Omgeo Central Trade Manager

FIX Interface Message Specification

Investment Managers (Current)

May 08, 2015

Copyright © 2015 Omgeo LLC. All rights reserved.

This publication (including, without limitation, any text, image, logo, compilation, code and/or design) is proprietary and

protected by copyright. This publication is for exclusive use by users authorized by Omgeo LLC. If you received this

publication from Omgeo by any electronic medium, you are granted a limited, non-exclusive, non-transferable, nonsublicensable, and freely revocable license. This license enables you to download and store this publication on your

computer and print copies for your own use. Except if and as authorized by the foregoing, no part of this publication may

be printed, stored, reproduced, copied, altered, modified, posted, distributed, transmitted, displayed, published, sold,

licensed, or used in any form or by any means, without Omgeo’s prior written approval.

Omgeo has attempted to ensure the accuracy, timeliness, and completeness of this publication, but makes no

warranties and assumes no responsibility relating thereto. The content of this publication may change from time to time

without notice; readers are advised to refer to the latest version available.

Omgeo® and the Omgeo logo are registered service marks owned by Omgeo LLC, 55 Thomson Place, Boston, MA

02210. All names of Omgeo services referenced herein are either registered service marks or service marks of Omgeo

in the United States and elsewhere. Other product or company names appearing in this publication are trade or service

marks of their respective owners.

The U.S. Securities and Exchange Commission regulates several Omgeo services. For more information, visit

www.omgeo.com/regulation.

Omgeo has approved this document for public distribution. The examples, pictures, and data are for illustrative

purposes only. This document contains no actual trade data.

Publication Date: May 08, 2015

Publication Code: CT622

Service: Omgeo Central Trade Manager

Title: FIX Interface Message Specification: Investment Managers (Current)

Contents

Preface

Audience

Purpose of this specification

Submit trade information

Receive trade Information

Changes in this version of the document

Related documents and training

Questions?

1. What is OFI?

Introduction

Overview

Terms

Set-up

FIX version

Session-level login

Documentation

Required reading

Reference documents

Conceptual documents

Key Omgeo CTM concepts

Pairing and matching

Status types

Match status values

Complete status values

Match Agreed status values

Block-level workflow

2. FIX messages

Introduction

Field types

Repeating groups and anchor tags

Repeating group

Anchor tag

Repeating field

Datatypes and syntax

Syntax

Escape characters and extended ASCII

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

9

9

9

9

10

10

10

10

11

11

11

11

14

14

14

15

15

15

15

16

16

16

16

17

18

19

21

21

21

21

22

22

22

23

23

24

3

Date fields

Numeric fields

Numbers in messages you submit

Numbers in messages you receive

Quotations, arrows, and ampersand characters

Extended ASCII character set

Escape fields Omgeo CTM validates on FIX messages you submit

Reverse escape fields on FIX messages Omgeo CTM sends to you

Currency code fields

Currency precision in messages you submit

Currency precision in messages you receive

Money fields

Validation

OFI system validation

XML validation

Synchronous validation

Asynchronous validation

FIX messages key

Message headers and trailers

Standard header with example

Standard trailer with example

3. Trade messages

Introduction

Interaction of block and allocation messages

Security identification

Pairing and matching fields

Pairing fields

Matching fields

Availability of the financial details of a trade

Hiding financials

Currency

Allocation Instruction (J)—block

Block J message flow

Block commissions

Block charges, fees, and taxes

Message fields

Allocation instruction (J)—allocation

Allocation J message flow

Block information on an allocation J message

Standing settlement instructions (SSIs)

Allocation commissions

Allocation charges, fees, and taxes

Message fields

24

25

25

25

25

25

26

26

26

26

27

27

28

28

29

29

29

30

30

30

32

33

33

33

33

33

34

34

35

36

36

36

37

37

38

38

46

47

47

48

48

49

49

4. Acknowledgment messages

64

Introduction

Levels of message validation

Level 1—OFI validation

64

64

65

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

4

Message fields—system valid (P) for all messages

Message fields—system Reject (3) for all messages

Level 2—XML validation

XML validation P messages for a J message

P message flow acknowledging a new, replace, or cancel block

Message fields—P message acknowledging an invalid block J

P message flow acknowledging a new, replace, or cancel allocation

Message fields—P message acknowledging a valid allocation J

Message fields—P message acknowledging an invalid allocation J

XML validation P messages for an AT message

P message flow acknowledging a reject counterparty block AT message

Message fields—P message for a valid reject counterparty block AT

Message fields—P message for an invalid reject counterparty block AT

P message flow acknowledging a reject counterparty confirmation

Message fields—P message for a valid reject counterparty confirm AT

Message fields—P message for an invalid reject counterparty confirm AT

5. Broker/dealer messages

Introduction

Allocation Report (AS)—alleged block

Alleged block message flow

Security identifiers

ISIN

Additional security identifiers

Alleged block commissions

Alleged block charges, fees, and taxes

Message fields

Allocation Report (AS)—broker confirmation

Alleged confirmation message flow

Security identifiers

ISIN

Additional security identifiers

Confirmation commissions

Confirmation charges, fees, and taxes

Message fields

6. Status messages

Introduction

Interaction of block and allocation status messages

Security identifiers

Trade identifiers

Status update triggers

Status update without status change

Allocation Report (AS)—block status update

Block status update AS message flow

Block reject-specific fields

Block error severity

Block field comparisons

Message fields

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

66

66

67

67

68

69

71

71

72

73

74

74

75

76

77

78

79

79

79

80

80

80

80

81

81

81

91

91

91

92

92

92

92

92

109

109

109

109

109

110

110

111

111

112

112

112

113

5

Allocation Report (AS)—allocation status update

Allocation status update message flow

Allocation reject-specific fields

Allocation error severity

Allocation field comparisons

Allocation identifiers

Message fields

7. Settlement view message

Introduction

Allocation Report (AS)—settlement view

Settlement view message flow

Common view

Settlement instruction groups

Settlement instruction examples

Example 1: NoSettlPartyIDs (781) and NoSettlPartySubIDs (801) data

Example 2: NoSettlPartySubIDs (801) data only

Example 3: NoSettlPartyIDs (781) data only

Valid values

Message fields

8. Exception messages

Introduction

Allocation Instruction (J)—cancel trade components

Trade component identification

Canceling blocks and allocations

Cancellation request

Pre-MATCH AGREED cancellation

MATCH AGREED cancellation request

MATCH AGREED response to cancellation request

Cancellation override

Block cancel J message flow

Allocation J cancel message flow

Allocation Report Ack (AT)—reject counterparty trade components

About the counterparty reject trade component AT message

Trade component identification

Reject-specific fields

Rejecting blocks and confirmations

Rejects and trade component updates

Mismatched trade component updates

Trade parties remain the same

Trade parties change

Match status change

Reject counterparty block AT message flow

Reject counterparty confirmation AT message flow

Message fields

A. Common reference values

Introduction

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

118

118

119

119

120

120

120

127

127

127

127

128

128

132

132

133

133

133

133

153

153

153

153

153

154

154

154

155

155

155

156

159

159

159

159

159

160

160

160

160

161

161

162

162

168

168

6

AllocationForceMatchIndicator (35572)

AllocTransType (71)

AltPartyIDSource (35555)

AltPartyRole (35552)

AltThirdPartyIDSource (35560)

AltThirdPartyRole (35557)

BlockForceMatchIndicator (35571)

CommType (13)

EventType (865)

MatchStatus (573)

MiscFeeBasis (891)

MiscFeeType (139)

NestedPartyIDSource (525)

NestedPartyRole (538)

OmgeoBlockChargesOrTaxesType (7351)

OmgeoBlockCommissionType (9865)

OmgeoBrokerCapacity (7362)

