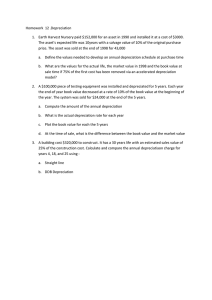

Component Accounting: A Case Study At Bromford Group

Component Accounting:

A Case Study At

Bromford Group

Mohit Dar

Financial controller, Bromford Group

Hugh Coombs

Professor of Accounting, University of Glamorgan

Journal of Finance and Management in Public Services. Volume 11. Number 2.

59

Component Accounting: A Case Study At Bromford Group

Abstract

This paper is a study of component accounting (CA) with reference to registered social housing providers – a contemporary topic of developing issue and importance to the sector. The importance of the topic has been given fresh impetus by the relatively new requirements in The Statement of Recommended Practice (SORP) 2010 for housing – which sets an effective date for adopting CA for accounting periods commencing on or after 1st April

2011. The paper is based on primary research at Bromford Group, a registered social housing provider. It provides a sector overview and then critically examines theory and specifi cally the practical difficulty in implementing CA at Bromford Group as a case study. A focus group provided the means for data collection and sharing ideas around the concept/issue.

Key research debate focused around how to account for components covering component identification, life cycles, cost identification and depreciation and net book value calcula tions. Further research questions were centred on social housing grant, valuations and prior period adjustments. It was recognised early on at Bromford that a pragmatic practical approach to CA was required and this led to an innovative solution. The paper concludes with a number of gaps in knowledge that could be further researched if CA techniques are to become more efficient and effective.

Key words: Component Accounting, Social Housing, Registered Social Landlord, Statement of Recommended Practice (2010), Housing Associations.Introduction

Introduction

The aims and objectives of this paper are to explore CA theory and practical application using Bromford Group, a registered social housing provider (RP) as the case study. CA is not a new concept, it has been around since 1999 (FRS 15 para.83). Past SORPs have included references to it (SORP 2008, par.176). Under CA, housing units/homes need to be classified into components such as windows, doors, heating systems, roofs, bathrooms and kichens in addition to the building structure itself. Replacement expenditure on these components is capitalised in the Balance Sheet, as opposed to being classed as revenue expenditure within

Income and Expenditure (I&E). Components have a shorter useful economic life (UEL) than that of the building structure and this gives rise to accelerated depreciation. A surplus benefit occurs where the increase in depreciation is smaller than the expenditure on component replacement in the year. This represents a significant change from traditional accounting methods for properties and a great deal of work was required to arrive at in formation needed to account for the changes. To-date, in practice, the majority of RPs only applied CA to the extent of treating land and buildings separately for depreciation purposes

(a single asset and one depreciable useful life - normally between 100-130 years).

A detailed review of the 2007/8 accounts of the top 60 RPs carried out by Beever and Struthers, Chartered Accountants, showed that only Knowsley HT, Helena Housing and Family

Housing Association had any CA policy. The 2012 Annual Review of Social Housing by the same firm shows that only 6 RPs adopted CA in the year, making 19 adoptions to date at year-end 31.3.11. The National Housing Federation (NHF) Consultation paper on Component

Accounting (2008) also stated that “indications suggest that component accounting may not be widely applied in the sector”. And, SORP 2010 Accounting by registered social housing providers states “To date very few social landlords have applied component accounting in full.” (p. 92).

60 Journal of Finance and Management in Public Services. Volume 11. Number 2.

Component Accounting: A Case Study At Bromford Group

An overview of social housing sector

A brief overview of how Bromford fits into the overall housing sector is provided below.

A clear definition of Registered Providers (or Housing Associations) is provided by the Scot tish Federation of Housing Associations:

A group of people get together with the aim of providing good quality low cost houses for rent and for sale. They elect a committee of volunteers, and the committee employs staff.

Using government grants and loans from banks they build some houses and improve others. That’s a housing association. Because there is a shortage of affordable housing, associations let to people in the greatest need. Any money they make is ploughed back into maintaining the houses they have, or providing more.

Historically, social housing had been under Local Authority (LA) control until the 1980s until the drive towards privatisation and commercialisation of the public sector under the

Thatcher Government. This led to the transfer of housing stock from LA control to quasipublic organizations using private finance. This was called the Large Scale Voluntary Trans fer (LSVT). The first LSVT was made in 1988 by Chiltern District Council. Although generally small in number (over 100), LSVTs tend to be the largest housing providers in the UK.

The regulators in social housing are as follows:

• Homes and Communities Agency (HCA) for England.

• Welsh Assembly Government for Wales.

• Scottish Housing Regulator (SHR) for Scotland.

• Department for Social Development in Northern Ireland.

Table 1 shows the overall size of the RP sector in England, Scotland and Wales. The total homes (units) in management at 2.9 million increased by 3.9% compared to 2009. Therefore, the sector continues to grow and it made an operating surplus of £2.5 billion (+33.8%) with a £768 million pre-tax surplus - again up 156.6% on previous year. Turnover rose 6.8% to £14 billion while operating costs rose 3.3% to £10.9 billion.

Table 1: RPs’ global accounts 2009/10: England, Scotland & Wales summary

Journal of Finance and Management in Public Services. Volume 11. Number 2.

61

Component Accounting: A Case Study At Bromford Group

Thus, Great Britain’s (GB) housing sector will continue to grow in terms of the number of homes (housing units). In terms of CA impact, if the total number of GB homes is 2,922,000 than an average of 6 components per unit would create a massive 17,532,000 asset records.

The Bromford Group

Within the overall context of the housing sector, founded over 50 years ago, Bromford

Group is a leading provider of affordable and supported houses thoroughout most of

Central England, managing 26,000 houses. The organisation has doubled in size in the last

5 years, employs over 1000 colleagues and works with over 60 local authorities to provide homes for more than 70,000 residents. Bromford’s mission is stated as “creating homes and supporting communities where people really want to stay”. Bromford’s name comes from

Bromford Bridge in Birmingham. The data analysis for Bromford shows that it is a good case study for research into CA and a basis to generalise for the whole sector. Reference to Bromford’s 10 year financial record can be found in Appendix 1.

Literature Review

Literature review serves as the driving force and jumping-off point for research investigation (Ridley 2008) into CA at Bromford Group. The review below covers literature from legal, tax, regulatory and practical points of view.

Legal and tax acceptability

The area of CA has links to depreciation. It has been researched in United States in 1979/80 by Gilliland (1980) and Davis and Wyndelts (1979) with reference to component depreciation.

Gilliland (1980) studies the role of appraisers in implementing and defending the component depreciation method of real estate valuation in United States. What is relevant from Gilliland’s study is the assertion that component depreciation method conceives of a building as being a group of distinct assets, which it values and depreciates individually. On the other hand, the composite method, regards the building as a single asset. Thus, from a housing perspective, Gilliland’s component system could be viewed as an application of the

“principle of contribution”, in that the value of each component equals the relative contribution that that component makes to the net return of the building. It follows, that the use ful economic value of the component continues only as long as the component contributes to the profitable operation of the building, e.g. for RPs, the continuation of the net rental stream.

