China Aviation Oil

advertisement

Singapore Company Guide

China Aviation Oil

Refer to important disclosures at the end of this report

Version 2 | Bloomberg: CAO SP | Reuters: CNAO.SI

DBS Group Research . Equity

30 Aug 2016

BUY

Proxy to China’s civil aviation growth

Last Traded Price: S$1.36 (STI : 2,829.43)

Price Target 12-mth: S$1.70 (26% upside)

Potential Catalyst: Earnings growth and delivery; value-accretive

acquisitions

Where we differ: Slightly below consensus

Analyst

Paul YONG CFA +65 6682 3712 paulyong@dbs.com

Singapore Research Team

What’s New

CAO’s management met with our investors in HK

recently

Organic growth to be mainly led by burgeoning

Chinese civil aviation growth and extension of

CAO’s global distribution network for its aviation

marketing business

Strong balance sheet to fund M&A opportunities

Reiterate BUY with TP of S$1.70

Price Relative

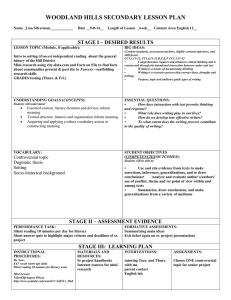

Forecasts and Valuation

FY Dec (US$ m)

Revenue

EBITDA

Pre-tax Profit

Net Profit

Net Pft (Pre Ex.)

Net Pft Gth (Pre-ex) (%)

EPS (S cts)

EPS Pre Ex. (S cts)

EPS Gth Pre Ex (%)

Diluted EPS (S cts)

Net DPS (S cts)

BV Per Share (S cts)

PE (X)

PE Pre Ex. (X)

P/Cash Flow (X)

EV/EBITDA (X)

Net Div Yield (%)

P/Book Value (X)

Net Debt/Equity (X)

ROAE (%)

2014A

17,061

55.6

51.0

49.2

49.2

(30.0)

7.77

7.77

(30)

7.77

2.06

87.5

17.4

17.4

18.2

13.7

1.5

1.5

CASH

9.1

Earnings Rev (%):

Consensus EPS (S cts):

Other Broker Recs:

2015A

8,987

66.2

63.6

61.3

61.3

24.7

9.69

9.69

25

9.69

2.88

93.7

14.0

14.0

16.5

10.4

2.1

1.4

CASH

10.7

2016F

7,299

80.6

78.5

75.4

75.4

23.0

11.9

11.9

23

11.9

3.58

102

11.4

11.4

22.7

7.7

2.6

1.3

CASH

12.2

2017F

8,454

91.0

89.0

85.4

85.4

13.3

13.5

13.5

13

13.5

4.05

111

10.0

10.0

38.8

6.3

3.0

1.2

CASH

12.6

B: 3

12.5

S: 0

15.1

H: 1

Source of all data on this page: Company, DBS Bank, Bloomberg

Finance L.P

ASIAN INSIGHTS

ed: JS / sa:YM, PY

Takeaways from investor meetings; reiterate BUY with TP of

S$1.70. We arranged several investor meetings for China

Aviation Oil (CAO) over two days in Hong Kong (25 and 26 Aug)

and met with ten different funds – most of which were new to

the company. In the following page, we present some of the

key highlights of the management presentation and questions

from investors raised during the sessions.

Sole supplier of imported jet fuel in China with growing

international presence. With monopoly on the supply of bonded

jet fuel to China’s civil aviation industry, CAO should benefit

from the long-term growth of China’s international air travel

market. Furthermore, with the backing of SOE parent China

National Aviation Fuel Group (CNAF), CAO has expanded its

business to the marketing and supply of jet fuel at 42

international airports outside China, and further growing its

reach, volumes, and ultimately greater economies of scale.

Firm outlook for prized asset 33%-owned associate, SPIA. As

the exclusive supplier of jet fuel to Pudong International Airport,

Shanghai Pudong International Airport Aviation Fuel Supply

Company (SPIA) has and should continue to benefit from rising

air traffic at the airport, which is driven by the continued

development of Shanghai as China’s key financial centre. Net

cash and strong balance sheet could fund acquisition-driven

growth. With net cash of c.US$169m at the end of 1H16, and

strong support from its parent CNAF, we believe that CAO

could be on the lookout for acquisitions to further grow the

scale and reach of its business and profits.

Valuation:

Our TP of S$1.70 is based on 12x FY17F PE. We think that 12x

earnings against the projected 18% EPS CAGR over FY15FY17F is reasonable, and believe that the group is poised to

see a structural re-rating of its valuation multiple on sustained

earnings growth, especially if CAO can utilise its strong cash

balance to further accelerate growth through M&A.

