Earnings Release Conference

First Quarter of FY2016

(April 1, 2016 to June 30, 2016)

July 28, 2016

Murata Manufacturing Co., Ltd.

http://www.murata.com/ir/library/index.html

1

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

Topics of Financial Results for

FY2016 First Quarter

• Sales for the first quarter could not achieve our plan by sales decrease

for specific customers and high-value of yen, while sales for automotive

and multi-band smartphone in China steadily increased.

• Operating income of the first quarter was down 24% from the same

period in FY2015 because of exchange fluctuation and cost increase

relevant to capital investment and R&D investment for demand increase

in the future.

• Operating income ratio was 18.7%, down 4.1 points from the same

period in FY2015.

• It was 39% of the projected finance results for the first half of FY2016

announced on April 28th.

2

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

1. First Quarter of FY2016

From April 1, 2016 to June 30, 2016

Consolidated Basis

3

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

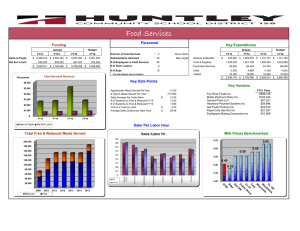

Quarterly Financial Results

(B JPY)

100.0

400.0

75.0

300.0

SALES

INCOME

(B JPY)

50.0

200.0

Operating

income

Income bef ore

income taxes

25.0

100.0

Net income

attributable to

Murata

Corporation

0.0

0.0

FY13

1Q

4

FY13

2Q

FY13

3Q

FY13

4Q

FY14

1Q

FY14

2Q

FY14

3Q

FY14

4Q

FY15

1Q

FY15

2Q

FY15

3Q

FY15

4Q

FY16

1Q

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

Sales

Financial Results Overview

FY2015

4th Quarter

FY2015

1st Quarter

(a)

(b)

(B JPY)

(%)

Y on Y

Change

(c)

(B JPY)

(%)

Q on Q

Change

(c) vs. (a)

(%)

(B JPY)

(c) vs. (b)

(B JPY)

(%)

(B JPY)

(%)

(0.2)

280.8

100.0

261.4

100.0

260.9

100.0

(19.9)

(7.1)

(0.4)

Operating income

64.0

22.8

40.0

15.3

48.7

18.7

(15.3)

(23.9)

+8.7

+21.8

Income before

income taxes

65.0

23.1

39.2

15.0

50.2

19.2

(14.8)

(22.8)

+11.1

+28.2

Net income attributable

to Murata Corporation

46.6

16.6

27.6

10.6

37.7

14.4

(8.9)

(19.1)

+10.0

+36.3

Net sales

Average exchange rates

Yen/US dollar

5

FY2016

1st Quarter

121.37

115.45

108.25

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

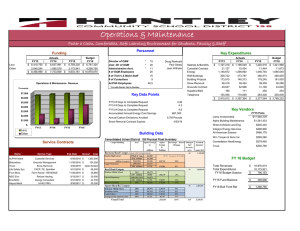

Quarterly Sales, Order and Backlog

(B JPY)

350.0

Backlog

Sales

Order

FY16 1Q Sales

260.9 B JPY

300.0

250.0

FY16 1Q Order

242.5 B JPY

200.0

FY16 1Q Backlog

112.3 B JPY

150.0

100.0

50.0

0.0

FY13

1Q

6

FY13

2Q

FY13

3Q

FY13

4Q

FY14

1Q

FY14

2Q

FY14

3Q

FY14

4Q

FY15

1Q

FY15

2Q

FY15

3Q

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

FY15

4Q

FY16

1Q

Orders by Product

(B JPY)

140.0

120.0

100.0

80.0

60.0

Capacitors

40.0

Piezoelectric

Components

Other Components

20.0

Communication

Modules

0.0

FY15

1Q

7

FY15

2Q

FY15

3Q

FY15

4Q

FY16

1Q

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

Power Supplies and

Other Modules

Sales by Product

FY2015

1st Quarter

FY2015

4th Quarter

(a)