OmgeoBrokerCapacityBlock (35597)

OmgeoBrokerIDSource (9061)

OmgeoCommissionReason (9867)

OmgeoCommissionSharingType (9808)

OmgeoCommSharingBasisIndicator (9873)

OmgeoCompleteStatus (9056)

OmgeoConfirmCommissionReason (7395)

OmgeoCptySettlInstSourceInd (7512)

OmgeoMatchAgreedStatus (9057)

OmgeoRejectComponentFlagAlloc (9155)

OmgeoRejectComponentFlagBlock (9055)

OmgeoSecurityTypeGroup (7348)

OmgeoSettlInstrSourceIndicator (9048)

OmgeoSettlTransCondIndicator (9045)

OmgeoTDBusinessExceptionCode (9036)

OmgeoTDFieldLevelMatchStatus (7387)

OmgeoTDHighestErrorSeverity (9037)

OmgeoTDISITCRejectReasonCode (7374)

OmgeoTDMessageFieldType (7521)

OmgeoTDWorkflowModifier (7508)

OmgeoTDWorkflowType (7506)

OmgeoTLBusinessExceptionCode (9038)

OmgeoTLFieldLevelMatchStatus (7383)

OmgeoTLHighestErrorSeverity (9058)

OmgeoTLISITCRejectReasonCode (7372)

OmgeoTLMatchStatus (9054)

OmgeoTLMessageFieldType (7520)

OmgeoTLWorkflowModifier (7507)

OmgeoTLWorkflowType (7505)

OmgeoTPDetailErrorSeverity (9229)

OmgeoTradeTransCondIndicator (9043)

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

168

168

168

168

169

169

169

169

169

170

170

170

171

171

172

172

172

173

173

173

173

174

174

174

174

174

175

175

175

175

176

177

177

178

178

179

179

180

180

180

180

180

180

181

181

181

181

181

7

PartyIDSource (447)

PartyRole (452)

SecurityExchange (207)

SecurityIDSource (22)

SecurityType (167)

SettlPartyIDSource (783)

SettlPartyRole (784)

SettlPartySubIDType (786)

SettlType (63)

Side (54)

StipulationStateCode (35587)

StipulationType (233)

TDSEBIRejectReasonCode (35578)

TLSEBIRejectReasonCode (35577)

YieldType (235)

B. FIX message examples

Introduction

New block

Inbound to Omgeo CTM—new block J message

Outbound to you—system valid P message

Outbound to you—XML valid P message

Outbound to you—block status AS message

New allocation

Inbound to Omgeo CTM—new allocation J message

Outbound to you—system valid P message

Outbound to you—XML valid P message

Outbound to you—allocation status AS message

Reject counterparty confirmation

Inbound to Omgeo CTM—reject counterparty confirmation AT message

Outbound to you—system valid P message

Outbound to you—xml valid P message

Outbound to you—allocation status AS message

Settlement view (AS)

183

183

183

184

184

185

185

186

186

187

187

188

189

190

190

192

192

192

192

193

194

194

196

196

197

197

198

200

200

201

201

202

203

C. Troubleshooting errors

208

Introduction

Synchronous errors

Syntax errors

Invalid data errors

Asynchronous errors

208

208

208

209

212

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

8

Preface

This specification describes the Financial Information eXchange (FIX) interface to Omgeo

Central Trade ManagerSM (Omgeo CTM). By reading it, you can gain a thorough understanding

of:

l

l

l

The structure and functions of FIX and Omgeo CTM

The role of the Omgeo CTM FIX interface (OFI)

The message formats that you use to submit data to and receive data from Omgeo CTM

Audience

This specification is for buy-side clients. The audience includes client IT staffers/developers,

application development managers, systems/business analysts, and Omgeo representatives.

This specification assumes:

l

l

A familiarity with the FIX Standards Committee FIX 4.4 protocol at

http://www.fixprotocol.org

A basic understanding of the securities business and Omgeo CTM

Purpose of this specification

This specification explains how to use FIX for debt and equity asset class trades.

Submit trade information

Use this specification to submit the following for debt and equity asset class trades:

l

New and replacement blocks and allocations

l

Cancellation of your blocks or allocations

l

Rejection of your counterparty’s blocks or confirmations

Note

All occurrences of new blocks and allocations in this specification include the same functionality as amended blocks and

allocations unless otherwise noted. For example, the acknowledgement AS message Omgeo CTM sends you for an

amend J message is the same as the acknowledgement AS message for a new J message. You designate an amend

message using the field-value pair, AllocTransType (71)=1 (replace).

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

9

Receive trade Information

Use this specification to receive:

l

l

l

l

l

Valid or Invalid responses to your block, allocation, cancellation, or rejection of counterparty

trade components.

New and canceled blocks and confirmations from your counterparty.

Updates when the status changes for your block or allocation.

Updates when your counterparty rejects your block or allocation.

Final trade settlement data from Omgeo CTM.

Changes in this version of the document

In support of Release 2 (2015), this version of the document includes new valid values for the

following common reference data fields:

l

l

OmgeoSecurityTypeGroup (7348) on page 175

SettlPartyRole (784) on page 185

Related documents and training

For related documents and all documents referenced in this document, go to

www.omgeo.com/documentation/ctm. Omgeo also offers training to clients on how the

product works and how to use it. Course information and a calendar of offerings are available

at visit www.omgeo.com/training.

Questions?

The Omgeo Client Contact Center (CCC) provides general assistance and technical help. Visit

www.omgeo.com/ServiceCentral to:

l

l

l

l

Enter a service request or check the status of an existing service request

Search the Omgeo knowledge base

Access the Omgeo documentation library

Obtain contact information

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

10

1. What is OFI?

Introduction

This chapter presents an overview of the new FIX 4.4 interface for investment managers.

Overview

The Omgeo CTM FIX interface (OFI) provides a message-based method for submitting trade

components, such as blocks and allocations, including settlement information. Through OFI,

you receive your counterparty blocks, trade status updates, and final trade data from Omgeo

CTM. OFI supports the following asset classes:

l

l

Debt (fixed income)

Equity

OFI supports service bureau or investment manager outsourcing. Outsourcers submit trades

for multiple underlying clients using a single FIX interface.

You submit your trade data to Omgeo CTM by using the supported FIX messages. OFI

translates the FIX messages into Omgeo CTM XML messages. When Omgeo CTM sends trade

data to you, OFI translates the XML messages into FIX messages.

Omgeo CTM processes trades by providing central matching, Omgeo ALERTSM standing

settlement instruction (SSI) enrichment, security cross-referencing, and a fully automated

settlement process.

Terms

Table 1.1 defines the terms in use in this specification.

Table 1.1 Terms

Term

alleged trade component

allocation

amend trade component

Definition

Any blocks and confirmations your counterparty submits to Omgeo CTM that pair and match your trade

components.

Designates portions of a block to specific accounts. You provide an allocation using the J message and OFI

translates it to a TradeDetail XML message.

See replace trade component on page 13

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

11

Table 1.1 Terms (continued)

Term

Allocation Instruction (J) FIX

message

Definition

A FIX message you send to Omgeo CTM to:

l

l

l

l

Allocation Instruction Ack (P) FIX

message

Allocation Report (AS) FIX message

Also referred to as a “J message.”

A FIX message Omgeo CTM sends to you to indicate whether your message is Valid or Invalid. You receive a P

message from Omgeo CTM for every trade component you send to Omgeo CTM. Also referred to as a "P

message."

A FIX message Omgeo CTM sends to you, which includes one of the following:

l

l

l

Allocation Report Ack (AT) FIX

message

l

l

asynchronous error

Business Identifier Code (BIC)

block

block-level workflow (BACW)

broker/dealer

Cancel XML Message

l

default L2 matching profile

Block

Single confirmation

Multiple confirmations

Also referred to as an “AT message.”