Key Risks to Our View:

Weaker demand for air travel and execution risk. A sustained

slowdown in demand for air travel could impact jet fuel

demand and volumes. Further, the group could also face

execution risk in its trading business and prospective M&A

activities.

At A Glance

Issued Capital (m shrs)

Mkt. Cap (S$m/US$m)

Major Shareholders (%)

China National Aviation Fuel Grp

BP Plc

Free Float (%)

3m Avg. Daily Val (US$m)

ICB Industry : Oil & Gas / Oil & Gas Producers

865

1,172 / 862

51.0

20.1

28.9

3.0

VICKERS SECURITIES

Company Guide

China Aviation Oil

WHAT’S NEW

Takeaways from investor meetings (25 and 26 Aug) in

HK

We arranged several meetings for CAO over two days in

Hong Kong (25 and 26 Aug) and met with ten different funds

– most of which were new to the company. Attendees from

CAO were:

Ms Jean Teo (Group Chief Operating Officer), Ms Elaine Ang

(Head, Investor Relations) and Ms Lilian Low (Investor

Relations officer)

Salient points from management presentation:

1) Strong corporate governance and risk management

policies. CAO, post the 2004 trading scandal, in which both

BP and Temasek entered as white knights to restructure the

company, is very much a risk-aware and prudent entity now

especially in terms of its trading activities. In management’s

view, the company has adopted the best of risk management

and corporate governance policies, and restructuring steps

from BP and Temasek (although Temasek has long divested its

4.9% stake while BP still holds 20%). Ten years on, CAO has

developed its own core competencies and expertise in these

vital areas independent of its shareholders, winning several

accolades in corporate governance and corporate

transparency.

2) Burgeoning Chinese civil aviation growth a key driver for

CAO. For its jet fuel import business in China, CAO benefits

from the expected long-term growth of China’s outbound

international passenger traffic, which is currently growing at

a high single-digit pace. Meanwhile, its key associate,

Shanghai Pudong International Airport Aviation Fuel Supply,

will benefit from the overall growth at Pudong airport, which

is expanding capacity to cater for future growth. These two

segments, by our estimates, account for more than 70% of

the company’s earnings, presenting a sustainable growth

trajectory for CAO going forward.

3) Extending global distribution network for its aviation

marketing business. Over the last few years, CAO has been

growing its global distribution presence, and currently

supplies jet fuel to 42 international airports outside of China.

The company continues to look for opportunities to gain

access to new airport/markets to grow its global presence. At

the same time, CAO is also confident of growing its market

share into recently penetrated regions/markets, such as the

US – the world’s largest aviation market today, even as it

maintains an entrenched positioning in China’s burgeoning

aviation market.

4) Trading segment to help augment margins and

opportunistic gains. Meanwhile, CAO’s trading arm will

continue to adopt prudent strategies that help to optimise

margins for its aviation fuel supply and marketing business

ASIAN INSIGHTS

Page 2

CAO’s increasing scale and volumes should also help to

increase economies of scale and enhance margins. CAO will

also continue to look for opportunistic gains from other types

of transportation fuel to boost its bottom line. Underpinning

the trading business is the company’s over-arching risk policy

that 90% of trading must be backed by physicals, and also

that CAO does not speculate on oil price movements but

enhance profits through supply optimisation.

5) Strong balance sheet to fund M&A opportunities. Besides

organic growth, CAO is also on the lookout for acquisitions

and/or investments to expand its business. This could be in

the form of 1) access/licenses to grow its distribution

network, or 2) equity investments in aviation related assets

such as airport refuelling/pipelines/storage tanks. Key questions raised by investors:

Q1: Will BP look to divest its 20% stake in CAO, and how

would that impact CAO? Management is not aware of any

plans by BP to divest its 20% stake (although BP has been

selling some of its other assets), however they do note that it’s

been 10 years since BP came onboard CAO. CAO has since

learnt a lot (in terms of risk management etc.) from BP, and

over time has also developed its own risk management culture

and practices. Hence, even if BP is no longer a strategic

investor, it would not impact CAO’s risk management

capability. In our view, BP’s divestment could help the liquidity

of CAO if placed to the right investors.

Q2: What is the risk that China will reform aviation fuel

supply into China and CAO loses its monopoly?

Management is of the view that CAO will not lose its

monopoly in the foreseeable future, and that aviation fuel

supply would be one of the last to be reformed, if at all. This

is because CNAF, CAO’s parent company who accords the

perpetual jet fuel import license to CAO, owns all of the

refuelling assets and infrastructure at China’s 210 airports,

representing a very high barrier of entry and is of national

strategic importance. CAO is also CNAF’s only overseas

subsidiary to fulfill the role.

