CRA RC4022

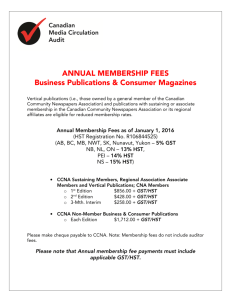

advertisement