In addition, the right to use component depreciation from a legal perspective was established in the United States as far back as 1959 in the legal case of Shainberg and this was reinforced by the Hastings case in 1967. The latter recognised the shortened useful lives for individual components relative to the life assigned to the basic structure. Furthermore, The

Merchant’s National Bank case in 1975 emphasised that useful life concepts required defen sive economic analysis.

Gilliland’s paper highlighted the importance of component cost breakdown and assignment of useful lives and then an application to a “hypothetical duplex” illustrating the impact of

“component depreciation” vs. “composite depreciation”. The former being “209%” of the latter and showing, therefore, accelerated depreciation associated with relatively short UEL.

62 Journal of Finance and Management in Public Services. Volume 11. Number 2.

Component Accounting: A Case Study At Bromford Group

An application of this theory to the Bromford case study is as follows:

Table 2: Bromford Group - Component depreciation cost breakdown for a new build.

Thus, component depreciation per annum is £1,485.45 (accelerated) whereas the composite depreciation would have given £942.62 (£122,540 /130years).

Davis and Wyndelts (1979) in their paper, researched Component Depreciation for a Shop ping Center and stated that the “ rationale for depreciating component parts based on their economic life is nothing more than economic reality.” And again, provided legal justification for using component depreciation in several tax cases. The Merchants National Bank case was again cited, which involved a new building and its components. The Inland Revenue

Service (IRS) made no argument against the use of component depreciation: the only issue was the useful life assigned to some of the components. Further support came from the

Harsh Investment Corporation case in 1971 which detailed a methodology for the taxpayer to use for separating land and improvement costs in the first instance and then improve ment costs into component parts.

A landmark decision, Hospital Corporation of America v. Commissioner, 109 T.C. 21 (1997)

(“HCA”), provided the legal support to use cost segregation studies for computing depreciation. In effect, this decision has reinstated a form of component depreciation.

There has been limited research since then on CA.

Accounting standards, Housing regulators and SORP 2010

In housing, depreciation is a charge made to I&E to reflect the economic benefits gained by an entity from operating the asset (Social housing economic benefit = rent received). To quote Goldberg (1955) depreciation itself “is one upon which so many articles have been written, and so many opinions expressed, that there would not appear to be much more which could profitably be said upon the subject.”

The main source of CA literature in recent times comes from UK accounting standards and

National Housing Federation recommendations. As stated earlier, the principles underlying

CA are not new and in fact well established in FRS 15 para 83. However, many RPs apparently for reasons of practicality have not followed the FRS 15 approach fully.

Journal of Finance and Management in Public Services. Volume 11. Number 2.

63

Component Accounting: A Case Study At Bromford Group

In the UK, the workplan leading to the publication of SORP 2010 and CA requirements was to introduce component accounting with immediate effect but it soon became clear that more time to prepare was necessary due to the sheer scale of the task. Initially, March 2011 was thought to be the first year of compliance but that too moved to March 2012. This lack of adoption due to time is further explored below.

Survey of RP published accounts

In order to assess the current take up of CA in the sector, a detailed review of the 2009/10 published accounts of the top 60 RPs was carried out by Beever and Struthers, Chartered

Accountants. It showed that only 15 of of the top 60 RPs had adopted some form of CA – an increase of 5 on previous year

In practice, a number of RPs have chosen to adopt partial CA. That is, only when work is un dertaken on an existing property will the RP identify a major component. The replacement component is then capitalised and depreciated over its useful life. The treatment of the replaced component will vary between practitioners with some correctly recognising the need to write off its original cost to avoid double counting while others choose to overlook the matter entirely. However, the first sentence of para. 126c of SORP 2010 would suggest that partial CA does not comply with the SORP:

Where component accounting is adopted it must be applied on a consistent basis to all assets in the same class. Land should always be dealt with as a separate asset.

While RPs traditionally recognised only land and buildings as the two components of housing properties, the housing 2010 SORP adopts a stronger view noting that housing properties will always comprise a number of components with substantially different economic lives.

Evidence from published accounts indicates that those RPs who chose to adopt partial

CA in the past, few have revised their accounting policies in 2009-10. This implies that the technical note in the SORP 2010 Update has done little to curtail poor practice and if left unchecked, will result in a number of RPs filing accounts that fall short of the SORP in 2011-

12. The Beever and Struthers 2012 Annual Review covering 2010/11 reporting season shows

19 adoptions to date of the top 60 or 31% take-up to year-end 31.3.11. Six RPs adopted CA for the first time in 2010/11: Gentoo, Southern, Notting Hill, Fabrick, Longhurst and Flag ship.

The literature review confirms that CA is not widely applied in the RP sector with confusion regarding its application. The review covered the literature from legal, tax, regulatory and practical points of view. It showed a lack of academic literature which meant that more reli ance on professional bodies, SORP and accounting standards was necessary.

Research methodology

The methodology used for CA research at Bromford has been primarily positivistic relying on quantitative data – numbers and figures. There was collection of data via interviews and focus groups. This allowed identification of components, estimated UEL, identification of costs, calculation of depreciation and net book values. Recommendations based on data collection and analysis then became possible.

64 Journal of Finance and Management in Public Services. Volume 11. Number 2.

Component Accounting: A Case Study At Bromford Group

CA research was based upon two balances:

• Primary and secondary data

• Qualitative and quantitative data

The nature of the research undertaken determined the balance required.

Secondary research was completed first i.e. textbooks, accounting standards, journals and

National Housing Federation recommendations and then followed by primary research i.e. case study at Bromford Group, focus groups and interviews. By using both types of research, a well-rounded view of the topic area was obtained together with information needed to make important decisions.

Primary data collection – case study

Bromford Group was the case study. Yin (2009 p. 18) defined case study as “an empirical inquiry about a contemporary phenomenon (e.g., a case), set within its real-world context – especially when the boundaries between phenomenon and context are not clearly evident”.

Robson (2002 p.178) has also defined case study in a similar fashion, emphasising “using multiple sources of evidence”. Thus, with a case study strategy, use was made of triangulation and multiple sources of data.

The Bromford Group case study rests implicitly on the existence of a macro-micro link in social behaviour. Sometimes in depth knowledge of an individual example is more helpful than fleeting knowledge about a large number of examples. It is hoped that using Bromford

Group as a good case study, will allow the relevant details of a narrative constructed at a certain time and space into a standardised form so that it can be meaningfully compared with other studies.

Primary data collection – Focus groups

One of the advantages of case studies identified by Yin (2012 p. 11) was the variety of re search methods, it could easily accommodate quantitative data and qualitative material.

Therefore, the research has interacted with RPs in a focus group specifically set-up and fol lowed up with interviews. The RPs making up the focus group were: Accord Group, Brom ford Group, Guinness Trust, Jephson Group, Knowsley Housing Trust, Midland Heart, Orbit

Group, Sanctuary Group, Walsall Housing Group, West Mercia Housing Group. The focus group was used at initial stages to clarify the themes and issues to be developed with the adoption of CA for the first time in the housing sector.

Primary data collection – mail, face-to-face, telephone.