Q3: Why doesn’t CAO pay more dividends given its assetlight, highly cash-generative business model? CAO’s organic

capital expenditure (largely spent on trading/risk

management IT systems) is not more than US$250k per year,

and may be less in some years while its associates are selffunded and provide dividends hence providing annual cash

inflow of c. US$60m. Furthermore, working capital needs are

generally well funded internally (AR days usually equal to AP

days) so only inventory (in contango markets) need to be

funded. Recognising that CAO’s cash coffers have been

accumulating over the last few years (which provides the

company with M&A appetite), CAO has already moved from

paying out annual dividends of 2Scts to a dividend payout of

30% of net profit.

VICKERS SECURITIES

Company Guide

China Aviation Oil

CRITICAL DATA POINTS TO WATCH

Jet Fuel Volumes (m tonnes)

Earnings Drivers:

Sole importer of jet fuel into the PRC with growing international

presence… Leveraging on the network of its parent, China National

Aviation Fuel Group Corporation (CNAF) – a state-owned enterprise

and the largest aviation transportation logistics services provider in

the PRC – China Aviation Oil (Singapore) Corporation Ltd (CAO) has

monopoly in the supply of imported jet fuel (or bonded jet fuel) to

17 international airports in China.

With the backing of its parent, CAO has also expanded its business

to the marketing and supply of jet fuel to airline companies at 41

international airports outside of the PRC, spanning across Asia

Pacific, North America, Europe and the Middle East.

Other Oil Product Volumes (m tonnes)

Owing to its domestic monopoly, CAO should benefit from the

long-term growth of China’s international air travel market.

Coupled with its ongoing international expansion, we expect jet

fuel volumes supplied and traded to grow at a 4.5% CAGR from

c.12m in FY15 to almost 13m by FY17F.

Optimising of margins through trading activities. As CAO enjoys

cost-plus pricing (we estimate gross profit of US$3.02/tonne) for its

China jet fuel supply business, and after hedging downside risk,

CAO will seek to further optimise margins when viable trading

opportunities arise.

Implied Average Jet Fuel Price (USD/bbl)

While opportunities to improve margins are available in both

backwardation and contango markets, CAO generally prefers

contango markets as it allows for superior opportunities for margin

optimisation from the storing and trading of fuels (which also

includes gas oil, fuel oil and avgas).

Management cautioned that the lack of clarity in the underlying oil

market could pose challenges to CAO’s trading business in 2H16.

Sharing similar concerns, we have since lowered our GP/tonne

assumptions by 21% and 16% to US$1.67 and US$1.92 for FY16F

and FY17F respectively.

Contributions from associates, including prized asset SPIA.

Arguably CAO’s best-performing asset, SPIA has never had a cash

call since the group first invested in Shanghai Pudong International

Airport’s exclusive supplier of jet fuel in 2002, and has historically

close to 90% share in the annual income contributions from CAO’s

associated companies. Notably, SPIA alone contributed c.61.3% of

the group’s FY15 profit, and continues to perform firmly as it

contributed c.62% of CAO’s 1H16 net profit.

Gross Profit per Tonne (US$)

Contribution from Associates (US$ m)

With two new runways added in the last 18 months, which has

doubled the capacity of the airport, and additional satellite

concourse expected to be completed by 2019, capacity at China’s

second-largest airport is expected to be raised from 60m to 80m

passengers p.a., which should underpin SPIA’s long-term growth

prospects.

Nearer term, given SPIA’s consistently firm performance - even as

expected air traffic increases from the recent opening of Shanghai

Disneyland have yet to show up, we think that contributions from

the associate should more than offset trading challenges (if any) in

2H16.

ASIAN INSIGHTS

Source: Company, DBS Bank

VICKERS SECURITIES

Page 3

Company Guide

China Aviation Oil

Leverage & Asset Turnover (x)

Balance Sheet:

Strong balance sheet with a net cash position of c.US$169m as at

end-2Q16. With net cash of US$169m even after paying dividends

of US$19.3m in 2Q16, we believe the company has sufficient

firepower with room to gear up further to finance its M&A

opportunities and grow the scale and reach of its business and

profits.

Share Price Drivers:

Progress on the M&A front. While CAO is armed with dry powder

for potential acquisitions and investments, it has yet to announce

significant M&A plans – its last major investment was in 2013,

when the company acquired a 39% stake in refueller CNAF Hong

Kong Refuelling Limited.

