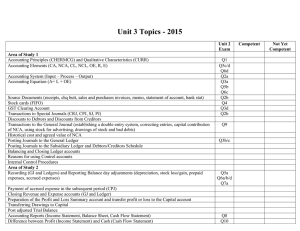

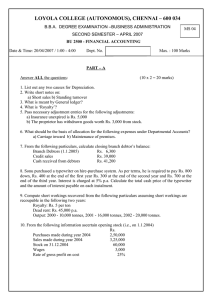

accounting revision notes and assessment tasks

advertisement