Guaranteed Annuity - at a glance

advertisement

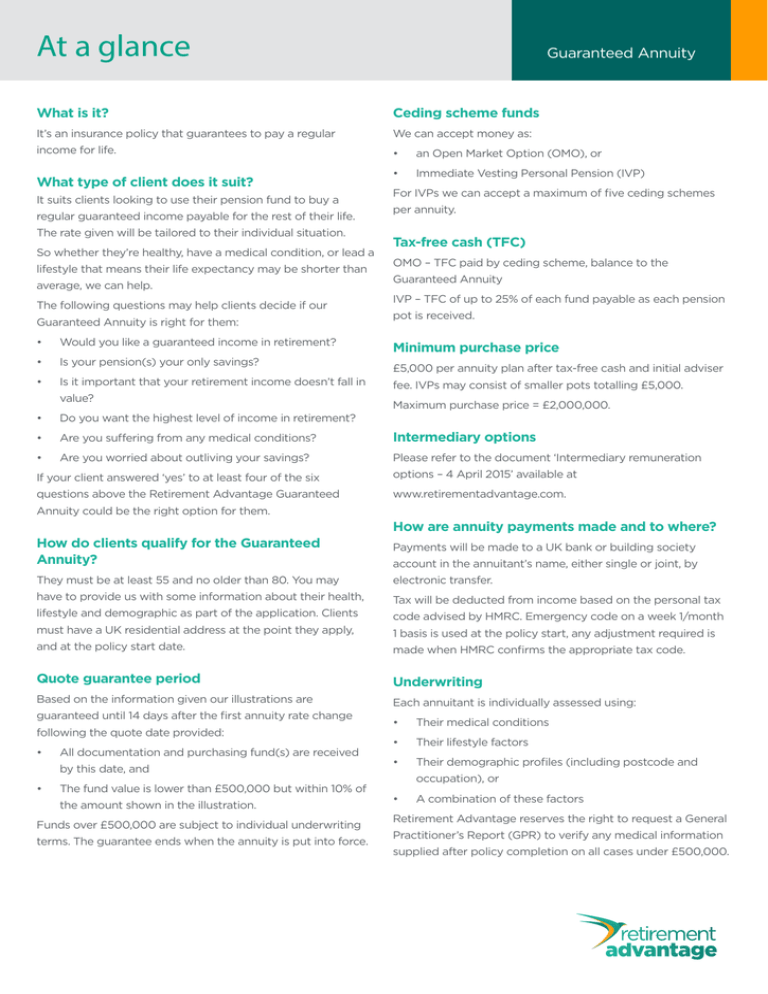

At a glance Guaranteed Annuity What is it? Ceding scheme funds It’s an insurance policy that guarantees to pay a regular We can accept money as: income for life. • an Open Market Option (OMO), or • Immediate Vesting Personal Pension (IVP) What type of client does it suit? It suits clients looking to use their pension fund to buy a regular guaranteed income payable for the rest of their life. The rate given will be tailored to their individual situation. So whether they’re healthy, have a medical condition, or lead a lifestyle that means their life expectancy may be shorter than average, we can help. The following questions may help clients decide if our Guaranteed Annuity is right for them: • Would you like a guaranteed income in retirement? • Is your pension(s) your only savings? • Is it important that your retirement income doesn’t fall in value? For IVPs we can accept a maximum of five ceding schemes per annuity. Tax-free cash (TFC) OMO – TFC paid by ceding scheme, balance to the Guaranteed Annuity IVP – TFC of up to 25% of each fund payable as each pension pot is received. Minimum purchase price £5,000 per annuity plan after tax-free cash and initial adviser fee. IVPs may consist of smaller pots totalling £5,000. Maximum purchase price = £2,000,000. • Do you want the highest level of income in retirement? • Are you suffering from any medical conditions? Intermediary options • Are you worried about outliving your savings? Please refer to the document ‘Intermediary remuneration If your client answered ‘yes’ to at least four of the six options – 4 April 2015’ available at questions above the Retirement Advantage Guaranteed www.retirementadvantage.com. Annuity could be the right option for them. How do clients qualify for the Guaranteed Annuity? How are annuity payments made and to where? Payments will be made to a UK bank or building society account in the annuitant’s name, either single or joint, by They must be at least 55 and no older than 80. You may electronic transfer. have to provide us with some information about their health, Tax will be deducted from income based on the personal tax lifestyle and demographic as part of the application. Clients code advised by HMRC. Emergency code on a week 1/month must have a UK residential address at the point they apply, 1 basis is used at the policy start, any adjustment required is and at the policy start date. made when HMRC confirms the appropriate tax code. Quote guarantee period Underwriting Based on the information given our illustrations are Each annuitant is individually assessed using: guaranteed until 14 days after the first annuity rate change following the quote date provided: • All documentation and purchasing fund(s) are received by this date, and • The fund value is lower than £500,000 but within 10% of the amount shown in the illustration. Funds over £500,000 are subject to individual underwriting terms. The guarantee ends when the annuity is put into force. • Their medical conditions • Their lifestyle factors • Their demographic profiles (including postcode and occupation), or • A combination of these factors Retirement Advantage reserves the right to request a General Practitioner’s Report (GPR) to verify any medical information supplied after policy completion on all cases under £500,000. If we