Capital Expenditure

Management has shared that they will be looking at both “assetlight” investments, which will allow the group to gain access to air

spaces, customer contracts, strategic alliances and further trading

synergies, as well as “asset-backed” investments (or infrastructure

assets), which may include airport refuelling stations, pipelines

going into airports and storage facilities.

ROE (%)

We believe that the eventual deployment of cash to fund valueaccretive opportunities should lead to a further rerating of the

stock.

Key Risks:

Weaker demand for air travel. Given the group’s exposure to the air

passenger market, events that could significantly dampen travellers’

sentiment, such as the outbreak of diseases and acts of terror, pose

direct threats to the tourism and air travel industry which in turn,

could weigh on global demand for jet fuel.

Forward PE Band (x)

Potential mark-to-market losses for associates. As SPIA and CNAFHKR hold inventories of fifteen days and seven days respectively,

these have to be marked to market. In a declining oil price

environment, these would result in paper losses for these

associates, which add volatility to CAO’s bottom line.

Trading and execution risks. CAO is exposed to a myriad of risks

that are inherent in the lifecycle of trades, which include market

risk, credit risk, and operational risk.

PB Band (x)

Company Background

China Aviation Oil (Singapore) Corporation Ltd (CAO SP) is

principally engaged in the supply and trading of bonded jet fuel,

with monopoly in China and a growing international presence.

Apart from jet fuel, the Group also trades and/or supplies other

transportation fuel (such as fuel oil, gas oil and aviation gas) and

has varying equity stakes in oil-related assets. These assets include

airport refuelling facilities (SPIA and CNAF HKR), pipelines (TSNPEKCL) and storage facilities (Xinyuan and OKYC).

ASIAN INSIGHTS

Page 4

Source: Company, DBS Bank

VICKERS SECURITIES

Company Guide

China Aviation Oil

Key Assumptions

FY Dec

Jet Fuel Volumes (m

Other Oil Product

Implied Average Jet Fuel

Gross Profit per Tonne

Contribution from

Segmental Breakdown

FY Dec

Revenues (US$m)

Middle distillates

Other oil products

Total

Income Statement (US$m)

FY Dec

Revenue

Cost of Goods Sold

Gross Profit

Other Opng (Exp)/Inc

Operating Profit

Other Non Opg (Exp)/Inc

Associates & JV Inc

Net Interest (Exp)/Inc

Exceptional Gain/(Loss)

Pre-tax Profit

Tax

Minority Interest

Preference Dividend

Net Profit

Net Profit before Except.

EBITDA

Growth

Revenue Gth (%)

EBITDA Gth (%)

Opg Profit Gth (%)

Net Profit Gth (Pre-ex) (%)

Margins & Ratio

Gross Margins (%)

Opg Profit Margin (%)

Net Profit Margin (%)

ROAE (%)

ROA (%)

ROCE (%)

Div Payout Ratio (%)

Net Interest Cover (x)

2013A

2014A

2015A

2016F

2017F

10.4

6.07

151

3.19

46.5

12.1

8.29

141

1.34

43.2

11.9

8.28

74.4

1.76

42.3

12.2

9.94

56.6

1.67

58.8

13.0

10.4

62.0

1.92

62.9

2013A

2014A

2015A

2016F

2017F

12,456

3,116

15,572

13,508

3,553

17,061

7,010

1,978

8,987

5,493

1,806

7,299

6,377

2,077

8,454

2013A

2014A

2015A

2016F

2017F

15,572

(15,519)

52.5

(21.2)

31.3

0.0

46.5

(5.3)

0.0

72.4

(2.2)

0.0

0.0

70.2

70.2

79.5

17,061

(17,034)

27.4

(16.5)

10.9

0.0

43.2

(3.1)

0.0

51.0

(1.9)

0.0

0.0

49.2

49.2

55.6

8,987

(8,952)

35.4

(13.1)

22.3

0.0

42.3

(1.0)

0.0

63.6

(2.3)

0.0

0.0

61.3

61.3

66.2

7,299

(7,262)

37.0

(16.8)

20.2

0.0

58.8

(0.5)

0.0

78.5

(3.1)

0.0

0.0

75.4

75.4

80.6

8,454

(8,409)

45.0

(18.4)

26.5

0.0

62.9

(0.5)

0.0

89.0

(3.6)

0.0

0.0

85.4

85.4

91.0

5.2

10.3

11.5

6.1

9.6

(30.1)

(65.1)

(30.0)

(47.3)

19.1

104.8

24.7

(18.8)

21.7

(9.4)

23.0

15.8

12.9

31.0

13.3

0.3

0.2

0.5

14.3

4.2

5.9

19.4

5.9

0.2

0.1

0.3

9.1

3.2

1.9

26.5

3.5

0.4

0.2

0.7

10.7

5.5

3.7

29.8

21.5

0.5

0.3

1.0

12.2

8.9

3.1

30.0

40.5

0.5

0.3

1.0

12.6

9.5

3.7

30.0

53.0

We recently adjusted our

GP/tonne assumptions

downward on the

expectation of a more

challenging trading

environment in 2H16.

