A BVR Special Report

Includes chapters from

Dixon Hughes Goodman’s

Timothy York, CPA/ABV, James L.

“Butch” Williams, CPA/ABV, and

Adam Lawyer, CPA/ABV/CFF

EXCERPT FROM:

Key Trends Driving

Auto Dealership Value

BVR

What It’s Worth

Key Trends Driving

Auto Dealership Value

A BVR SPECIAL REPORT

1000 SW Broadway, Suite 1200, Portland, OR 97205

(503) 291-7963 • www.bvresources.com

Special thanks to Timothy W. York, CPA/ABV, for his expert guidance

and contributions to this special report.

Copyright © 2013 by Business Valuation Resources, LLC (BVR). All rights reserved.

Printed in the United States of America.

No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any

means, electronic, mechanical, photocopying, recording, scanning or otherwise, except as permitted under Sections

107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher or

authorization through payment of the appropriate per copy fee to the Publisher. Requests for permission should be

addressed to the Permissions Department, Business Valuation Resources, LLC, 1000 SW Broadway St., Suite 1200,

Portland, OR 97205, (503) 291-7963, fax (503) 291-7955.

Information contained in this book has been obtained by Business Valuation Resources from sources believed to

be reliable. However, neither Business Valuation Resources nor its authors guarantee the accuracy or completeness

of any information published herein and neither Business Valuation Resources nor its authors shall be responsible

for any errors, omissions, or damages arising out of use of this information. This work is published with the

understanding that Business Valuation Resources and its authors are supplying information but are not attempting

to render business valuation or other professional services. If such services are required, the assistance of an

appropriate professional should be sought.

Editor: Jan Davis

Publisher: Sarah Andersen

Managing Editor: Janice Prescott

Chair and CEO: David Foster

President: Lucretia Lyons

Vice President of Sales: Lexie Gross

Customer Service Manager: Retta Dodge

ISBN: 978-1-62150-031-5

Library of Congress Control Number: 2013951535

Table of Contents

INTRODUCTION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

SECTION 1. THE CURRENT AUTO DEALERSHIP MARKETS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

1. THE VALUE DRIVERS OF AUTO DEALERSHIPS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

2. WORDS OF WISDOM FROM ONE OF THE NATION’S LARGEST AUTOMOTIVE RETAILERS . . 9

3. DEALERSHIP AND DEALERSHIP GROUP PERFORMANCE TRENDS . . . . . . . . . . . . . . . . . . . . 11

By Alan Haig and Erin Kerrigan

SECTION 2. VALUATION CONSIDERATIONS IN AUTO DEALERSHIPS . . . . . . . . . . . . . . . . . . . . . . . 14

4. REAL ESTATE IS AN IMPORTANT COMPONENT OF AN AUTO DEALERSHIP VALUATION . . . 15

By Adam Lawyer, CPA/ABV/CFF

5. SPECIAL ISSUES TO CONSIDER WHEN VALUING A USED CAR DEALERSHIP . . . . . . . . . . . . 19

By Carl Woodward, CPA

6. LOST PROFITS FOR AUTOMOBILE DEALERSHIPS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

By Timothy W. York, CPA/ABV

SECTION 3. AUTO DEALERSHIP BUY-SELL TRENDS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

7. THE CURRENT AUTO DEALER ACQUISITION ENVIRONMENT AND ITS IMPACT ON BLUE

SKY. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

By Timothy W. York, CPA/ABV

8. THINKING OF SELLING? A 23-FACTOR CHECKLIST TO HELP YOU MAXIMIZE VALUE . . . . 41

By James L. “Butch” Williams, CPA/ABV

9. DEALERSHIP BUY-SELL ACTIVITY IS INCREASING SHARPLY . . . . . . . . . . . . . . . . . . . . . . . . . 46

By Alan Haig and Erin Kerrigan

10. BUY-SELL TRENDS AND FRANCHISE VALUATION RANGES . . . . . . . . . . . . . . . . . . . . . . . . . 50

By Alan Haig and Erin Kerrigan

11. SUCCESSION PLANNING BUILDS AUTO DEALER VALUE . . . . . . . . . . . . . . . . . . . . . . . . . . . 55

By Loyd H. Rawls

APPENDICES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58

APPENDIX A. PRICING A NEW CAR DEALERSHIP—RULES OF THUMB . . . . . . . . . . . . . . . . . . . 59

APPENDIX B. PRICING A USED CAR DEALERSHIP—RULES OF THUMB . . . . . . . . . . . . . . . . . . 65

APPENDIX C. NEW AND USED CAR DEALERSHIPS: SOURCES OF INFORMATION . . . . . . . . . 68

Introduction

Valuations by their very nature are fluid; therefore it can be difficult to describe “the value” of an

auto dealership. Despite the challenges, this publication serves to accomplish two main objectives:

(1) to leave a lasting record of key points to consider when performing a valuation of an automobile

dealership; and (2) to discuss the current market in which a dealership operates.

