The RIC Report

Investment Strategy

Global

12 September 2006

Local vs. Global

ML RIC Group

MLPF&S

local” as the global profits cycle slows

“Think

Investors tend to focus on the economic cycle, but the way in which assets

perform is much more sensitive to profits cycles than it is to economic cycles.

The profits cycle is considerably more volatile than the economic cycle, and it

historically has had a greater influence on global and regional sector, style, and

asset class rotations.

Global profits cycles tend to be highly correlated. With that in mind, it should be

disconcerting to investors everywhere that one of the most reliable profits

forecasting indicators in the U.S. has turned negative.

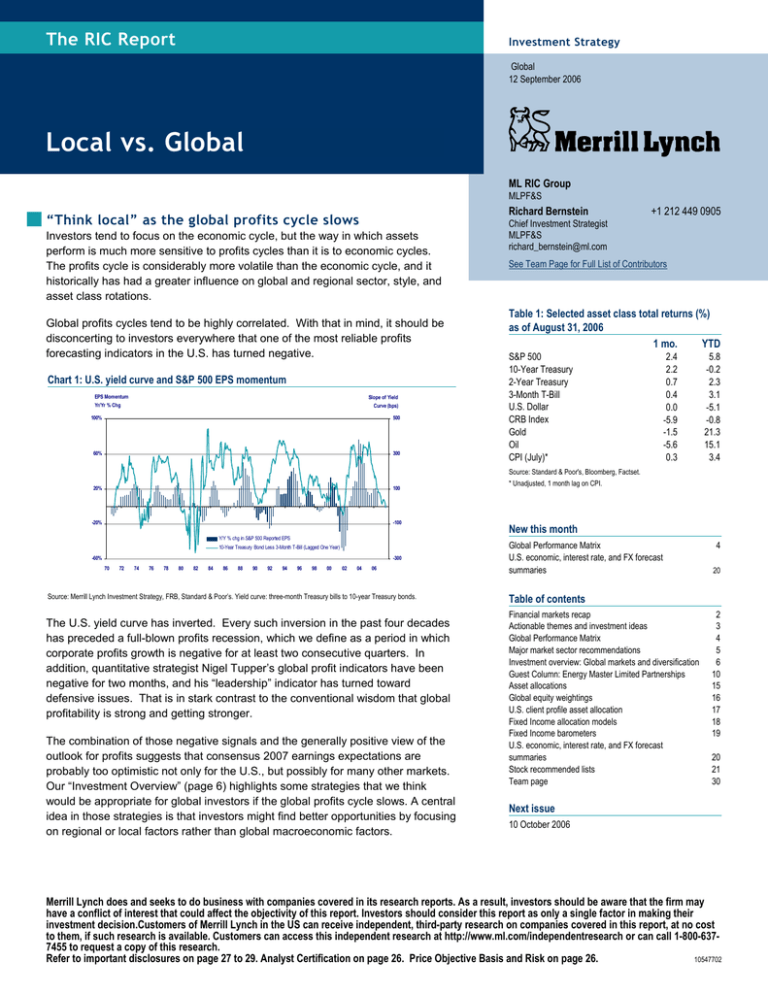

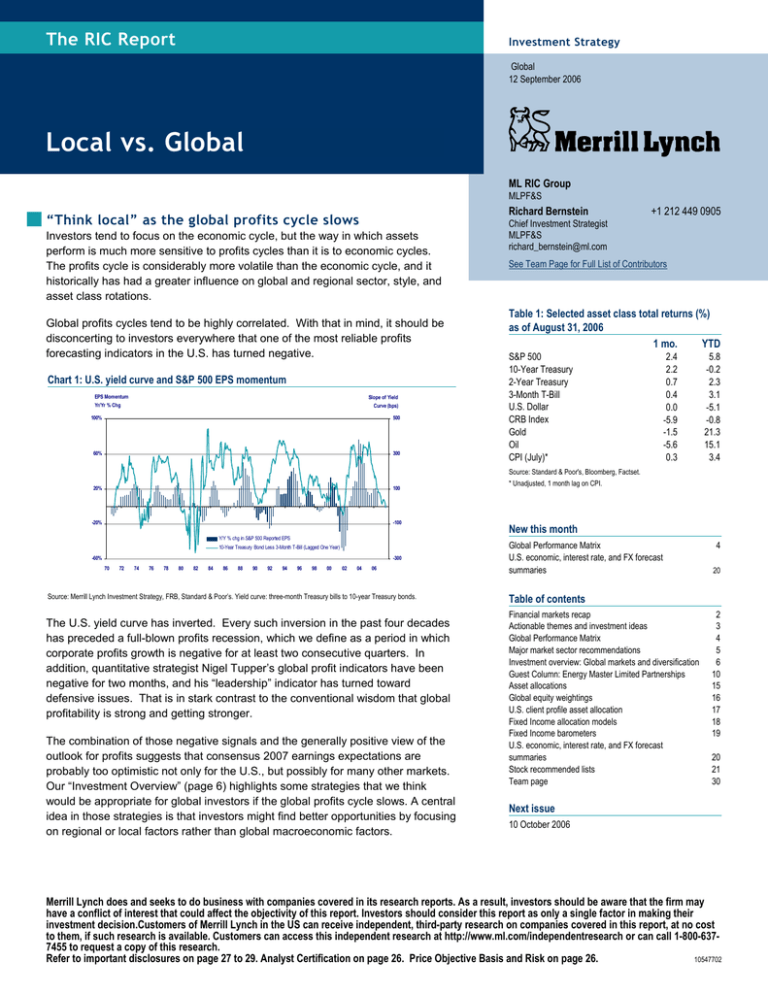

Chart 1: U.S. yield curve and S&P 500 EPS momentum

EPS Momentum

Slope of Yield

Yr/Yr % Chg

Curve (bps)

100%

500

60%

300

20%

100

-20%

-100

Y/Y % chg in S&P 500 Reported EPS

10-Year Treasury Bond Less 3-Month T-Bill (Lagged One Year)

-60%

-300

70

72

74

76

78

80

82

84

86

88

90

92

94

96

98

00

02

04

06

Source: Merrill Lynch Investment Strategy, FRB, Standard & Poor’s. Yield curve: three-month Treasury bills to 10-year Treasury bonds.

The U.S. yield curve has inverted. Every such inversion in the past four decades

has preceded a full-blown profits recession, which we define as a period in which

corporate profits growth is negative for at least two consecutive quarters. In

addition, quantitative strategist Nigel Tupper’s global profit indicators have been

negative for two months, and his “leadership” indicator has turned toward

defensive issues. That is in stark contrast to the conventional wisdom that global

profitability is strong and getting stronger.

The combination of those negative signals and the generally positive view of the

outlook for profits suggests that consensus 2007 earnings expectations are

probably too optimistic not only for the U.S., but possibly for many other markets.

Our “Investment Overview” (page 6) highlights some strategies that we think

would be appropriate for global investors if the global profits cycle slows. A central

idea in those strategies is that investors might find better opportunities by focusing

on regional or local factors rather than global macroeconomic factors.

Richard Bernstein

+1 212 449 0905

Chief Investment Strategist

MLPF&S

richard_bernstein@ml.com

See Team Page for Full List of Contributors

Table 1: Selected asset class total returns (%)

as of August 31, 2006

1 mo.

YTD

S&P 500

10-Year Treasury

2-Year Treasury

3-Month T-Bill

U.S. Dollar

CRB Index

Gold

Oil

CPI (July)*

2.4

2.2

0.7

0.4

0.0

-5.9

-1.5

-5.6

0.3

5.8

-0.2

2.3

3.1

-5.1

-0.8

21.3

15.1

3.4

Source: Standard & Poor's, Bloomberg, Factset.

* Unadjusted, 1 month lag on CPI.

New this month

Global Performance Matrix

U.S. economic, interest rate, and FX forecast

summaries

4

20

Table of contents

Financial markets recap

Actionable themes and investment ideas

Global Performance Matrix

Major market sector recommendations

Investment overview: Global markets and diversification

Guest Column: Energy Master Limited Partnerships

Asset allocations

Global equity weightings

U.S. client profile asset allocation

Fixed Income allocation models

Fixed Income barometers

U.S. economic, interest rate, and FX forecast

summaries

Stock recommended lists

Team page

2

3

4

5

6

10

15

16

17

18

19

20

21

30

Next issue

10 October 2006

Merrill Lynch does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may

have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their

investment decision.Customers of Merrill Lynch in the US can receive independent, third-party research on companies covered in this report, at no cost

to them, if such research is available. Customers can access this independent research at http://www.ml.com/independentresearch or can call 1-800-6377455 to request a copy of this research.

Refer to important disclosures on page 27 to 29. Analyst Certification on page 26. Price Objective Basis and Risk on page 26.