Tax rate to remain low

as CAO receives tax

incentives under

Singapore’s Global

Trader Programme.

Source: Company, DBS Bank

ASIAN INSIGHTS

VICKERS SECURITIES

Page 5

Company Guide

China Aviation Oil

Quarterly / Interim Income Statement (US$m)

FY Dec

2Q2015

3Q2015

Revenue

Cost of Goods Sold

Gross Profit

Other Oper. (Exp)/Inc

Operating Profit

Other Non Opg (Exp)/Inc

Associates & JV Inc

Net Interest (Exp)/Inc

Exceptional Gain/(Loss)

Pre-tax Profit

Tax

Minority Interest

Net Profit

Net profit bef Except.

EBITDA

4Q2015

1Q2016

2Q2016

2,524

(2,515)

9.20

(3.9)

5.36

0.0

13.5

(0.3)

0.0

18.6

(0.8)

0.0

17.8

17.8

18.9

2,399

(2,386)

12.9

(4.1)

8.80

0.0

9.73

(0.2)

0.0

18.3

(0.6)

0.0

17.7

17.7

18.5

1,973

(1,965)

8.00

(5.7)

2.30

0.0

9.75

(0.2)

0.0

11.9

(0.4)

0.0

11.4

11.4

12.0

1,464

(1,451)

13.2

(2.3)

10.8

0.0

14.2

(0.1)

0.0

24.9

(0.7)

0.0

24.2

24.2

25.0

3,023

(3,013)

9.90

(4.3)

5.62

0.0

19.4

(0.2)

0.0

24.8

(1.2)

0.0

23.6

23.6

25.0

21.3

24.0

(8.9)

23.9

(4.9)

(1.7)

64.2

(0.3)

(17.8)

(35.0)

(73.9)

(35.6)

(25.8)

107.7

371.7

111.6

106.5

(0.1)

(48.1)

(2.2)

0.4

0.2

0.7

0.5

0.4

0.7

0.4

0.1

0.6

0.9

0.7

1.6

0.3

0.2

0.8

Balance Sheet (US$m)

FY Dec

2013A

2014A

2015A

2016F

2017F

Net Fixed Assets

Invts in Associates & JVs

Other LT Assets

Cash & ST Invts

Inventory

Debtors

Other Current Assets

Total Assets

7.38

268

9.90

56.3

113

1,267

0.0

1,721

6.79

270

9.96

94.3

38.1

959

0.0

1,379

6.21

266

9.43

171

56.8

337

0.0

846

5.64

275

8.70

235

46.1

281

0.0

851

5.06

285

7.97

284

53.4

313

0.0

948

ST Debt

Creditor

Other Current Liab

LT Debt

Other LT Liabilities

Shareholder’s Equity

Minority Interests

Total Cap. & Liab.

28.6

1,163

0.37

0.0

6.23

524

0.0

1,721

0.0

819

0.02

0.0

6.24

554

0.0

1,379

0.0

247

0.01

0.0

6.16

593

0.0

846

0.0

196

3.15

0.0

6.16

645

0.0

851

0.0

234

3.56

0.0

6.16

705

0.0

948

Non-Cash Wkg. Capital

Net Cash/(Debt)

Debtors Turn (avg days)

Creditors Turn (avg days)

Inventory Turn (avg days)

Asset Turnover (x)

Current Ratio (x)

Quick Ratio (x)

Net Debt/Equity (X)

Net Debt/Equity ex MI (X)

Capex to Debt (%)

Z-Score (X)

217

27.7

29.9

27.6

1.5

9.2

1.2

1.1

CASH

CASH

0.5

NA

179

94.3

23.8

21.2

1.6

11.0

1.3

1.3

CASH

CASH

N/A

NA

147

171

26.3

21.7

1.9

8.1

2.3

2.1

CASH

CASH

N/A

NA

127

235

15.4

11.1

2.6

8.6

2.8

2.6

CASH

CASH

N/A

NA

129

284

12.8

9.3

2.2

9.4

2.7

2.5

CASH

CASH

N/A

NA

Growth

Revenue Gth (%)

EBITDA Gth (%)

Opg Profit Gth (%)

Net Profit Gth (Pre-ex) (%)

Margins

Gross Margins (%)

Opg Profit Margins (%)

Net Profit Margins (%)

Contribution from SPIA alone

represented > 60% of 1H16

net profit.

