Account Data Compromise User Guide

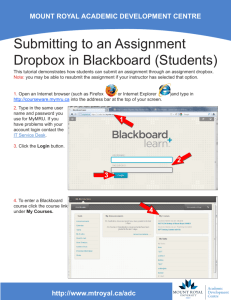

advertisement