Collection of Papers on Myanmar`s Financial Sector

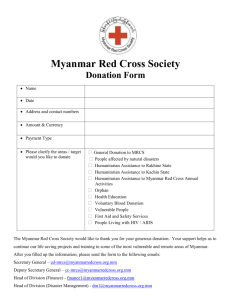

advertisement