With net cash of

US$169m as at 1H16,

CAO is well able to

finance value-accretive

M&A opportunities

internally, if they arise.

Source: Company, DBS Bank

ASIAN INSIGHTS

Page 6

VICKERS SECURITIES

Company Guide

China Aviation Oil

Cash Flow Statement (US$m)

FY Dec

Pre-Tax Profit

Dep. & Amort.

Tax Paid

Assoc. & JV Inc/(loss)

Chg in Wkg.Cap.

Other Operating CF

Net Operating CF

Capital Exp.(net)

Other Invts.(net)

Invts in Assoc. & JV

Div from Assoc & JV

Other Investing CF

Net Investing CF

Div Paid

Chg in Gross Debt

Capital Issues

Other Financing CF

Net Financing CF

Currency Adjustments

Chg in Cash

Opg CFPS (S cts)

Free CFPS (S cts)

2013A

2014A

2015A

2016F

2017F

72.4

1.80

(2.3)

(46.5)

(97.5)

1.20

(70.8)

(0.1)

0.0

(5.0)

38.8

(1.3)

32.4

(11.6)

26.9

0.0

(2.0)

13.4

0.26

(24.9)

4.22

(11.2)

51.0

1.50

(2.6)

(43.2)

36.1

4.34

47.2

(0.2)

0.0

0.0

35.2

0.07

35.0

(13.7)

(28.6)

0.0

(1.6)

(43.9)

(0.4)

38.0

1.76

7.43

63.6

1.56

(2.2)

(42.3)

33.1

(1.7)

52.1

(0.3)

0.0

0.0

37.2

0.19

37.2

(12.8)

0.0

0.0

(0.3)

(13.0)

(0.1)

76.2

3.00

8.20

78.5

1.56

0.0

(58.8)

16.4

0.0

37.7

(0.3)

0.0

0.0

49.9

0.0

49.6

(22.6)

0.0

0.0

0.0

(22.6)

0.0

64.7

3.37

5.93

89.0

1.56

(3.1)

(62.9)

(2.4)

0.0

22.1

(0.3)

0.0

0.0

52.9

0.0

52.6

(25.6)

0.0

0.0

0.0

(25.6)

0.0

49.1

3.86

3.45

Source: Company, DBS Bank

Target Price & Ratings History

Source: DBS Bank

Analyst: Paul YONG CFA

Singapore Research Team

ASIAN INSIGHTS

VICKERS SECURITIES

Page 7

Company Guide

China Aviation Oil

DBS Bank recommendations are based an Absolute Total Return* Rating system, defined as follows:

STRONG BUY (>20% total return over the next 3 months, with identifiable share price catalysts within this time frame)

BUY (>15% total return over the next 12 months for small caps, >10% for large caps)

HOLD (-10% to +15% total return over the next 12 months for small caps, -10% to +10% for large caps)

FULLY VALUED (negative total return i.e. > -10% over the next 12 months)

SELL (negative total return of > -20% over the next 3 months, with identifiable catalysts within this time frame)

Share price appreciation + dividends

Completed Date: 30 Aug 2016 11:11:45

Dissemination Date: 30 Aug 2016 15:42:55

GENERAL DISCLOSURE/DISCLAIMER

This report is prepared by DBS Bank Ltd. This report is solely intended for the clients of DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,

its respective connected and associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or duplicated

in any form or by any means or (ii) redistributed without the prior written consent of DBS Bank Ltd.

The research set out in this report is based on information obtained from sources believed to be reliable, but we (which collectively refers to DBS

Bank Ltd, its respective connected and associated corporations, affiliates and their respective directors, officers, employees and agents (collectively,

the “DBS Group”)) do not make any representation or warranty as to its accuracy, completeness or correctness. Opinions expressed are subject to

change without notice. This document is prepared for general circulation. Any recommendation contained in this document does not have regard

to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is for the information of

addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate independent legal

or financial advice. The DBS Group accepts no liability whatsoever for any direct, indirect and/or consequential loss (including any claims for loss of

profit) arising from any use of and/or reliance upon this document and/or further communication given in relation to this document. This

document is not to be construed as an offer or a solicitation of an offer to buy or sell any securities. The DBS Group, along with its affiliates and/or

persons associated with any of them may from time to time have interests in the securities mentioned in this document. The DBS Group may have

positions in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and

other banking services for these companies.