(b)

Y on Y

Change

(c)

Q on Q

Change

(c) vs. (a)

(c) vs. (b)

(B JPY)

(%)

(B JPY)

(%)

(B JPY)

(%)

(B JPY)

(%)

(B JPY)

(%)

Capacitors

89.1

31.8

85.5

32.8

84.3

32.4

(4.9)

(5.5)

(1.2)

(1.4)

Piezoelectric

Components

38.2

13.7

38.3

14.7

44.8

17.2

+6.5

+17.1

+6.5

+16.9

Other Components

56.6

20.2

48.5

18.6

50.8

19.5

(5.8)

(10.2)

+2.4

+4.9

83.0

29.7

76.2

29.3

69.2

26.6

(13.8)

(16.6)

(7.1)

(9.3)

13.0

4.6

12.0

4.6

11.1

4.3

(1.9)

(14.4)

(0.8)

(7.0)

280.0

100.0

260.4

100.0

260.1

100.0

(19.8)

(7.1)

(0.3)

(0.1)

Communication

Modules

Power Supplies

and Other Modules

Net sales

8

FY2016

1st Quarter

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

Sales by Product

FY16 First Quarter vs. FY15 Fourth Quarter

Capacitors

(1.4%)

Multilayer Ceramic Capacitors : Sales of ultra-compact MLCCs and highcapacitance MLCCs for smartphone decreased because of high-value of yen,

while sales for car electronics, computers and peripherals increased.

Piezoelectric

Components

+16.9%

SAW filters : Sales greatly increased thanks to demand increase for LTE

smartphones and advancing multi-band in China.

Other Components

+4.9%

9

Inductors(Coil) : Sales of High frequency coils increased for smartphones.

Connector : Sales decreased for smartphones.

Communication

Modules

(9.3%)

Wireless modules and RF sub module : Sales decreased by high-value of

yen and decrease of production for smartphone and tablets.

Power Supplies and

Other Modules

(7.0%)

Power Supplies : Sales decreased for office automation equipment.

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

Sales by Application

FY2015

1st Quarter

FY2015

4th Quarter

(a)

AV

Communication

Computers and

Peripherals

Automotive

Electronics

Home Electronics

and Others

Net sales

FY2016

1st Quarter

(b)

Y on Y

Change

(c)

Q on Q

Change

(c) vs. (b)

(c) vs. (a)

(%)

(B JPY)

(%)

(B JPY)

(%)

(B JPY)

(%)

11.8

4.2

10.2

3.9

10.7

4.1

(1.1)

(9.6)

+0.5

+4.9

164.0

58.6

145.3

55.8

145.5

55.9

(18.5)

(11.3)

+0.2

+0.1

39.2

14.0

38.6

14.8

37.8

14.5

(1.5)

(3.7)

(0.8)

(2.2)

36.6

13.1

38.7

14.9

39.0

15.0

+2.4

+6.5

+0.3

+0.9

28.3

10.1

27.6

10.6

27.2

10.5

(1.2)

(4.1)

(0.5)

(1.7)

280.0

100.0

260.4

100.0

260.1

100.0

(19.8)

(7.1)

(0.3)

(0.1)

*Based on our estimate

10

(B JPY)

(B JPY)

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

(%)

Sales by Application

FY16 First Quarter vs. FY15 Fourth Quarter

AV

+4.9%

Communication

+0.1%

Computers and

Peripherals

(2.2%)

Automotive Electronics

+0.9%

Sales of MLCCs increased for gaming device and set-top box.

Sales of SAW filters significantly increased for smartphones in China. High

frequency coils also increased.

High-value of yen brought negative impact for the sales. Sales of Wireless

modules, RF sub modules decreased.

Sales of Wireless modules for tablets decreased.

Sales of Shock sensors increased for HDD.

Sales of MLCCs increased for car advanced electrification.

Sales of MEMS sensor increased for safety devices.

Sales of power supply decreased for car navigation.