On these pages, you’ll read thoughts from numerous experts that deal with dealerships and valuation issues daily. These individuals include accountants, brokers, merger and acquisition executives,

former dealership employees and owners, and other consultants and advisors. Combined, these

experts point you in the direction to “hit the mark” when valuing a dealership. What better resources

for this publication than professionals who daily advise on buy/sells, executives who lead their

groups on acquisition strategy, professionals whose financial livelihoods depend on transactions

in this space, and others whose combined experience with dealerships is approaching 200 years.

The authors also educate the readers on issues such as the real estate considerations of auto dealerships, the used and independent dealership area, and the need for succession planning, which

may create the need for valuations more than any other driver.

Auto dealers can also find useful information in these chapters, such as how to build value in a

dealership for future sale and what the larger retailers are thinking in terms of future acquisitions.

We hope this report is helpful—in whole or in part—as you strive to address the complex world of

automobile dealership valuations.

Sincerely,

Timothy W. York, CPA/ABV

Editor

4

www.bvresources.com

6. Lost Profits for Automobile Dealerships1

By Timothy W. York, CPA/ABV

Lost profits pertaining to automobile dealerships can at times include a wide variety of businesses

underneath the “dealership” umbrella. Typically, most cases concern traditional automobile dealerships, although some others might additionally focus on motor sports, “power” sports, and heavy

truck areas.2 This chapter discusses primarily automobile dealerships because they are most likely

to incur damages from lost profits. Although there are differences among the various auto dealerships, this chapter will assist the financial expert in identifying certain key areas that are also

likely to be present in the motor sports, power sports, and heavy truck arenas.

A wide variety of circumstances can evolve into disputes in the dealership arena. Cases can involve

the following, among others:

• Natural disasters (insurance claims quantification, etc.);

• Business interruption and damaging events;

• Highway construction and/or easement changes;

• Unawarded or terminated dealership franchises;

• Management shortfalls or inattentiveness;

• Labor strikes;

• Lack of proper product;

1

2

22

Excerpted from the forthcoming Comprehensive Guide to Lost Profits and Other Commercial Damages for Experts and Attorneys, Third

Edition.

Motor sports generally include motorcycles and related equipment, and most power sports dealers sell and service watercraft

of many sizes. Heavy truck dealerships include those in a variety of classes, often separated by the size of the trucks.

www.bvresources.com

6. Lost Profits for Automobile Dealerships

• Governmental or regulatory changes;

• Employee theft;

• New real estate or business developments; and

• Loss of large employer.

Frequent disputes arise within this country’s approximately 18,000 new vehicle dealerships in the

context of their franchise agreements and related manufacturer relationships. Economic damages

can and do occur to the over 25,000 used vehicle dealerships in the United States, but as an initial

matter, this discussion will focus on lost profits damages as they relate to new vehicle dealerships.

Franchise Relationships

Franchise Agreements

New automobile dealerships operate by approval from a manufacturer. The manufacturer provides

the dealer with vehicles, parts and accessories, training, sales materials, and other services for a

certain brand. Such relationships between the dealership and the manufacturer are dictated by

terms located in a franchise dealer sales and service agreement. Some areas that these agreements

typically cover include:

• Location;

• Management;

• Ownership of dealership;

• Product allocation;

• Product ownership;

• Facility requirements and/or improvements;

• Standards of customer service;

• Regulatory requirements;

• Dealer evaluation;

• Restrictions on marketability of franchise;

• Rights of first refusal on ability to sell;

• Capital requirements;

• Systems’ coordination; and

• Termination.

www.bvresources.com

23

Key Trends Driving Auto Dealership Value

Some manufacturers have multiple brands. General Motors, for instance, holds the Chevrolet,

Cadillac, Buick, and GMC brands. Not only will some dealerships have the right to sell multiple

brands under the same manufacturer umbrella, but some will also have equivalent rights to sell

and service brands from multiple manufacturers. Dealerships often acquire franchises of various

types to help diversify their holdings and products from which consumers choose. A dealer with

a franchise to sell vehicles from a domestic manufacturer (e.g., Ford) might also desire a franchise

from an import manufacturer (Honda). This could be a sound financial decision for a dealer, but at

times, it can create friction among the affected manufacturers because they each dictate terms with

the dealer and compete for items such as highway frontage, number of parking spaces, remodeled

facilities, customer waiting areas, etc.