10547702

The RIC Report

1 2 Se ptembe r 20 06

Financial markets recap

August review

Risk-taking made a strong comeback in

August as the Federal Reserve paused in

its tightening cycle. High-beta stocks

immediately rallied, and were up by 10%

for the month.

Not surprisingly, technology stocks rallied

around the world. The hardware group

was among the best-performing industries

(see our new Global Performance Matrix

on page 4).

The renewed taste for risk-taking also was

evident in the fixed-income market, where

emerging market bonds led the way.

Commodities sold off during the month as

many global inflation measures came in at

levels that were more benign than many

investors expected. As inflation concerns

subsided, TIPS spreads narrowed sharply.

Table 2: Total return (%, U.S. dollar terms)

Asset Class

Equity Indices

S&P 500

NASDAQ Comp

FTSE 100

TOPIX

Hang Seng

DJ Euro Stoxx 50

MSCI EAFE

MSCI Emerging Markets

MSCI AC Asia Pac. Ex. Japan

2005

YTD

4.9

2.1

8.8

26.5

8.7

8.7

14.0

34.5

20.1

2.4

4.5

2.2

1.6

2.7

2.9

2.8

2.6

3.5

3.1

0.4

6.0

-0.9

9.8

5.5

3.8

3.9

3.4

8.9

2.1

22.0

22.3

20.7

21.5

24.8

31.0

25.5

5.8

-0.6

19.8

0.1

19.5

17.2

14.7

11.8

11.7

4.6

3.5

6.3

9.0

6.5

3.0

3.3

1.5

0.7

2.7

0.3

3.4

2.9

-3.3

-0.3

9.4

5.2

12.8

4.5

9.5

7.8

2.5

9.2

2.6

8.9

S&P 500 Sectors

Consumer Discretionary

Consumer Staples

Energy

Financials

Health Care

Industrials

Information Technology

Materials

Telecom Services

Utilities

-6.4

3.6

31.4

6.5

6.5

2.3

1.0

4.7

-5.3

16.8

2.0

3.7

-3.8

1.2

3.0

1.4

8.4

3.0

1.1

2.8

-1.7

7.3

3.2

3.0

8.7

-4.3

2.6

-0.3

11.3

10.5

-0.7

12.6

12.9

16.8

5.4

9.5

-0.4

19.2

19.0

10.8

1.0

10.5

14.9

6.9

4.5

2.8

-1.8

6.4

20.9

12.7

Merrill Lynch Bond Indices

10 Year Treasury

2 Year Treasury

TIPS

Municipals*

Corporate Bonds

High Yield Bonds

Emerging Markets

2.0

1.5

2.8

3.9

2.0

2.7

12.0

2.2

0.7

1.7

1.5

1.9

1.6

2.7

4.0

1.6

3.7

2.3

3.5

2.3

5.9

-2.1

2.7

1.6

3.2

0.7

5.5

10.0

-0.2

2.3

1.6

3.1

1.9

5.9

5.7

Foreign Exchange**

U.S. Dollar

British Pound

Euro

Yen

Swiss Franc

10.2

-11.6

-16.7

-20.1

-15.2

0.0

3.6

0.3

-5.5

-0.5

1.5

3.7

-0.1

-8.8

-2.4

-1.9

8.9

6.0

-12.6

0.5

-5.1

16.3

11.2

-2.8

6.2

Commodities**

CRB Index

Gold

Oil

16.9

17.9

40.5

-5.9

-1.5

-5.6

-4.6

-2.8

-1.4

-0.1

44.1

1.9

-0.8

21.3

15.1

Size & Style

Russell 2000

S&P 500 Citigroup Growth

S&P 500 Citigroup Value

S&P 600 Citigroup Growth

S&P 600 Citigroup Value

Source: Standard & Poor's, MSCI, Bloomberg, Factset, Merrill Lynch.

* Not tax adjusted. **Calculated by Bloomberg

2

As of August 31, 2006

1 month 3 months 12 months

The RIC Report

1 2 Se ptembe r 20 06

Actionable themes and investment ideas

Table 3: Actionable themes and investment ideas

Themes

Rationale

Short-Term/Tactical

Turnaround Industries Contrarian theme. Focuses on three very out-offavor industries within the U.S. market.

Investment ideas

Risks

Drugs, Media, and Diversified Telecom.

Fed eases and liquidity fuels speculative

investments.

Relative earnings deterioration may be attributable to

lack of cyclicality rather than secular causes.

Downward re-rating appears to have halted.

Cash/Equity Income

Central bank tightening.

Favor cash in Eurozone and Japan. Begin to

Central banks reverse course and ease.

extend maturities in U.S. and Canada.

Non-dollar equity income.

“Better Protected”

Emerging Markets

Central bank tightening draws liquidity away from

economies with weaker finances and current-account

deficits.

Overweight markets with current-account surpluses Central banks stop tightening.

and low P/Es such as Brazil, Russia, Korea, and

Indonesia.

Underweight markets that are expensive, have high

Global recession could mean that all

emerging markets underperform.

current-account deficits, or vulnerable earnings

outlooks; India, Central Europe, China, Chile.

Japanese Domestic

Demand

A budding credit cycle might make early-cycle

Housing stocks.

Japanese stocks attractive.

A return of deflation or a negative turn in

consumer sentiment.

Minimize exposure to consumer-oriented exporters.

Long-Term/Strategic

U.S. Exporters/NonU.S. Domestic

Demand

Weakening dollar, healthy global growth. Dollar

particularly vulnerable vs. the euro.

Gain exposure to other currencies. Non-U.S.

investors should continue to hedge their dollar

currency risk.

Higher interest rates, strengthening dollar,

and significant weakening of global

growth.

The trends that prevailed during the past five-to-10

years seem to be reversing.

Large cap U.S. exporters; smaller non-U.S., non-

export stocks.

Defense

A global arms race appears to be beginning.

U.S. and European defense stocks.

U.S. mid-term elections might be a short-

Large company stocks and stocks with S&P

Falling volatility.

Defense spending is increasing in the U.S., Asia, and

term risk, but could provide a longer-term

buying opportunity.

Latin America.

Large Cap/High

Quality

Undervalued relative to intrinsic value.

Provide hedge against rising global financial market

volatility.

Common Stock Ranks of B+ or better. Our High

Quality and Dividend Yield Screen is on page 23.

In the fixed income market, A-rated or insured

Central banks ease, spurring renewed

speculative activity.

municipals, mortgage-backed securities, and

selected bank preferreds.

Vaccines

The global vaccine business is beginning to expand

after years of weak demand and under-investment.

New markets related to the threats of a flu pandemic

and bioterror, a global push for higher inoculation

rates, and the promise of therapeutic vaccines.

Shares of companies with growing revenue streams Funding; competition and excess

related to the vaccine business (see August 7

Thematic Investing report, “Vaccines get a shot in

the arm”).

capacity; immaturity of individual

companies; legal liabilities associated with

vaccines; governments as single

customers.

Source: Merrill Lynch Investment Strategy.

3

The RIC Report

1 2 Se ptembe r 20 06

Global Performance Matrix

The Global Performance Matrix provides a quick, comprehensive way to compare

how 15 major market sectors and groups performed during the past month in 25

equity markets around the world. The returns, which are in U.S. dollar terms, are

price returns weighted by market capitalization. Blue/lighter shading indicates

that a sector or group posted a return that was more than 4% greater than that of

the MSCI World Index (2.4%); orange/darker shading indicates a return that was

more than 4% below that of the index.

Table 4: Global Performance Matrix

Cons.

Div.

