From the Stockholder to the Stakeholder

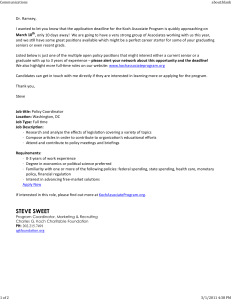

advertisement