Housing Profile City of Mill Creek

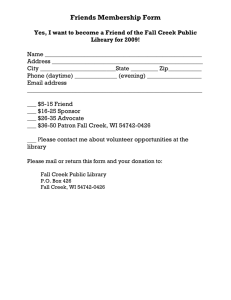

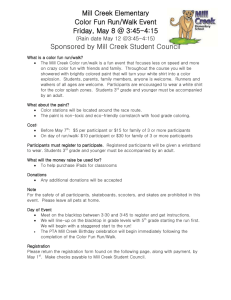

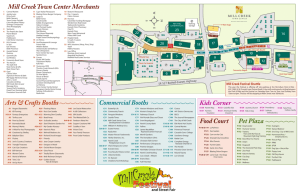

advertisement