Following the set-up of the focus group - email, telephone and face-to- face interaction at user group meetings and interaction with other RPs at conferences was carried out to determine approaches and experiences of adopting CA.

Primary data collection – Interviews (face-to-face, telephone)

The focus group enabled a contact list to be circulated for colleagues to talk on a 1-2-1 basis with those undertaking detailed work in their organisations. Therefore, either by personal interview or telephone interview, information was shared about the key research questions:

• Why and what components each RP was proposing to use?

Journal of Finance and Management in Public Services. Volume 11. Number 2.

65

Component Accounting: A Case Study At Bromford Group

• Why and what life cycle estimates were being used for those components?

• How were costs being identified?

• How was depreciation and net book value calculations being made?

• How was Social Housing Grant accounted for?

• How was valuation being treated?

• Was the RP going to make a PPA or not?

Key Research Questions

Literature reviews both academic and from professional accounting bodies showed gaps in demonstrating how CA could be adopted in practice. In exploring research methodology and data collection methods, a number of research questions based on the “how” and “why” were posed and have lent themselves to the Bromford case study research (Yin, R.K. 2012).

In its development paragraphs, FRS 15 states that:

The decision to record a tangible fixed asset as several different components with different useful economic lives will depend upon the individual circumstances. In practice the Board expects a commonsense approach, so that only significant, major components with substantially different useful economic lives are identified and treated separately for depreciation purposes. (p.77 para 14).

Accounting for components

In order to evaluate the impact of CA in RPs, a series of “how” research questions needed to be addressed:

• How do you identify components?

• How do you calculate their UEL?

• How do you identify the costs (i.e. obtain original cost of components)?

• How do you calculate depreciation?

• How do you work out their net book value (NBV)?

One of the main areas of controversy relates to what could or should be identified as a separable component. The judgement call on whether to identify separate components of an asset took account of:

• Whether the UEL of the components was substantially different from that of the rest of the asset;

• The degree of irregularity of expenditure in the replacement required;

• The materiality of the component;

• The materiality of the effect of separately depreciating the component;

• Discussion with auditors.

Merchant, A. & Harrison, J. (2010) state that decisions about what constitutes a significant separable component with a substantially different UEL from other components will properly be made by individual RPs and will depend on a number of factors such as the types of properties (e.g. houses, flats, bedsits, rooms, maisonettes and bungalows) and views of components’ UEL.

Individual components need only be accounted for where they have substantially different lives and where the financial effect is material. RPs will distinguish a number of different components but efforts should be made to apply materiality to minimise the number of cat-

66 Journal of Finance and Management in Public Services. Volume 11. Number 2.

Component Accounting: A Case Study At Bromford Group egories treated differently. Auditors would generally consider a major component to be any component where accounting for it separately would give materially different results either annually or cumulatively.

Some major components may themselves be made up of components with different useful lives. For example, a central heating system. The boiler may not have the same useful life as the radiators and pipework.

Housing 2010 SORP (p. 92) states that possible components might include: structure/building; roofs; windows and doors; kitchens; bathrooms; central heating systems; and lifts. The list is not meant to be exhaustive and each RP will need to consider which components are

“major” and separately identifiable within the context of their own Asset Management plans and spend. Thus, whilst guidance is provided in the SORP there is no defined list of com ponents.

Table 2 below taken from the focus group, shows how there is non-standardisation in the assignment of UEL to components across different focus group RPs.

Table 3: Review of Focus group components and UEL

Calculation of UEL could be standard lifetimes and linked to RPs asset management strat egies and expected replacement cycles e.g. looking at stock condition survey data. UEL benchmarks might also include Department for Environment, Transport and Regions

(DETR) document on Major Repairs Allowances.

Having identified the components and UEL, the next step was to identify the original cost of components. In identifying component costs:

• Actual / empirical cost data could be used when available. However, such data may not be available for some older properties and for some stock transfers (LSVTs).

Similarly, cost data is not broken down into components by developers on new build properties. Thus, costs of individual components may be difficult to identify.

• Some practical assumptions would need to be made e.g. allocation based on:

• Estimation techniques; or

• Asset management software e.g. Real Asset Management (RAM).

• Royal Institute of Chartered Surveyors (RICS) data on build cost.

• Treatment of directly attributable overheads may be contentious.

• Management costs

• Where records are not available, a possible source is the NHF/Savills’ national matrix of property components.

Journal of Finance and Management in Public Services. Volume 11. Number 2.

67

Component Accounting: A Case Study At Bromford Group

• The National Housing Federation (NHF), in collaboration with property surveyors Savills, has published the national matrix of property components (appendix

6). Generally, Savills has obtained broad acceptance from auditors that the matrix can be used, but only by associations “in exceptional circumstances when all other reasonable sources of internally generated information have been exhausted”.

UEL should be realistic. UEL of a tangible fixed asset is defined in FRS 15 as “the period over which the entity expects to derive economic benefits from the asset”. Decent Homes guid ance may require a bathroom to be 30 years old or less, in which case a 30 year useful life is only appropriate if that is Bromford’s intended replacement cycle. If Bromford actually replaced the bathroom every 15 years, it would experience large volatile charges to its I&E as half the cost of the old bathroom would be written off upon replacement. Bromford’s Asset

Management strategy gave a useful indicator of the actual life expectancy of the selected key components.

Once cost and UEL was established, then depreciation was simply the cost divided by UEL

(assuming no residual value). The final step would be to work out the components NBV. In this respect, identifying old assets may be required as there may be a need to write out old assets to justify capitalisation of replacement. Information sources would include existing records and statistical indices.

Thus, debates about how to account for components, in the first instance, required a judge ment call on the materiality of the component and views on such factors as the types of properties and components’ UEL. For example, evidence collected from focus group validated the existence of non-standardisation of UEL across focus group RPs.

In addition to debates about how to account for components, further research questions arising were:

• Was a prior period adjustment (PPA) required?

The impact of PPA was dependent on previous RP capitalisation policy For Bromford

Group, adoption of CA constituted a change in accounting policy because costs of major repairs that have previously been written off were now capitalised.

• How to account for social housing grant (SHG)?

3 alternative approaches could be identified:

• Proportional grant allocation across all components.

• Allocate grant against land and “unidentified structure only

• Allocate grant against net cost after depreciation has been charged.

SORP 2010 has opted for the second approach as being most accurate and straightforward, least onerous and perhaps most logical and practical (Technical Notes, A6)

• Accounting for components at valuation.

The SORP allows RPs to carry their housing properties at historical cost (less provision for depreciation) or valuation at existing use, derived from discounted net income streams. FRS 15 is also clear that CA applies to RPs that account for housing properties at valuation as well as those that use historic cost. The SORP 2010 Technical Notes allow RPs to argue that the value of components other than land and structure will not be materially different from their cost and therefore any revaluation gains and losses apply soley to the land and structure components.

68 Journal of Finance and Management in Public Services. Volume 11. Number 2.

Component Accounting: A Case Study At Bromford Group

Bromford case study findings

Findings of the Bromford case study are discussed below – the approach, PPA calculation and impact, component pools, cost capture and risks. One of the key findings was Bro mford’s pragmatic stance on CA, applying an innovative global approach to prior periods unlike focus group RPs.

