Factsheet as at : October 01, 2016

Lazard UK Smaller Companies Ret C Inc

Fund objective

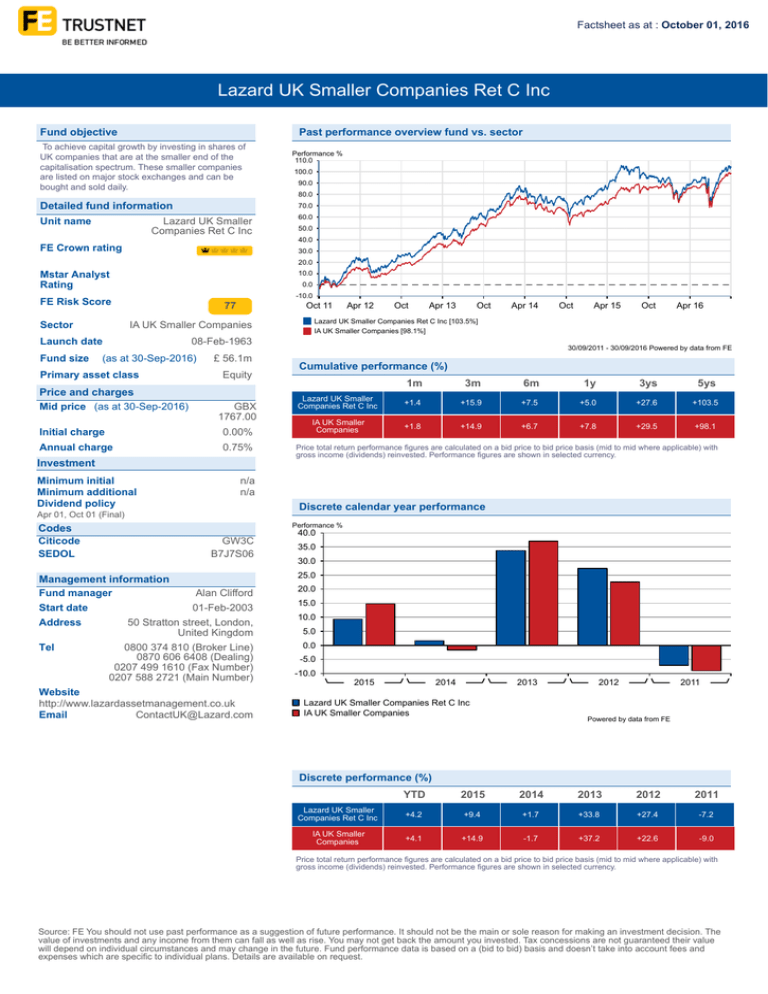

Past performance overview fund vs. sector

To achieve capital growth by investing in shares of

UK companies that are at the smaller end of the

capitalisation spectrum. These smaller companies

are listed on major stock exchanges and can be

bought and sold daily.

Performance %

110.0

100.0

90.0

80.0

Detailed fund information

70.0

Unit name

60.0

Lazard UK Smaller

Companies Ret C Inc

50.0

40.0

FE Crown rating

30.0

20.0

Mstar Analyst

Rating

10.0

0.0

-10.0

FE Risk Score

Sector

77

IA UK Smaller Companies

Launch date

Fund size

Oct 11

Price and charges

Mid price (as at 30-Sep-2016)

£ 56.1m

Equity

GBX

1767.00

Initial charge

0.00%

Annual charge

0.75%

Investment

Minimum initial

Minimum additional

Dividend policy

Apr 13

Oct

Apr 14

Oct

Apr 15

Oct

Apr 16

IA UK Smaller Companies [98.1%]

30/09/2011 - 30/09/2016 Powered by data from FE

Cumulative performance (%)

1m

3m

6m

1y

3ys

5ys

Lazard UK Smaller

Companies Ret C Inc

+1.4

+15.9

+7.5

+5.0

+27.6

+103.5

IA UK Smaller

Companies

+1.8

+14.9

+6.7

+7.8

+29.5

+98.1

Price total return performance figures are calculated on a bid price to bid price basis (mid to mid where applicable) with

gross income (dividends) reinvested. Performance figures are shown in selected currency.