As the first field after a NumInGroup datatype field, the anchor tag in a FIX message always specifies the

beginning of a new repeating group. See Anchor tag on page 22.

An error that can occur when Omgeo CTM validates the content of a message submission against your

counterparty’s trade side data. An asynchronous error typically indicates an illegal action, ambiguous content,

or matching rule violation. Asynchronous errors can also occur during Omgeo ALERT enrichment. FIX does

not return asynchronous errors to you. You view and act on asynchronous errors using the Omgeo CTM

trade blotter. Omgeo CTM requires that you close fatal asynchronous errors before a trade can reach MATCH

AGREED status.

A unique identifier code SWIFT assigns to financial institutions, including trading organizations. Omgeo CTM

supports 8 and 11 character formats. In the messages, the syntax is 4!a2!a2!c[3!c] (for example,

OMGOUS33ABC).

Specifies trade data that is common to an unallocated total quantity, such as number of shares, price, and

currency. You provide your block using the J message and OFI translates it to a TradeLevel XML message.

Use when trading with broker/dealers who match on both block and allocation/confirmation information.

Your counterparty or the trading partner who executes a trade, also called the executing broker.

Indicates that a party wants to cancel a block or an allocation as follows:

l

component block

confirmation

Your block status or allocation status update

Your final trade settlement view

Broker-alleged block or confirmation

Also referred to as an “AS message.”

A FIX message you send to Omgeo CTM to reject your counterparty’s:

l

anchor tag

Create or replace your block or allocation

Cancel your block or allocation before a trade reaches MATCH AGREED

Request cancellation of a trade post-MATCH AGREED

Accept your counterparty’s request to cancel a trade post-MATCH AGREED

Omgeo CTM allows the unilateral cancellation of components of a pre-MATCH AGREED (pre-MAGR) trade

by the originating party.

Omgeo CTM requires a bilateral cancellation for a MATCH AGREED trade.

OFI translates the cancels that you submit as J messages into Cancel XML messages.

Grouping of similar fields that appear together, such as Parties and Instrument.

A legally binding agreement between two parties. It contains information such as trade amount, settlement

amount, settlement currency, local fees and taxes, and commissions.

Defines the allowable fields for a type of trade, the required fields for L1 pairing, and the eligible L2 matching

fields. There is one default matching profile per asset class or instrument type: equity and debt. Investment

managers, who control default matching profiles, must have one default matching profile set-up for each

asset class.

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

12

Table 1.1 Terms (continued)

Term

InfoResponse XML message

InfoSettlementResponse XML

message

Invalid XML message

investment manager

Level 1 pairing (L1 pairing)

Level 2 matching (L2 matching)

Omgeo CTM FIX interface (OFI)

RejectComponent XML message

repeating group

replace trade component

settlement instruction enrichment

synchronous error

trade blotter

trade component

Definition

Part of the Omgeo CTM direct XML interface. Returns trade information about a block or a block and

allocations. OFI translates an InfoResponse into an AS message.

Part of the Omgeo CTM direct XML interface. Returns information about an entire contracted trade going to

settlement. Includes all trade data for both sides of a MATCH AGREED or CANCEL MATCH AGREED trade. OFI

translates an InfoSettlementResponse into an AS message.

Part of the Omgeo CTMdirect XML interface. Indicates that Omgeo CTM cannot process a message. This

situation occurs when system errors prevent Omgeo CTM from processing a message or when the message

fails parsing, validation, or normalization. OFI translates an Invalid into a P message.

The trading partner (counterparty) who places an order, also called the instructing party (IP). An investment

manager can be a hedge fund manager.

The act of identifying and linking a trade side to a counterparty’s submitted trade side. L1 pairing uses criteria

Omgeo sets and must be COMPLETE before level 2 (L2) matching begins.

The act of comparing client-identified fields and tolerances to a counterparty’s corresponding fields. The

outcome of L2 matching determines the Match status of a trade component or trade side.

An Omgeo service that enables investment managers and their broker/dealer counterparties to send trades

to Omgeo CTM and manage exceptions.

Part of the Omgeo CTM direct XML interface. Allows one trade party to reject the counterparty’s UNMATCHED

or MISMATCHED trade component that is alleged against it.

Repeating groups in FIX messages allow you to submit and receive more than one set of values for a group of

fields. See Repeating groups and anchor tags on page 21.

When you replace a trade component, Omgeo CTM replaces the information on the trade component you

identify with information in the new trade component. When you replace a trade component, the

AllocTransType (71)=1 (replace) in the J message. In Omgeo CTM, the same concept is referred to as

amending a trade component.

The process of adding standing settlement instructions (SSIs) to trade components. Omgeo ALERT can

automatically add SSIs into the appropriate Omgeo CTM trade components:

l

You can submit SSIs on allocations.

l

Broker/dealers can submit SSIs on both blocks and confirmations.

An error that can occur when Omgeo CTM checks each submitted message for syntax errors, missing

information, or duplicate messages. If a FIX is message is Invalid, Omgeo CTM returns the synchronous errors

to you in a P message.

Use the Omgeo CTM trade blotter to perform all non-FIX trade-related activities. For example, use the trade

blotter to track and resolve Match status issues and to view and close trade component errors.

One or both portions of a trade side:

l

l

TradeDetail XML message

TradeLevel XML message

trade side

Valid XML message

Your block and allocation

Your counterparty’s block and confirmation

In this document, the term “trade” implies both components unless specified otherwise.

Part of the Omgeo CTM direct XML interface. You provide your allocations using the J message and OFI

translates them to TradeDetail XML messages.

Part of theOmgeo CTM direct XML interface. Provides a summary of block information and is equivalent to a

block. The data in the message pertains to all corresponding TradeDetails. You provide your blocks using the J

message and OFI translates them to TradeLevel XML messages.

All of the trade components that constitute your side of a trade or your counterparty’s trade side. A trade side

consists of one block and one or more allocations or confirmations.

Part of the Omgeo CTM direct XML interface. Indicates that Omgeo CTM accepted a message for processing.

Returns information to the sender, such as the Omgeo-generated OmgeoTradeSideID (9052). OFI translates a

Valid into a P message.

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

13

Set-up

Before sending and receiving messages to and from OFI, do the following:

l

Set up your FIX engine to create FIX J messages and, optionally, AT messages.

l

Set up your FIX engine to receive P and AS messages.

This document describes the FIX implementation in OFI. It does not explain the entire FIX

protocol. For information on the FIX protocol, see the specifications that the FIX Standards

Committee publishes at http://www.fixprotocol.org.

l

l

Work with your Omgeo representative to set up the configuration file for the interface. At a

minimum, address the following:

l

IP port addresses and ports for Client Test and Production

l

SenderCompID (49)

l

Globally unique AllocID (70) values

Work with your Omgeo representative to set up your Omgeo CTM matching profiles and

optional broker matching groups.

Omgeo representatives work with you and outsourcers to map necessary FIX tags. You build

the necessary application logic to send new trades, replace trades, receive trades, and cancel or

reject trades. Omgeo assumes that your organization can appropriately route trade status,

updated financials, and SSIs.

FIX version

Omgeo CTM supports FIX Protocol version 4.4. All mention of FIX in this document refers

specifically to FIX version 4.4.

Session-level login

The client sends messages for one or more investment managers over a single FIX connection.

FIX and Omgeo CTM route these messages to separate connections, so each investment

manager has a private, direct connection to Omgeo CTM

When FIX and Omgeo CTM receive a logon message from the client, the Username (553) and

Password (554) values establish a preliminary Direct Client Interface (DCI) connection to

authenticate the user. This user is known as the machine user to distinguish it from a person

who has access to the Omgeo CTM user interface. Machine user ID passwords expire annually

and must be reset. Omgeo delivers pending expiration notifications to the email address

associated with the machine user four times before expiration at 60, 30, 15, and 2 days.