Health

Tech

Autos/Dur

Country /Services* Banks Staples Financials Energy Care Industrials Insurance Materials Media Retailing Software Hardware Telecom Utilities

Canada

USA

Belgium

Finland

France

Germany

Italy

Netherlands

Norway

Spain

Sweden

Switzerland

UK

Australia

Hong Kong

Japan

Singapore

China

India

Korea

Taiwan

Brazil

Mexico

Russia

South Africa

n/a 6.7%

2.8% 0.0%

1.1% 1.3%

16.9%

n/a

4.8% 6.6%

2.9% 4.6%

2.5% 7.8%

3.3% 3.0%

n/a 2.5%

1.8% 4.6%

6.8% 2.5%

6.3%

n/a

5.1% 2.3%

1.8% 3.6%

1.3% 3.8%

2.7% -1.0%

10.3% 0.5%

-3.3% -1.0%

8.4% 10.8%

10.0% -6.8%

-1.3% -5.6%

26.5% -0.9%

1.4% 6.2%

n/a 21.9%

6.2% -2.5%

7.1%

3.5%

0.5%

1.9%

3.0%

4.4%

n/a

0.6%

n/a

0.8%

2.4%

4.8%

3.2%

10.1%

n/a

-0.1%

n/a

3.8%

6.6%

-0.4%

-3.0%

4.9%

6.9%

n/a

-0.4%

7.0%

1.4%

6.7%

n/a

4.3%

0.4%

5.3%

5.1%

n/a

2.5%

-3.7%

2.2%

2.0%

2.9%

2.3%

6.3%

12.6%

14.7%

n/a

11.5%

-2.2%

n/a

n/a

n/a

-0.5%

-0.7% 9.6%

-4.0% 2.5%

4.6% -0.3%

-8.6% 8.4%

-0.4% -4.9%

n/a 6.9%

-0.2%

n/a

1.0%

n/a

-6.9%

n/a

2.3% -4.0%

-9.5% 5.4%

n/a 1.1%

-4.6% 3.6%

-3.5% -0.9%

n/a

n/a

-7.3% 1.8%

n/a -6.0%

2.1%

n/a

8.9% 9.7%

-5.7% 9.0%

n/a

n/a

-2.5% 10.4%

n/a

n/a

6.5%

n/a

-3.8% 5.1%

6.3%

1.1%

7.9%

2.8%

5.8%

4.6%

2.2%

2.5%

7.3%

1.3%

4.4%

2.4%

4.0%

1.6%

0.8%

0.1%

0.6%

0.9%

11.8%

1.3%

-2.2%

15.4%

5.5%

n/a

7.6%

5.2%

2.2%

n/a

9.7%

7.7%

8.4%

4.9%

5.2%

0.5%

1.9%

n/a

3.5%

5.5%

3.6%

n/a

-3.2%

n/a

1.5%

n/a

4.6%

-7.2%

n/a

n/a

n/a

-6.0%

3.5%

n/a

3.0% 2.0%

5.3%

n/a

4.7%

n/a

5.4% 2.3%

1.7% 4.1%

-0.7% 0.7%

2.8% 7.7%

-1.3% 8.7%

0.2% 2.8%

1.9% 3.9%

0.9%

n/a

1.6% 4.7%

-0.5% 3.9%

n/a -7.2%

2.1% 0.5%

n/a 2.3%

0.2%

n/a

5.9% 4.4%

4.4% 0.2%

-1.0%

n/a

-5.2%

n/a

1.0% 1.8%

-1.9%

n/a

1.1% -1.7%

12.5%

2.8%

2.5%

n/a

3.4%

-4.5%

n/a

n/a

n/a

3.8%

4.2%

n/a

1.6%

0.8%

10.9%

5.3%

5.9%

-2.1%

n/a

0.4%

n/a

15.1%

n/a

n/a

-2.0%

n/a

5.1%

n/a

20.7%

7.2%

4.4%

-6.0%

-32.4%

n/a

3.7%

7.9%

n/a

0.8%

-1.1%

n/a

-0.7%

n/a

3.5%

7.2%

-9.1%

n/a

n/a

n/a

n/a

n/a

n/a

9.5%

3.2%

5.6%

10.5%

9.5%

n/a

10.7%

4.3%

n/a

6.0%

6.8%

4.4%

n/a

10.3%

3.5%

15.0%

8.1%

n/a

7.0%

6.7%

n/a

n/a

n/a

4.5%

13.0%

1.4%

3.0%

2.0%

2.3%

-5.6%

2.9%

8.7%

-0.3%

1.5%

9.5%

1.5%

1.4%

-6.1%

0.9%

0.5%

-3.6%

4.3%

14.4%

-1.5%

-7.1%

8.9%

3.7%

10.8%

1.9%

8.5%

2.4%

n/a

-0.7%

3.6%

5.0%

1.3%

n/a

n/a

3.6%

n/a

n/a

4.5%

5.8%

3.3%

6.1%

n/a

3.4%

5.4%

2.2%

n/a

4.2%

n/a

0.5%

n/a

Price returns in U.S. dollars, weighted by market capitalization. MSCI World Index return for August was 2.4%. Blue/lighter shade: more than 4% above MSCI. Orange/darker shade: more than 4% below MSCI. N/A = not available. As of monthend August 31, 2006. * Autos/Dur/Services: dur is durables, services comprises hotels, restaurants, leisure, and diversified consumer services.

Source: Merrill Lynch Global Quantitative Strategy.

4

The RIC Report

1 2 Se ptembe r 20 06

Major market sector

recommendations

Table 5: Sector recommendations

Sector

Brian Belski, our U.S. sector strategist,

overweights industrials and telecom

services and underweights utilities. For a

detailed discussion of sector weightings,

please see his September 11th “Sector

Strategy Update.”

Consumer Discretionary

Consumer Staples

Energy

Financials

Health Care

Industrials

Information Technology

Materials

Telecommunications Services

Utilities

U.S.

Europe

Japan

Asia ex-Japan

=

=

=

=

=

+

=

=

+

-

+

+

+

=

+

=

+/=

=

+

+

+

=

=

=

=

=

=

+/=

+

=/=

+/=

+/=

-

Source: U.S: Brian Belski, Europe: Khuram Chaaudhry, Japan: Masatoshi Kikuchi, Asia ex. Japan: RIC recommendations based on the work of

Spencer White and Nigel Tupper. + means Overweight, - means Underweight, and = means Equal weight.

Table 6: U.S. Sector Strategy Weightings

Sector Blended EPS

EPS

S&P 500

Val.

Growth

Revisions

Sector

Weight +/- MKT/LTA MKT/LTA MKT/LTA

Favored

Industries/Themes

Comments

Industrials

10.7%

+

P/P

-/+

+/+

Consistent deliverer of earnings growth intact; stuck between

growth and cyclical "tag" during current market transition

Conglomerates; Aerospace &

Defense

Telecom Services

3.4%

+

D/D

-/+

-/+

Valuation discounts persist despite price outperformance;

earnings growth trending above average again (L-T positive)

Integrated providers

Utilities

3.5%

-

D/P

-/+

-/+

Expensive on an historical basis and not defensive

Consistent dividend growers

Cons. Discretionary

9.7%

=

D/D

+/=

+/=

Everyone's sector to despise appears to be bottoming; theme

for retailers is "you get what you pay for." Avoid bottom fishing

Media becoming consensus play;

seek premium growth within retailers

Consumer Staples

9.9%

=

P/D

-/-

+/+

Defense wins championships, but likely source of cash when

the market rallies; premium valuation to market intact

Tobaccos for defense; drug retailers

for growth

Energy

9.9%

=

D/D

+/+

-/+

Hard to ignore earnings momentum, but supply/demand tugof-war likely to increase near term volatility; take some gains

Integrated oil & gas

Financials

21.7%

=

D/P

-/-

+/+

Earnings growth trending below the market; future Fed rate

cuts "should be" positive, but discounting mechanism risky

Asset managers, brokers, select

insurance and large banks

Health Care

12.9%

=

D/D

-/-

-/+

Second most defensive sector; prospects for premier growth

industries remain ambiguous and vulnerable to election risk

Specialty services; pharma recovery

increasingly selective

Info Technology

15.1%

=

P/D

+/-

-/-

Valuations bottoming, but no one wants to "make the call";

positive long-term, but vulnerable to seasonal correction

Telecom equipment; selected semis

selected software

Materials

2.9%

=

D/D

+/+

+/+

Another tug-of-war situation-- this one is inflation vs. global

growth; commodity price volatility hard to chase

Selected specialty chemicals

Source: Merrill Lynch Sector Strategy.

S&P 500 Weights as of August 31, 2006.

+/-/=: Current Merrill Lynch Sector Strategy Opinion; Overweight (+), Underweight (-) or Market Weight (=) relative to respective sector within S&P 500 Index.

P/D: (MKT/LTA): Current Premium (P) or Discount (D) relationship of Sector Valuation compared to the S&P 500 Index (MKT) and to that respective sector's long-term average (LTA).

+/-/=: (MKT/LTA): Stronger (+) or Weaker (-) or Equivalent (=) EPS Growth and EPS Revision readings sector relative to the S&P 500 Index (MKT) and to that respective sector's long-term average (LTA).

5

The RIC Report

1 2 Se ptembe r 20 06

Investment overview

Global Markets and Diversification

Investors take note: diversification can

work in unexpected ways.

History suggests that correlations between global economies and, more important

for investors, global stock markets tend to increase during economic downturns.

Every investor knows the importance of geographic diversification, but few seem

to realize that, in practice, diversification often works in unexpected ways —

sometimes exactly the opposite of how it is supposed to work. In fact, history

shows that correlations among markets seem to get weaker (diversification takes

hold) during bull markets, but get stronger (diversification does not work) during

bear markets.

The following table shows the correlations among major equity markets during up

and down markets. Markets do, in fact, have higher correlations during down

markets. That suggests that diversifying globally might not be as opportunistic as

one might think.