Bromford’s approach to component accounting

Bromford has componentised roofs, kitchens, bathrooms, windows and doors, boilers and heating systems so that they are accounted for separately. Prior to this change, Bromford accounted for the property as a complete asset and depreciated the complete value over the structures UEL (130 years). Replacements to these components, under the planned maintenance programme, had traditionally been expensed through the I&E Account. These components were now classed as assets and depreciated separately, using an appropriate

UEL. In essence, the annual depreciation of all these components went through I&E rather than the full replacement cost of the current year’s replacement programme. For Bromford, this change was classed as a change to accounting policy and therefore, required a

PPA.

The Bromford approach was to split asset values for buildings as at 31.3.11 into the separate constituents, leading to 2 separate databases in Bromford’s asset registers (RAM), namely

RAM live and pooled database (PAM) and a global PPA in Sun Accounts (the accounting software used for preparing accounts). The standard costs for each of the components used for this exercise weree based on new build costs and not replacement costs. This was because the policy at Bromford had been to write off major replacements to the I&E, therefore original purchase cost values were stated on the Balance Sheet.

As explained earlier, the approach has been to reduce buildings costs as at 31/3/11 to

84.89% in order to represent structures only. Then the individual components held at

31/3/11 (as per the planned maintenance system) were placed in separate pools by component (not associated with properties) and aged. This became the historical pooled database in RAM (called PAM pool), with each pool having a different life:

Excluded from this reduction were shared ownership properties not applicable for component accounting (SORP 2010, para. 126E, p.40) and grants that were only being associated to structure.

Journal of Finance and Management in Public Services. Volume 11. Number 2.

69

Component Accounting: A Case Study At Bromford Group

Having created the historical pools (PAM) the next step was capitalising all component replacements from 1/4/11 onwards. The following steps were followed to achieve this:

• New codes were set up in SUN (the accounting software) to enable transactions against each component (Appendix 2).

• Component replacements during 2012 are notified to Finance by Asset Management

Operations. This data was sourced from contractor/surveyor control sheets which listed replacements undertaken by property at the point when the work is complete and invoiced. The details for these completed component replacements by property were entered on standard component cost upload sheets by Asset Management Operations on a monthly basis. There are separate monthly sheets for each component.

• These sheets were then coded and format checked in Financial Accounts. The sheets were then in a form to upload into the main RAM live database (asset register).

• The RAM system then generated journals for input into SUN accounts and transfer of component replacement costs from I&E (where they are originally coded) to relevant balance sheet codes.

• For each component replacement uploaded one was disposed off from PAM pool database on an oldest first basis (unless actual age was notified). Again, this generated disposal journals to update SUN. In the next 4/5 years, as pool disposals are oldest first, they are zero net book value (NBV) and therefore no profit/loss on disposal arises. The disposal process leads to the PAM pooled database diminishing over time, as the main RAM live database showing components attached to properties continues to build up.

• The costs as uploaded were compared to actual invoiced charges and any necessary adjustments carried out. This was done with the assistance of Asset Management

Finance.

As the CA at Bromford was actioned in 2 parts:

• the calculation of a PPA (PAM pooling); and then

• the on-going accounting requirements for the current year 2011/12 (RAM live).

Both parts required significant and detailed work to ensure the result complied with the

SORP whilst not creating an industry from having to component account.

Prior period adjustment (PPA) and existing assets

The purpose of the PPA is to adjust the opening balances and also the previous year’s results as though this new policy had always been operated. Bromford applied a pooling methodology to evaluate the PPA. In essence, this meant that Bromford populated 6 Asset

Component pools using data provided by Bromford’s Active H Housing Management System. The data provided an accurate assessment of the age of components, enabling a fairly robust adjustment to asset values and historic depreciation using average unit costs for each component category. Bromford applied a standard annual deflation rate of 2.5% to the current year value of components to arrive at a reasonable historic cost for the PPA. This enabled

Bromford to provide sufficient audit evidence for the evaluation of the PPA.

The 6 component pools plus the UEL are shown in Table 3 below:

70 Journal of Finance and Management in Public Services. Volume 11. Number 2.

Component Accounting: A Case Study At Bromford Group

With building/structure, the component cost breakdown is:

Table 4: Component pools

The providers of the Real Asset Management (RAM) - asset register software assisted Bromford in creating the 6 Pools in RAM rather than maintenance on a spreadsheet.

PPA calculation and the resultant impact on Bromford’s Reserves

The impact on numbers depends on previous capitalisation policy:

• Prudent capitalisation policy

• Big improvement in reserves (PPA)

• Larger depreciation charge moving forward

• Aggressive capitalisation policy

• Reduction in reserves (PPA)

• Larger depreciation charge moving forward

• Component accounting in line with previous policy

• Results in re-lifing

• Not a PPA

• Highly unlikely

Journal of Finance and Management in Public Services. Volume 11. Number 2.

71

Component Accounting: A Case Study At Bromford Group

Compared to RPs who have already adopted CA early, it has been a prudent capitalisation policy for Bromford – it is seeing a £41 million improvement to Reserves for year-ended 31

March 2012 as shown in Appendix 3.

Historical component pooling (PAM)

For financial years prior to 2011/12 all the components have been counted and aged in accordance with Bromford’s planned maintenance system. This has enabled each component group to be pooled by age for quantity, gross value, cumulative depreciation, and net book value. Details of the calculations in the historic PAM pools is given in Appendix 4. The pooling values are derived from new build costs provided by Bromford’s Development team

(Table 3) , and based on an average new build cost of £122,540. The average values used are: structure set at 84.89% of building cost; bathroom £3,742; kitchen £2,640; roof £3,589; boiler £1,018; heating circulatory system £4,402; and windows/doors £3,120.

New Assets

For the financial year 2011/12 Bromford has established a new process to enable new/re placement components to be coded to the Balance Sheet as assets and depreciated rather being expensed through the I&E Account. A new Fixed Asset Register structure and capital codings were established using RAM.

The cost of new and replaced components were recorded in RAM to enable ongoing accounting. RAM posts appropriate transactions into SUN each month. RAM holds the following data for each component - scheme name, scheme number, property reference, property type, component i.e. building, roof, kitchen, bathroom, windows/doors, heating, cost.

In more detail , the process worked as follows:

New component cost uploads

From the commencement of the 2011/12 financial year all replacements for the individual components identified are capitalised on completion. Component costs are uploaded upon their completion and depreciated from the start of the following financial year. Standard upload sheets are used for input into RAM.

The key reference number (or unique identifier) is the Active H system (Housing Manage ment System) reference that is used as the property identifier on both the Active H system

72 Journal of Finance and Management in Public Services. Volume 11. Number 2.

Component Accounting: A Case Study At Bromford Group and RAM. It is loaded against each transaction processed into RAM and enables correct property identification across both systems.

The data provided by the Asset Management Operations team is derived from contractor component cost control sheets , within the planned maintenance programmes. These control sheets are used to monitor planned maintenance works and contain details of all com pleted and invoiced jobs. VAT is added to the works cost, to obtain the total cost incurred.