Franchise Laws

The first franchise agreement between automobile dealers and manufacturers was created in 1931 by

the National Automobile Dealers Association (NADA) from its desire to protect dealers’ investments

in franchises. Since then, these contracts naturally evolved into complex agreements setting forth the

parties’ understanding, including details regarding the areas listed above, among others. Due to the

concern over the large capital investments in acquiring or building dealerships and sustaining their

operations, states have enacted regulations to protect dealers. These franchise laws serve to protect

and enhance a dealer’s contractual rights and eliminate sudden and erratic changes to the values of

these rights. State franchise laws share common characteristics, including provisions that prevent

a manufacturer from declining to renew a franchise agreement without reasonable cause; create

mileage restrictions within which dealers can operate (e.g., dealers of similar brands cannot operate

within a 10-mile radius of one another); and protect dealers who attempt to transfer franchises through

transactions with other dealers and dealership groups. These are just a few of the focal points for

these laws, all of which are designed to ensure that a dealer’s investment in the franchise (which can

include massive investments in property aligned with a brand’s image requirements) is protected.

These laws are in place in all 50 states, and resources are available at various state and local dealer

trade associations to assist in understanding the laws that apply in each jurisdiction. Further, many

attorneys specialize in this area and are often “of counsel” for the various dealer trade associations

located in all states and in most large metropolitan areas.

Finally, in 2009, many state legislatures began considering amendments to expand or enhance

these laws, a response to the large number of franchise terminations by GM and Chrysler during

the severe economic downturn that began in 2008.

Franchise Damages

As one might expect, many of the disputes over the dealer’s lost profits involve and include the

franchise agreement. In some of these disputes, the dealer and the manufacturer are the primary

parties. Others may include additional dealers—when, for example, one dealer claims that another

has violated relevant franchise laws.

24

www.bvresources.com

6. Lost Profits for Automobile Dealerships

Lost profits cases involving auto dealerships often include the dealer’s claim that the manufacturer/

franchise partner has violated either the relevant franchise agreement or the applicable franchise

laws. To provide some background for these disputes, automobile manufacturers are continually studying the markets in which a dealership operates and/or wishes to operate. These market

studies typically consider demographics, traffic counts, population growth patterns, and sales

expectations, among other factors. Based on these analyses, manufacturers make strategic decisions to meet their objectives, which often include opening new dealerships in developing areas,

deemphasizing certain other areas, aligning various franchises, or adjusting areas of responsibility

(AORs). The manufacturer’s decision to take any of these four actions would affect existing dealers

in the area and create opportunities for concern and ultimately disputes. There are other potential

areas in which disagreements may arise, but these are the more common ones observed and are

detailed below.

Examples

A dealer’s AOR or territory, as outlined in the franchise agreement, is often referred to in the

industry as a “point.” Thus, one might say that a certain dealer has the western Birmingham

“point” for a certain franchise. One of the most common causes of a lost profits dispute is when

a manufacturer opens a new point. Based on its market studies, a manufacturer may decide that

its brand underserves a certain geographic area. To make up for this perceived weakness in brand

coverage, the manufacturer awards a new franchise to a dealer who may be completely new to the

area or, in some cases, owns another dealership brand there. While such a decision presumably

complies with the local franchise laws, this point will often lie at the crux of a dispute between

the existing dealer and the manufacturer. Common claims are that the new dealership at the new

point will erode the business and profits of the existing dealership. Lost profits analyses are often

based on the assumption that the new dealer is taking profits away from the existing one, which

should be compensated for its losses.

An additional area of friction arises from the common practice of the manufacturer awarding the

new point for no consideration. The new dealer provides adequate facilities and operations within

the manufacturer’s guidelines, but pays no actual purchase price for the franchise. In many cases,

the existing dealer purchased its franchise from a prior owner, paying significant amounts. Thus

a new dealer who was “given” the franchise in the same point negatively impacts the existing

dealer—which has sizable investments in the franchise and facilities. While this factor may not

be a technical component of a lost profits calculation, it certainly creates the negativity that can

permeate such cases.

In other cases, manufacturers deemphasize certain markets based on their strategic objectives.

This scenario can involve a number of perspectives or alternatives. A common example is when

a manufacturer decides to close a point or a specific brand—for example, Mercury in 2011. Again,

after reviewing market studies, a manufacturer may decide not to renew a franchise agreement.

This decision is most often based on declining performance in the area, changes in demographics,

population, or the perceived future of marketing the manufacturer’s brand in the location. This

www.bvresources.com

25

Key Trends Driving Auto Dealership Value

has occurred more frequently in recent years as domestic manufacturers (GM, Ford, and Chrysler)

try to consolidate their dealer body by reducing underperforming stores, often in less populated,

rural areas. In some cases, the manufacturer will attempt to compensate the dealer for the value

of the terminated franchise. However, based on the number of lost profits cases in this area, many

dealers often feel that the compensation offered for the loss of that franchise is inadequate.

