HUD 221(d)4 PROGRAM

construction and substantial

rehabilitation of multifamily properties

Beech Street is now Capital One Multifamily Finance and our commitment to customer service is even stronger.

Capital One Multifamily Finance provides an array of financing solutions for multifamily investors that includes acquisitions,

refinancing, and new development. We offer a wide range of Fannie Mae, Freddie Mac, and FHA programs nationwide as well

as balance sheet products in selected markets for construction, bridge, and term loans. This gives us the breadth of resources

to structure transactions that closely meet the needs of our customers. We take pride in delivering “good enough just isn’t”

service at every stage of the lending process, from origination and underwriting to closing and beyond.

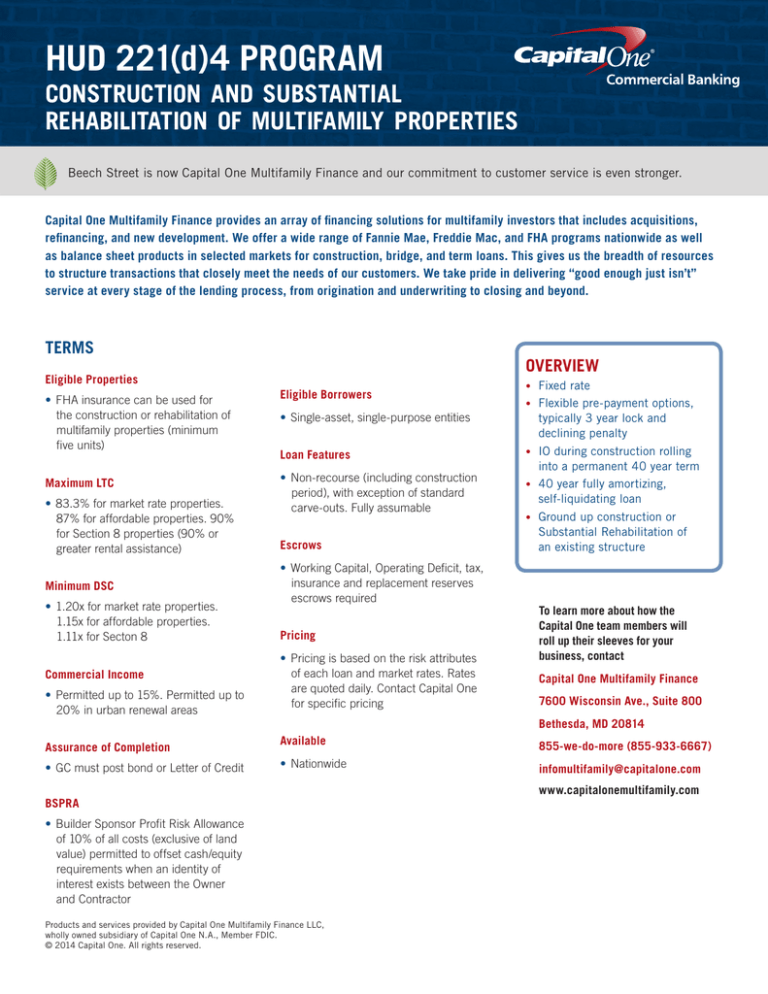

TERMS

OVERVIEW

Eligible Properties

•FHA insurance can be used for

the construction or rehabilitation of

multifamily properties (minimum

five units)

Eligible Borrowers

Maximum LTC

•Non-recourse (including construction

period), with exception of standard

carve-outs. Fully assumable

•83.3% for market rate properties.

87% for affordable properties. 90%

for Section 8 properties (90% or

greater rental assistance)

Minimum DSC

•1.20x for market rate properties.

1.15x for affordable properties.

1.11x for Secton 8

Commercial Income

•Permitted up to 15%. Permitted up to

20% in urban renewal areas

Assurance of Completion

•GC must post bond or Letter of Credit

•Single-asset, single-purpose entities

Loan Features

Escrows

•Working Capital, Operating Deficit, tax,

insurance and replacement reserves

escrows required

Pricing

•Pricing is based on the risk attributes

of each loan and market rates. Rates

are quoted daily. Contact Capital One

for specific pricing

• Fixed rate

• Flexible pre-payment options,

typically 3 year lock and declining penalty

• IO during construction rolling

into a permanent 40 year term

• 40 year fully amortizing, self-liquidating loan

• Ground up construction or

Substantial Rehabilitation of

an existing structure

To learn more about how the

Capital One team members will

roll up their sleeves for your

business, contact

Capital One Multifamily Finance

7600 Wisconsin Ave., Suite 800

Bethesda, MD 20814

Available

855-we-do-more (855-933-6667)

•Nationwide

infomultifamily@capitalone.com

BSPRA

•Builder Sponsor Profit Risk Allowance

of 10% of all costs (exclusive of land

value) permitted to offset cash/equity

requirements when an identity of

interest exists between the Owner

and Contractor

Products and services provided by Capital One Multifamily Finance LLC,

wholly owned subsidiary of Capital One N.A., Member FDIC.

© 2014 Capital One. All rights reserved.

www.capitalonemultifamily.com