Table 7: Global market correlations with S&P 500

S&P 500 Negative

S&P 500 Positive

Return

Return

Germany DAX

France CAC 40

MSCI Emerging

Markets

KOSPI

Japan Nikkei Avg 225

Hang Seng

FTSE 100

Difference (Negative Positive)

0.70

0.70

0.30

0.33

0.39

0.38

0.58

0.34

0.40

0.39

0.66

0.26

0.07

0.17

0.17

0.47

0.32

0.27

0.24

0.22

0.20

Source: Merrill Lynch Investment Strategy, MSCI, Factset.

Sorted by highest to lowest correlation difference. Monthly data from August 1988 thru June 2006.

U.S slows. World to follow?

This time around, a slowdown in the U.S.

economy might have a muted effect

elsewhere in the world.

The U.S. economy seems to be poised for a slowdown. The “front end” or early

cycle sectors of the economy (those that are most sensitive to changes in shortterm interest rates) are now showing signs of weakness; housing and autos are

two examples. Overall, our economists are forecasting GDP growth of only 3.4%

for 2006 and a paltry 1.9% for 2007.

However, the U.S. slowdown might not spread to all parts of the world. We

expect global GDP growth to slow somewhat in 2007, but because the U.S.

accounts for such a large proportion of worldwide economic activity, much of the

expected slowdown can probably be attributed to a sluggish performance by

America.

That makes it more important than ever for investors to carefully look for

investment opportunities around the world. Clearly, some portions of the global

economy will suffer as the U.S. slows, but if our economists are correct, there will

be portions of the global economy that might continue to do well.

One word of warning: the profits cycles of countries around the world have

historically been highly correlated. Before every economic slowdown, analysts

argue that cyclical investments are no longer cyclical. We view such comments

with skepticism. However, there are some country-specific or region-specific

events that might counteract the global macro environment.

6

The RIC Report

1 2 Se ptembe r 20 06

No slowdown in China could be good for global bonds

China seems likely to continue expanding

its productive capacity come what may;

ultimately, that’s disinflationary.

Investors need to remember that China is not a traditional capitalistic economy; it

is a socialistic/government version of capitalism. Traditional capitalism focuses

on profit maximization; one could argue that the Chinese version of capitalism

focuses on employment maximization.

If Chinese capitalism really does focus on employment maximization rather than

profit maximization, it is likely that a slowdown in the global economy might not

impede China’s headlong rush to expand its productive capacity. Indeed, Michael

Hartnett, our chief emerging market strategist, has suggested that investors

underweight China because corporations there are already having trouble raising

prices. Investors focus on profits, and not employment.

Although the profitability of Chinese companies may be under pressure, China’s

expansion has helped Japan begin to solve its deflation problems. Japan is

among the most cyclical of the developed markets, but the boom in Asian growth

has allowed many of the Japanese banks to reliquify their balance sheets, and a

traditional lending cycle is budding. If that bud flowers, early-cycle stocks in

Japan could be attractive. On the flip side, investors might want to avoid the

shares of Japanese companies that depend to a large extent on exports to the

U.S. (auto or electronics companies, for example). Instead, it might be a good

idea to overweight Japanese stocks that are more closely tied to domestic

demand, such as homebuilding.

Global bonds stand to benefit as China

makes it difficult for secular inflation to

take hold.

Another point: if China continues to increase its productive capacity without

regard to global demand, global inflation expectations might fall. We have been

somewhat concerned about the late-cycle inflation pressures that are currently

evident in the U.S., but our opinion that the forces of disinflation (or deflation)

have the upper hand for the long term should remain intact as long as China’s

capacity continues to grow. Simply put, it is hard to see how secular inflation can

take hold when the world economy is undergoing the greatest capacity expansion

in our lifetimes. In such a climate, global bonds might become increasingly

attractive.

With that in mind, consider the next table (see Table 8 on the following page). Its

design is similar to that of Table 7, which deals with markets, but it shows the

correlations of 10 major asset classes in the S&P 500 during up and down

periods (for more information on these asset classes’ historical performance and

risk/return characteristics, see our July 17, 2006, U.S. Strategy Update, “A Simple

Risk Reduction Tool: Time”). Note that global equities’ (MSCI EAFE®) correlation

to the S&P 500 becomes stronger when the S&P 500 goes down (the correlation

increases from 0.31 to 0.53). However, the opposite is true for fixed-income: the

correlations between the S&P 500 and cash, long-term Treasuries, and corporate

bonds all fall when the S&P 500 goes down.

The consensus is that China’s unbridled growth would be bullish for commodities,

and that it might spur inflation fears. A contrarian point of view, which seems to

be supported by market history, is that China’s unbridled growth coupled with a

slowing U.S. economy might actually be bullish for bonds.

7

The RIC Report

1 2 Se ptembe r 20 06

Table 8: Asset class correlations with S&P 500

S&P 500 Negative Return S&P 500 Positive return

EAFE

REITS

CRB

Smalls

Gold

ART

Cash

LT Treasury

Corporates

0.53

0.42

0.01

0.61

0.00

-0.07

-0.06

0.00

0.02

0.31

0.30

-0.10

0.52

-0.05

-0.05

0.10

0.24

0.32

Difference (Neg-Pos)

0.22

0.12

0.11

0.09

0.05

-0.02

-0.16

-0.24

-0.30

Source: Merrill Lynch Investment Strategy, MSCI, Factset.

Bolded have higher correlations in down U.S. markets. Sorted by highest to lowest Correlation Difference, Monthly data Jan 1970 thru June 2006.

Even Europe is changing

The Old World may be changing its old

ways. As it does, investors should “think

local.”

European markets generally have higher correlations to the U.S. than others do,

and Europe might be the region that is most effected by slower U.S. growth. The

correlations between the S&P 500 and both the DAX and the CAC40 tend to rise

quite substantially during down markets (they more than double). That means

that, in general, a defensive posture toward Europe might be appropriate.

If the U.S. economy slows, investors interested in Europe might find better

opportunities by focusing on microeconomics instead of macroeconomics.

European corporations’ much criticized, sclerotic approach to corporate

restructuring seems to be changing; a new period of restructuring may be getting

under way, one that might even include the sale of public assets. If that proves to

be the case, investors ought to concentrate on individual opportunities rather than

make broad country allocations.

Central banks out of synch

Dollar-denominated assets could face

tough sledding if the Fed and other

central banks diverge.

If the U.S. economy does slow while economies elsewhere begin to or continue to

advance, global central banks are likely to become out of synch with each other.

GDP growth of 1.8% in the U.S. next year would mean that the Federal Reserve

would be more likely to ease; at the same time, healthy growth in Japan, Europe,

and Asia would mean that central banks in those areas might be in the earlier

stages of their tightening cycles.

Unsynchronized monetary policies might not bode well for assets denominated in

U.S. dollars. That’s because the dollar would be likely to weaken if non-U.S.

central banks were tightening while the Fed was easing. In last month’s RIC

Report “Investment Overview,” we commented that it was becoming increasingly

important for dollar-based investors to consider non-dollar sources of income.

We have repeatedly argued that investors pay too much attention to

diversification when it comes to potential capital appreciation and too little when

the subjects are income and overall total return.

Our foreign exchange strategy group recently revised its forecasts to reflect a

weaker-than-expected showing by the dollar. Their latest forecast is on page 20.

A sea change is taking place

The U.S. consumer may soon relinquish

the driver’s seat when it comes to global

growth and investment themes.

Taking a broad view, the economic backdrop seems to strongly support one of

our long-term investment themes: the trends that prevailed during the past five-to10 years are reversing themselves.

The strong growth of the U.S. consumer sector was a key variable in the global

economic equation in recent years, and investments that were tied to that growth

8

The RIC Report

1 2 Se ptembe r 20 06

tended to do quite well. In the U.S., the big winners included domestic demand

stories such as housing, retailing, and small capitalization stocks. Outside the

U.S., the growth stories were often exporters that provided goods (China) or

services (India) to the U.S. consumer. U.S. domestic demand stories

outperformed U.S. exporters, and non-U.S. exporters outperformed non-U.S.

domestic demand stories.

We think the next several years will see a complete reversal of that situation.

Taken together, a number of factors -- a weaker U.S. dollar, the reliquification of

U.S. consumers’ balance sheets as individuals boost their savings rate, and

selected pockets of counter-trend domestic demand growth such as the housing

sector in Japan -- could provide the impetus for a new secular investment theme

that favors U.S. exporters and non-U.S. domestic demand stories. It may be time

for global investors to “think local.”

9

The RIC Report

1 2 Se ptembe r 20 06

Guest column

Energy Master Limited Partnerships:

High yields, attractive total-return potential

In last month’s “RIC Report,” we emphasized the importance of income in a

diversified global portfolio and discussed potential income opportunities in U.S.

and non-U.S. equities, U.S. and non-U.S. preferreds, and several sections of the

fixed-income market. Our guest column this month highlights another incomeoriented idea: Gabe Moreen, our natural gas pipelines, utilities and master limited

partnership analyst, discusses the opportunities and risks in the energy MLP

sector. The average yield of the MLPs that he covers is 6.8%.