*Based on our estimate

11

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

Breakdown of Operating Income Changes

FY15 Fourth Quarter to FY16 First Quarter

(B JPY)

60.0

40.0

FY16 1Q

Operating

income

+48.7

FY15 4Q

Operating

income

+40.0

JPY/US$ : 115.45YEN(FY15 4Q)→108.25YEN(FY16 1Q)

Sensitivity : 3.5 BJPY per 1 JPY/US$ change per year.

20.0

Cost

reduction

(estimate)

+4.0

Production

increase

(estimate)

+8.0

Decrease of

depreciation

expenses

+3.5

Decrease of

semi variable

Others

cost and other (Product mix etc.)

f ixed cost

+4.2

+2.0

0.0

Price decline Exchange rate

(estimate)

(estimate)

(6.0)

(7.0)

(20.0)

12

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

Breakdown of Operating Income Changes

FY15 First Quarter to FY16 First Quarter

(B JPY)

80.0

FY15 1Q

Operating

income

+64.0

FY16 1Q

Operating

income

+48.7

60.0

40.0

20.0

Cost

reduction

(estimate)

+17.0

JPY/US$ : 121.37 YEN(FY15 1Q)→108.25 YEN(FY16 1Q)

Sensitivity : 3.5 BJPY per 1 JPY/US$ change per year.

Production

increase

(estimate)

+7.0

Others

(Product mix etc.)

+4.2

0.0

Exchange rate

(estimate)

(12.0)

(20.0)

Increase of

depreciation

expenses

(3.5)

Increase of

semi variable

cost and other

f ixed cost

(4.0)

Price decline

(estimate)

(24.0)

(40.0)

13

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

2. Projected Financial Results for FY2016

(From April 2016 to March 2017)

14

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

Projected Financial Results for FY2016

FY2015

Actual

(B JPY)

1st

Half

(%)

(B JPY)

2nd

Half

(B JPY)

FY2016

Projections

(B JPY)

Change

(%)

(B JPY)

(%)

1210.8

100.0

620.0

605.0

1225.0

100.0

+14.2

+1.2

Operating income

275.4

22.7

125.0

115.0

240.0

19.6

(35.4 )

(12.9 )

Income before income

taxes

279.2

23.1

126.0

115.0

241.0

19.7

(38.2 )

(13.7 )

Net income attributable to

Murata Corporation

203.8

16.8

93.0

85.0

178.0

14.5

(25.8 )

(12.6 )

Net sales

Average exchange rates

Yen/US dollar

120.14

110.00

・The Company did not revise the projected results for the year ending March 31, 2017,

which were announced on April 28, 2016.

15

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

This report contains forward-looking statements concerning Murata Manufacturing Co., Ltd. and

its group companies' projections, plans, policies, strategies, schedules, and decisions. These

forward-looking statements are not historical facts; rather, they represent the assumptions of the

Murata Group (the “Group”) based on information currently available and certain assumptions

we deem as reasonable. Actual results may differ materially from expectations due to various

risks and uncertainties. Readers are therefore requested not to rely on these forward-looking

statements as the sole basis for evaluating the Group. The Company has no obligation to revise

any of the forward-looking statements as a result of new information, future events or otherwise.

Risks and uncertainties that may affect actual results include, but are not limited to, the following:

(1) economic conditions of the Company's business environment, and trends, supply-demand

balance, and price fluctuations in the markets for electronic devices and components; (2) price

fluctuations and insufficient supply of raw materials; (3) exchange rate fluctuations; (4) the

Group's ability to provide a stable supply of new products that are compatible with the rapid

technical innovation of the electronic components market and to continue to design and develop

products and services that satisfy customers; (5) changes in the market value of the Group's

financial assets; (6) drastic legal, political, and social changes in the Group's business

environment; and (7) other uncertainties and contingencies.

The Company undertakes no obligation to publicly update any forward-looking statements

included in this report.

16

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.

Thank you

17

Copyright © Murata Manufacturing Co., Ltd. All rights reserved.