Thereafter, Omgeo CTM uses this authentication information to establish all connections to

Omgeo CTM for investment managers using the same FIX connection to send messages.

The parties component block of inbound business messages determines the investment

manager identity. The party associated with PartyRole (452) containing a value of 13 (order

originator) reflects the BIC of the investment manager. The outsourcer identity is not present

on the trade message.

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

14

Documentation

This section lists the documents to read or refer to as you use FIX. All Omgeo CTM and FIXrelated documentation is at www.omgeo.com/documentation/ctm.

Required reading

To understand Omgeo CTM concepts and features, read the documents in Table 1.2 below.

Table 1.2 Required reading

Document

Product Overview

Description

Provides background information required to understand Omgeo CTM features, processes,

conventions, and terminology.

Trade Blotter Reference: Investment Managers Describes how to manage trade exceptions in the Omgeo CTM web-based trade blotter.

Trade Blotter Reference: Settlement Notification Explains how to add standing settlement instruction (SSI) data to trade component fields.

Counterparties can enrich manually or automatically from Omgeo ALERT.

Reference documents

This specification and the documents listed in Table 1.3 are companion documents. Use the

documents in Table 1.3 to learn about Omgeo CTM fields, data types, allowed values, and direct

XML interface error codes.

Table 1.3 Reference documents

Document

Description

Data Dictionary

Defines all elements used in the direct XML interface and of all fields used in FIX. Most FIX fields

map to one or more elements in the direct XML interface.

Lists, sequentially, synchronous and asynchronous error codes and the error text. For

asynchronous errors, the table also lists the severity and the validation rule.

Describes the optional notification services:

Error Code Data Reference

Notification Services Reference

l

l

l

l

Settlement Services Reference: SWIFT

MT541/543 and CSV Mapping

Trade notification

Central counterparty notification

Depository notification

Copy for Information notification

Describes the mapping between Omgeo CTM XML trade components and SWIFT MT541/543 and

CSV messages for settlement notification.

Conceptual documents

Refer to the documents in Table 1.4 to learn about submitting data in different business

scenarios.

Table 1.4 Conceptual documents

Document

Fees and Taxes: Best Practices

Equity Trade Commissions: Best Practices

L1 Pairing and L2 Matching: Questions and

Answers

Description

Provides recommendations on how to populate fee and tax fields for Omgeo CTM

Explains how to submit and match on commissions for equity trades. It defines terminology and

fields relating to commissions and provides examples.

Addresses the questions most commonly ask about pairing and matching in Omgeo CTM.

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

15

Table 1.4 Conceptual documents (continued)

Document

TBA (To Be Announced) Mortgage-Backed

Securities: Questions and Answers

Description

Provides information clients most commonly ask about how to implement TBAs in Omgeo CTM.

Key Omgeo CTM concepts

FIX 4.4 shared services requires an understanding of the following Omgeo CTM concepts.

Pairing and matching

Omgeo CTM uses pairing and matching to match your trade components to your

counterparty’s trade components.

l

l

Level 1 (L1) pairing compares your trade components to your counterparty’s components.

When critical fields match, Omgeo CTM considers the trade paired. L1 pairing occurs before

L2 matching.

Level 2 (L2) matching compares your data for paired trade components to your

counterparty’s data. When data differences fall within the defined field tolerance, Omgeo

CTM considers the component MATCHED. When the data differences fall outside of the

tolerance, Omgeo CTM considers the component MISMATCHED.

Status types

Omgeo CTM supports three different status types: Match, Complete, and Match Agreed.

l

Each trade component—block (TradeLevel) and allocation (TradeDetail)—has a Match status.

l

Each trade side has a Complete status.

l

Both trade sides of the transaction share a Match Agreed status.

Each status type has different values. For each trade component, Omgeo CTM keeps track of

each of the three status types. It changes those status values as the trade progresses through the

work flow. For example:

l

A broker/dealer’s trade side can have a Complete status with the value COMPLETE.

An allocation with a Match status of MATCHED.

- and -

l

A Match Agreed status with the value NOT MATCH AGREED.

l

Match status values

The Match status applies to a block or allocation. In the AS message, OFI uses the

OmgeoTLMatchStatus (9054) field for block status and MatchStatus (573) for allocation status.

Table 1.5 describes all Match status values that OFI returns for status information in the

Allocation Report (AS) message.

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

16

Table 1.5 Match status values

Match Status Value

UNMATCHED

MISMATCHED

MATCHED

CANCELED

CANCEL REQUESTED

COUNTERPARTY CANCEL

REQUESTED

CANCEL REJECTED

Code A trade component with this status is …

NMAT A component that does not locate a corresponding counterparty component containing pairing L1 values.

MISM A component that locates a corresponding counterparty’s component by pairing L1 values but fails to match

on L2 values or tolerances.

MACH A component that locates a corresponding counterparty’s component by pairing L1 values and matches on

all L2 values.

CAND A component that one party has withdrawn from the trade side before it is MATCH AGREED. Canceling a

block cancels all allocations. You can unilaterally cancel an individual allocation before the trade side is MATCH

AGREED.

CREQ A component of your trade side when you have requested to withdraw the trade side after it is MATCH

AGREED. A component that is CANCEL REQUESTED has a trade side that is MATCH AGREED.

CCRQ A component of your trade side when the counterparty wants to withdraw the trade side after it is MATCH

AGREED. A component that is COUNTERPARTY CANCEL REQUESTED has a trade side that is MATCH

AGREED.

CREJ A component of your trade side when:

l

l

COUNTERPARTY CANCEL

REJECTED

CCRJ

The counterparty requested you to cancel the trade side after it was MATCH AGREED.

You refused to cancel.

A component that is CANCEL REJECTED has a trade side that is MATCH AGREED.

A component of your trade side when:

l

You requested the counterparty to cancel the trade side after it was MATCH AGREED.

l

Your counterparty refused to cancel.

CANCEL AGREED

A component that is COUNTERPARTY CANCEL REJECTED has a trade side that is MATCH AGREED.

CANA A component of a trade side that was MATCH AGREED until one party requested a cancellation, and the

counterparty agreed. A trade side that is CANCEL MATCH AGREED has all its components set to CANCEL

AGREED.

PENDING

PEND

A block is waiting for completion. The Match status of PENDING is applied in two circumstances:

l

l

DISQUALIFIED

DISQ

A trade side is NOT COMPLETE and that NOT COMPLETE trade side uses an Omgeo-generated block.

A party submits a block (either a new one or a replacement) that L1 pairs with a counterparty’s block that

is of the PENDING status.

In both cases, a Match status of PENDING implies that L1 pairing fields have matched and that the L2

matching fields other than the calculated fields have matched. When Omgeo CTM determines that an L2 field

does not match, the Match status becomes MISMATCHED. When all of the required L2 fields match, the

Match status can change to MATCHED.

An allocation that failed certain asynchronous validations, such as submitting an allocation on a MATCH

AGREED trade. Omgeo CTM does not use DISQUALIFIED allocations in any calculations or processing. An

allocation can pass synchronous validation (sending a Valid response message), but fail initial asynchronous

processing. In this situation,Omgeo CTM creates a DISQUALIFIED allocation and attaches the component

identifiers to it. You can replace the allocation to correct the asynchronous failure.

