport fresh produce from

producers to grocery retailers.

3 August 2016

$20,856m

1,586.0m

$13.64

$9.34

Investment Fundamentals

FYE 30 Jun

2012A

2013A

2014A

2015A

Profit

Profit (norm)

m

m

565.5

612.8

690.7

730.1

1,345.8

641.9

760.9

815.2

EPS($A)

EPS Growth

P/E

P/E Relative

¢

%

x

%

41.0

23.0

16.7

1.3

46.6

13.6

16.4

1.2

40.9

-12.2

22.5

1.6

51.9

26.8

19.8

1.3

DPS($A)

¢

26.0

27.0

Yield

%

3.8

3.5

Franking

%

25

30

Source: Morningstar historical financials

27.0

2.9

30

36.5

3.6

30

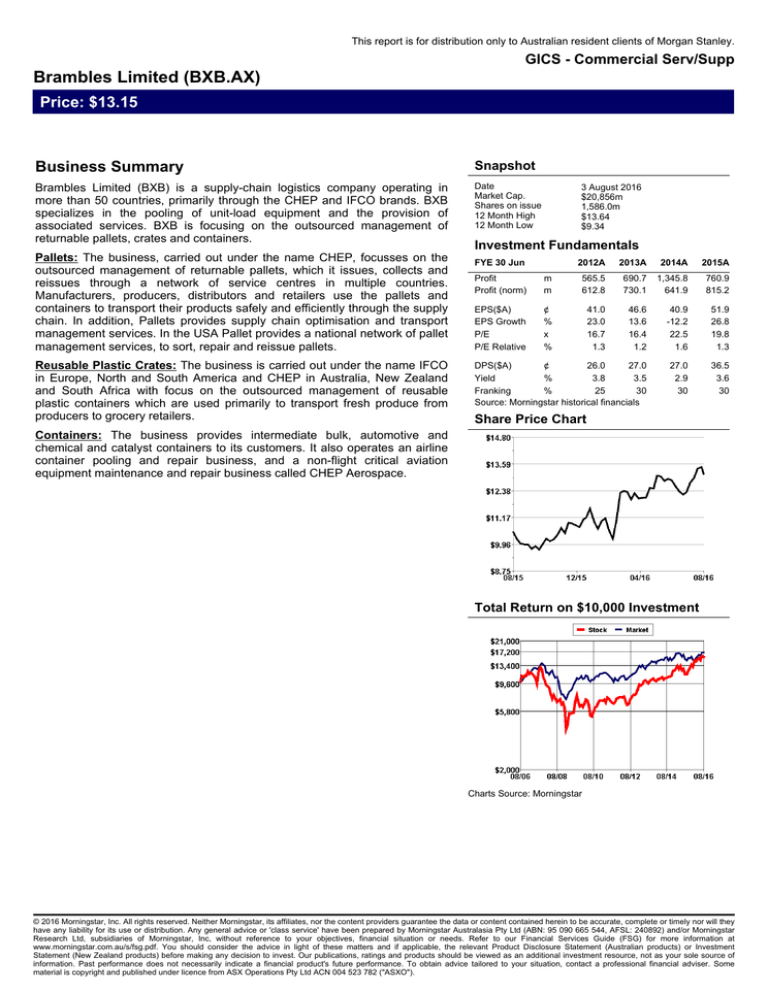

Share Price Chart

Containers: The business provides intermediate bulk, automotive and

chemical and catalyst containers to its customers. It also operates an airline

container pooling and repair business, and a non-flight critical aviation

equipment maintenance and repair business called CHEP Aerospace.