The control sheets show breakdowns by property and component, with a further column for other costs (i.e. decorations etc). It is the component values and other costs that are easily associated with the specific component replacements that are currently included on the upload sheets.

Invoice/Certificate numbers and dates were obtained from component and contractor data held in the financial folders. Any missing details are drawn from the Housing System Re porting database (Active H).

All costs submitted to Financial Accounts would then have the end column on the sheet completed to signify that they had been passed on, and to avoid any duplications.

The sheets were then checked for formatting by Financial Accounting team, who would also add coding information. New codes had been set up in SUN, for both the I & E and Balance

Sheet, to record acquisitions, depreciation, and disposals.

The upload sheets were then uploaded into RAM by using the upload wizard in the RAM software programme.

RAM generated nominal ledger journals each month in order to process the following transactions in SUN (the accounts package):

• New component costs to be transferred from the I&E accounts (where the invoices were initially coded) to the Balance Sheet accounts (not depreciated until the following financial year) from the main RAM live database.

• Depreciation charges from the RAM live database (although components replaced in

2011/12 would not depreciate until 1/4/12).

• Depreciation charges relating to the historical pool data-from pooled database (PAM)

• Disposed/replaced components to have costs and depreciation transferred from

Balance Sheet accounts to P&L accounts ,and any gain/loss realised-from PAM and

RAM as applicable

Any part completed works (i.e. work in progress - WIP) were accrued on separate balance sheet codes and only included on upload sheets upon completion.

Audit considerations

Invoices, certificate references and dates for each job were noted on the upload sheets and loaded into RAM. These were usually referenced against the invoices on the Sun Accounts

Purchase Ledger. This was supported by the cost analysis provided on the contractor control sheets. For replacements undertaken by the Bromford in-house Repairs team, orders were raised on Active H.

Journal of Finance and Management in Public Services. Volume 11. Number 2.

73

Component Accounting: A Case Study At Bromford Group

Cost capture

• Cost of components built when property was new (i.e. new build) was likely to be lower than cost when replaced (because of extra costs of work set-up and VAT).

• Component costs were only recognised and uploaded to RAM/ journaled in SUN, upon final completion, valuation has been agreed, and invoice issued. Part completed works were accrued against WIP account codes, by component, on the balance sheet.

• Only projects costing over £1k in total were capitalised (de-minimis rule).

• No overhead costs were included in the capitalised component costs.

• New component costs were based on actual costs charged by contractors and detailed on invoices or contractor control spreadsheets. The contractor spreadsheets show net cost of installing, for example, new kitchens. VAT was then added to these figures to obtain the true costs. On these spreadsheets, there is also a column show ing other costs which consist of items such as level access showers, en suite, cloak room, and any decorations.

• Contractors raise invoices upon completion, and final valuation, of significant parts of contracts-for example, completion of all addresses in a certain area as at a certain valuation date. Certificates for payment will also be issued giving a brief descrip tion of the work carried out, Issue and valuation date, cost code, the relevant invoice no., the contract start date, the contract reference (usually area/entity/component type/period), and the total contract sum of which the invoice is just a part of.

• Reconciliations were produced to show the differences between the component costs as uploaded to RAM and hence transferred on the general ledger from I&E to

Balances Sheet accounts, and the total invoiced charges originally posted to the general ledger P&L component codes.

Roofs

Actual costs were used as per invoices received. These would include all incidental costs, e.g. scaffolding, necessary to complete the roof replacement. Only full roof replacements were included. Therefore, works such as guttering repairs, fascias, and dormer roofs which involve replacing only part of the roof, are excluded and charged to I&E.

Boilers and circulatory systems

Jobs were broken down on the invoices (e.g. from contractor PH Jones) to show whether a boiler or a full central heating system had been replaced. If a full central heating system replacement was identified then the cost as stated for boilers only at other addresses on the invoice was used for the boiler element, with the remainder used as the cost for the circulatory system. Also, itemised separately were charges for additional radiators, electric fires etc. which did not apply to every installation, and were immaterial in themselves (c£180-

£650). These were not included in the component cost.

Kitchens and bathrooms

These costs were shown on the invoices as a combined charge for each address, i.e. values in total for kitchens/bathrooms/rewires. Rewires have not been identified as components for capitalisation purposes and so were ignored for this exercise.

The breakdown analysis for kitchens and bathrooms were obtained from the components

74 Journal of Finance and Management in Public Services. Volume 11. Number 2.

Component Accounting: A Case Study At Bromford Group control sheets within the planned maintenance programmes (arranged by contractor).These gave an analysis by property of the net costs for the installations of kitchens and bathrooms separately. It also had amounts noted in a column titled ‘Other Value’. These were the costs relating to level access showers, cloakrooms, en suite, outside wc, and decorations. These are included where the association can be made directly to the kitchen or bathroom instal lation, e.g. is noted as a level access shower or there is only a kitchen or bathroom being installed. The invoices came in showing the costs for the total work carried out for each property, i.e. kitchens, bathrooms and rewires as appropriate .

New property additions (new builds) in 2012

For new property additions from 2012 the costs of each unit needed to be capitalised at component level. There were two types of additions:

• those that had been developed internally and would already have a cost breakdown between land and buildings

• those that were purchased as complete (off the shelf) for which all the costs were posted to the land costs balance sheet account.

The Bromford Development team provided land/buildings cost split at scheme level where necessary. Having established the buildings cost at scheme level, this was then allocated across all individual properties within the scheme on a square footage basis. The cost for each individual property would then be analysed further down to component level. This was achieved using the National Housing Federation Matrix of Property Components (Appendix 6). It seems reasonable to use the percentage splits given for 1/2 bedroom houses, because there were very few bungalows and high rise flats, and the percentages were fairly close across the other ranges.

Property disposals 2012

For all property disposals during the year the process was to dispose of them on RAM and post the automatically generated journals to SUN. The structure, any components replaced, land, and grant for the property would be disposed of on the RAM live database. However, because the components prior to this year were held on the pooled database (PAM) then the relevant components were needed to be picked and disposed of from this separate da taset in RAM (oldest first basis unless the actual age of the component is known).

As a consequence of CA a PPA has arisen in which the property values and I&E reserves have increased by £41m. This will lead to a difference at scheme level between the disposed amounts from RAM and the values for that scheme on SUN. This difference will be calculated on the scheme disposal and adjusted against the I&E reserves (where the PPA was posted).

What other options could be/have been considered?

Bromford must comply with the housing SORP 2010 and therefore has researched a methodology that provided fair and reasonable values for the calculation of the PPA without creating a significant industry and incurring material costs.

As is the case with all other RPs, the non-availability of historical data, especially in relation to the actual costs of specific components such as a kitchen replacement from 15 years ago at a particular property meant that an alternative approach needed to be taken. The in -

Journal of Finance and Management in Public Services. Volume 11. Number 2.

75

Component Accounting: A Case Study At Bromford Group novative global pooling methodology provided a fair and reasonable method with which to calculate the PPA.

Are there any significant risks?