Once again, in 2009, both GM and Chrysler terminated hundreds of points based on the criteria

listed above, as well as numerous financial and performance metrics of the dealerships’ performance. In almost all of those cases, the manufacturers paid almost no compensation for these

terminations, although they reinstated several in the last three years.

This scenario can also come about when manufacturers decide to discontinue entire brands, such

as Chrysler eliminating the Plymouth line in 1999, GM eliminating the Oldsmobile in 2000, and

Ford eliminating Mercury in 2011. The manufacturers attempted to compensate affected dealers

for those massive changes. For example, Chrysler would often award Chrysler, Dodge, and/or Jeep

franchises to dealers that may have been lacking one of those brands. GM and Ford, on the other

hand, chose to pay dealers cash based on self-created formulas. Naturally, many dealers chose

to take the alternative route of the legal system, claiming a lack of adequate compensation, and

numerous lost profits and economic damages cases stemmed from those events.

Other disagreements in the franchise area involve a manufacturer’s goal to properly align its

dealerships in accordance with its branding strategies. The term “channeling” is often used to

describe when a manufacturer aggregates its brands, such as GM’s desire to group GMC Trucks

and Buick brands within one dealership in designated market areas and the actions it took to

achieve this objective. Similarly, for years, Ford wanted to channel the Lincoln brand with Mercury

and Chrysler typically wanted one dealership in each area to hold the Chrysler, Dodge, Jeep, and

Ram franchises. Chrysler’s channeling stemmed from its desire to have “Genesis” stores, a term

it used to indicate a store holding all lines. In some cases, the preferred alignments occur through

natural merger and acquisition activity, but most resulted from either “soft” encouragement by the

manufacturer or stronger persuasion. The manufacturer might also provide financial assistance

and other incentives to encourage buyers and sellers of these franchises to interact and align the

stores according to the desired tracks. Naturally, these exchanges of brands can create concerns

among the existing dealers that are either affected by the channeling changes or not included and

could benefit by such alignments. Such concerns occasionally turn into lost profits engagements

for financial experts.

In more isolated instances, manufacturers will adjust territories or AORs based on a number of

different reasons. Predictably, these adjustments can create strife among parties who perceive the

adjustments to have a negative impact on their franchises and dealerships. Alternatively, some

franchisors could argue that the changes have impacted other dealerships more favorably than

their own. Although these cases occur in more limited instances, they do provide an avenue for

lost profits matters.

26

www.bvresources.com

6. Lost Profits for Automobile Dealerships

Several cases on lost profits include disputes revolving around franchise agreements. Among the

more relevant cases:

• Belleville Toyota, Inc. v. Toyota Motor Sales, U.S.A., Inc., 770 N.E.2d 177, 197 (Ill. 2002);

• Bero Motors, Inc. v. General Motors Corporation, 2007 WL 844899 (Ill. 2007);

• FMS, Inc. v. Volvo Construction Equipment North America, Inc., 2009 U.S. App. LEXIS 4938

(7th Cir. March 4, 2009), rev’ing FMS, Inc. v. Volvo Construction Equipment North America,

Inc., 2007 U.S. Dist. LEXIS 19577 (N.D. Ill. March 20, 2007);

• To-Am Equipment Co. v. Mitsubishi Caterpillar Forklift America Inc., 152 F.3d 658 (7th Cir. 1998);

• Davis v. Forest River, Inc., 2002 WL 764262 (Minn. App. 2002)(unpublished);

• Reeder-Simco GMC, Inc. v. Volvo GM Heavy Truck Corp., 374 F.3d 701 (8th Cir. 2004);

• Fabrication & Truck Equipment, Inc. v. Powell, 195 Or.App 72, 96 P.3d 1251 (Or.App. 2004); and

• Flood Mobile Homes, Inc. v. Liberty Homes, Inc., 203 Wis.2d 270, 551 N.W. 2d 869 (Wis. App.

1996).

Three of these—the To-Am Equipment Co., Davis v. Forest River, and Flood Mobile Homes cases—involved

the termination of the franchise agreements or the relevant relationship contracts. The Bero Motors

case concerned efforts by General Motors to channel its brands. The Belleville Toyota and FMS, Inc.

cases claimed breaches in the franchise agreements due to product allocation, rebranding, and

supply issues. The Reeder-Simco case alleged supposed favoritism in pricing by a manufacturer,

and the Fabrication & Truck Equipment case highlighted issues related to faulty product.