Energy MLPs offer high current yields and

attractive total-return potential.

Energy Master Limited Partnerships (MLPs) handily outperformed the market

during the past 10 years (the benchmark Alerian MLP Index [AMZX] posted a

gain of about 391% vs. an increase of 135% for the S&P 500). Even so, we think

that energy MLPs continue to offer investors the potential for annual double-digit

total returns.

Chart 2: Energized performance; MLPs have been doing much better than the S&P 500

450%

400%

Total Return (%)

350%

300%

250%

200%

150%

100%

50%

Se

p9

Ma 6

y-9

7

Ja

n9

Se 8

p9

Ma 8

y-9

Ja 9

n0

Se 0

p0

Ma 0

y-0

1

Ja

n0

Se 2

p0

Ma 2

y-0

3

Ja

n0

Se 4

p0

Ma 4

y-0

Ja 5

n06

0%

AMZX total return

S&P 500 total return

Source: Alerian MLP Index, Factset. Data as of 31 August 2006.

In particular, we consider the yield component of the MLP sector’s total return to

be both important and attractive, particularly in what our economists think will be

a declining interest rate environment. Even so, we think that a greater portion of

energy MLP’s total-return potential is tied to capital appreciation driven by robust

cash distribution (dividend) growth.

MLPs are meeting energy infrastructure needs

Increases in the cash distributions of energy MLPs are likely to be increasingly

driven by a focus on growth from attractive, high-return internal projects as MLPs

participate in the build-out of needed energy infrastructure projects related to

increasing crude oil imports to the U.S. and new sources of natural gas supplies

such as the Rocky Mountain region. We also expect growth to be supplemented

by other internal initiatives (fee increases, for example) and acquisition activity.

10

The RIC Report

1 2 Se ptembe r 20 06

Chart 3: Healthy growth in MLPs’ cash distributions

Aggregate YoY MLP cash distribution growth

10%

8%

6%

4%

2%

0%

2002

2003

2004

2005

2006E

2007E

Source: Merrill Lynch analysis and estimates. Note: figures and estimates are only for the MLPs covered by Merrill Lynch.

Energy MLPs are still an “under the radar” asset class

Energy MLPs are likely to attract more

attention in the years ahead.

Despite a decade of robust growth and strong returns, the energy MLP sector

remains something of a hidden gem, in our opinion. One reason is the structure

of MLPs, which we discuss on page 13. Another is their ownership profile, which

is heavily skewed toward individual rather than institutional investors. We think

that the visibility of MLPs will increase as institutional interest in the sector picks

up, growth continues, and more qualifying assets are placed into an MLP

structure. We would not be surprised to see the MLP sector’s current aggregate

market capitalization of about $85 billion double by the end of the decade.

Chart 4: The MLP sector’s market cap has been on the upswing

Energy MLP market capitalization ($bn)

90

80

70

60

32.4% CAGR

50

40

30

20

10

0

YE00

YE01

YE02

YE03

YE04

YE05

9/1/06

Source: Alerian MLP Index. As of 1 September 2006.

11

The RIC Report

1 2 Se ptembe r 20 06

A sector with low business risk….

A lower-risk link in the energy chain.

Most energy MLPs operate in what we consider to be the lower-business-risk

segment of the energy chain, by transporting or storing hydrocarbons (natural

gas, crude oil and refined products), usually subject to government regulation. In

general, the revenues of energy MLPs tend to be fee-based and not particularly

sensitive to commodity-price fluctuations (although investors should keep in mind

that each MLP has its own commodity exposure and asset mix).

…..and diversification benefits

Historically, the MLP sector has traded at low correlation levels to other fixedincome and equity asset classes. That means that MLPs give investors a way to

diversify their portfolios. Although the direction of interest rates does matter for

MLPs, the sector has shown an increasing tendency to decouple from interest

rate movements over time. That reflects a growing realization that MLPs are not

bonds (MLPs offer a growing, not static, coupon, in our view), and the fact that

many of the business that MLPs operate hold up relatively well during the

economic cycle (for example, the demand for refined products tends to slow, but

not decline, during a recession).

MLPs and commodity prices

On balance, energy MLPs stand to benefit

from higher commodity prices in the

energy sector.

The equity-market performance of the MLP sector and the movements of energy

commodity prices have shown little correlation over the long term. That makes

sense because most MLP revenues are derived from fee-based services that do

not fluctuate with commodity prices. However, commodity prices influence MLPs

in different ways; we would argue that MLPs that own refined-product pipelines

and terminals actually tend to be somewhat “short” commodity prices because

higher prices tend to induce conservation. However, in a larger sense, higher

commodity prices have been a boon for MLPs by fostering development in areas

that were considered uneconomic or too risky in a lower commodity price

environment (Canadian crude oil sands, unconventional natural gas drilling). On

balance, MLPs stand to be long-term beneficiaries of higher commodity prices

because they provide infrastructure that brings energy supplies to market.

Chart 5: Investing in the business

MLP capex ($bn)

7.0

6.0

5.0

38.9% CAGR

4.0

3.0

2.0

1.0

0.0

2003

2004

Source: Partnership reports, Merrill Lynch analysis. As of 31 August 2006.

12

2005

2006E

2007E

The RIC Report

1 2 Se ptembe r 20 06

What is an energy MLP?

How MLPs work.

A publicly-traded MLP is a limited partnership (LP) interest that is traded on a

public exchange and whose operations are managed by a general partner (GP).

An interest in an MLP is referred to a “unit” rather than a “share.” MLP units

generally trade on the NYSE and NASDAQ. An MLP typically pays out the bulk

of its operating cash flow on a quarterly basis as distributions (not dividends) to its

limited and general partners; as such MLPs are relatively high-yielding securities

whose main aim is to grow cash distributions over time.

To qualify for MLP status under the IRS code, partnerships must generate 90% or

more of their gross income from “qualifying income,” which includes “income and

gains derived from the exploration, development, mining or production,

processing, refining, transportation (including pipelines transporting gas, oil, or

products thereof), or the marketing of any mineral or natural resource (including

fertilizer, geothermal energy, and timber).” Most energy MLPs operate in the

“midstream” energy sector, transporting or storing different hydrocarbons.

In addition, MLPs are tax advantaged securities; no taxes are paid at the

corporate level, and cash distributions to LP unitholders are generally 80-to-90%

tax deferred. The non-deferred portion of distributions is taxed at ordinary income

rates, and the deferred portion of distributions is recaptured at ordinary rates

when units are sold. During tax season, investors in publicly-traded MLPs file a

Form K-1, an annual form replacing the 1099 investors use to report interest and

dividend income. K-1 forms provide the unitholder’s share of taxable income,

which is offset by deductions such as interest expense and DD&A.

Due to their tax-advantaged structure and emphasis on cash distributions, assets

within MLPs have tended to trade at higher valuations than those under a

traditional corporate structure. The higher valuations and their tax-advantaged

status have provided MLPs with a low cost of capital with which to drive growth.

MLP recommendations

Some Buy-rated, larger-cap, more-liquid

energy MLPs that we think are

particularly attractive.

Here are some of the larger-cap, more-liquid MLPs that we currently rate Buy:

Kinder Morgan Energy Partners, L.P. (NYSE: KMP: B-1-7: $42.08 on

September 8)/Kinder Morgan Management (NYSE: KMR: B-1-7: $44.04). In

our view, KMP is a good example of an MLP whose growth opportunities have

shifted from being acquisition-oriented to internally generated. Through its

extensive asset footprint, KMP should be able to participate in needed energy

infrastructure projects to bring increasing amounts of Rockies natural gas

production and liquefied natural gas (LNG) imports to market. The partnership

should also see growth opportunities related to the need to develop pipelines and

terminals to facilitate rising imports of Canadian crude oil to the lower-48 states.

Once several major projects are completed in 2008, we expect KMP’s cash

distribution growth rate to reaccelerate from 4-to-5% annually in 2006-07 to 8% or

more. KMP’s current yield of 7.4%; KMR’s is 7.7%. The pending $22-billion

buyout of KMP’s GP, Kinder Morgan Inc. (NYSE: KMI), should have little

fundamental impact on KMP, in our view.

KMR is economically equivalent to KMP, but is a paid-in-kind security and pays

dividends in additional shares. Unlike investing in a traditional MLP, KMR also

does not generate a form K-1 or unrelated business taxable income.

