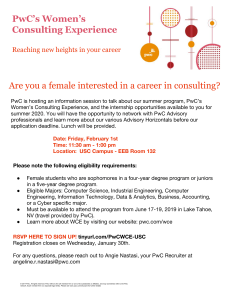

Collaborate with industry leaders, diverse teams and innovative

advertisement

Collaborate with industry leaders, diverse teams and innovative minds. Our Tax Services practice: In our Tax Services practice, we work with clients to manage their tax opportunities. Our Canadian and global practices are linked, which means clients look to us for expert advice and guidance. We’re the first choice when it comes to strategies on reducing taxes, innovative tax planning, and the effective management of reporting burdens. The Opportunity: Manager, Corporate Tax We are looking to hire our future leaders… people with an outstanding track record in developing exceptional tax consulting and compliance skills and delivering results… people who have the vision and foresight to take their career to the next level and be part of a winning team. Responsibilities: Manage a portfolio of clients that vary in size and scope and act as the point of contact for internal and external clients Manage multi-disciplinary teams of tax professionals and assistants working on client projects Manage risk and financial performance of engagements including billing, collections, and project budgets Build and manage client relationships; advise clients by delivering high quality tax service and advice Participate in and contribute to market and business activities external to the firm Requirements: CA, CGA, or CMA designation Completion of the In-depth Level I & II is an asset Strong technical background and broad based tax skills as a result of 5+ years of prior experience in a professional services firm or in industry, with a minimum of 3 years of tax consulting and/or compliance experience A proven leader with strong business development and entrepreneurial skills and possess exceptional interpersonal and communication skills Strong analytical capability, sound business sense and creative mind that have earned you the reputation of providing excellence in client service Ability to work effectively under pressure and manage multiple assignments in an organized manner Demonstrated ability to identify tax consulting opportunities and a willingness to aggressively market services to existing and prospective clients Ability to manage, develop, retain and mentor junior tax professionals Proficiency in using current technologies, particularly the MS Office Suite of application Why Work for PwC Our employees make an impact with their dedication to client service, creativity, and high performance. Whatever your passion is, the opportunities available to you at PwC will help you realize your career aspirations. PwC is committed to building a diverse workforce representative of the communities we serve. We encourage and are pleased to consider all qualified candidates, without regard to race, colour, citizenship, religion, sex, marital / family status, sexual orientation, gender identity, aboriginal status, age, disability or persons who may require an accommodation, to apply. This is a place that will inspire you to be at your best each and every day. PwC: the Opportunity of a Lifetime Click here to submit an application for this amazing opportunity. Any queries about the position can be emailed directly to Brandon Lau