Lost Profits Considerations

One difference between assessing dealerships and other types of businesses in lost profits matters is

that the former may include valuing the franchise agreement itself. Although more traditional lost

profits models may include franchise rights, they may not consider all the facts and circumstances

involved in owning dealerships. These circumstances will include focusing on dealerships that

are not profitable or have not shown the consistent ability to produce profits.

When considering a dealership with historical profit levels or an ability to sustain profits, traditional

models apply when performing lost profits analyses. By contrast, when dealerships lack such an

ability or history, traditional models may not apply to assessing the intangible value arising from

ownership of the franchise agreement. In most cases, however—and regardless of the dealership’s

performance—there will be a baseline value associated with the franchise rights. This is supported

by the recent year’s practice among publicly traded dealership groups to list franchise rights separately on their financial statements.3 As these groups publish more acquisitions and continue to

3

See, e.g., public filings re: AutoNation, Inc. (ticker “AN”); Sonic Automotive, Inc. (SAH); Asbury Automotive Group, Inc. (ABG);

Penske Auto Group, Inc. (PAG); Group 1 Automotive, Inc. (GPI); and Lithia Motors, Inc. (LAD).

www.bvresources.com

27

Key Trends Driving Auto Dealership Value

itemize franchise rights and other intangible assets, there should be more relevant information in

future years on valuing franchise rights.

Again, traditional valuation and damages models may imply that the franchise agreements lack

a specific, discrete value, but in most cases, a baseline value or consideration exists within the

ownership of the agreement. Numerous dealership transactions involve large payments for the

franchise rights, even when the parties expected little or no profits at the existing dealership. These

transactions illustrate the importance of considering franchise rights in an engagement for lost

profits, even when superficially they might appear to have little impact on the matter.

Consideration of this baseline value for the franchise rights most often comes into play when

calculating lost profits for a specific franchise, such as described in some of the scenarios above.

In those cases, one must make sure that the franchise rights’ baseline value is considered, even

when there otherwise appears to be little or no lost profits. For example, in developing a lost

profits calculation, one might calculate $500,000 in damages, when the market repeatedly shows

that comparable franchises change hands for $750,000. Unfortunately, there are no published

studies of franchise rights, but in-depth inquiries and market research can help disclose such

information. The damages expert should make relevant inquiries of the dealer as well as other

dealers in the area, dealers’ association representatives, dealership brokers, representatives of

the manufacturer and any other comparable manufacturers, and attorneys and CPAs who specialize in dealerships.

Understanding the Dealership Business

Complexity of the Business

Many involved in the industry often talk of the intriguing complexity of the dealership business.

While outsiders may perceive the market to involve only selling and servicing automobiles, dealerships can often include five different types of businesses or more under one umbrella. New vehicles are retail sales of new product shipped from the manufacturer, while preowned (or “used”)

vehicles still involve retailing, but also involve a variety of acquisition methods. The servicing of

vehicles caters to a number of different customers, including the manufacturer for warranty work,

the preowned department for engine and internal reconditioning work, and customer retail work.

The parts department must maintain inventories for all brands held, many of which are small and

lower-cost items, so inventory management is a major consideration. Finally, for stores that have

collision centers (also referred to as “body shops”), the customer is most often a large insurance

carrier, so these departments cater to a different type of customer than the rest of the dealership.

In this brief summary description, one can envision a large variety of activities going on within

one dealership, including retailing and wholesale sales, production for service and collision work,

and areas that have no inventories to major process-oriented areas. Thus, when conducting a lost

profits engagement, one must be familiar with how a dealership operates and what specific areas

of the business will become a focus for the engagement.

28

www.bvresources.com

6. Lost Profits for Automobile Dealerships

There are additional complexities to consider when developing calculations for lost profits. Often

dealership performance is most accurately developed by “building up” each of the affected

departments, instead of applying general and overall industry averages. To build up a dealership’s expected performance for these purposes requires detailed departmental data, industry

data, and a basic understanding of the core components of each department’s business. When

starting such an engagement, financial analysts should be sure to acquire the appropriate data

(discussed below) and gain access to dealership personnel or other experts who can help navigate these complex areas.

Significant Considerations

Facilities

In today’s dealership environment, almost all manufacturers have what are known as “image

programs” and related requirements. Most dealerships are involved in ongoing discussions with

manufacturers about the adequacy of their facilities, including the need to: expand for new capacity,

remodel due to the facility’s age, respond to the manufacturer’s desire to include that dealership

within its preferred image, or relocate to a preferred location. This preferred image often includes

the manufacturer’s suggestions and occasional requirements on size, color, shape, appearance,

and other characteristics that will make most of the dealerships that offer a particular brand appear similar. The manufacturers often provide dealers with detailed illustrations to enhance their

position, including supplying data that support increased sales and performance on new and/or

renovated stores. In some cases, manufacturers will apply substantial pressure to dealers to comply

with their desires for the facilities. While these pressures have increased in recent years, so has

the resistance, particularly with a study commissioned by the NADA that is beginning to question the effectiveness and return on investments (ROI) of facility improvements. In more limited

cases, some may even use these facility upgrade requests as leverage in renewing the franchise

agreement, which often occurs every three to five years.