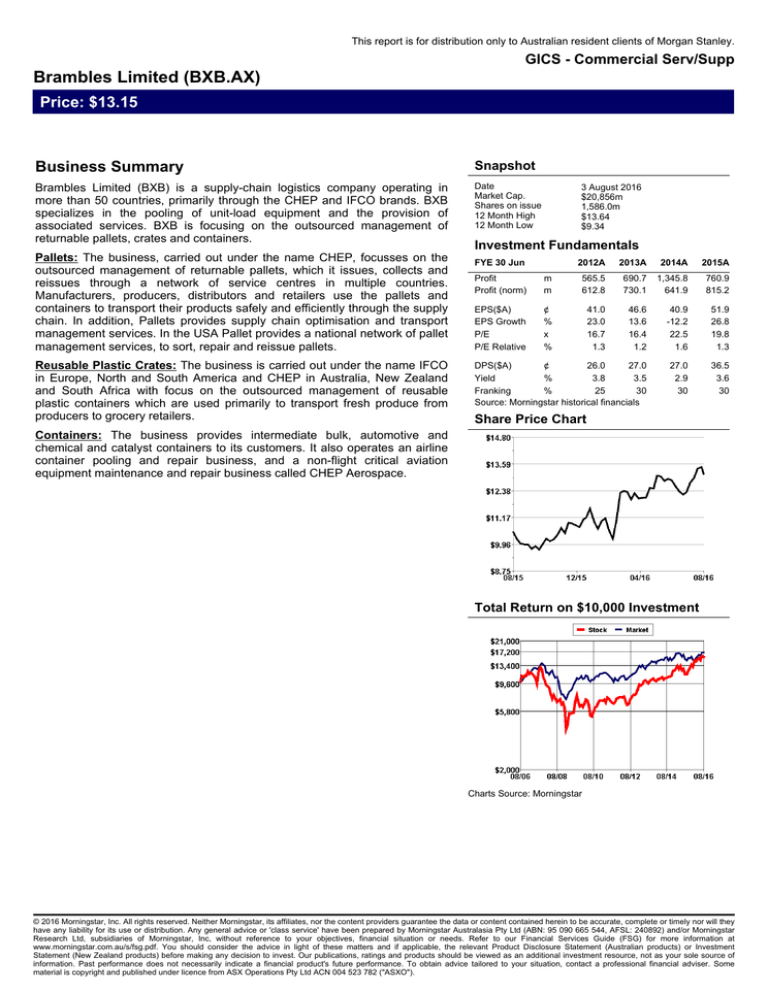

Total Return on $10,000 Investment

Charts Source: Morningstar

© 2016 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they

have any liability for its use or distribution. Any general advice or 'class service' have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar

Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Refer to our Financial Services Guide (FSG) for more information at

www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement (Australian products) or Investment

Statement (New Zealand products) before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of

information. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a professional financial adviser. Some

material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782 ("ASXO").

Brambles Limited (BXB.AX)

Profit & Loss ($AM)

Cash Flow ($AM)

2011A

2012A

Sales Revenue

4,352

5,520

Total Revenue ex. Int.

4,477

5,660

EBITDA

1,245

1,533

Depreciation & Amort.

-447

-542

Goodwill Amortisation

--EBIT

798

991

Net Interest

-119

-149

Profit Before Tax

679

842

Income Tax

-192

-229

Outside Equity Int.