Any valuations, opinions, estimates, forecasts, ratings or risk assessments herein constitutes a judgment as of the date of this report, and there can

be no assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk assessments.

The information in this document is subject to change without notice, its accuracy is not guaranteed, it may be incomplete or condensed and it

may not contain all material information concerning the company (or companies) referred to in this report and the DBS Group is under no

obligation to update the information in this report.

This publication has not been reviewed or authorized by any regulatory authority in Singapore, Hong Kong or elsewhere. There is no planned

schedule or frequency for updating research publication relating to any issuer.

The valuations, opinions, estimates, forecasts, ratings or risk assessments described in this report were based upon a number of estimates and

assumptions and are inherently subject to significant uncertainties and contingencies. It can be expected that one or more of the estimates on

which the valuations, opinions, estimates, forecasts, ratings or risk assessments were based will not materialize or will vary significantly from actual

results. Therefore, the inclusion of the valuations, opinions, estimates, forecasts, ratings or risk assessments described herein IS NOT TO BE RELIED

UPON as a representation and/or warranty by the DBS Group (and/or any persons associated with the aforesaid entities), that:

(a)

(b)

such valuations, opinions, estimates, forecasts, ratings or risk assessments or their underlying assumptions will be achieved, and

there is any assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk

assessments stated therein.

Please contact the primary analyst for valuation methodologies and assumptions associated with the covered companies or price targets.

Any assumptions made in this report that refers to commodities, are for the purposes of making forecasts for the company (or companies)

mentioned herein. They are not to be construed as recommendations to trade in the physical commodity or in the futures contract relating to the

commodity referred to in this report.

DBS Vickers Securities (USA) Inc ("DBSVUSA")"), a U.S.-registered broker-dealer, does not have its own investment banking or research

department, has not participated in any public offering of securities as a manager or co-manager or in any other investment banking transaction

in the past twelve months and does not engage in market-making.

ASIAN INSIGHTS

Page 8

VICKERS SECURITIES

Company Guide

China Aviation Oil

ANALYST CERTIFICATION

The research analyst(s) primarily responsible for the content of this research report, in part or in whole, certifies that the views about the

companies and their securities expressed in this report accurately reflect his/her personal views. The analyst(s) also certifies that no part of his/her

compensation was, is, or will be, directly, or indirectly, related to specific recommendations or views expressed in the report. The DBS Group has

procedures in place to eliminate, avoid and manage any potential conflicts of interests that may arise in connection with the production of

research reports. As of 30 Aug 2016, the analyst(s) and his/her spouse and/or relatives who are financially dependent on the analyst(s), do not hold

interests in the securities recommended in this report (“interest” includes direct or indirect ownership of securities). The research analyst(s)

responsible for this report operates as part of a separate and independent team to the investment banking function of the DBS Group and

procedures are in place to ensure that confidential information held by either the research or investment banking function is handled

appropriately.

COMPANY-SPECIFIC / REGULATORY DISCLOSURES

1.

DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd (''DBSVS''), their subsidiaries and/or other affiliates do not have a proprietary

position in the securities recommended in this report as of 31 Jul 2016.

2.

3.

DBS Bank Ltd does not market make in equity securities of the issuer(s) or company(ies) mentioned in this Research Report.

Compensation for investment banking services:

DBSVUSA does not have its own investment banking or research department, nor has it participated in any public offering of securities as a

manager or co-manager or in any other investment banking transaction in the past twelve months. Any US persons wishing to obtain further

information, including any clarification on disclosures in this disclaimer, or to effect a transaction in any security discussed in this document

should contact DBSVUSA exclusively.

RESTRICTIONS ON DISTRIBUTION

General

This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of

or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would

be contrary to law or regulation.

Australia

This report is being distributed in Australia by DBS Bank Ltd. (“DBS”) or DBS Vickers Securities (Singapore) Pte Ltd

(“DBSVS”), both of which are exempted from the requirement to hold an Australian Financial Services Licence under the

Corporation Act 2001 (“CA”) in respect of financial services provided to the recipients. Both DBS and DBSVS are

regulated by the Monetary Authority of Singapore under the laws of Singapore, which differ from Australian laws.

Distribution of this report is intended only for “wholesale investors” within the meaning of the CA.

