Power electronics: a strategy for success

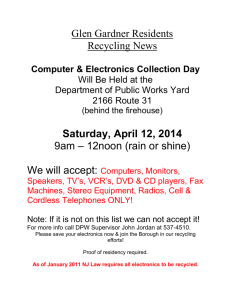

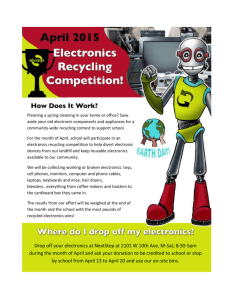

advertisement