Not surprisingly, the costs of these seemingly continual improvements affect the dealership’s

earnings and cash flows and become a large component to consider in a lost profits matter, as it

would seem unlikely that a dealer would continue indefinitely without a significant expenditure

toward facilities improvement and/or compliance with manufacturer conditions. Further, the lost

profits expert must consider how an upgrade to the manufacturer’s requirements would affect the

dealership because the additional investment could change the dealer’s performance.

Location

It is critical to underscore the importance of location on a dealership’s ability to perform because

location is often deemed to be among the top two or three most important characteristics of a store.

A store located in a very affluent section of a city would logically be more attractive to a high-end

brand, such as Lexus, BMW, or Mercedes, to name a few. Predictably, franchises that provide lowerpriced vehicles may not perform as well in that area. Thus, simply utilizing dealership “averages”

can be deceiving and can produce inaccurate conclusions.

www.bvresources.com

29

Key Trends Driving Auto Dealership Value

Additional considerations beyond simple population and demographic factors include traffic counts

and traffic patterns. A store located in an auto mall would naturally expect to have more traffic than

a store located away from other dealerships. Large retail areas are often attractive to dealerships,

although they are expensive to acquire and dealers often compete with other “big-box” retailers

for such prime real estate.

There are also resources available to determine a dealership’s market penetration. R. L. Polk &

Companies, for example, publishes information regarding the extent to which a dealership sells

vehicles in its own market. (Selected industry and related valuation resources are listed at the end

of this chapter.) Thus one would expect that a dealership with an excellent location for its vehicle

types would sell more than its brand competitors with less envious locations. Prime locations

typically allow for easier access and convenience for customers desiring to have their particular

vehicles serviced. In sum, the location can “drive” much of the consideration for a dealership’s

expected performance and must be a major part of a lost profits determination.

Franchise Type

When compiling data for such a lost profits engagement, the damages expert should spend significant time on understanding and researching data related to specific brands that the dealership

carries. This is important not only for the perceived desirability of the franchise, but also to more

accurately predict its performance “but for” the damaging acts. Quite simply, some vehicle brands

are always attractive and others are not, and it is crucial to understand where the considered franchise fits in that spectrum to develop accurate forecasts in the context of franchise rights issues

(discussed above). In the current economic environment, some franchise types are on the verge

of extinction and there is little or no value in simply holding the franchise, while others garner

millions of dollars solely for the particular franchise rights. Various industry surveys detail the

desirability of franchises and dealer satisfaction in carrying the various brands (see list of selected

resources below).

Addressing this concept is critical to develop accurate assumptions for a lost profits calculation.

When creating models, it is imperative that the financial expert avoid using dealership “averages.” These averages may include high-dollar luxury import dealerships all the way down to

the lower-priced volume vehicle sellers. They also include both domestic brands (GM, Ford, and

Chrysler) as well as imports (Toyota, BMW, Hyundai, Kia, etc.). As one might expect, the average

performance of these franchise types vary dramatically, so focusing on this factor is a must in lost

profits engagements.

Financial and Operational Reporting

Each manufacturer has its own prescribed format for reporting a dealership’s monthly performance.

These “dealer financial statements” are typically several pages long and provide summarized

balance sheet data, general and detailed statement of operational data, and a number of pieces

of operating data. These usually provide an excellent source of data for lost profits calculations,

30

www.bvresources.com

6. Lost Profits for Automobile Dealerships

including detailed data at the department level. In addition, dealerships often use a long list of

industry-specific terms, many of which appear on these financial statements. Acquiring a basic

understanding of these terms is helpful because they provide clarity in interviewing dealership

personnel as well as ease in understanding and interpreting the relevant financial and operating

data. A very brief sampling of these terms includes:

• Back end—another name for fixed operations (parts, service, and body shop) of the

dealership;

• Blue sky—another name for the goodwill or other intangible assets of the dealership;

• Finance chargebacks—the unearned portion of finance income that is repaid to the financial

institution when customers prematurely pay off their loans;

• CSI—Customer Satisfaction Index, a measure of polled data obtained by the manufacturer

to evaluate the dealership’s customer service performance;

• Demo (demonstrator)—a vehicle typically driven by the dealership’s sales personnel and/

or management that is always made available to customers for demonstration purposes;