Hong Kong

This report is being distributed in Hong Kong by or on behalf of, and is attributable to DBS Vickers (Hong Kong) Limited

which is licensed and regulated by the Hong Kong Securities and Futures Commission and/or by DBS Bank (Hong Kong)

Limited which is regulated by the Hong Kong Monetary Authority and the Securities and Futures Commission. Where this

publication relates to a research report, unless otherwise stated in the research report(s), DBS Bank (Hong Kong) Limited is

not the issuer of the research report(s). This publication including any research report(s) is/are distributed on the express

understanding that, whilst the information contained within is believed to be reliable, the information has not been

independently verified by DBS Bank (Hong Kong) Limited. This report is intended for distribution in Hong Kong only to

professional investors (as defined in the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong) and

any rules promulgated thereunder.)

For any query regarding the materials herein, please contact Paul Yong (CE. No. ASE988) at equityresearch@dbs.com.

Indonesia

This report is being distributed in Indonesia by PT DBS Vickers Securities Indonesia.

Malaysia

This report is distributed in Malaysia by AllianceDBS Research Sdn Bhd ("ADBSR"). Recipients of this report, received from

ADBSR are to contact the undersigned at 603-2604 3333 in respect of any matters arising from or in connection with this

report. In addition to the General Disclosure/Disclaimer found at the preceding page, recipients of this report are advised

that ADBSR (the preparer of this report), its holding company Alliance Investment Bank Berhad, their respective connected

and associated corporations, affiliates, their directors, officers, employees, agents and parties related or associated with

any of them may have positions in, and may effect transactions in the securities mentioned herein and may also perform

or seek to perform broking, investment banking/corporate advisory and other services for the subject companies. They

may also have received compensation and/or seek to obtain compensation for broking, investment banking/corporate

advisory and other services from the subject companies.

Wong Ming Tek, Executive Director, ADBSR

ASIAN INSIGHTS

VICKERS SECURITIES

Page 9

Company Guide

China Aviation Oil

Singapore

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) or DBSVS (Company Regn No.

198600294G), both of which are Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the

Monetary Authority of Singapore. DBS Bank Ltd and/or DBSVS, may distribute reports produced by its respective foreign

entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial

Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert

Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such

persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 6327 2288 for matters

arising from, or in connection with the report.

Thailand

This report is being distributed in Thailand by DBS Vickers Securities (Thailand) Co Ltd. Research reports distributed are

only intended for institutional clients only and no other person may act upon it.

United Kingdom

This report is produced by DBS Bank Ltd which is regulated by the Monetary Authority of Singapore.

This report is disseminated in the United Kingdom by DBS Vickers Securities (UK) Ltd, ("DBSVUK"). DBSVUK is authorised

and regulated by the Financial Conduct Authority in the United Kingdom.

In respect of the United Kingdom, this report is solely intended for the clients of DBSVUK, its respective connected and

associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or duplicated in

any form or by any means or (ii) redistributed without the prior written consent of DBSVUK. This communication is

directed at persons having professional experience in matters relating to investments. Any investment activity following

from this communication will only be engaged in with such persons. Persons who do not have professional experience in

matters relating to investments should not rely on this communication.

Dubai

This research report is being distributed in The Dubai International Financial Centre (“DIFC”) by DBS Bank Ltd., (DIFC

rd

Branch) having its office at PO Box 506538, 3 Floor, Building 3, East Wing, Gate Precinct, Dubai International Financial

Centre (DIFC), Dubai, United Arab Emirates. DBS Bank Ltd., (DIFC Branch) is regulated by The Dubai Financial Services

Authority. This research report is intended only for professional clients (as defined in the DFSA rulebook) and no other

person may act upon it.

United States

This report was prepared by DBS Bank Ltd. DBSVUSA did not participate in its preparation. The research analyst(s)

named on this report are not registered as research analysts with FINRA and are not associated persons of DBSVUSA. The

research analyst(s) are not subject to FINRA Rule 2241 restrictions on analyst compensation, communications with a

subject company, public appearances and trading securities held by a research analyst. This report is being distributed in

the United States by DBSVUSA, which accepts responsibility for its contents. This report may only be distributed to Major

U.S. Institutional Investors (as defined in SEC Rule 15a-6) and to such other institutional investors and qualified persons as

DBSVUSA may authorize. Any U.S. person receiving this report who wishes to effect transactions in any securities

referred to herein should contact DBSVUSA directly and not its affiliate.

Other jurisdictions

In any other jurisdictions, except if otherwise restricted by laws or regulations, this report is intended only for qualified,

professional, institutional or sophisticated investors as defined in the laws and regulations of such jurisdictions.

DBS Bank Ltd

12 Marina Boulevard, Marina Bay Financial Centre Tower 3

Singapore 018982

Tel. 65-6878 8888

e-mail: equityresearch@dbs.com

Company Regn. No. 196800306E

ASIAN INSIGHTS

Page 10

VICKERS SECURITIES