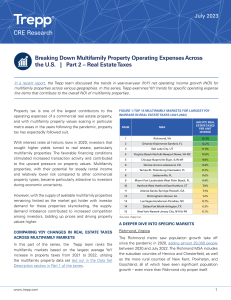

August 2023 CRE Research Breaking Down Multifamily Property Operating Expenses Across the U.S. | Part 3 – Property Insurance In a recent report, the Trepp team discussed the trends in year-over-year (YoY) net operating income growth (NOI) for multifamily properties across various geographies. In this series, Trepp examines YoY trends for specific operating expense line items that contribute to the overall NOI of multifamily properties. In a continuation of our series on multifamily property expenses, we shift our focus to property insurance. Property insurance, a fundamental component of operating expenses for commercial real estate properties, plays a crucial role in safeguarding properties against unforeseen risks. According to Trepp’s property line-item financials extracted from the TreppInsights tool, insurance expenses have trended upwards for multifamily properties across major metropolitan statistical areas (MSAs) in the U.S. in recent years. In this report, Trepp finds that the cost of property insurance increased roughly 13.6% on average across the 50 largest MSAs from 2021 to 2022, with a few key southern multifamily markets seeing particularly pronounced insurance expense growth. Property insurance costs are dependent on two primary factors: property value and associated risk. Insurance companies meticulously analyze property location, construction materials, security measures, historical claims, and other factors to assess the property value and the level of risk involved with the property. Based on these factors, insurance companies will set a policy premium that strikes a balance between affordability for the insured and sustainability for the insurance provider. The year 2021 witnessed record-breaking frequency and severity of natural disasters, such as hurricanes, floods, and wildfires. Consequently, property owners have faced heightened risks of climate-related property damage. In response to these escalating risks, insurers have found themselves compelled to reevaluate their policies and pricing models, leading to fluctuations in insurance premiums for properties. Our previous report on real estate taxes highlighted the booming nature of the multifamily market in certain growing MSAs. This trend may also further contribute to even higher insurance premiums for multifamily properties. COMPARING YOY CHANGES IN PROPERTY INSURANCE ACROSS MULTIFAMILY MARKETS In this part of the series, the Trepp team ranks the multifamily markets based on the largest average YoY increase in insurance expenses from 2021 to 2022, utilizing the multifamily property FIGURE 1: TOP 15 MULTIFAMILY MARKETS FOR LARGEST YOY INCREASE IN INSURANCE EXPENSES (2021-2022) RANK MSA AVG YOY INSURANCE EXPENSES PER UNIT CHANGE 1 Miami-Fort Lauderdale-West Palm Beach, FL 28.0% 2 New Orleans-Metairie, LA 27.9% 3 Jacksonville, FL 27.4% 4 Salt Lake City, UT 21.3% 5 Houston-The Woodlands-Sugar Land, TX 21.1% 6 Tampa-St. Petersburg-Clearwater, FL 19.3% 7 San Antonio-New Braunfels, TX 19.2% 8 Raleigh, NC 17.9% 9 Dallas-Fort Worth-Arlington, TX 16.9% 10 Riverside-San Bernardino-Ontario, CA 16.7% 11 Denver-Aurora-Lakewood, CO 16.1% 12 Atlanta-Sandy Springs-Roswell, GA 15.8% 13 Louisville/Jefferson County, KY-IN 15.5% 14 Cleveland-Elyria, OH 15.4% 15 Charlotte-Concord-Gastonia, NC-SC 15.1% Sources: Trepp Inc. www.trepp.com 1 August 2023 CRE Research data set laid out in the Data Set Description section in Part 1 of the series. A majority of the MSAs featured in the ranking have encountered at least one of the 22 separate billiondollar weather and climate disasters in 2021. A DEEPER DIVE INTO SPECIFIC MARKETS Florida Florida’s geographic location makes the state susceptible to weather and climate disasters, specifically tropical storms and hurricanes. Three MSAs in the state have surfaced in our rankings, with the Miami, Jacksonville, and Tampa MSAs experiencing an average rise of 24.9% in insurance expenses from 2021 to 2022. In 2021, Florida faced an unusually busy hurricane season, witnessing 21 named storms and surpassing the norm of 14 named storms. These weather events caused significant damage, leading to a surge in insurance claims and necessitating insurers to reassess risk and implement higher premiums for the subsequent renewal periods. The cost of building materials for home building and rebuilding has gone up over 31% from 2020 to 2022. Moreover, Florida leads the country in insurance lawsuits, which can also raise insurers’ operation costs. These additional costs will inevitably be passed on to policyholders through higher premiums. For instance, the average cost insurers pay to cover a wind damage claim in the Miami metro area has roughly quadrupled since 2010. Despite disaster risk, however, Florida continues to draw a continuous influx of new residents. In 2022, over 318,000 individuals relocated to Florida, which was the highest influx among all states. This demand surge has driven developers to construct multifamily homes in areas riddled with high flood and hurricane risks, thus concentrating the state’s insurance risk and subsequently leading to higher premiums. Taking Miami as an example, Miami has the highest flood-risk score in the U.S., but there were 147 multifamily buildings totaling 36,414 units under construction in 2021. This construction volume represented 11.3% of the inventory in the Miami market, with the vacancy rate dropping to sub-5% in that period. www.trepp.com From the insurance company’s standpoint, the challenge lies in the inadequacy