A DISQUALIFIED component is not used for processing or to update any status settings or previously sent

block data. The amounts in it are not used in totaling the calculated fields. Since block information is not

updated, a search on the block fields using the value from the allocation sent does not find the

DISQUALIFIED allocation. And, once found, a retrieval of the DISQUALIFIED allocation shows the previously

set block values rather than any sent in the DISQUALIFIED allocation. Some circumstances causing this

disqualified status are:

l

l

Submitting an allocation for a MATCH AGREED or CANCEL MATCH AGREED trade side

Submitting an allocation with inconsistent block information

Complete status values

The Complete status applies to a trade side. In the AS message, OFI uses the

OmgeoCompleteStatus (9056) field for Complete status. Table 1.6 describes the COMPLETE and

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

17

NOT COMPLETE status values that OFI returns for status information in the Allocation Report

(AS) message

Table 1.6 Complete status values

Complete Status

Value

COMPLETE

Code

Description

COMP

NOT COMPLETE

INCP

A trade side is COMPLETE if the sum of the QuantityAllocated field on the allocations (for all allocations not CANCELED

and not DISQUALIFIED) equals the value of the QuantityOfTheBlockTrade field.

Either the sum of the QuantityAllocated field on the allocations (for all allocations not canceled):

Does not equal the value of the QuantityOfTheBlockTrade field.

l

- or l

A block for the trade side is expected but not received.

Match Agreed status values

The Match Agreed status has the same value on both trade sides. In the AS message, OFI uses

the OmgeoMatchAgreedStatus (9057) field for MATCH AGREED status. Table 1.7 describes all

MATCH AGREED status values that OFI returns for status information in the Allocation Report

(AS) message.

Table 1.7 Match Agreed status values

Match Agreed

Status Value

NOT MATCH

AGREED

Code

Description

NMAG Also known as pre-MAGR, the NOT MATCH AGREED status applies to a trade side with any of the following conditions:

l

l

l

l

MATCH AGREED

The blocks are not MATCHED.

One or more allocations are not MATCHED.

Either trade side is NOT COMPLETE.

Open, fatal asynchronous errors exist on any trade component on either trade side.

MAGR A trade side for which the matching process is complete and that is considered ready for settlement. A trade side

cannot become MATCH AGREED unless the following conditions are true:

l

l

l

The blocks and all allocations are MATCHED.

Both trade sides are COMPLETE.

No open, fatal asynchronous errors exist on any trade component on either trade side.

The Match status of the components can change from MATCHED without changing the Match Agreed status from

MATCH AGREED. For instance, if a trade side is MATCH AGREED and a cancel request is submitted, the Match status

of each component in the trade side becomes CANCEL REQUESTED but the Match Agreed status remains MATCH

AGREED, and processing continues.

A MATCH AGREED trade side is considered ready for settlement even if its components have a Match status of:

l

CANCEL REQUESTED

l

COUNTERPARTY CANCEL REQUESTED

l

CANCEL REJECTED

l

DISQUALIFIED

l

CANCELED

l

COUNTERPARTY CANCEL REJECTED

CANCEL MATCH

AGREED

CMAG A trade that was MATCH AGREED and that both parties have agreed to cancel. No further action can occur on either

trade side of a trade that is CANCEL MATCH AGREED.

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

18

Block-level workflow

FIX 4.4 supports the Omgeo CTM block-level workflow, which allows you and your

counterparty to:

Submit blocks and allocations or confirmations in any order.

l Match on both block and allocation/confirmation information.

Figure 1.1 below illustrates the flow of data in the block-level workflow. The figure illustrates a

typical trade sequence, but trade parties can submit blocks, allocations, and confirmations in

any order, as they are available. The workflow assumes that each message you submit to Omgeo

CTM receives both system valid P and XML valid P responses.

l

Investment

Manager

(You)

1

New Block (J)

Your Block Status (AS) - NMAT

2

Omgeo

CTM

1a

Broker/

Dealer

New Allocation (J) with 3 Allocations

Your Allocation Status (AS) 1 - NMAT

Your Allocation Status (AS) 2 - NMAT

Your Allocation Status (AS) 3 - NMAT

2a

Broker-Alleged Block Status (AS) - NMAT

3a

Your Block Status Update (AS) - MACH

3b

Broker-Alleged Alloc Status (AS) 1 – NMAT

Broker-Alleged Alloc Status (AS) 2 – NMAT

Broker-Alleged Alloc Status (AS) 3 – NMAT

Your Allocation Status Update (AS) 1 - MACH

Your Allocation Status Update (AS) 2 - MACH

Your Allocation Status Update (AS) 3 - MACH

Settlement View (AS) - MATCH AGREED

New Block (J)

3

New Confirm (J)

with 3 Allocations

4

4a

4b

5

Figure 1.1 Block-level workflow

Table 1.8 describes each step in a successful block-level workflow (Figure 1.1) where you and

your counterparty submit blocks and allocations/confirmation J messages. The steps highlight

the values for trade component matching statuses in the messages.

Table 1.8 Block-level workflow steps

Step Description

1

1a

2

2a

3

3a

You create a block in your internal system and send it to Omgeo CTM as a new block J message.

Omgeo CTM validates your message and Omgeo CTM processes your block, assigning it an UNMATCHED (NMAT) status. Any subsequent

change in your block status triggers the generation of an InfoResponse XML message that OFI translates into a block status AS message.

You create an allocation in your internal system and send it to Omgeo CTM as a new allocation J message. In Figure 1.1, your allocation J

message contains three allocations for the same block.

Omgeo CTM validates your message and Omgeo CTM processes your three allocations, assigning each one an UNMATCHED (NMAT) status.

Any subsequent change in your allocation status triggers Omgeo CTM to generate an InfoResponse XML message that OFI translates into an

allocation status update AS message.

Your counterparty submits a block to Omgeo CTM containing matching information with your block J message from step 1.

Omgeo CTM sends you the broker-alleged block status AS message. Even if the information in your counterparty’s message matches your

block, Omgeo CTM sends you the new broker-alleged block status AS message as UNMATCHED (NMAT).

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

19

Table 1.8 Block-level workflow steps (continued)

Step Description

3b

4

4a

5

Omgeo CTM successfully validates and compares your counterparty’s block information to your block from step 1. Omgeo CTM sends you a

block status update AS message showing that the blocks are MATCHED (MACH).

Your counterparty submits an allocation J message with three allocations to Omgeo CTM. The J message contains matching information with

your allocation J message with three allocations from step 1.

Omgeo CTM successfully validates and compares your counterparty’s confirms to your allocations from step 2. Omgeo CTM sends you three

allocation status update AS messages showing that your allocations are MATCHED (MACH).

Omgeo CTM sends you a settlement view AS message.

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

20

2. FIX messages

Introduction

This chapter provides an overview of FIX messages as they relate to Omgeo CTM. It describes

field types, data types and syntax, validation, headers, and trailers.

Field types

Each FIX message you submit contains information for one or more trade components. The FIX

protocol allows some fields to repeat, which requires understanding of the following terms:

l

Repeating group

l

Anchor tag

l

Repeating field

Repeating groups and anchor tags

FIX repeating groups allow you to submit more than one set of values for a group containing

one or more fields. They also allow you to receive more than one set of values from Omgeo

CTM.

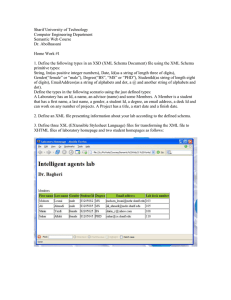

Figure 2.1 shows a truncated section of the NoMiscFees (136) repeating group in the allocation J

message on page 60.

Figure 2.1 Field types

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

21

Repeating group

In this specification, repeating group field names start with No or OmgeoNo. Where applicable,

these fields indicate the maximum number of times the group can repeat in the message.