The risk grid is shown in Appendix 5. Bromford’s innovative global pooling methodology has reduced workload for carrying out the PPA.

Use of systems in CA

Four alternatives were considered:

• Totally new package not linked to existing systems

• Module on asset management system

• Module on finance system

• Excel-based, separately monitored

Bromford used its existing Asset Management system called RAM (Real Asset Management) and componentised. The pool averaging was created on spreadsheets for the PPA and then loaded as a second database into RAM – thus, Bromford created 2 databases : RAM (live) and

PAM (pooled). Over time, PAM will disappear as new components are added to RAM (live).

Upon the completion of the two new RAM databases a reconciliation was produced to show the audit trail from the database figures as at 31/3/11 and the new revised RAM system fig ures at 31/10/11 (P7 October 2011).

The following areas were reconciled:

• The old RAM database at 31st March 2011 to the new RAM live database at P7 (October 2011), in total.

• The reductions of the building costs for all stock (excluding shared ownership)at 31st

March to 84.89% of their original values .

• The component cost upload sheets for 2012, provided by Asset Management Operations and coded and checked in Financial Accounts, to the values in RAM at P7

(October 2011) .

• The RAM pool database to the historical (prior to 1st April 2011) component pool data provided on spreadsheets.

Consequences and conclusions

In terms of the consequences of CA for Bromford – these can be summarised under the headings: I&E, Balance Sheet, Cashflow, Covenants and Workload.

As regards, I&E Account in the year:

• Before componentisation

– Expense to I&E all major repairs spend circ. £10m.

• After componentisation

– Capitalise (asset) major repairs expense (add £10m to profit – since replace ment components gone to Balance Sheet)

– Depreciate components (deduct £9m from surplus)

– Net benefit £1m

• Operating margin increase by circ. 3%

• EBITDA (earnings before interest tax depreciation and amortisation) cover improves

76 Journal of Finance and Management in Public Services. Volume 11. Number 2.

Component Accounting: A Case Study At Bromford Group

• Tax - £1m surplus is not an issue for charities.

In terms of Balance Sheet:

• Before componentisation.

– Cost of house = original cost (i.e. land & buildings).

• After componentisation.

– Additions to assets = original cost + capitalised major repairs.

– Additions line will be £10m p.a. higher than before.

• PPA

– Capitalising past years major repairs increases asset value.

– Depreciation for past years also adjusted.

– Upshot is the creation of:

• £41m additional assets (£153m cost less £112m depreciation).

• £41m additional reserves.

With regards to cashflow:

• Before componentisation.

– Major repairs were part of operating cashflow (as expensed).

• After componentisation.

– Major repairs are part of “investing activity” cashflow.

• Operating cashflow .

– Improves by £10m.

• Overall cashflow.

– Unchanged.

The situation with covenants:

• General

– Agreed with lenders that impact of this (and subsequent accounting changes) should be neutral.

• Interest cover covenants

– Are after adding back major repairs spend and depreciation

– Adjustments required but not too major

• Gearing covenant

– Additional assets “created” £153m (cost) (PPA)

– Improves asset gearing (net debt/cost of housing property) by circ. 3% i.e. lowers it from 37% to 34%

– Going forward asset cover gearing will be improved by the changes (assets at cost will increase in value)

In terms of workload, at the outset Bromford’s approach has been to minimise the amount of detail work - given the historic gaps in information and expense of additional colleagues to identify every component and date of its last replacement. For Bromford, 26,000 assets/homes just became 182,000 asset records, meaning a huge additional workload just to process. On top of that, having to adjust assets every year to reflect replacement pro gramme e.g. only 1 kitchen per home.

Bromford’s approach has been pragmatic, not making an industry out of it. An innovative global approach to prior periods was adopted – recognising there would be gaps in the information anyway. Bromford has spent considerably less than other RPs saving circ. £250k

Journal of Finance and Management in Public Services. Volume 11. Number 2.

77

Component Accounting: A Case Study At Bromford Group by avoiding consultants, teams of finance staff and investment in new software. Time and effort was weighed against benefits. More time on component accounting would mean less time spent meeting tenant needs.

Bromford chose 6 component pools and populated globally using data from its Active H

Housing Management System. This aged data allowed a fairly robust adjustment to asset values and historic depreciation using average unit costs for each component category.

Each component group was pooled by age for quantity, gross value, cumulative depreciation and net book value. This was a cost effective way of getting to the PPA.

The Asset Register (RAM) was separated into 2 database: an historic global pooled database

(PAM) for the PPA and a RAM live database (in which building costs had been reduced by

15% to take account of the components in PAM). Over time, PAM will depreciate to zero and new components will be captured on RAM.

In addition, Bromford designed and implemented new fixed asset register structure and capital codings. An interface to automate postings from RAM to the accounting system

(SUN).

Critically, the case for CA is that there is less lumpy surpluses/deficits in the I&E when RPs spend material amounts irregularly on components. So, smoother I&E through component depreciation. Furthermore, it is not right to depreciate a kitchen over 130 years when it will not last that long – a truer reflection of depreciation. Moreover, it is difficult to argue that housing property is not made up of a number of major components with differing economic lives, when RPs have a planned maintenance programme that takes account of the very fact.

Finally, when the SORP Working Party consulted on this matter in November 2008, 68% of the respondents felt that CA applied to housing property assets in the sector, those that felt it did not generally raised issues about the practicalities of applying it rather than stating that it should not apply.

Finally, the innovative pooling methodology for the historic data (PAM) has certainly saved time and money. The approach undertaken by Bromford has been at variance with the rest of the focus group and it remains to be researched if such an approach has been used nationally.

Limitations

A number of gaps in knowledge have become apparent and could be further addressed if CA techniques are to become more efficient and effective. Future research should therefore:

• Seek to clarify further the approach and extent of CA adoption post implementation

(1.4.12) based on a larger sample review of the published accounts of RPs available in

July/August 2012. The research has undertaken an in-depth case-study research at one organisation, and liaised with focus group RPs. Therefore, some limitations stem from a single case-study.

• Target the varied approach to component identification as we have little knowledge outside Bromford case study and user/focus group.

• Investigate further the extent of the non-standardised approach to assigning useful economic lives.

• Understand better the value to the tenant of adopting CA.

• Assess the impact on covenants in the sector of adopting CA. For example, impact

78 Journal of Finance and Management in Public Services. Volume 11. Number 2.

Component Accounting: A Case Study At Bromford Group on gearing covenants, which may be positive, since a larger amount of component replacement costs will be capitalised, increasing the RPs asset base in proportion to debt.

• Aim to understand better the dimensions of CA through greater collaboration with social sciences.

If the needs and knowledge gaps are further explored and addressed, the knowledge gath ered will increase our understanding of the impact, occurrence and determinants of CA nationally. Ultimately, CA adoption and its impact on RPs will be felt for some time to come.

Conclusions

The aims and objectives of this paper were to explore CA theory and practical application using Bromford Group, a RP as the case study. CA is not a new concept, it has been around since 1999 (FRS 15 para.83). Past SORPs have included references to it (SORP 2008, par.176).

