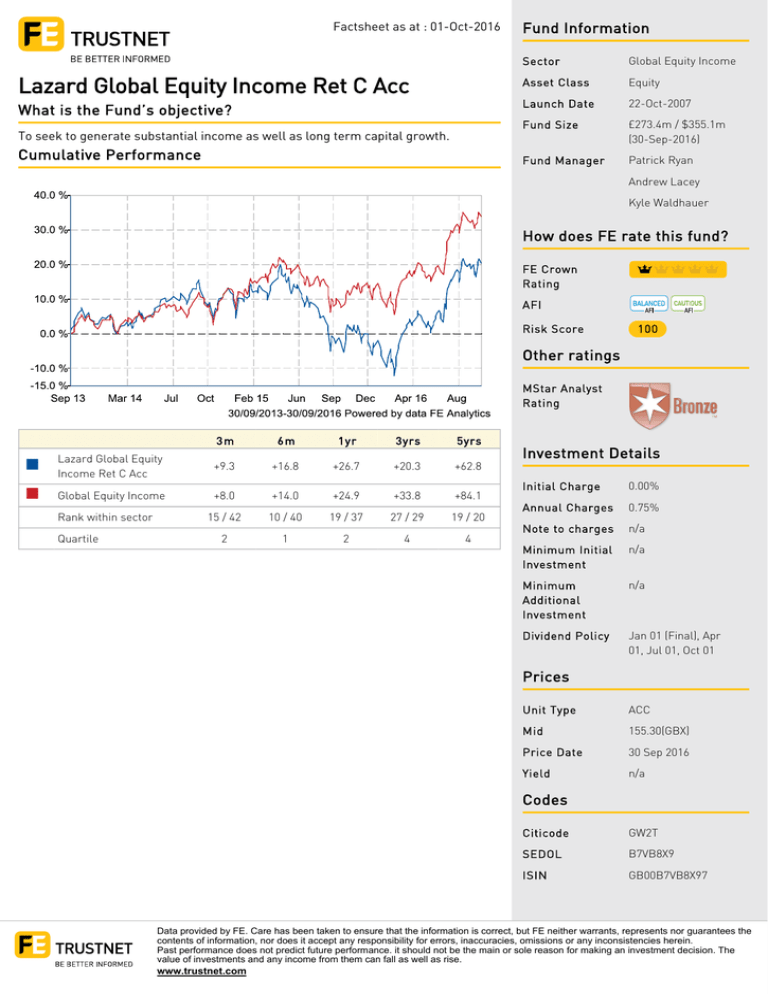

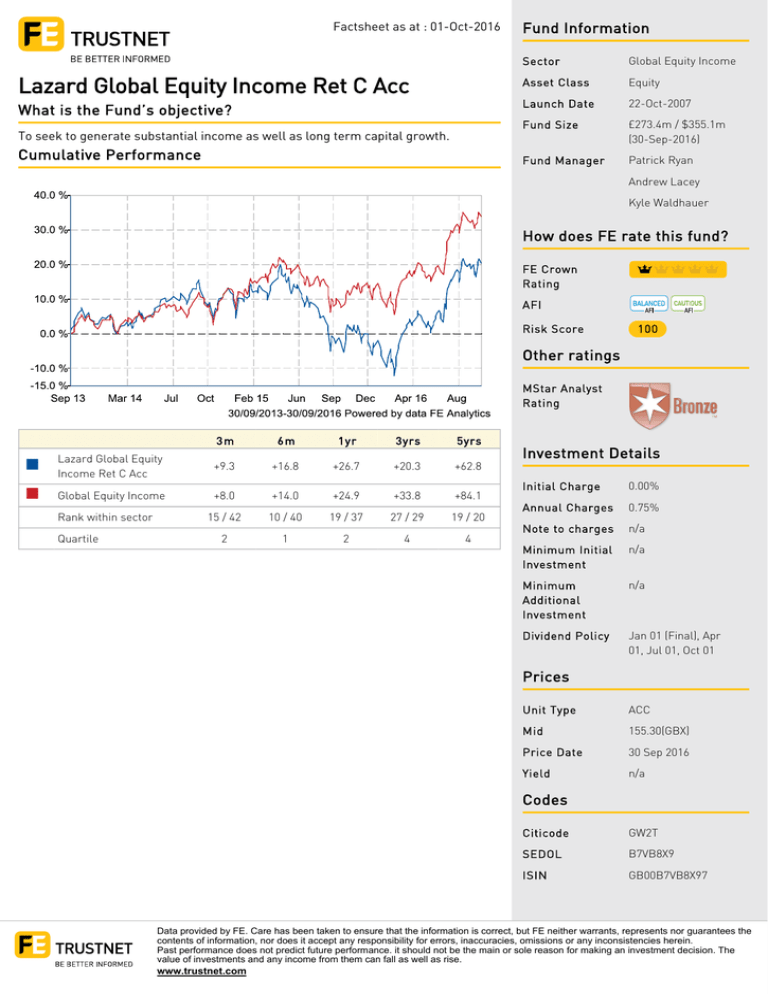

Factsheet as at : 01-Oct-2016

Fund Information

Sector

Global Equity Income

Lazard Global Equity Income Ret C Acc

Asset Class

Equity

What is the Fund’s objective?