Some examples of repeating groups include:

l

l

NoMiscFees (136) for the number of miscellaneous fees, which includes the following fields:

l MiscFeeAmt (137) (anchor tag)

l MiscFeeCurr (138)

l MiscFeeType (139)

l MiscFeeBasis (891)

l OmgeoConfirmCommissionReason (7395)

OmgeoNoTradeTransCondIndicators (9042) only contains a single field,

OmgeoTradeTransCondIndicator (9043).

As a best practice, include only repeating groups that you intend to populate. When you do not

intend to populate a repeating group, omit it from your message.

Anchor tag

The anchor tag is always the first field beneath the NumInGroup datatype field. It specifies the

beginning of a new repeating group. In Figure 2.1, MiscFeeAmt (137) is the anchor tag.

Repeating field

Repeating fields are multiple instances of information in contiguous fields. FIX does not require

you to declare the number of instances that the field repeats. Table 2.1 lists all of the fields and

messages in which they reside.

Table 2.1 Repeating fields

FIX Tag/

Number

Datatype/

Syntax

J

J

J

Block Alloc Cancel

Issuer (106)

PartySubID (523)

SecurityDesc

(107)

Text (58)

String/4*35z

String/2*35z

String/4*35z

X

X

String/10*35z

X

AS

Alleged

Confirm

X

AS

Block

Status

X

AS

Alleged

Block

X

X

X

X

X

X

AT Reject

Cpty Trade

AS

Alloc

Status

X

X

X

AS

Settlement

View

X

X

X

X

For example, in a cancel J message, you can use the Text (58) tag to include up to ten narratives

about the reason for the cancellation.

As a best practice, include only repeating fields that you intend to populate. When you do not

intend to populate a repeating field, omit it from your message.

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

22

Datatypes and syntax

FIX uses symbols in the Datatype/Syntax column for specific the purposes described in this

section.

Syntax

Table 2.2 explains the symbols used in the Syntax portion of the Datatype/Syntax column for all

of the messages in this specification.

Table 2.2 Syntax symbols

Symbol

*

n

!n

d

Description and Examples

Maximum number of field instances and allowed syntax for each instance. See Repeating field on page 22.

Allowed contents: Depends on field syntax

Syntax example:

String/4*35z

FIX field example: SecurityDesc (107)

XML element:

DescriptionOfTheSecurity

Value example:

107=SUN KINGDOM GILT 4.75 (first instance) 107=DGE (second instance)

Digits up to a maximum length.

Allowed contents: 0 1 2 3 4 5 6 7 8 9

Syntax example:

3n

FIX field example: OmgeoBlockChargesOrTaxesType (7351)

XML element:

ChargeTaxType

Value example:

7351=2 (charges/fees), 7351=102 (local tax)

Digits with exact length.

Allowed contents: 0 1 2 3 4 5 6 7 8 9

Syntax example:

8!n

FIX field example: MaturityDate (541)

XML element:

MaturityDate

Value example:

541=20320101

Digits (0–9) with a decimal comma up to a maximum length. The following rules apply:

l

The integer part is mandatory and contains at least one digit.

l

You can submit or expect to receive leading zeros.

l

A decimal comma precedes the fractional part.

l

The fractional part can be missing, but the decimal comma is always present.

l

You cannot submit or expect to receive a decimal point, space, or any symbol other than the decimal comma.

l

The maximum length includes the decimal comma.

Allowed contents:

Syntax example:

FIX field example:

XML element:

Value example:

a

0 1 2 3 4 5 6 7 8 9,

17d

GrossTradeAmt (381)

TotalTradeAmount/Sign and Amount

381=1223,76 (1223.76), 381=12,1 (12.10 for currency precision of 2)

Uppercase letters up to a maximum length.

Allowed contents:

Syntax example:

FIX field example:

XML element:

Value example:

AB CD EF G H I J K L M NOP QR STU VW X YZ

3a

OmgeoAlertCountryCode (9049)

AlertCountryCode

9049=GEU (Germany), 9049=QA (Qatar)

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

23

Table 2.2 Syntax symbols (continued)

Symbol

!a

Description and Examples

Uppercase letters with exact length.

Allowed contents:

Syntax example:

FIX field example:

XML element:

Value example:

c

Uppercase alphanumerics up to a maximum length.

Allowed contents:

Syntax example:

FIX field example:

XML element:

Value example:

!c

AB CD EF G H I J K L M NOP QR STU VW X YZ 0123456789

3c

SecurityIDSource (22)

NumberingAgencyCode

22=1 (CUSIP number, USA and CA), 22=A (other or Bloomberg symbol)

Uppercase alphanumerics with exact field length.

Allowed contents:

Syntax example:

FIX field example:

XML element:

Value example:

z

AB CD EF G H I J K L M NOP QR STU VW X YZ

2!a

StipulationStateCode (35587)

StipulationStateCode

35587=NY, 35587=CA

AB CD EF G H I J K L M NOP QR STU VW X YZ 0123456789

4!c

OmgeoCommSharingBasisIndicator (9873)

CommissionSharingBasisIndicator

9873=FLAT (flat rate, absolute), 9873=PERU (Rate per share/unit)

ISO/IEC 8859-1 (Latin 1) characters up to a maximum length.

Allowed contents:

Syntax example:

FIX field example:

XML element:

Value example:

The ISO /IEC 8859-1 (Latin 1) characters without <cr> or <lf>

35z

OmgeoL2MatchingProfileName (9041)

L2MatchingProfileName

(9041) DebtEuroBuys for all DLD5 clients

Although Omgeo CTM allows the full character sets outlined in 2, some counterparties use

different systems with less extensive character sets.

Escape characters and extended ASCII

Omgeo CTM enforces two levels of escaping ASCII characters that include a set of four

characters and the extended character set.

Date fields

For messages you send and receive, OFI processes the following date fields using the

LocalMktDate/8!n datatype/syntax:

l

l

l

DatedDate (873)

EventDate (866)

IssueDate (225)

l

l

l

MaturityDate (541)

TradeDate (75)

SettlDate (64)

The 8!n syntax contains YYYYMMDD. An example value for DatedDate (873)=20121112.

OFI truncates the TransactTime (60) field and uses the UTCTimestamp/8!n6!n datatype/syntax.

An example value for TransactTime (60)=031500.

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

24

Numeric fields

Depending on whether you submit or receive a message, Omgeo CTM handles numbers as

follows.

Numbers in messages you submit

When a field in a message submission contains a numeric value, follow these syntax rules:

l

l

l

Represent a decimal point with either a comma or a decimal point.

Do not use a comma as a separator for thousands, millions, billions, and so on.

Optionally, use double quotes to improve readability.

For example, Table 2.3 shows valid and invalid representations of the number 432010.25:

Table 2.3 Specifying numbers in messages you submit

Valid Number Syntax

Invalid Number Syntax

432010.25

“432010.25”

“432010,25”

432,010.25

“432,010.25”

“432,010,25”

Numbers in messages you receive

On response messages, Omgeo CTM returns amount fields to you as follows:

l

l

Numbers contain a decimal point to indicate precision, not a comma.

Numbers include only one non-significant trailing zero.

Table 2.4 provides examples of submitted and received numeric amounts.

Table 2.4 Numeric amounts in export files

Submitted Number

“1,”

“1,0000”

“1,12000”

“1,00001”

Received Number

1.0

1.0

1.12

1.00001

Quotations, arrows, and ampersand characters

Table 2.5 shows how to escape quotation marks (“), arrows (< and >), and the ampersand (&)

before submitting your FIX message

Table 2.5 Escaping ASCII characters

Character

“

<

>

&

Escape

&quot;

&lt;

&gt;

&amp;

Extended ASCII character set

For characters that fall into the Extended ASCII Character Set, use the &#(IntegerValue)

escape. See http://www.currency-iso.org/isocy/global/en/home/tables/table-a1.html.

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

25

Escape fields Omgeo CTM validates on FIX messages you submit

Table 2.6 lists the FIX fields and messages on which Omgeo CTM validates your escapes.

