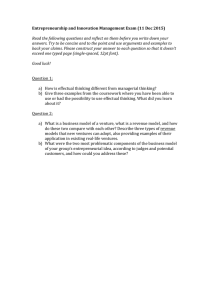

Centre for Technology Management

advertisement