n/a

n/a

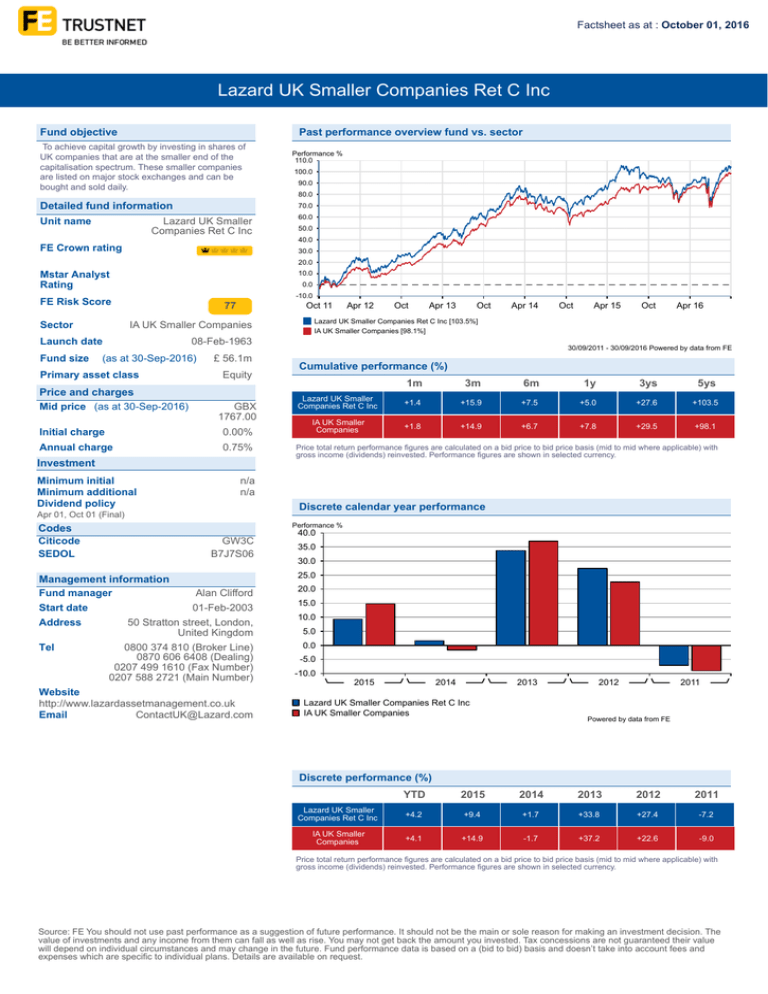

Discrete calendar year performance

Apr 01, Oct 01 (Final)

Codes

Citicode

SEDOL

Oct

08-Feb-1963

(as at 30-Sep-2016)

Primary asset class

Apr 12

Lazard UK Smaller Companies Ret C Inc [103.5%]

Performance %

GW3C

B7J7S06

Management information

Fund manager

Alan Clifford

Start date

01-Feb-2003

50 Stratton street, London,

Address

United Kingdom

0800 374 810 (Broker Line)

Tel

0870 606 6408 (Dealing)

0207 499 1610 (Fax Number)

0207 588 2721 (Main Number)

Website

http://www.lazardassetmanagement.co.uk

Email

ContactUK@Lazard.com

40.0

35.0

30.0

25.0

20.0

15.0

10.0

5.0

0.0

-5.0

-10.0

2015

2014

2013

Lazard UK Smaller Companies Ret C Inc

IA UK Smaller Companies

2012

2011

Powered by data from FE

Discrete performance (%)

YTD

2015

2014

2013

2012

2011

Lazard UK Smaller

Companies Ret C Inc

+4.2

+9.4

+1.7

+33.8

+27.4

-7.2

IA UK Smaller

Companies

+4.1

+14.9

-1.7

+37.2

+22.6

-9.0

Price total return performance figures are calculated on a bid price to bid price basis (mid to mid where applicable) with

gross income (dividends) reinvested. Performance figures are shown in selected currency.

Source: FE You should not use past performance as a suggestion of future performance. It should not be the main or sole reason for making an investment decision. The

value of investments and any income from them can fall as well as rise. You may not get back the amount you invested. Tax concessions are not guaranteed their value

will depend on individual circumstances and may change in the future. Fund performance data is based on a (bid to bid) basis and doesn’t take into account fees and

expenses which are specific to individual plans. Details are available on request.

Lazard UK Smaller Companies Ret C Inc

Asset allocation

Key

A

B

Rank

Asset class

1

2

UK Equities

Money Market

% of Fund

(31.08.2016)

97.1

2.9

Regional breakdown

Key

A

B

Rank

1

2

% of Fund

(31.08.2016)

Region

UK

Cash

97.1

2.9

Sector breakdown

Key

A

B

C

D

E

F

G

H

I

J

K

Rank

1

2

3

4

5

6

7

8

9

10

11

% of Fund

(31.08.2016)

Sector

Industrials

Financials

Consumer Services

Technology

Basic Materials

Health Care

Consumer Goods

Oil & Gas

Cash

Telecommunications

Others

24.3

20.7

17.4

9.4

7.1

6.4

5.2

3.6

2.9

2.5

0.5

Top ten holdings

Rank Holding

1

2

3

4

5

6

7

8

9

10

Acacia Mining plc

CVS

RPC

DIGNITY PLC

Bodycote

Lookers

Morgan Advanced Materials

Senior

Spire Healthcare

Synthomer

% of Fund

(31.08.2016)

2.1

1.6

1.5

1.4

1.3

1.3

1.3

1.3

1.3

1.3

© Trustnet Limited 2016 FE Trustnet is a free website devoted exclusively to research, and does not offer any transactional

facilities to its users, or offer any advice on investments.The Institute of Company Secretaries and Administrators (ICSA)

Registrars Group has issued an official warning to investors to beware of fraudulent use of authorised firms’ logos and trademarks

by illegitimate and illegal trading operations or ‘boiler rooms’. Data supplied in conjunction with Thomson Financial Limited,

London Stock Exchange Plc, StructuredRetailProducts.com and ManorPark.com, All Rights Reserved. Please read our Disclaimer

and Privacy Policy.