discover that any of the information provided was The policy terms and conditions will provide further detail – incorrect we may have to change the amount and/or terms of see www.retirementadvantage.com. the annuity. Death benefits On all cases over £500,000, a GPR will be required to There are three ways to provide for loved ones on death. verify the medical information prior to completion. Cases of £1 million or more are individually underwritten before a guaranteed quote is issued. We also request a GPR for smoker cases to verify the information provided although we do not hold up completion of the policy (unless the fund value is £500,000 or more. Cancelling the policy OMO – 30 day cooling off period from the day the money is 1. The joint-life option On the death of the main annuitant we’ll pay up to 100% of their income (0 – 100% in whole percentages available) to the second annuitant specified at the time the Guaranteed Annuity was brought. This will be paid for the remainder of the second annuitant’s life. 2. The guarantee period option Guarantee periods of between one and thirty years available. applied If the main annuitant dies before the end of the selected IVP – 30 day cooling off period which starts on the day the guarantee period, we’ll continue to pay the annuity until the first pension fund is transferred to Retirement Advantage. guarantee period ends. Cancellation form and any payments must be returned by the 3. annuitant within the 30 day period. If we have facilitated a fee between a customer and an intermediary, the monies returned to the ceding scheme will be net of the intermediary fee. Payment frequencies Monthly, quarterly, half yearly, and annual. Minimum annuity payment of £50 for monthly payments. If the monthly payment is less than £50, the quote reverts to the next available frequency, eg quarterly. Proportion and overlap With or without overlap available. With or without proportion available on payments made ‘in arrears’. Value protection This option allows an annuitant to protect up to 100% of their purchase price should they die. A lump sum would be paid on the main annuitant’s death, based on: • The chosen percentage of the purchase price they selected, less any annuity payments made to them (before we deducted tax) For both the guarantee period and value protection options we will have discretion to decide who will receive payment of the annuity for the rest of the guarantee period. However although the final decision is ours, nominations may be made. More detail about all of the death benefits (including tax) can be found in the terms and conditions document - see Income options We offer level (stay the same) or a range of escalating www.retirementadvantage.com. options. Fixed increases – 0.1% to 10%. Retail Prices Index (RPI) – annuity will increase in line with the percentage increase in RPI. Limited Price Indexation (LPI) – the rate used will be RPI with a maximum of 5%. Telephone calls may be recorded for training and quality monitoring purposes. Retirement Advantage™ is a trading name of MGM Advantage Life Limited. Registered no. 08395855. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Retirement Advantage™ and the Retirement Advantage™ logo are trademarks of MGM Advantage Holdings Limited. Registered in England and Wales. Registered office MGM House, Heene Road, Worthing, West Sussex, BN11 3AT. 21-250 05/15