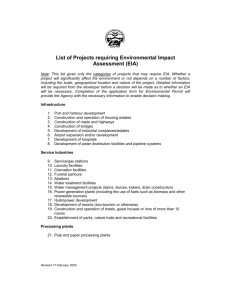

ISIC Rev.3.1 - United Nations Statistics Division

advertisement