Our 12-month price objective of $50 per LP unit for KMP/KMR is based on an

analysis of discounted cash distributions per LP unit. We estimate the cost of

13

The RIC Report

1 2 Se ptembe r 20 06

equity at 10% and distributions per LP unit growth of 5% in 2006, 4% in 2007, 5to-8% in 2008-2011 with a terminal growth rate of 2%. Business risks to our rating

and price objective on KMP/KMR are a decrease in crude oil production at its

CO2 segment; an outright decline in demand for refined products or natural gas;

and supply chain disruptions (such as hurricanes).

Enterprise Products Partners, L.P. (NYSE; EPD; B-1-7; $26.25). As the

largest MLP, EPD’s diversified asset mix is likely to provide numerous organic

growth opportunities for energy infrastructure development to capture increases

in natural gas liquids (NGL) production in the Rockies, as well as Deepwater Gulfof-Mexico (GOM) crude oil and natural gas production. EPD’s current yield is

6.9%. We see the partnership’s organic growth profile allowing for annual

increases to its cash distributions of 7% in 2006 and another 7% in 2007. The

partnership’s operations are somewhat sensitive to end-user demand for natural

gas liquids (NGLs), which is itself a function of the overall economic environment.

Our 12-month price objective of $29 per LP unit for Enterprise is based on an

analysis of discounted cash distributions per LP unit. We estimate the cost of

equity at 9.5% and distributions per LP unit growth of 7% in 2006, 7% in 2007, 4to-6% in 2008-11 with a terminal growth rate of 2%. Business risks to our rating

and price objective are a decrease in natural gas and crude oil imports into the

Gulf Coast, an outright decline in demand for energy commodities due to higher

prices, an economic slowdown or other reasons, and supply chain disruptions.

Plains All American Pipeline, L.P. (NYSE; PAA; A-1-7; $45.01). A crude oil

logistics MLP, PAA’s model differs somewhat from the industry’s norm. About

half of its operating margin is derived from traditional fee-based crude oil pipeline

and terminal activities. In addition, PAA has a significant proprietary crude oil

logistics business which seeks to take advantage of physical and temporal

dislocations in the crude oil markets. The recent volatility in the crude oil markets,

which we expect to continue, has provided opportunities for that segment of

PAA’s business. Although the company’s business model entails higher risk than

those of most MLPs, the partnership has one of the highest cash distribution

coverage ratios in the sector (more than 1.5 for 2005). We project that PAA will

raise its cash distribution at an annual rate of 8-to-10% through the end of the

decade, aided by continued crude oil market volatility, a strong slate of organic

growth projects and its pending merger with Pacific Energy Partners, L.P. PAA’s

current yield is 6.4%.

Our 12-month price objective of $51 per LP unit for PAA is based on an analysis

of discounted cash distributions per LP unit. We estimate PAA’s cost of equity at

9.2% and distributions per LP unit growth of 10% in 2006, 9% in 2007, 6-to-9% in

2008-2011 with a terminal growth rate of 1%. Business risks to our rating and

price objective on PAA are a decrease in crude imports into the Gulf Coast and

from Canada, an outright decline in demand, and supply chain disruptions.

Risks to our MLP outlook

Watch for higher interest rates, changes

in energy consumption patterns, supply

disruptions, and regulatory changes.

14

Access to capital is all-important for the MLP sector because MLPs pay out the

bulk of their operating cash flow in the form of distributions and need to fund their

growth. Although the MLP sector has shown a declining sensitivity over time to

interest rate movements, a material rise in interest rates would likely present

headwinds to MLP sector performance. Other risks include significant changes in

energy consumption patterns, supply disruptions (hurricanes, for example), and

regulatory changes.

The RIC Report

1 2 Se ptembe r 20 06

Asset allocations

Table 9: Asset allocation guidelines as of 8/3/2006

Recommended

Equities

U.S. Stocks

Non-U.S. Stocks

Bonds

Policy Range

50%

35

15

30

40-100%

40-80

0-20

10-50

Cash

20

0-30

Alternative Investments

10*

0-20

Source: Merrill Lynch Investment Strategy.

* Alternative investments should be allocated via diversification from other asset categories, depending on an investor's risk tolerance.

Asset allocations for global investors

The Global Asset Allocation Models show target asset allocation guidelines as

well as ranges. The midpoint of the ranges is the long-term neutral benchmark

allocation for a particular investor profile.

Table 10: Global asset allocation guidelines with alternative investments*

Allocation Ranges

Capital

Income &

Preservation Income

Growth

Growth

Equities

Equity Range

Fixed Income

Fixed Income Range

Cash

Cash Range

Alternative Investments

AI Range

25%

10-30

50

45-65

20

10-30

5

0-10

35%

20-40

45

40-60

15

5-25

5

0-10

45%

30-50

35

30-50

5

0-20

15

0-20

55%

40-60

25

20-40

0

0-10

20

5-25

Aggressive

Growth

65%

50-70

10

5-25

0

0-10

25

10-30

Source: RIC.

*These percentage allocation recommendations are for the global investor in the major base currency regions including the US$, Euro, Yen, and

Sterling.

Table 11: Global asset allocation guidelines without alternative investments*

Rounded Allocation Ranges

Capital

Income &

Preservation Income

Growth

Growth

Equities

Equity Range

Fixed Income

Fixed Income Range

Cash

Cash Range

25%

10-30

55

50-70

20

10-30

40%

25-45

45

40-60

15

5-25

55%

40-60

35

30-50

10

0-20

65%

50-70

30

25-45

5

0-10

Aggressive

Growth

80%

65-85

15

10-30

5

0-10

Source: RIC.

*These percentage allocation recommendations are for the global investor in the major base currency regions including the US$, Euro, Yen, and

Sterling.

15

The RIC Report

1 2 Se ptembe r 20 06

Global equity weightings

The following table summarizes the RIC’s regional equity market and sector views:

Table 12: Regional equity view

MSCI

Equity

Region

Weight*^ Overweight**

U.S.

46%

Equity

Underweight**

The sector may be caught between “growth” and “cyclical” labels. Earnings growth has been

consistent and remains well above long-term average levels, yet Industrials are still inexpensive

compared to historical averages. We have become increasingly selective; the sector’s cycle is not

in its early stages. We favor conglomerates and aerospace/defense stocks.

Telecom Services

Despite its solid price performance so far this year, the sector trades near historic valuation lows

and offers high dividend yields. Its long-term relative price performance appears to have

bottomed, and we expect continued improvement, unless the economy slows significantly.

Utilities

Europe

29%

Materials

Financials

Energy

16%

5%

Utilities and Consumer Staples appear expensive, but EPS growth rates have improved. The

technology sector’s EPS growth and revisions have deteriorated, and it now ranks as the least

favored in the model. The Consumer Discretionary sector has “fallen from grace” as its earnings

and valuation measures have become less attractive.

Japan

Strategist Masatoshi Kikuchi thinks that portfolios should be oriented toward domestic demand

themes, and he has become more aggressive this month. The food industry has been

downgraded in favor of areas such as financials and retailing. He also suggests housing-related

stocks (rising household incomes should benefit this industry). Electronics remain underweight,

due to concerns over rising inventories and a weaker U.S. consumer sector.

Australia

Indonesia

Thailand

Regional strategist Spencer White believes that subdued risk appetites toward the region favor

core markets and larger-cap stocks. In Australia, the economy appears to be on firmer footing

ahead of income tax cuts and enhanced capital spending, and valuations are low. Indonesia

remains a domestic story as rate pressures and inflation ease; he suggests adding to holdings of

bank and discretionary stocks. Economic momentum in Thailand is improving and oil prices are

declining; that should fuel earnings.

Taiwan

Emerging Markets

The sector looks expensive by several measures. Stocks have moved up along with the market’s

defensive bias, but we don’t find Utilities to be defensive at all. Instead, they appear to be more

economically sensitive. That would be a negative if the U.S. economy slows, as expected.

According to quantitative strategist Khuram Chaudhry, sector valuations have diverged this year

compared to their very tight range in 2005. This is favorable for sector rotation, with Materials now

the most favored from a quantitative view. EPS estimate revisions have been especially strong for

Materials, Energy and Financials; Energy and Financials also appear to have good relative value.

Technology

Cons. Discretionary

Cons. Staples

Utilities

Asia

Comments

Industrials

Brazil

Russia

Indonesia

Turkey

In Taiwan, the dual challenges are technology and politics. The tech sector may see a fourthquarter rally (low valuations, seasonal demand), but we do not favor it for the longer term.

GEM strategist Michael Hartnett thinks that investors should focus on undervalued markets in

countries with current-account surpluses. Two of his favorites remain Brazil and Russia. Brazil’s

valuation is one of the lowest among the GEMs, and interest rate cuts should foster a recovery in

economic growth. Indonesia appears to be in a similar position. In Russia, growth and liquidity

appear ample. In Turkey, a currency recovery is easing inflation and interest rate fears.

India

China

Central Europe

India is the most expensive emerging market, and it has the largest current account deficit in Asia;

rising inflation is likely to pressure the exchange rate, and more monetary tightening is expected.

