Statement and solutions to problems 10 and 11 in Problem Set on

advertisement

EconDecMakHW02.tex

P ROBLEM S ET

ON

E CONOMIC D ECISION M AKING

FOR

E NGINEERS

7

10. Uncertain simple interest. (p.33) A loan, P , with simple interest i for N periods incurs a

future repayment F = (1 + iN )P . Given an estimate ei with error si , use a fractional-error

info-gap model:

{

}

i − ei U(h) = i : (1)

≤h , h≥0

si (a) Derive an expression for the robustness of requiring that the future repayment will not

exceed the critical value Fc .

(b) Given: N = 5, ei = 0.06, si = 0.02, P = $10, 000 and contextual information that the

estimated interest of 6% can err by several percentage points or more. What is a reliable

estimate of the future repayment?

EconDecMakHW02.tex

P ROBLEM S ET

ON

E CONOMIC D ECISION M AKING

FOR

E NGINEERS

8

11. Uncertain compound interest. (p.33) Invest $P at the start of N years with estimated yearly

rate of return ei, where the estimate may err by tens of percent or more. While the actual rate of

return, i, is unknown, assume that it is constant over time. Furthermore, assume that i cannot

be less than −1 (i = −1 implies FW is zero, and any more negative value of i implies debt).

(a) Derive an expression for the robustness of requiring that the future worth of the investment

will not be less than the critical value FWc .

(b) Based on (a) and given that N = 5, ei = 0.06 and P = $10, 000, what is a reliable estimate

of the future worth?

(c) Return to (a) and compare two alternatives with different estimated rates of return, ei1 < ei2 .

For what values of FWc do you prefer each alternative, based on the robustness to uncertainty?

(d) Evaluate (c) for ei1 = 0.02, ei2 = 0.03, N = 5 and P = $10, 000.

P ROBLEM S ET

EconDecMakHW02.tex

ON

E CONOMIC D ECISION M AKING

FOR

E NGINEERS

33

Solution to Problem 10, Uncertain simple interest, (p.7).

(a) The robustness is defined as:

{

(

)

}

b

h(Fc ) = max h :

max F (i) ≤ Fc

(67)

i∈U(h)

Let m(h) denote the inner maximum, which occurs when i = ei + si h:

[

]

m(h) = 1 + (ei + si h)N P

(68)

Equate this to Fc and solve for h:

[

]

1 + (ei + si h)N P = Fc

=⇒

b c) =

h(F

Fc − (1 + eiN )P

si N P

(69)

or zero if this is negative.

b = 3. Solving eq.(69) for Fc :

(b) We require “several” units of robustness, for instance h

b + (1 + eiN )P = 0.02 × 5 × 10, 000 × 3 + (1 + 0.06 × 5) × 10, 000 = 16, 000

Fc = si N P h

(70)

The estimated interest rate, ei, can err by 3 times the estimated error, si , and the repayment will not

exceed $16,000.

The nominal repayment is:

Fc = (1 + eiN )P = (1 + 0.06 × 5) × 10, 000 = 13, 000

(71)

Solution to Problem 11, Uncertain compound interest, (p.8).

(a) The FW is:

FW(i) = (1 + i)N P

(72)

because i is constant over time. The info-gap model is:

{

U (h) =

}

i − ei i : i ≥ −1, ≤h ,

s h≥0

(73)

where s is chosen to equal “tens of percent” of ei, for example s = 0.3ei. If i = −1 then the FW is zero,

and any more negative value entails debt. We suppose that debt would terminate the operation

through bankruptcy.

The robustness is defined as:

{

(

b

h(FW

c ) = max h :

)

}

≥ FWc

min F (i)

i∈U(h)

(74)

Let m(h) denote the inner minimum, which occurs when i = ei − sh, for h ≤ (1 + ei)/s:

(

m(h) = 1 + ei − sh

)N

(75)

P

Equate this to FWc and solve for h:

(

1 + ei − sh

)N

(

P = FWc

=⇒

1

b

1 + ei −

h(FW

c) =

s

(

FWc

P

)1/N )

(76)

P ROBLEM S ET

EconDecMakHW02.tex

ON

E CONOMIC D ECISION M AKING

FOR

E NGINEERS

34

or zero if this is negative. Note that:

b

h(FW

c = 0) =

1 + ei

s

(77)

Thus eq.(76) is valid for all non-negative values of FWc .

b = 3 and s = 0.3ei = 0.018. Solving eq.(76)

(b) We require “several” units of robustness, for instance h

for FWc :

b N P = (1 + 0.06 − 0.018 × 3)5 10, 000 = $10, 303.62

FWc = (1 + ei − sh)

(78)

Thus, even if the estimated rate of return errs by as much as a factor of 3 times s, (implying a

lower-than anticipated rate of return) the FW will not be less than $10,303.62.

Compare this with the estimated FW:

FW(ei) = (1 + ei)N P = (1 + 0.06)5 10, 000 = $13, 382.26

(79)

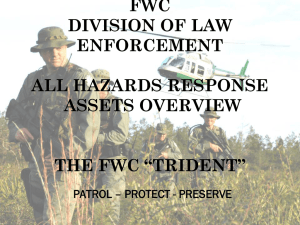

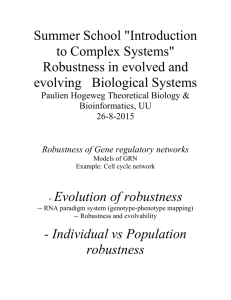

(c) and (d) Choose the uncertainty weights for each case as sk = geik , k = 1, 2. Equate the

robustnesses of the two alternatives to find the value of FWc at which the robustness curves cross:

b

b

e

e

h(FW

× , i1 ) = h(FW× , i2 )

FW× = P

(80)

b

e

eN

h(FW

c ) = 0 if FWc = FW(i) = (1 + i) P

(81)

=⇒

The robustness reaches zero at the estimated FW:

b

b

e

e

e

e

Thus h(FW

c , i2 ) reaches the FWc axis to the right of h(FWc , i1 ) because i1 < i2 . The robustness

b ) = ei /s = 1/g. This is

curves cross at FWc = P , at which value the robustness equals h(P

k k

illustrated in fig. 4 with g = 1, where we see that ei2 = 0.03 is robust-preferred over ei1 = 0.02 for

FWc ≥ $10, 000, which is precisely the initial investment, P .

8

N = 5, P = $10, 000

7

6

5

b

h(F Wc )

ei1 = 0.02

4

3

2

ei2 = 0.03

1

0

6000

8000

10000

12000

F Wc

Figure

4:

Robustness

curves for problem 11 (c),

eq.(76).