• DOC—Daily Operating Control Report, an internally produced summary report, prepared

for management that details the dealership’s daily and month-to-date sales, gross profit,

and expense information by department;

• Dueling—a practice of maintaining more than one new vehicle franchise at one common

physical facility (e.g., Toyota and Mazda);

• F & I—finance and insurance;

• Factory—another name for the manufacturer or franchisor (example, Ford, Toyota, etc.);

• Fixed operations—another name for the dealership’s nonvehicle sales operations (e.g., parts,

service, and body shop);

• Floor plan—financial institution financing of vehicle inventory, with each floor plan note

secured by a vehicle;

• Front end—another name for the vehicle sales (new and used) operations of the dealership;

• Holdback—an amount held by the manufacturer that is later remitted to the dealership in

addition to a new vehicle’s purchase price;

• Rebates—inventory-related compensation received from the manufacturer;

• SSI—Service Satisfaction Index; and

• Water—a term used to indicate the inventory cost (usually parts and used vehicles) that is

carried on the financial statements in excess of fair value.

www.bvresources.com

31

Key Trends Driving Auto Dealership Value

Notably, two cases involving automobile dealerships focused on financial and operational reporting. In Gardner v. Little, an acquirer claimed that the seller misrepresented the net worth of

the dealership, raising issues of the appropriate level of due diligence by an acquiring party in

studying the seller’s financial data.4 Fairway Dodge, Inc. v. Decker Dodge, Inc. dealt with the theft of

dealership data by the plaintiff’s former employees, later employed by the defendant.5 In that case,

the alleged theft supported claims not only for the lost profits of the plaintiff/dealership, but also

a diminution of its intangible value.

Relevant Resources

Understanding the Business

Fortunately there are ample data to help financial experts gain a reasonable understanding of the

auto dealership industry. A number of publications address several different facets of a dealership,

including a basic description of operations as well as specific operational considerations and accounting issues. Many of these sources also provide an exhaustive glossary of relevant terms and

reference materials. NADA has an extensive number of publications available. Thomson PPC’s offers

a Guide to Dealerships, and the American Institute of Certified Public Accountants (AICPA) holds

an annual National Automobile Dealership Conference with extensive related resource materials

Due to the auto dealership’s economic prominence, a number of periodicals focus on the industry. These include the weekly Automotive News, as well as the monthly Ward’s Dealer Business and

AutoExec magazines. In addition, numerous Internet-based publications and sites provide tools to

assist the financial expert in a lost profits project. For these and other helpful resources, see the

list at the end of this section.

Financial and Operational Data

Like many industries, the auto dealership area has information providers that deliver timely and

detailed data for use in lost profits matters. As discussed above, the most accurate calculations

utilize industry data that are most similar to the subject dealership.

While data from the publicly traded dealership groups may have limited application to the more

common dispute concerning a privately owned dealership, these sources can still be helpful, depending on the particular engagement and its purpose. As mentioned above, for example, cases

involving the rights to a franchise may now require the separation and particular consideration of

these rights. This is especially true in traditional valuation engagements but, as noted above, can

enter into the lost profits calculations. A study of the publicly traded groups can be useful due to

the numerous pricing multiples that can be derived from their daily stock pricing. Again, while

differences in dealership sizes often limit the usefulness of comparisons, they at least provide

another indicator for use in the engagement.

4

5

32

Gardner v. Little, 755 So.2d. 1273 (Miss. App. 2000).

Fairway Dodge, Inc. v. Decker Dodge, Inc., 191 N.J. 460, 924 A.2d 517 (2007).

www.bvresources.com

6. Lost Profits for Automobile Dealerships

However, the more common lost profits engagements involve a single dealership. Thus, it is imperative that the financial expert acquire the relevant data. Many dealerships throughout the country

participate in what the industry refers to as “20 Groups,” a nice-size grouping (not always of exactly

20 dealerships) of similar type, size, and branded stores that regularly share operating and financial

data from the dealership financial statements. Facilitators often start the groups and lead regular

exchanges of information, including very detailed reports of comparative financial performance.

The level of detail in these reports is quite helpful to lost profits analysts because the typical 20

Group report will provide numerous pages on each department. Such detail naturally allows for

excellent analysis of the subject company’s performance and also provides group averages to help

build expectations of the dealership’s future performance. NADA and NCM Associates are the two

main facilitators of 20 Groups that share sanitized operating and financial information.

Using 20 Group information eliminates the concern over using averages compiled from all dealerships as well as from those that may occupy a wide spectrum of franchise types and sizes. When

performing a lost profits analysis, the financial expert may do well to ask whether the subject

dealership is involved in a 20 Group. Reports that include the specific dealership’s information are

invaluable in providing comparable data and should be acquired whenever available.