In China, the massive build-up in capacity is cutting into profit margins, and earnings growth is

declining sharply; we are concerned that tightening may be too aggressive. In Central Europe,

valuations remain expensive and vulnerable to higher rates and currency pressures.

Source: Merrill Lynch Research Investment Committee. * Weighting represents percentage of MSCI All Country Equity Index. ** Sector and country recommendation is versus local regional/country index weights. ^ Weights do not add to 100%

because Canada is excluded.

16

The RIC Report

1 2 Se ptembe r 20 06

U.S. client profile asset allocation

Our investor profiles are designed to serve as guidelines for a three-to-five-year

investment horizon. For the most part, they are strategic in nature, not tactical.

Table 13: Asset allocation by investor with alternative investments

US Stocks

US Range

Non-US Stocks

Non-US Range

Bonds

Bonds Range

Cash

Cash Range

Alternatives

Alternative Range

TOTALS

Capital

Preservation

Income

Income &

Growth

Growth

Aggressive

Growth

20%

10-20

5

0-5

45

45-60

25

10-25

5

0-10

100

35%

30-40

5

0-10

40

40-55

15

0-15

5

0-10

100

40%

40-55

5

0-10

35

30-45

10

0-15

10

10-15

100

50%

40-60

10

5-15

25

20-35

5

0-15

10

10-20

100

60%

50-70

15

10-25

10

10-20

5

0-15

10

10-25

100

Source: Merrill Lynch.

Table 14: Traditional asset allocation by investor profile

US Stocks

US Stocks Range

Non-US Stocks

Non-US Stocks Range

Bonds

Bonds Range

Cash

Cash Range

TOTALS

Capital

Preservation

Income

Income &

Growth

Growth

Aggressive

Growth

20%

10-20

5

0-5

50

45-65

25

15-30

100

35%

30-40

5

0-10

45

40-60

15

0-20

100

45%

40-60

5

0-10

40

35-45

10

0-15

100

55%

50-65

10

0-15

25

20-30

10

0-15

100

65%

50-70

15

10-25

10

10-25

10

0-15

100

Source: Merrill Lynch.

Table 15: Equity allocation by investor profile using size & style

Large Cap Growth

Large Cap Value

Small Cap Growth

Small Cap Value

Non-U.S.

TOTALS

Capital

Preservation

Income

Income &

Growth

Growth

Aggressive

Growth

10%

15

0

0

0

25

10%

20

0

5

5

40

20%

15

5

5

5

50

25%

20

5

5

10

65

25%

20

10

10

15

80

Source: Merrill Lynch.

Table 16: Sector weights across investor profile — August 2006

% Weight* in

Capital

Income &

Aggressive

S&P 500 Index Preservation Income Growth Growth Growth

Technology

HealthCare

Consumer Staples

Consumer Discretionary

Industrials

Materials

Telecomm. Services

Financials

Utilities

Energy

TOTALS

15.1%

12.9

9.9

9.8

10.8

3.0

3.4

21.8

3.5

9.9

100

3%

17

22

8

14

0

3

15

6

12

100

0%

8

19

4

12

0

7

22

12

16

100

10%

11

16

8

16

0

3

18

8

10

100

23%

21

6

12

18

0

2

7

0

11

100

24%

23

3

10

23

0

3

4

0

10

100

Source: Merrill Lynch. * S&P 500 Weights are as of August 31, 2006.

17

The RIC Report

1 2 Se ptembe r 20 06

Fixed income allocation models

If we are right that the Federal Reserve

will be cutting rates next year, yields on

money market funds will decline in 2007.

We expect intermediate- and long-term

yields to decline by then as well. That’s

why we recommend locking in the yields

that are currently available on

intermediate and longer-term issues.

For income, growth, and income and growth investors, we emphasize the

five-to-15 year maturity range in both the taxable and municipal markets.

We suggest high-quality securities, Treasuries, mortgage-backed, and

selected preferreds in the taxable market, and higher quality munis.

Table 17: Fixed-income allocation by investor profile

Capital

Income &

Preservation

Income

Growth

TAXABLE-Maturity

1-4.99 years

5-14.99 years

15+ years

TOTALS

TAXABLE-Sector

Nominal Treasuries

TIPS

Certificates Of Deposit

Agencies

Corporates

Mortgage-backed

Asset-backed

Preferreds

High Yield

Cash

TOTALS

TAX EXEMPT-Maturity

1-4.99 years

5-9.99 years

10-14.99 years

15+ years

TOTALS

100%

Growth

Aggressive

Growth

100

30%

55

15

100

30%

55

15

100

30%

55

15

100

43%

42

15

100

17

3

25

35

20

0

0

0

0

0

100

11

5

5

9

32

21

0

12

5

0

100

11

5

5

9

32

21

0

12

5

0

100

11

5

5

9

32

21

0

12

5

0

100

30

5

0

8

16

28

3

6

4

0

100

100

20

30

35

15

100

20

30

35

15

100

20

30

35

15

100

15

20

30

35

100

100

Source: Merrill Lynch.

Table 18: Taxable vs. tax-exempt: suggested allocations by profile and tax rate

Aggressive

Federal Marginal

Capital

Income &

Tax Rate

Market

Preservation Income Growth Growth

Growth

35%

33%

28%

25%

0% (e.g., IRA)

Source: Merrill Lynch.

18

Munis

Treasuries

Munis

Treasuries

Munis

Treasuries

Munis

Treasuries

Munis

Treasuries

97%

3

89

11

79

21

69

31

0

100

99%

1

97

3

94

6

91

9

0

100

99%

1

97

3

94

6

91

9

0

100

99%

1

97

3

94

6

91

9

0

100

98%

2

96

4

93

7

89

11

0

100

The RIC Report

1 2 Se ptembe r 20 06

Fixed income barometers

Chart 6: Short-term rates decline after the Fed stops

Chart 7: Individuals moving to money funds

3-Month Treasury Bill Yields

10.0

Assets in money market funds

800

9.0

780

760

7.0

$ Billions

Percent

8.0

6.0

5.0

740

720

4.0

700

3.0

1

2

3

4

5

6

7

8

9

10

11

12

680

Months after fed stops raising rates

1989

1995

Jan-04

2000

Aug-04

Apr-05

Dec-05

Aug-06

Source: Federal Reserve Board, Merrill Lynch.

Source: Federal Reserve Board

Short-term yields typically decline in the months after the last

Fed tightening because the Fed soon shifts gears to cutting

rates.

Individuals are flocking to money market funds, but if we are

right that the Fed will be cutting rates next year, yields on

these funds will start declining. We recommend locking in

intermediate- and long-term yields.

Chart 8: What’s your marginal tax rate?

Table 19: Summary of tax strategies

Effective Marginal Tax Rate, Married Couple, Two Children

40%

Emphasize munis in taxable accounts

Tax-favored assets in taxable accounts, fully-taxable

assets in tax-deferred accounts

High-yielding bonds in tax-deferred accounts

Be aware of tax treatment of market discount/premium

bonds

Avoid Alternative Minimum Tax (AMT) munis

Effective Marginal Tax Rate, %

30%

20%

10%

0%

-10%

-20%

-30%

-40%

-50%

0

100

200

300

400

500

Source: Merrill Lynch.

Income, Thousands $

Source: Merrill Lynch bond indices

The tax system has become mind-numbingly complex, and it’s

hard for many individuals to determine their marginal tax rate.

Still, intermediate- and longer-term munis provide better

income than Treasuries in the 28% Federal tax bracket and

higher, which applies to most higher-income individuals.

Despite the complexity of the current tax system and the

uncertainty about future changes, the recommendations in the

table above should be appropriate for most individuals.