Launch Date

22-Oct-2007

Fund Size

£273.4m / $355.1m

(30-Sep-2016)

Fund Manager

Patrick Ryan

To seek to generate substantial income as well as long term capital growth.

Cumulative Performance

Andrew Lacey

Kyle Waldhauer

How does FE rate this fund?

FE Crown

Rating

AFI

Risk Score

100

Other ratings

MStar Analyst

Rating

3m

6m

1yr

3yrs

5yrs

Lazard Global Equity

Income Ret C Acc

+9.3

+16.8

+26.7

+20.3

+62.8

Global Equity Income

+8.0

+14.0

+24.9

+33.8

+84.1

15 / 42

10 / 40

19 / 37

27 / 29

19 / 20

2

1

2

4

4

Rank within sector

Quartile

Investment Details

Initial Charge

0.00%

Annual Charges

0.75%

Note to charges

n/a

Minimum Initial

Investment

n/a

Minimum

Additional

Investment

n/a

Dividend Policy

Jan 01 (Final), Apr

01, Jul 01, Oct 01

Prices

Unit Type

ACC

Mid

155.30(GBX)

Price Date

30 Sep 2016

Yield

n/a

Codes

Citicode

GW2T

SEDOL

B7VB8X9

ISIN

GB00B7VB8X97

Data provided by FE. Care has been taken to ensure that the information is correct, but FE neither warrants, represents nor guarantees the

contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein.

Past performance does not predict future performance. it should not be the main or sole reason for making an investment decision. The

value of investments and any income from them can fall as well as rise.

www.trustnet.com

Lazard Global Equity Income Ret C Acc

Discrete Performance

Contact Details

0-12m

12m-24m

24m-36m

36m-48m

48m-60m

Lazard Global Equity

Income Ret C Acc

+26.7

-12.4

+8.4

+15.8

+16.9

Global Equity Income

+24.9

-1.4

+8.7

+18.7

+15.9

Rank within sector

19 / 37

31 / 32

19 / 29

19 / 25

11 / 20

2

4

3

3

3

Quartile

Address

50 Stratton street,

London, United

Kingdom, W1J 8LL

Telephone

numbers

0800 374 810 (Broker

Line)

0870 606 6408

(Dealing)

0207 499 1610 (Fax

Number)

0207 588 2721 (Main

Number)

Website

www.lazardassetman

agement.co.uk

Email

ContactUK@Lazard.c

om

All prices in Pence Sterling (GBX) unless otherwise specified. Price total return performance figures are

calculated on a bid price to bid price basis (mid to mid for OEICs) with net income (dividends) reinvested.

Performance figures are shown in Pound Sterling (GBP).

Asset Allocation (31 Aug 2016)

Rank

Asset Classes

%

1

North American Equities

40.30

2

European Equities

20.70

3

Asia Pacific Emerging Equities

13.00

4

Money Market

6.30

5

UK Equities

4.90

6

Asia Pacific ex Japan Equities

4.60

7

American Emerging Equities

3.50

8

European Emerging Equities

2.30

9

Japanese Equities

1.80

10 Others

2.60

Data provided by FE. Care has been taken to ensure that the information is correct, but FE neither warrants, represents nor guarantees the

contents of information, nor does it accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein.

Past performance does not predict future performance. it should not be the main or sole reason for making an investment decision. The

value of investments and any income from them can fall as well as rise.

www.trustnet.com

Lazard Global Equity Income Ret C Acc

Regional Breakdown (31 Aug 2016)

Rank

Regions

%

1

North America

40.30

2

Continental Europe

20.70

3

Emerging Asia

13.00

4

Money Market

6.30

5

UK

4.90

6

Asia Pacific ex Japan

4.60

7

Latin America

3.50

8

European Emerging Markets

2.30

9

Japan

1.80

10 Others

2.60

Sector Breakdown (31 Aug 2016)

Rank

Sectors

%

1

Financials

30.00

2

Information Technology

13.90

3

Telecommunications Utilities

12.00

4

Energy

7.60

5

Health Care

7.60

6

Consumer Discretionary

6.80

7

Money Market

6.30

8

Industrials

5.50

9

Utilities

5.10

10 Others

5.20

Top Holdings (31 Aug 2016)

Rank

Largest Holdings

%

1

Pfizer

3.80

2

TSMC

3.80

3

Telenor

3.80

4

Cisco Systems

3.60

5

Total

3.00

6

Blackstone Mortgage Trust

2.80

7

PacWest Bancorp

2.80

8

Eaton

2.50

9

MTS

2.30

10

Novartis

2.30

Authorised and Regulated by the Financial Conduct Authority

© Trustnet Limited 2016.All Rights Reserved.

Please read our Terms of Use / Disclaimer and Privacy and Cookie Policy.

Data supplied in conjunction with Thomson Financial Limited, London Stock Exchange Plc, StructuredRetailProducts.com and

ManorPark.com

www.trustnet.com