Many manufacturers provide constant operating data to their dealers, some distributing information daily. Much of this information relates to sales and how the dealership’s performance may

relate to its peers. However, manufacturers also distribute information on customer satisfaction

related to service and sales, and a more select few provide data comparing their dealerships on

many financial metrics, including detailed operational categories. Many dealerships ignore or

forget these reports, and so a lost profits expert should see whether they receive this information

or encourage dealership personnel to contact the manufacturer’s representative to acquire the data.

Valuation-Related Guidance

Although lost profits calculations differ in many ways from traditional valuation approaches and

methods, at least two general valuation sources may be helpful in a particular lost profits engagement. One is A Dealer Guide to Valuing an Automobile Dealership, published by NADA and updated

periodically. Also, Chapter 20 in the Handbook of Advanced Business Valuation addresses common

issues that arise in valuing a dealership. Much of the commentary in these two publications can

be helpful in a lost profits matter.

What follows is a comprehensive list of the relevant providers and resources to use when valuing

automobile dealerships for lost profits engagements:

National Automobile Dealers Association

www.nada.org

R. L. Polk & Co.

www.polk.com

Ward’s Dealer Business

www.WardsAuto.com

Annual Market Data Book from Automotive News

www.autonews.com/section/datacenter

www.bvresources.com

33

Key Trends Driving Auto Dealership Value

NCM Associates Inc.

www.ncm20.com

Dealer’s Edge

www.dealersedge.com

A Dealer’s Guide to Valuing an Automobile Dealership

www.nada.org

The Handbook of Advanced Business Valuation

www.mcgraw-hill.com

NADA 20 Group Operating & Expense Profiles

www.nada.org

First Research Industry Profiles: Automobile Dealership www.firstresearch.com

The Automobile Dealership Valuation Guide

www.nvst.com/pubs/autodealval-pub.asp

Valuation Resources.com

www.valuationresources.com

General Bibliography

The NADA Story: America’s Resilient Auto Retailer, available at www.nada.org.

NADA Data—New Car Dealerships 2009, www.nada.org.

Automobile Dealerships Industry Profile, by First Research, www.firstresearch.com.

Robert F. Reilly and Robert P. Schweihs, Handbook of Advanced Business Valuation (McGraw-Hill 2000).

Timothy W. York, CPA/ABV, is partner-in-charge, dealer services group, at Dixon Hughes Goodman LLP. He can be reached

at tim.york@dhgllp.com or 205-212-5300.

34

www.bvresources.com

BVR

What It’s Worth

A BVR Special Report

Key Trends Driving

Auto Dealership Value

Key Trends Driving Auto Dealership

Value: A BVR Special Report

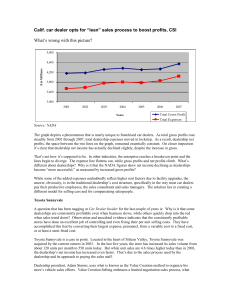

After a long lull, auto dealership buy/sell activity is on the rise. With an improving industry landscape, owners need to know how to create more value in their dealerships to get the most when

BVR they are ready to sell, while business appraisers should be prepared for an increased demand for

auto dealership valuation. Key Trends Driving Auto Dealership Value: A BVR Special Report discusses the unique characteristics and considerations important to both owners who are looking to increase and maintain their competitiveness and the valuation professionals who appraise auto dealerships for buy/sell purposes, gift and

estate and expert witness testimony.

What It’s Worth

Highlights of the Special Report include:

•

•

•

•

•

•

•

•

•

Top value drivers in the auto dealership industry

Blue sky multiples and buy-sell trends

Current trends in auto dealership retailing

Real estate considerations when determining the value of an auto dealership

Key issues that arise when valuing an auto dealership

Unique aspects of valuing used car dealerships

A checklist for preparing to sell an auto dealership

Rules of thumb and key sources of auto dealership data

Key sources of oil and gas industry data

Learn more & order online at: www.bvresources.com/publications

If you prefer, please call (503) 291-7963 or fax this page to our secure line: (503) 291-7955

❏

Yes! Please send me Key Trends Driving Auto Dealerships, A BVR Special Report for

$143.10 – a 10% savings! (delivered as a PDF via email)

Name:

Firm:

Address:

Phone:

City,State,Zip:

Fax:

E-mail:

Billing Information:

❏ Visa ❏ Mastercard ❏ AMEX ❏ Check payable to: Business Valuation Resources, LLC

Exp. Date:

Sec. Code:

Credit Card #:

Cardholder Name & Address (if different):

Business Valuation Resources, LLC . 1000 SW Broadway, Suite 1200, Portland, OR 97205 . (503) 291-7963

PRIOR1892