Table 2.6 Escape fields validation

FIX Field/Tag

XML Element

AllocID (70)

AllocText (161)

AllocText (161)

IndividualAllocID (467)

Issuer (106)

OmgeoL2MatchingProfileName (9041)

PartyID (448)

Pool (691)

RefAllocID (72)

MasterReference

AdditionalText

RejectComponentText

ClientAllocationReference

Issuer

L2MatchingProfileName

PartyValue

PoolNumber

MasterReference

SecurityDesc (107)

DescriptionOfTheSecurity

AdditionalText

CancelText

RejectComponentText

Text (58)

FIX Message Containing the Escape Field

J Block

J Alloc

J Cancel

AT Reject

X

X

X

X

x

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

Reverse escape fields on FIX messages Omgeo CTM sends to you

Omgeo CTM reverses the escape fields on messages it sends to you. For example, if any

message contains one of the following characters, OFI escapes the character before it sends the

FIX message to you:

l

l

l

l

Quotation marks (“)

Arrows (< and >)

Ampersand (&)

Extended ASCII Character Set

Currency code fields

Omgeo CTM returns all monetary amounts with the valid International Organization for

Standardization (ISO) precision for the specified currency. If you do not specify a monetary

amount with the required precision, Omgeo CTM adjusts the precision so that it conforms to

the ISO standard. For example, for US dollar amounts, Omgeo CTM returns 100.00 instead of

100 or 100.0.

For a list of ISO currency codes, see http://www.currencyiso.org/isocy/global/en/home/tables/table-a1.html. For Office of Foreign Assets Control (OFAC)

information and conditions that apply to currencies, see the CurrencyCode section of the

Common Reference Data.

Currency precision in messages you submit

When you specify a number for a money amount field, use the correct ISO precision. Table 2.7

shows valid and invalid decimal precision for US dollar amounts (the ISO precision for the US

dollar is 2).

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

26

Table 2.7 Currency precision in messages you submit

Valid Precision for US Dollar Amounts

“25,12”

“25,00”

25.12

25.00

Invalid Precision for US Dollar Amounts

“25,124”

“25,000”

25,124

25,000

If a money amount field exceeds the allowed precision, Omgeo CTM returns synchronous error

S14064, “Amount exceeds maximum precision.”

Some valid ISO currencies, such as gold or silver, do not have precisions. If you trade in these

currencies, Omgeo CTM does not validate the precision.

Omgeo CTM enforces currency precision on amount values. It does not enforce currency

precision on price values. For example, the US dollar value provided for AvgPx (6) can exceed

the US dollar precision of 2. But the US dollar value provided for GrossTradeAmt (381) cannot

exceed the US dollar precision of 2.

Currency precision in messages you receive

Follow these best practices:

l

l

l

If an amount is null, Omgeo CTM does not map the currency.

If a field exceeds the maximum Omgeo CTM value, Omgeo CTM truncates the field. For

example, if an amount field exceeds the maximum number of decimals, Omgeo CTM

truncates the field.

If you receive XML field value, CDATA, on any message, ignore it. Derive the data for the

FIX field from the innermost parentheses (()).

Money fields

Omgeo CTM validates the value in the money fields to ensure that the precision (the number of

digits to the right of the decimal) does not exceed the limit of the currency. For example, a

MiscFeeAmt (137) value of 25, or 25,00 with a Currency (15) value of GBP is valid, but 25,000 is

invalid.

Note

Omgeo CTM uses the decimal comma. If you use a decimal point, OFI converts it to a decimal comma. If the value does

not include a decimal, OFI adds a decimal comma at the end.

Table 2.8 describes the FIX money field mappings to the Omgeo CTM XPath.

Table 2.8 FIX money field mappings to Omgeo CTM XPath

FIX Field

AllocAccruedInterestAmt (742)

Allocation Detail Original Face (9974)

AdditionalFixedIncome/OriginalFaceAmount

MiscFeeAmt (137)

XPath Mapping

AccruedInterestAmount/Amount

AdditionalFixedIncome/OriginalFaceAmount

Commissions/Commission/Amount

ChargesOrTaxes/ChargeAmount/Amount

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

27

Table 2.8 FIX money field mappings to Omgeo CTM XPath (continued)

FIX Field

AllocNetMoney (154)

AllocSettlCurrAmt (737)

OmgeoTLAccruedInterestAmount (9859)

NetMoney (118)

GrossTradeAmt (381)

OmgeoTradeDetailTradeAmount (9047)

OmgeoBlockChargesOrTaxesAmount (7353)

OmgeoBlockCommissionAmount (9866)

AllocationBlockOriginalFace (9878)

XPath Mapping

NetCashAmount/Amount

SettlementAmount/Amount

TotalAccruedInterestAmount/Amount

TotalNetCashAmount/Amount

TotalTradeAmount/Amount

TradeAmount/Amount

TradeChargesOrTaxes/ChargeAmount/Amount

TradeCommissions/Commission/Amount

TradeLevelTotals/TotalOriginalFaceAmount

The precision depends on the currency as well as the field. Price is a special case. For AvgPx (6),

the standard practice is to have four degrees of precision, regardless of the currency. You can

have up to 16 numbers to the right of the decimal point for AvgPx (6).

Validation

Omgeo applies two types of initial validation to each FIX message that you submit:

Level 1—OFI system validation checks the message formatting to ensure that it conforms to

FIX 4.4 protocol rules.

l Level 2—Omgeo CTM XML validation checks that the message contains data that conforms

to Omgeo CTM processing rules.

The FIX interface requires certain fields, but not all of these fields map to Omgeo CTM. Other

fields are optional in the FIX interface, but mandatory in Omgeo CTM.

l

OFI system validation

Omgeo applies standard FIX 4.4 protocol rules to messages that you submit and to messages

that it sends to you. Ensure that your FIX messages:

Include tag=value field pairs with delimiters between fields.

l Do not include optional fields without values.

l Follow the FIX message format (in order): header, body, and trailer.

Table 2.9 lists the verification rules that OFI applies to your FIX messages

l

Table 2.9 OFI verification rules

Validation Rule

Duplicate Tags

Unsupported

Message Types

OFI rejects a message when...

Any tag that is not part of a repeating group and appears more than once in the message. Or, you submit a tag in a

repeating group that appears more than once in the group. OFI allows one exception for duplicate tags: when a field resides

in both the clear text portion and the encrypted data portion of the same message. Clients typically use the configuration for

validation and testing. For example, sending the SenderCompID (49) in the encrypted data section allows you to use the

field in a validation exercise. In cases where the clear text data differs from the encrypted data, Omgeo CTM generates a

security warning only.

Your message type (MsgType) is not in this specification.

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

28

Table 2.9 OFI verification rules (continued)

Validation Rule

Invalid Tags

Tag Order

Repeating Order

Group

Repeating Group

Count

Required Tags

OFI rejects a message when...

You submit a message that contains a tag that not included in this specification.

Your tag does not appear in the appropriate position (header, body, or trailer).

A repeating group tag appears outside its group or more than once inside its group.

The number specified in the repeating group component does not match the number of repeating group instances you

provide in the submit message.

You do not provide a mandatory value in a submit message.

Omgeo CTM complies with these validation rules for all FIX messages that it sends to you, in

accordance with the FIX 4.4 protocol. See Chapter 8, Exception messages on page 153.

XML validation

Omgeo CTM features two types of validation: synchronous and asynchronous. It performs

synchronous validation checks on every submitted message by:

Parsing the incoming message

Normalizing certain data fields, such as security code which one party can submit as an ISIN

and the other as a CUSIP. Omgeo CTM handles them as the same security

l Validating field level data against Appendix A, Common reference values on page 168.