The literature review – academic, professional accounting bodies, survey of accounts, National Housing Federation Consultation paper on Component Accounting (2008) and 2010

SORP all indicate that CA is not widely applied in the RP sector with confusion regarding its application. The lack of academic literature evidenced, meant that the research relied more on professional bodies, Housing SORPs and accounting standards.

This paper has critically examined the theory and practical difficulty in implementing component accounting for RPs and specifically Bromford Group. Key research questions focused around how to account for components covering component identification, life cy cles, cost identification and depreciation and net book value calculations. Further research questions arising were centred on PPA, social housing grant (SHG) and valuations.

In the UK, the release of Technical Notes in Housing SORP 2010 sort to aid comparability amongst RPs. The case study research at Bromford and data collected from focus group has suggested otherwise. Key decisions relating to whether the adoption of CA is deemed a

PPA and the number of separately identified components and the assessment of their UEL has probably lead to wider diversity in accounting treatment then envisaged by the SORP

Working Party.

The choice of data collection was case study using Bromford Group, with triangulated multiple sources of data – focus groups and targeted interviews with individuals from the focus group.

A pragmatic approach was sort by Bromford to prevent lots of resourcing to rework fixed asset records. The CA approach at Bromford was actioned in two parts: the calculation of a prior period adjustment and then the on-going accounting requirements for the current year (2011/12). Both parts required significant and detailed work to ensure the result com plied with the housing SORP 2010 whilst not creating an industry from having to component account. Time and effort spent on preparing for CA was weighed against the level of detail required. Important point in all of this was that the more time spent on component accounting would mean the less time spent meeting tenant needs.

An innovative global pooling methodology was applied to evaluate the PPA. Bromford designed and implemented new fixed asset register structure and capital codings. The asset

Journal of Finance and Management in Public Services. Volume 11. Number 2.

79

Component Accounting: A Case Study At Bromford Group register (RAM) was separated into 2 database: an historic global pooled database (PAM) for the PPA and a live RAM database (in which building costs had been reduced by 15%).

The issues faced were that CA could not be looked at in isolation of Bromford’s Asset

Management system; each property had to be on the system; the 6 components identified added to the records. Opportunities to keep the number of components down were consid ered in the earlier stages of implementation by looking for similarities in terms of lifespan and re-investment patterns. Other considerations for Bromford, included the need to get auditors to agree on the approach at an early stage and also the fact that the depreciation figure was secondary to the amount needed to ensure the business plan was sustainable and in meeting tenant needs.

On a positive note, it should be noted that after implementation Bromford has more comprehensive and accurate asset records, an enhanced ability to track asset history and a better base for future plans. Finance has also benefited with improved working relationship with other teams such as Asset Management and Development. It is these advantages that have outweighed the challenges of implementing CA. In conclusion, whilst the theoretical principles are clear, the practical adoption of CA has certainly been complicated.

Using Bromford as a case study methodology was a powerful tool in interrogating the value of the concept and theory of CA – assessing whether it held up in reality. With the case study approach, the research was able to finely tune the mode of investigation to the re search questions. The research also recognised the limits of case studies. Qualitative studies are often important building blocks that can be used to inform a quantitative study later.

It is difficult to generalise particularly well from case study, nor can you make “truth” claims in the same way. Nonetheless, the Bromford case study was structured with comparison to other RPs and “scientific” rigour applied.

80 Journal of Finance and Management in Public Services. Volume 11. Number 2.

Component Accounting: A Case Study At Bromford Group

References and further reading

BDO, Applying SORP 2010 Accounting By Registered Social Housing Providers, A Practicial

Guide To Disclosure For The Year Ended 31 March 2012, December 2011.

Beever and Struthers, Chartered Accountants, Statutory Reporting By RSLs 2009, Annual

Review (HA 90), February 2009.

Beever and Struthers, Chartered Accountants, 2011 Annual Review of Social Housing.

Beever and Struthers, Chartered Accountants, 2012 Annual Review of Social Housing.

Bell, J (2005) Doing Your Research Project, 4th Edition. Buckingham: Open University Press.

Berg, B. L. (2001) Qualitative Research Methods for the Social Sciences, Pearson.

Blaxter, L., Hughes, C. and Tight, M. (2010) How to Research (4th Edn) Open University

Press, McGraw-Hill Education.

Chua, W.F. (1996) ‘Issues in Substantive Areas of Research: Field Research in Accounting’, in

A.J. Richardson (ed.), Research Methods in Accounting: Issues and Debates, The Canadian

General Accountants Research Foundation, Vancouver, pp. 209-28.

Collier, P.M. (2005) Governance and the quasi-public organisation: a case study of social housing, Critical Perspectives on Accounting 16 (2005) 929-949.

Coombs ,H. M., Jenkins, D .E. (2002) Public Sector Financial Management, 3rd Edition,

Thomson Learning.

Coombs, H., Hobbs D, Jenkins E. (2005) Management Accounting Principles and Applica tions, Sage Publications.

Connole, H. (1993) Issues and Methods in Research, Distance Education Centre, University of South Australia, Adelaide.

Consultation Paper On Component Accounting, 2008.

Cowley, R. (2011) “Surpluses soar thanks to spending cuts and low borrowing costs”, Inside

Housing, Special Report, June 2011.

Creswell, JW (2009), Research Design: Qualitative, Quantitative and Mixed Method Ap proaches, Third edn, Sage Publishers,Thousand Oaks, Calif.

Davis, Joseph M., Wyndelts, Robert W. (1979), Component Depreciation for a Shopping

Center, Appraisal Journal; Apr 79, Vol. 47 Issue 2, p204, 14p.

Dawson, C. (2009) Introduction to Research Methods – Practical Guide, How to Books Ltd.

Department for Environment, Transport & Regions (DETR) document on Major Repairs Al -

Journal of Finance and Management in Public Services. Volume 11. Number 2.

81

Component Accounting: A Case Study At Bromford Group lowance.

Financial Reporting Standard (FRS) 3 Reporting Financial Performance.

Financial Reporting Standard (FRS) 12 Provisions and Contingencies.

Financial Reporting Standard (FRS) 15 Tangible Fixed Assets.

Gerring, J. 2006 Case study research: principles and practices, Cambridge University Press.

Gilliland, Charles E. (1980), Component Depreciation – The Appraiser’s Role. Appraisal Jour nal; Jan 1980, Vol.48 Issue 1, p78, 6p.

Gliner,J.A., Morhan,G.A., Leech,N.L. (2009) Research Methods in Applied Settings: An Inegrated Approach to Design and Analysis, 2nd edn., Rotledge, Taylor & Francis Group, an

Informa business.

Goldberg, L., Concepts of Depreciation, The Accounting Review, Vol.30, No.3 (Jul.,1955), pp

468-484.

Harsh Investment Corporation vs. United States. USTC 1971-1 (9183)

Hastings, II (DC Calif.; 1967) 20 AFTR 2d. 5633, F. Supp. 13.

Hollander, G. (2011) “Associations’ spare cash soars towards £1bn mark”, Inside Housing,

30/09/11

Holt, Graham, Accounting And Business UK 06/2011 (ACCA), pp 65-67.