-0

-Profit after Tax

487

614

Significant Items after Tax

-45

-49

Reported Profit after Tax

443

565

Preferred Dividends

--Source: Company Reports and Morningstar

2013A

6,350

6,507

1,740

-601

-1,140

-120

1,020

-290

-731

-40

691

--

2014A

5,737

5,880

1,582

-561

-1,022

-122

899

-257

-1,367

-21

1,346

--

2015A

7,115

7,281

2,021

-715

-1,306

-162

1,144

-329

-814

-53

761

--

Ratios and Substantial Shareholders

2012A

2013A

2014A

2015A

Profitability Ratios

EBITDA Margin

EBIT Margin

Net Profit Margin

Return on Equity

Return on Assets

%

%

%

%

%

28.61

18.34

11.20

21.36

8.04

27.77

17.95

11.10

22.79

9.89

27.41

17.95

11.50

22.38

9.67

27.58

17.81

11.19

21.98

9.34

28.40

18.35

11.46

23.71

9.40

Debt/Safety Ratios

Net Debt/Equity

Interest Cover

%

x

122.33

6.72

98.16

6.64

89.72

9.53

85.85

8.35

101.81

8.08

Source: Company Reports and Morningstar

Price vs. EPS

2013A

7,121

1,772

1,445

-1,015

-193

--1,089

127

-459

-426

-71

165

-13

81

2014A

6,887

1,696

1,346

-972

-46

--489

5

-418

-690

167

80

-11

235

2015A

7,980

2,078

1,723

-1,299

-648

--1,845

--468

78

-44

289

-41

204

2013A

139

1,212

61

77

1,489

4,752

2,235

87

7,085

8,573

3,066

2,246

5,312

3,262

7,136

-7,276

3,402

-3,262

2014A

236

1,171

71

75

1,553

4,636

1,639

79

6,343

7,896

2,743

2,232

4,975

2,920

6,362

-7,158

3,716

-2,920

2015A

216

1,360

106

77

1,759

5,761

2,280

84

8,130

9,889

3,718

2,732

6,450

3,439

7,848

-9,247

4,838

-3,439

Balance Sheet ($AM)

2011A

Top 5 Substantial Shareholders

Commonwealth Bank of Australia

MFS Investment Management Limited

2011A

2012A

Receipts from Customers

4,852

6,101

Funds from Operations

1,299

1,431

Net Operating Cashflow

944

1,069

Capex

-755

-984

Acquisitions & Investments

-978

-22

Sale of Invest. & Subsid.

-2

-0

Net Investing Cashflow

-1,641

-915

Proceeds from Issues

215

320

Dividends Paid

-209

-390

Net Financing Cashflow

646

-54

Net Increase Cash

-51

99

Cash at Beginning

115

79

Exchange Rate Adjust.

11

-29

Cash at End

75

150

Source: Company Reports and Morningstar

9.6%

9.0%

2011A

2012A

Cash & Equivalent

129

171

Receivables

978

1,035

Inventories

53

47

Other Current Assets

64

74

Current Assets

1,223

1,327

Prop. Plant & Equipment

3,985

4,061

Intangibles

1,954

1,933

Other Non-Current Assets

72

82

Non-Current Assets

6,010

6,077

Total Assets

7,233

7,404

Interest Bearing Debt

2,921

2,810

Other Liabilities

2,029

1,905

Total Liabilities

4,951

4,715

Net Assets

2,283

2,689

Share Capital

13,381

6,363

Reserves

-13,704

-6,564

Retained Earnings

2,605

2,890

Outside Equity Int.

0

-Total Shareholders Equity

2,283

2,689

Source: Company Reports and Morningstar

Principals & Directors

Principals

Company Secretary

Mr Robert Nies Gerrard

Directors

Mr Stephen Paul Johns ( Non-Executive Director,Non-Executive

Chairman )

Ms Sarah (Carolyn) Hailes Kay ( Non-Executive Director )

Mr Anthony (Tony) Grant Froggatt ( Non-Executive Director )

Mr David Peter Gosnell ( Non-Executive Director )

Mr Scott Perkins ( Non-Executive Director )

Mr Thomas Joseph Gorman ( Chief Executive Officer,Executive

Director )

Mr Brian James Long ( Non-Executive Director )

Ms Tahira Hassan ( Non-Executive Director )

Ms Christine Cross ( Non-Executive Director )

Mr George El Zoghbi ( Non-Executive Director )

Source: Company Reports and Morningstar

© 2016 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they

have any liability for its use or distribution. Any general advice or 'class service' have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar

Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Refer to our Financial Services Guide (FSG) for more information at

www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement (Australian products) or Investment

Statement (New Zealand products) before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of

information. Past performance does not necessarily indicate a financial product's future performance. To obtain advice tailored to your situation, contact a professional financial adviser. Some

material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782 ("ASXO").