Immediate Annuity Overview

advertisement

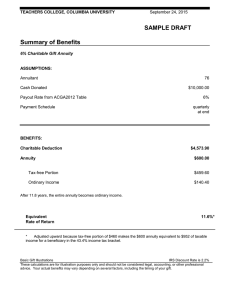

GUARANTEED RETIREMENT INCOME PLAN (GRIP) (A Single Premium Immediate Annuity) 800-472-8722 Guaranteed income you can’t outlive. An immediate annuity lets you exchange a lump sum of money for a monthly check that can be guaranteed to continue for the rest of your life. The monthly check you receive from the annuity can take the worry away from paying your fixed living expenses during retirement. Product Description: This is a fixed, single premium immediate annuity that helps you secure a lifetime of income for retirement. The policy is bought with a single lump sum and you receive a guaranteed stream of income for life, a set period of time, or both. USAA Life Insurance Companies continue to earn high ratings from the three major ratings agencies— A.M. Best, Moody’s and Standard & Poor’s. Tailoring Your Guaranteed Retirement Income Plan to your Needs: • You can choose the timeframe and schedule that works for your needs and lifestyle. • The income you receive is guaranteed and free from loss due to market volatility. • Your payment can last for your lifetime (or joint lifetimes) or a fixed number of years. • Options are available that can guarantee you will receive more money than what you put in.1 • You can choose to have a fixed payment or have your income increase annually. How It Works2 20-year Guaranteed Payout Total Payout with Longevity Member, at age 95, has received $61,067.60 more than the $100,000 he put in. $180,000 $160,000 Total Income Received See if a guaranteed income annuity is right for you. Member continues to receive $447.41/month until he dies. $140,000 Member, at age 85, has received $7,378.40 more than the $100,000 he put in. $120,000 Member, at age 65, opens immediate annuity with $100,000 and starts to receive $447.41/month $100,000 $80,000 $60,000 20-year Guaranteed Payout to you or beneficiaries: $107,378.40 $40,000 $20,000 0 65 70 75 80 Total Payout with Longevity to age 95: $161,067.60 85 90 95 Age Your Guaranteed Retirement Income Plan Options: • Number of years only: Income is paid for the number of years (and months) chosen as the guaranteed period3. If the annuitant dies before the end of the guaranteed period, we will continue to pay for the remainder of the period to the beneficiaries. • Life only: Income continues for as long as the annuitant(s) is alive and may be based on a single life or joint lives. Income ends upon the death of the annuitant(s). USAA Life Insurance Company • 9800 Fredericksburg Rd, San Antonio, TX 78288 • 800-472-8722 usaa.com • facebook.com/usaa • twitter.com/USAA • Number of years and life: Income is paid for the number of years (and months) chosen as the guaranteed period3 or for as long as the annuitant(s) is alive and may be based on a single life or joint lives. If the annuitant(s) dies before the end of the guaranteed period, we will continue to pay for the remainder of the period to the beneficiaries. If the annuitant lives beyond the guaranteed period, income continues until the death of the annuitant(s). Withdrawal Features: • Financial Emergency Liquidity Rider: If you have a qualified emergency4, you may request a onetime withdraw up to 30% of the present value of the remaining expected income. This will reduce future income payments. • • • • Must be 59½ to exercise option. Contract must be at least 3 years old. Automatically included in your contract. No need to apply separately.5 For Traditional IRA, Roth, and Qualified plans it is only included, in approved states, if you are less than age 71 on effective date. Optional Features: • Optional Rising Income Privilege: In return for less income at the beginning, your monthly income increases by 1%, 2%, or 3%, whichever you choose, on an annual basis.6 • Must be 59½ or older on the effective date. • Available only for non-qualified money (not available for IRAs, Roth or qualified money per IRS rules). • Must select option at time of application. • Survivor Benefit Percentage: When Joint Lives are selected as your distribution option, income can be adjusted after the death of either annuitant and the end of the Guaranteed Period, if chosen. This income will continue as long as the remaining annuitant is alive. Qualifications and Additional Information: • Minimum Investment: $20,000. • Enhanced payments for contract values greater than $250,000. • No maintenance fees. • Payments can be received monthly, quarterly, semi-annually, or annually. • First payment must be received within first 12 months of contract effective date. Financial Ratings: An annuity is an insurance contract, so there is minimal risk since the guarantee is tied to the strength of the insurer. USAA Life Insurance Companies ratings are as follows: • A.M. Best: A++ (Superior, highest of 16 possible ratings). • Moody’s Investors Service: Aa1 (Excellent, second highest of 21 possible ratings). • Standard & Poor’s: AA+ (Very Strong, second highest of 21 possible ratings). Investments/Insurance: Not FDIC Insured ∙ Not Bank Issued, Guaranteed or Underwritten ∙ May Lose Value 1 Must select a distribution option that has a period certain and income at end of period is more than the initial investment. 2This example is based on a 65 year old male whose payout option is life with 20 years of guaranteed payments. Rates as of January 8, 2015. 3Period certain options: 15 to 30 years. 4Financial Emergencies include: Funeral expenses for direct family; payments to avoid foreclosure or eviction from your primary residence; large unpaid bills, including medical bills which are not covered by insurance, Medicare, or Medicaid. “Large” is the amount of income you receive from GRIP over a full year or more. 5State availability: Available in all states except to residents of Connecticut, Massachusetts, New York, Oregon and Washington state. 6State availability: Available in all states. Company ratings represent an opinion of financial strength and the company’s ability to meet ongoing obligations to policyholders. Money not previously taxed is taxed as income when paid. Withdrawals before age 59½ may be subject to a 10% federal tax penalty. Annuities are suitable for long-term investing, particularly retirement savings. An annuity is a long-term insurance contract sold by an insurance company designed to provide an income, usually after retirement that cannot be outlived. There are fees, expenses and surrender charges that may apply. You may wish to seek independent legal or financial advice before selling or liquidating any assets and prior to the purchase of any life or annuity products. Single Premium Immediate Annuity (SPIA): Form ASI94832ST 10-11; in NY, NSI97130NY 10-11, NSI94897NY 10-11 (SPIA form varies by state and by payout option). Call for details on specific costs, benefits, limitations and availability in your state. Annuities by USAA Life Insurance Company, San Antonio, TX and in New York by USAA Life Insurance Company of New York, Highland Falls, NY. All insurance products are subject to state availability, issue limitations and contractual terms and conditions. Each company has sole financial responsibility for its own products. ©2015 USAA. 218760-0815