Hospital Corporation of America v. Commissioner (1997) 109 T.C. 21

Houghton, K. A. (1987) ‘The Development of Meaning in Accounting: An International Study’,

Accounting and Finance, Vol. 27, No. 27, No. 2, November, pp. 25-40.

Houghton, K. A. (1988) ‘The Measurement of Meaning in Accounting: A Critical Analysis of the Principal Evidence’,Accounting Organisations and Society, Vol. 13, No. 3, pp. 263-80.

Hronsky, J.J.F. and Houghton, K. A. (2001) ‘The Meaning of a Defined Accounting Concept:

Regulatory Changes and the Effect on Auditor Decision Making’, Accounting Organisations and Society, Vol. 26, No. 2, pp. 123-39.

International Accounting Standard (IAS) 16 Property, Plant and Equipment.

The Local Authority Accounting Panel, LAAP Bulletin 86 – Component Accounting, June

2010.

KPMG, National Housing Federation, Tenant Services Authority, Depreciation and Impair ment Accounting (2010) Guidance for Registered Social Housing Providers, 4th Edn.

82 Journal of Finance and Management in Public Services. Volume 11. Number 2.

Component Accounting: A Case Study At Bromford Group

Kuhn, T. (1970) The Structure of Scientific Revolutions. Chicago, IL: University of Chicago

Press.

Kostenbauer, K, Housing Depreciation in the Canadian CPI, Catalogue No. 62F0014MIE,

Series No. 15.

Laying the foundations – A Housing Strategy for England, 21 November 2011, HM Government publication.

Jay A. Soled and Charles E. Falk , “A taxpayer can substantially increase cash flow by segre gating property costs”, Journal of Accountancy, August 2004

Jackson, MC 2003, Systems Thinking: Creative Holism for Managers, John Wiley & Sons Ltd,

Chichester.

Lowe, E.A. and Shaw, R.W. (1968) ‘An Analysis of Managerial Biasing: Evidence of a Company’s

Budgeting Process’, Journal of Management Studies, October, pp.304-15.

Lowe, Howard D., The Essentials Of A General Theory Of Depreciation, The Accounting

Review, Vol. 38, No.2 (Apr 1963) pp 293-301.

Merchant, A & Harrison, J. (2010) “Component accounting: Keep it simple in the interests of accounts’ non-financial users”, Social Housing February 2010.

Merchant, K.A. (1985) “Organisational Controls and Discretionary Program Decision Making:

A Field Study”, Accounting Organisations and Society, Vol. 10, No.1, pp. 67-85.

Merchants National Bank of Topeka vs. Commissioner, TCM 1975-238, July 15, 1975.

Morgan, G. and Smircich, L. (1980) “The case of qualitative research”,Academy of Management Review, 5,pp. 491-500.

Onsi, M. (1973) ‘Factor Analysis of Behavioural Variables Affecting Budgetary Slack’, The Ac counting Review, Vol. 48, No. 3, pp. 535-48.

Outhwaite, W. and Turner, S. P. 2007 The SAGE Handbook of Social Science Methodology,

SAGE, London.

Oppenheim, A.N. (2000) Questionnaire Design, Interviewing and Attitude Measurement

(new edn). London: Continuum International.

Pryor, J. (2010) “Prepare for component accounting”, Inside Housing, 16/10/10

Published Accounts for Southern Housing Group for the year ended 31 March 2010 and 2011.

Published Accounts for Peabody for the year ended 31 March 2010 and 2011.

Published Accounts for Harvest Housing for the year ended 31 March 2010.

Journal of Finance and Management in Public Services. Volume 11. Number 2.

83

Component Accounting: A Case Study At Bromford Group

Published Accounts for Family Mosaic for the year ended 31 March 2010.

Published Accounts for Viridian Housing for the year ended 31 March 2010 and 2011.

Published Accounts for Liverpool Mutual Homes for the year ended 31 March 2010 and 2011.

Ragin, C 2008 Redesigning Social Inquiry: Fuzzy Sets and Beyond, The University of Chicago

Press.

Redman, L.V. and Mory, A.V.H., The Romance of Research, 1923

Ridley, D. (2008), The Literature Review: A Step-by-Step Guide for Students, SAGE Publica tions Limited.

Robson, C. (2002) Real World Research (2nd Edn).Oxford: Blackwell.

RSL SORP 2008 update – Exposure Draft 2010

Saunders, M., Lewis P., Thornhill, A. (2009), Research Methods for Business Students, 5th

Edition, Pearson.

Simon, R. (1990) “The role of Management Control Systems in Creating Competitive Advantage: New Perspectives”, Accounting Organisations and Society, Vol. 15, No. 1/2, pp. 127-43.

SORP 2010 Update: Component Accounting, IFRS, Impairment and beyond, National Housing Federation

Shainberg vs Commissioner, 33 TC 241, 1959

Smith, M. (2003) Research Methods In Accounting, London, Sage.

Statement of Recommended Practice (SORP): accounting by registered social housing providers: Update 2010.

Statement of Recommended Practice (SORP): accounting by registered social housing providers: 2008.

Statement of Standard Accounting Practice (SSAP) 4 Accounting for Government Grants.

Statistics Canada (1995), The Consumer Price Index Reference paper: Update based on 192

Expenditures, Catalogue No. 62-553, p.55, Prices Division

Tashakkori, A. and Teddlie, C. (1998) Mixed Methodology: Combining Qualitative and Quan titative Approaches. Thousand Oaks, CA: Sage.

Yin, R.K. (2009) Case Study Research: Design and Methods (4th Edition). Thousand Oaks,

CA: Sage.

84 Journal of Finance and Management in Public Services. Volume 11. Number 2.

Component Accounting: A Case Study At Bromford Group

Yin, R.K. (2012) Applications of Case Study Research (3rd Edition). Thousand Oaks, CA: Sage.

“2010 SORP set to include component accounting”, Social Housing, April 2009.

Unusually for a journal a decision has been made to include the following appendices to help readers, particularly from a professional background, explore the detail of the work underpinning component accounting and for them to judge relevance to their own organisation.

Appendices

Appendix 1: Bromford’s 10 year record

Appendix 2: New component codes set-up

Journal of Finance and Management in Public Services. Volume 11. Number 2.

85

Component Accounting: A Case Study At Bromford Group

Appendix 3: Bromford’s PPA impact using global pooling

86 Journal of Finance and Management in Public Services. Volume 11. Number 2.

Component Accounting: A Case Study At Bromford Group

Journal of Finance and Management in Public Services. Volume 11. Number 2.

87

Component Accounting: A Case Study At Bromford Group

88 Journal of Finance and Management in Public Services. Volume 11. Number 2.

Component Accounting: A Case Study At Bromford Group

Journal of Finance and Management in Public Services. Volume 11. Number 2.

89

Component Accounting: A Case Study At Bromford Group

Appendix 4: Calculations for historic pools (ie. PAM)

Appendix 5: Risk assessment grid

90 Journal of Finance and Management in Public Services. Volume 11. Number 2.