NH12-87-2011

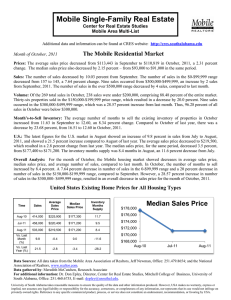

advertisement