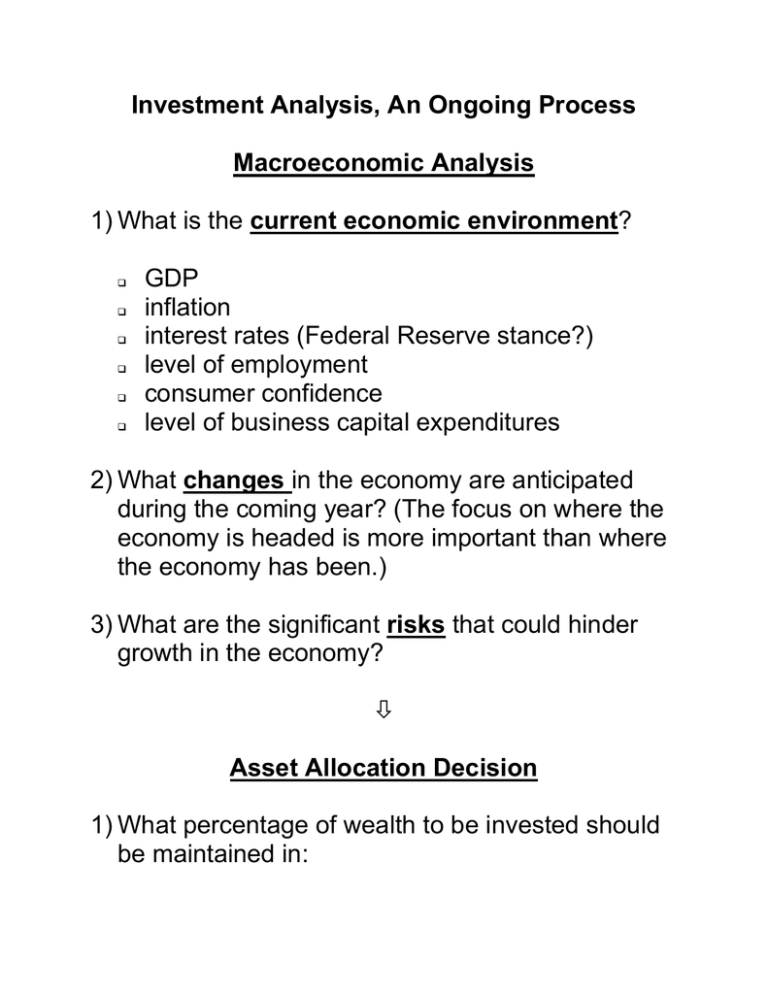

Investment Analysis, An Ongoing Process Macroeconomic Analysis current economic environment

advertisement

Investment Analysis, An Ongoing Process Macroeconomic Analysis 1) What is the current economic environment? GDP inflation interest rates (Federal Reserve stance?) level of employment consumer confidence level of business capital expenditures 2) What changes in the economy are anticipated during the coming year? (The focus on where the economy is headed is more important than where the economy has been.) 3) What are the significant risks that could hinder growth in the economy? Asset Allocation Decision 1) What percentage of wealth to be invested should be maintained in: Equity securities (Stocks) Debt securities (Bonds) Cash (Money market) Other (Real estate, precious gems & metals, other collectibles) 2) Observation – Most of the time, most of your wealth should be invested in equities. Why? Equities have the best risk-return tradeoff over time. Lasik’s Equities Selection Process 1) Given the asset allocation decision (with the assumed focus on equities), what industries within the economy are favored? Why? The S&P publication, Industry Surveys, available online in our library, is an excellent source. Analysis of Specific Companies 1) Within the selected industry, who are the major competitors? Who is the leader in terms of sales? In terms of profitability? Market capitalization? Develop a peer group of 4 or 5 other companies to analyze prior to taking a position in any single company. 2) What are the most attractive companies within the selected industry? Identify the financial strengths and weaknesses for the companies selected. For each company, analyze the following: Most important Standard & Poors (S&P) stock rating (5 stars best) VL timeliness and safety rankings (timeliness rank 1 best) Annual EPS estimate for the current fiscal year and the next fiscal year PE ratios: current year, and next year (forward) PEG – price earnings to growth analysis Earnings estimates changes and momentum Other factors Zack’s rank Operating margin percentages Net margin percentages Debt ratio Debt to equity Cash position Return on equity (3-way preferred) Market capitalization Beta coefficient Dividend record Construction of a Diversified Equity Portfolio 1) Portfolio should include a minimum of 15 different equities. Why 15? 2) No more than 15 percent of the total value should be invested in a single industry. Why no more than 15 percent? 3) Appropriate benchmarks should be established to gauge the performance of the portfolio.