Omgeo CTM returns all results of synchronous processing immediately using the Valid and

Invalid XML messages. OFI translates these messages into block- and allocation-level AS

messages.

l

l

Synchronous validation

A synchronous error indicates that the message you submitted does not comply with the

Omgeo CTM message specification. Some examples of conditions that result in synchronous

errors include the following:

l

l

l

File syntax errors

Invalid field data

Missing mandatory field values

l

l

l

Invalid field content

Extra fields

Conflict between data in two dependent or associated

fields

Asynchronous validation

Asynchronous validation occurs after successful completion of synchronous processing. While

synchronous processing validates the message structure, asynchronous processing validates the

content of the messages against the existing trade side data. An asynchronous error can

indicate that Omgeo CTM forbids the requested action or that the message intent is not clear.

Asynchronous validation ensures the integrity of your trade side data. It generates errors that

Omgeo CTM cannot identify during synchronous validation. In addition to parsing FIX

messages that Omgeo CTM sends, you can use the Omgeo CTM trade blotter to view

asynchronous error information.

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

29

FIX messages key

The first shaded heading row at the beginning of each FIX message in Chapters 3 through 8 of

this specification indicates field-related information. Table 2.10 describes the meaning of each

column.

Table 2.10 FIX messages key

Column Header

Field Name

Tag

Datatype/Syntax

M/O/C or E/O/C

Description

FIX name assigned to the FIX tag. Most, but not all, FIX fields map to the XML elements in the direct XML interface of Omgeo CTM.

FIX tag number assigned to the FIX field.

The datatype and syntax of the FIX field. See Repeating field on page 22.

Indicates if the field is mandatory/expected, optional, or conditional.

l

Submit messages to Omgeo CTM:

M—The field is mandatory for Omgeo CTM, including fields that are mandatory for both FIX and Omgeo. One exception

to this rule is a NumInGroup field, which is optional in most cases. If you provide a positive integer in a NumInGroup field,

the following anchor tag is mandatory along with other required fields, depending on the field. For example, in Figure 2.1

on page 21, the NoMiscFees (136) tag is optional. However, if you provide a value such as 136=2, the requirements for the

five tags in the repeating group fields vary.

l

O—The field is optional.

l

C—The field is conditional and depends on other tag values in the message. If a repeating group is mandatory, then all

fields within the group are also mandatory. An example is the Parties component, which is mandatory in Omgeo CTM.

Response messages from Omgeo CTM:

l

E—You can expect to receive a value in the tag from Omgeo CTM.

l

O—Omgeo CTM only returns a value in the field if you or your counterparty submitted a value or if FIX or Omgeo CTM

generate a value.

l

C—The field is conditional and depends on other tag values in the message.

l

l

Notes

XPath

For all message types, N/A indicates that any value you supply is not applicable. Either Omgeo CTM or FIX ignores your value,

does not map your value, or supplies a value internally to conform with FIX requirements.

This specification does not distinguish between fields that are mandatory or expected for FIX and Omgeo CTM. For example, if a

field is mandatory for FIX, but not mandatory for Omgeo CTM, this specification labels the field as mandatory in the message. The

same is true for fields that are mandatory for Omgeo CTM but not FIX, such as the Parties component block.

A description of the tag, allowed values, examples, valid values, and other information about the field.

When applicable, the path of Omgeo CTM XML field name that maps to the FIX field names. To avoid repeating the full XPath for

each XML field name, all XML field names use relative XPaths. For fields that do not have a corresponding XML value or Omgeo

CTM handles in OFI, the XPath states “Not mapped.” For information about the field, see the Data Dictionary at

www.omgeo.com/documentation/ctm.

Message headers and trailers

Omgeo CTM requires that you submit FIX messages with standard headers and trailers. It uses

the same standard headers and trailers on FIX messages that it sends to you. The column

header descriptions in FIX messages key above apply to the column headers for message

headers and trailers. Another Encryption column header indicates whether you can encrypt

the field on an inbound message to Omgeo CTM. It also indicates whether Omgeo CTM

encrypts the value on the message to you.

Standard header with example

Table 2.11 outlines the standard header.

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

30

Table 2.11 Standard header fields

Tag Field Name

8

BeginString

Datatype

String

M-E/O

M-E

Notes

Identifies beginning of new

message and protocol

version. Always include as

the first field in a message.

Represents length in bytes.

Always include as the first

field in a message.

Identifies the FIX message

type you submit (J or AT) or

receive (AS, P, or 3). Always

resides in the third field of a

message.

Assigned value used to

identify firm sending the

message.

XPath

Not mapped.

Encryption

No

9

9BodyLength

Length

M-E

Not mapped.

No

35

MsgType

String\3c

M-E

Not mapped.

No

49

SenderCompID

String

M-E

56

TargetCompID

String

M-E

Assigned value used to

identify the receiving firm.

String

O

128 DeliverToCompID

String

O

Trading partner company

identifier used when

sending messages using a

third party.

Trading partner company

identifier used when

sending messages using a

third party.

Not mapped, but always included on the No

standard FIX header on messages from

Omgeo CTM to you.

Not mapped.

Yes

115 OnBehalfOfCompID

34

MsgSeqNum

SeqNum\10n

M-E

52

SendingTime

UTCTimestamp

M-E

Must be a positive value.

Not mapped.

SubmitHeaderFields/

SubmitHeader/

SendersMessageReference

Time/date combination

SubmitHeaderFields/

represented in Universal

SubmitHeader/

Time Coordinated (UTC) also DateTimeOfSentMessage

known as Greenwich Mean

Time (GMT), as one of the

following:

l

l

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

Not mapped, but always included on the No

standard FIX header on messages from

Omgeo CTM to you.

Yes

Yes

Yes

YYYYMMDDHH:MM:SS—Whole

seconds

YYYYMMDDHH:MM:SS.sss—Whole

seconds and milliseconds

format, including colons,

a dash, and a period.

31

The following is an example standard header for a J message:

...

8=FIX.4.4

9=1531

35=J

49=INTEGRTN

56=OFI-ST

34=3

52=20121209-20:45:11.962

Standard trailer with example

Table 2.12 outlines the standard trailer for a FIX message, which must always be the last field.

Table 2.12 Standard trailer field

Tag

10

Field Name

CheckSum

Datatype

String/3n

M-E/O

M

Notes

XPath

Three-digit character of the CheckSum Not mapped.

value.

Encryption

No

The following is an example standard trailer for a J message:

...

10=1807

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

32

3. Trade messages

Introduction

This chapter explains how to use the block J message and the allocation J message. You can use

these J messages to submit new blocks or allocations to Omgeo CTM.

l

l

Allocation Instruction (J)—block on page 36

Allocation instruction (J)—allocation on page 46

Note

See Chapter 8, Exception messages on page 153 for the cancel trade component J message fields.

Interaction of block and allocation messages

The block J message is the notification of a block trade and contains data that is consistent

across the entire trade. The allocation J message allocates parts of the block to various client

accounts.

Security identification

You send security identification information on all block and allocation J messages. Three fields

provide identifying security information about your trade:

l

l

l

SecurityID (48)—The security identifier value

SecurityIDSource (22)—The source of the SecurityID (48) value

CountryOfIssue (470)—The country code associated with the SecurityIDSource (22)

Omgeo CTM requires the SecurityID (48) and SecurityIDSource (22) fields. CountryOfIssue

(470) information is conditional. Populate CountryOfIssue (470) based on SecurityIDSource (22)

values according to the guidelines in OmgeoBrokerIDSource (9061) and SecurityIDSource (22)

table on page 184.

Pairing and matching fields

Omgeo CTM uses the following fields to L1 pair and L2 match trades.

FIX Interface Message Specification: Investment Managers (Current)

May 08, 2015

33