of even increased premiums to cover their rising costs. The impact of Category 4 Hurricane Ian in 2022 devastated Florida, resulting in staggering costs exceeding $117 billion, pushing several insurers perilously close to insolvency. Frequent extreme-weather events have already forced some national insurers, including Farmers and AAA, to cease renewals of some home and auto policies in Florida. As a result, the remaining insurers are left facing a more concentrated risk in the state, which will probably lead to even higher insurance expenses for multifamily properties in the future. Texas Texas stands out as another state where property insurance expenses witnessed a surge across the majority of its main MSAs. Three MSAs, Houston, San Antonio, and Dallas, landed in the top ten of the ranking, reporting an average rise of approximately 19.0% in insurance costs for multifamily properties. The distinctive aspect of Texas’ weather lies in its extremes, with both scorching hot conditions and rare freezing temperatures impacting the region. In 2021, Texas faced an unprecedented winter storm and severe cold weather in February, leaving a trail of destruction in its wake. Insurers reported paying out $9.3 billion in claims for commercial and residential properties, with a record-setting 478,735 insurance claims filed throughout the state. Just two months later, Texas experienced another calamity, as the “Gorilla” hailstorm pummeled the northern part of the state in April. The San Antonio and Dallas metros bore the brunt of this damaging hailstorm, shattering windows and even penetrating homes’ roofs. In the hotter month of September, Hurricane Nicholas soaked Houston and left at least 503,000 properties without power in Texas, mostly in Houston. The concentration of natural disasters in Texas during 2021 led to several insurance companies going out of business, while others had to readjust their risk ratings and raise premiums to cope with the escalating costs. 2 August 2023 CRE Research In 2022 and 2023, hailstorms and hurricanes continued to pose a significant threat to regions in Texas, resulting in billion-dollar losses and driving up insurance expenses in the affected areas. Similar to the situations seen in Florida, some private insurance companies in hurricaneprone regions of Texas have faced financial challenges, leading to insolvency or discontinuation of policy renewals. Consequently, many residents have turned to the region’s state-chartered insurance programs. However, the current reserves of these programs may not be sufficient to cover claims if another devastating hurricane strikes. There is a pressing need to address the insurance infrastructure in Texas in order to ensure adequate coverage and financial stability for both insurers and policyholders. WHAT’S AHEAD FOR PROPERTY INSURANCE Trepp data shows that property insurance for multifamily properties has seen double-digit rate increases for major MSAs. In the short term, this rise can be attributed to inflation, at least in part. However, it is essential to recognize that extreme weather has played a crucial role in reshaping the insurance premium landscape in the past several years. The reduced availability of insurance providers can ultimately result in higher concentration risk, or conversely, lower risk diversification. In these cases, the insurance burden will often fall onto state-backed insurance programs, who are typically lenders of last resort. Moreover, the influx of private capital into insurance companies may prompt a shift towards prioritizing more profitable policies, which can also impact the affordability and availability of insurance for multifamily properties. In response to these challenges, regulatory efforts such as FEMA’s “Risk Rating 2.0” system have been launched to establish a new premium equilibrium. However, the Trepp team anticipates ongoing fluctuations in the short-term future as the insurance industry adapts to these changes. Trepp remains steadfast in monitoring changes in insurance expenses for multifamily properties and staying abreast of all relevant trends and news. Stay tuned for further updates. The increased frequency and severity of weather-related disasters have made it challenging for insurers to remain profitable in disaster-prone states. As a result, some insurance companies have been compelled to readjust their climaterelated risk models and reevaluate their market strategies, leading some insurers to withdraw from certain regions. For more information about Trepp’s commercial real estate data, contact info@trepp.com. For inquiries about the data analysis conducted in this research, contact press@trepp.com or 212-754-1010. About Trepp Trepp, founded in 1979, is the leading provider of data, insights, and technology solutions to the structured finance, commercial real estate, and banking markets. Trepp provides primary and secondary market participants with the solutions and analytics they need to increase operational efficiencies, information transparency, and investment performance. From its offices in New York, Dallas, and London, Trepp serves its clients with products and services to support trading, research, risk management, surveillance, and portfolio management. Trepp subsidiary, Commercial Real Estate Direct, is a daily news source covering the commercial real estate capital markets. Trepp is wholly owned by Daily Mail and General Trust (DMGT). The information provided is based on information generally available to the public from sources believed to be reliable. 3