Addendum 2 released March 2, 2015

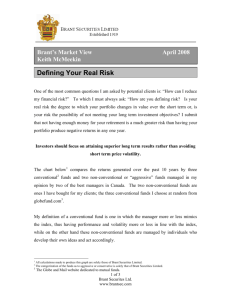

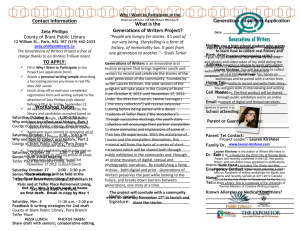

advertisement