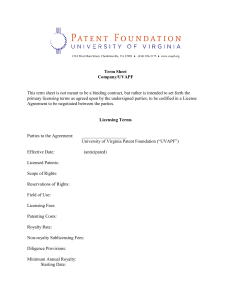

Royalty And Fees for Technical Services

advertisement