19

The RIC Report

1 2 Se ptembe r 20 06

U.S. economic, interest rate, and FX forecast summaries

Table 20: U.S. Economic forecast summary (as of 8 September 2006)

Real Economic Activity, % SAAR

4Q05 1Q06 2Q06

Real GDP

Domestic Demand

Consumer Spending

Residential Investment

Nonresidential Investment

Structures

Equipment and Software

Government

Net Exports (billions of $)

Key Indicators

Industrial Production, FRB, % SAAR

Capacity Utilization (percent)

Civilian Unemployment Rate (%)

Productivity, % SAAR

Personal Savings Rate (%)

Housing Starts (Thousands SAAR)

Corporate Profits and Earnings

S&P 500 Earnings Per Share ($)*

% Change, Year Ago

Inflation

GDP Price Index, % SAAR

CPI, Consumer Prices, % SAAR

CPI Ex Food & Energy, % SAAR

3Q06

4Q06

1Q07

2Q07

3Q07

4Q07

2005

2006

2007

1.8

0.7

0.8

-1.0

5.2

12.0

2.8

-1.1

-636.6

5.6

5.4

4.8

-0.3

13.7

8.8

15.6

4.9

-636.6

2.9

1.7

2.6

-9.8

4.7

22.1

-1.6

0.9

-623.6

2.3

2.6

3.7

-18.5

8.4

12.5

7.5

1.7

-622.5

2.0

1.9

2.0

-6.8

5.7

5.8

6.0

2.0

-608.6

1.7

1.1

1.2

-10.3

5.2

5.5

5.3

2.2

-590.9

1.5

0.4

0.5

-13.0

4.8

5.0

5.0

2.0

-567.0

2.0

1.4

1.7

-12.3

5.6

5.5

6.0

2.2

-544.4

2.5

2.0

2.0

-7.5

6.3

6.0

6.7

2.5

-525.9

3.2

3.6

3.5

8.6

6.8

1.1

8.9

0.9

-619.2

3.4

3.0

3.2

-3.1

7.7

9.2

7.1

2.0

-622.8

1.9

1.4

1.7

-11.3

5.7

7.3

5.4

2.0

-557.0

5.2

80.5

4.9

-0.1

-0.3

2060

5.0

81.1

4.7

4.3

-0.3

2123

6.4

81.9

4.6

1.6

-0.7

1875

3.5

82.3

4.8

1.3

-0.7

1770

2.9

82.4

5.0

1.7

-0.5

1700

0.8

82.2

5.2

2.3

-0.1

1610

0.1

81.8

5.5

2.4

0.2

1500

2.5

81.9

5.7

2.7

0.2

1450

2.6

82.0

6.0

3.6

0.0

1420

3.2

80.1

5.1

2.3

-0.4

2073

4.3

81.9

4.8

2.3

-0.6

1867

2.0

82.0

5.6

2.2

0.0

1495

17.3

24.1

19.7

16.2

20.3

10.8

19.2

10.6

18.4

6.6

20.4

3.6

20.5

1.2

20.1

4.5

19.0

3.0

69.9

19.4

77.6

11.0

80.0

3.0

3.3

3.2

2.4

3.3

2.2

2.4

3.3

5.0

3.5

3.0

3.2

2.9

2.4

1.5

2.3

2.2

1.7

1.8

1.8

1.2

1.7

1.6

1.5

1.7

1.4

1.9

1.6

3.0

3.4

2.1

3.1

3.6

2.5

2.2

1.7

2.0

Source: Merrill Lynch Economics. Shaded regions represent Merrill Lynch forecast.

Table 21: U.S. Interest rate forecast summary

(% End of Period, as of 25 August 2006) 1Q06

Fed Funds

3-Month T-Bill

2-Year T-Note

10-Year T-Note

4.75

4.63

4.82

4.85

2Q06

3Q06

4Q06

1Q07

2Q07

3Q07

4Q07

2005

2006

2007

5.25

5.01

5.16

5.15

5.25

4.95

4.90

4.85

5.25

4.80

4.70

4.70

4.75

4.65

4.45

4.45

4.50

4.20

4.00

4.45

4.25

3.95

3.80

4.35

4.00

3.70

3.60

4.25

4.25

4.10

4.40

4.39

5.25

4.80

4.70

4.70

4.00

3.70

3.60

4.25

Source: Merrill Lynch Interest Rate Committee. Shaded regions represent Merrill Lynch forecast.

Table 22: Currency rate forecast summary

As of September 6, 2006

Euroland Euro

Japanese Yen

British Pound

Swiss Franc

US$/Euro

¥/US$

¥/Euro

US$/£

£/Euro

SF/US$

SF/Euro

Source: Merrill Lynch FX Strategy. Spot rate exchange at previous London close.

20

Spot

Dec-06

Mar-07

Jun-07

Sep 07

Dec-07

1.28

116

149

1.89

0.68

1.23

1.58

1.34

107

143

1.94

0.69

1.16

1.55

1.26

110

139

1.77

0.71

1.21

1.52

1.26

103

130

1.75

0.72

1.19

1.50

1.27

100

127

1.74

0.73

1.19

1.51

1.30

96

125

1.75

0.74

1.19

1.53

The RIC Report

1 2 Se ptembe r 20 06

Stock recommended lists

The following are stock recommended lists and are not designed to constitute a

portfolio. Based on investor profile and risk tolerance, investors may choose to

buy securities from the lists.

U.S. Focus 1

Table 23: U.S. Focus 1 List as of 9/7/2006

Company

Price as of 9/11/2006

3M Co.

Adobe Systems

Aflac

American

International Group

CVS Corp

Duke Energy

Ecolab

Edison International

Embraer

Freescale

Semiconductor

Goodrich

Hershey

JPMorgan Chase

Motorola

Newfield Exploration

News Corp

Qualcomm

SkyWest

Transocean

Merrill Lynch Research selects certain stocks to highlight for the Focus 1 list.

These recommendations reflect either Merrill Lynch’s current economic and

investment outlook or an unusual fundamental and/or investment development.

A selected stock remains on our Focus 1 stock list for a period of 12 months

unless the Focus 1 committee, at its discretion, removes the stock in

connection with an analyst downgrade or otherwise. The table below shows

the Focus 1 selections currently on our actively managed Focus 1 list.

Symbol

Opinion

Country

Date Added

Price When Added

Footnotes*

70.59

31.50

44.70

MMM

ADBE

AFL

A-1-7

C-1-9

B-1-7

US

US

US

3/29/06

4/27/06

8/1/06

BLbijoprsvx

BLbvx

bBxLjopv

63.90

35.11

29.88

41.73

42.54

40.19

AIG

CVS

DUK

ECL

EIX

ERJ

B-1-7

B-1-7

B-1-7

A-1-7

B-1-7

C-1-7

US

US

US

US

US

Brazil

3/14/06

11/9/05

3/13/06

7/11/06

8/9/06

6/8/06

76.30

38.15

44.14

68.07

30.32

39.54

51.53

45.20

23.04

41.90

19.38

36.97

23.84

73.28

FSL

GR

HSY

JPM

MOT

NFX

NWS

QCOM

SKYW

RIG

C-1-9

B-1-7

B-1-7

B-1-7

C-1-7

B-1-9

B-1-7

C-1-7

C-1-7

B-1-9

US

US

US

US

US

US

US

US

US

US

8/28/06

11/16/05

4/26/06

2/15/06

7/21/06

8/25/06

12/8/05

8/16/06

5/10/06

11/22/05

26.96

28.11

40.02

41.77

33.19

29.21

36.14

52.29

40.10

20.60

43.02

16.04

35.45

23.54

62.26

jopsvbBixLgOw

BLbjopwx

BLbijopsvx

BbxLjo

BLObijopsvx

bBxLv

BLbvx

ijsbBxpLwv

bBxLsivjopg

ijopsvbBx#LwOsg

BLObijpsvwx

bBxwLO

#BLObjovx

BLbjopvx

BLObisvx

bwBxLv

Source: Merrill Lynch Research.

(American International Group, Embraer, Goodrich Corp., JP Morgan, Motorola, and News Corp.) One or more analysts responsible for selecting the securities held in the Focus 1 List owns such securities. Investors should review the most recent

report on a company prior to making an investment decision.

Please refer to Footnote Key on page 25.

21

The RIC Report

1 2 Se ptembe r 20 06

Preferred Securities Recommendations

The following are preferred stock recommendations and are not designed to constitute a portfolio. Based on investor profile and risk

tolerance, investors may choose to buy securities from this list. Note that only the securities that pay Qualified Dividend Income are

those listed in the bottom two sections (the foreign preference and the DRDs).

Table 24: Preferred securities recommendations for individual investors

Issuer1

ML Sec. #

/CUSIP # Dividend

As of Sept. 8, 2006

Spread to

Ratings Call Date Price2 CY/YTM3 YTC3

Worst4

U.S Trust Preferreds and other deferrable hybrids (maturities generally about 30 years) — Do not pay Qualified dividend income

C Pr O

Citigroup Capital

52GX1

6.88%

Aa2/A 6/30/2011

25.38

6.77

USB Pr I

USB Capital

52GW4

6.50%

Aa3/A 4/12/2011

24.57

6.62

MSJ

Morgan Stanley

49D09

6.60%

A1/A- 2/1/2011

24.77

6.66

WNA

Wachovia Preferred Funding7

8Y0S1

7.25%

A2/A- /*+ 12/31/2022

27.67

6.55

LNC Pr G

Lincoln National

52GW5

6.75%

Baa2/A- 4/20/2011

24.83

6.80

U.S. Senior Debt Securities (maturities generally about 30 years) — Do not pay Qualified dividend income

GER

General Electric Capital

31XF0

6.45%

Aaa/AAA 6/15/2011

25.25

6.39

ABA

Alabama Power

03JE8

6.38%

Aaa/AAA 6/14/2011

25.25

6.31

CCT

Comcast Corp.