3 High-Yielding Fund Picks for Contrarian Investors

advertisement

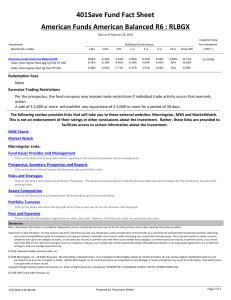

Reprinted by permission of Morningstar, July 14, 2016 • PM251089 3 High-Yielding Fund Picks for Contrarian Investors These counterpunching funds deliver the income, but it’s apt to come with a big dose of volatility. Our Picks | 07-13-16 | by Christine Benz Confounding many market experts, Treasury yields have remained stubbornly low even as stocks have rallied back following the Brexit vote. Investors seem to be betting that even if the Federal Reserve takes action to raise rates later this year, it won’t act aggressively to do so. That means that yield-starved investors are going to need to venture beyond the realm of high-quality bonds if their goal is to wring out a positive real yield. Because yield is so scarce these days, it also means that every rock has been turned over in search of it. That helps explain the recent rallies in junk bonds, emerging-markets credits, and senior loans; investors are looking for returns wherever they can find them. As a money manager friend recently put it, anything with upside in the current market “has a little hair on it.” (I know. Ew.) To help identify such ideas for income-seeking fund investors who are willing to take some risks, I turned to Morningstar’s Premium Fund Screener. I screened for medalist funds with SEC yields of 4% or higher, homing in on 4% because it’s often considered a “safe” starting spending rate for retirees. (Note that the 4% research doesn’t distinguish between income distributions and withdrawals of capital; both methods of extracting cash flow count as spending.) To further winnow down that universe to the subset of funds with returns that have been under a bit of a cloud lately--and may look better in the future--I looked for those whose three-year returns rank in the bottom quartile of their categories. The screen turned up three funds as of July 12, 2016: a pure foreign-stock fund, a tactical asset allocation offering, and a world-bond fund. A unifying theme among the three--while they operate in different investing realms--is that they’re all bold, counterpunching funds that aren’t content to go where the crowd is. Premium users can click here to view the screen or tweak it to suit their specifications. (For example, I didn’t exclude advisor-sold offerings, but DIY investors will likely choose to do so.) Here’s a closer look at the three funds that made the cut. Causeway International Value (CIVVX) Category: Foreign Large Value Analyst Rating: Gold Foreign stocks currently feature lush dividends relative to their U.S. counterparts. Of course, that’s not without justification, as slumping security prices push up yields. European banks, a major source of dividends overseas, are fighting for viability and have taken a beating, and the slowdown in emerging-markets growth has cast a pall over many developed foreign markets, too. Those problems aren’t likely to go away overnight, but this fund’s penchant for contrarian plays makes it an interesting contrarian idea itself. Nearly three fourths of the current portfolio lands in Europe and the U.K.--not surprising given that management has usually tread lightly in emerging markets--and deeply unloved picks such as Volkswagen have dragged on results. Yet senior analyst Kevin McDevitt lauds management for its consistent application of its long-term, valuation-conscious strategy. McDevitt also views its highly experienced team as a key asset: Sarah Ketterer and Harry Hartford have been running foreign-stock assets together for nearly two decades. Investors venturing into this fund should bear a few items in mind, however. First, dividends from foreign stocks held inside of a retirement account will be reduced by the foreign taxes paid on those distributions, but the account holder won’t be able to take advantage of the foreign tax credit she receives to offset those taxes, as discussed here. (That’s not necessarily a reason to avoid foreign dividend payers in a tax-sheltered account, but it is something to be aware of.) Second, it’s worth nothing that a broad swath of foreign stock funds, including some index funds and exchange-traded funds, have robust yields today; for example, funds and ETFs that track the MSCI EAFE currently have yields north of 2.5%. PIMCO All Asset All Authority (PAUIX) Category: Tactical Asset Allocation Analyst Rating: Bronze This go-anywhere fund has enjoyed a very strong resurgence thus far in 2016; its year-to-date gain of 11% places in the tactical asset allocation group’s top 10%. But it still has a way to go to atone for its abysmal run from 2013 through 2015, and its results have fallen short of the fund’s self-professed goal of beating CPI by 6.5 percentage points over a full market cycle. Over the past few years, manager Rob Arnott’s unwavering emphasis on emerging-markets equities and debt dragged down results as growth in such markets slowed. Arnott’s focus here is on high-yielding assets with attractive valuations, a quest that has led him to hold emerging markets debt, inflation-protected bonds, and alternative investments, to name a few. He also has the latitude to employ shorts and relies on PIMCO’s funds to populate the portfolio. Analyst Jeff Holt notes that Arnott’s use of leverage is the portfolio’s most distinctive trait; while leverage could spell trouble in a liquidity crunch, Holt believes Arnott has used it responsibly thus far. Templeton Global Total Return (TGTRX) Category: World Bond Analyst Rating: Silver Senior analyst Karin Anderson notes that this fund takes on even more risk than sibling Templeton Global Bond (TPINX). Whereas both funds place a heavy emphasis on emerging-markets debt, this fund stakes more in corporate bonds and isn’t shy about venturing down the credit-quality ladder. That has led to a rocky ride for investors: Anderson notes that the fund has one of the highest correlations to equities of any world bond fund, so despite being focused on bonds, the fund shouldn’t be considered ballast for investors’ riskier assets. Yet Anderson gives the fund plaudits for manager Michael Hasenstab’s successful application of his distinctive strategy, as well as the fund’s experienced team and deep resources. Christine Benz is Morningstar’s director of personal finance and author of 30-Minute Money Solutions: A Step-by-Step Guide to Managing Your Finances and the Morningstar Guide to Mutual Funds: 5-Star Strategies for Success. Follow Christine on Twitter: @christine_benz. For performance data current to the most recent month end, please call 1-866-947-7000 or visit our website at www.causewayfunds.com. As of 6/30/16, the Causeway International Value Fund Institutional Class returned -1.27% (QTD), -13.15% (one-year), 0.73% (three-year), 1.90% (five-year), 2.32% (ten-year) and 6.83% (since inception). Inception is 10/26/01. Performance greater than one year is annualized. As of 6/30/16, Volkswagen Ag represented 3.2% of the Causeway International Value Fund. The performance data quoted for the Causeway International Value fund represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth less than their original cost and current performance may be lower than the performance quoted. Returns greater than one year are average annual total returns. Total returns assume reinvestment of dividends and capital gains distributions at net asset value when paid. All information is as of the date shown. Investment performance may reflect contractual fee waivers. In the absence of such fee waivers, total return would be reduced. The expense ratio for Investor Class shares is 1.15% and for Institutional Class shares is 0.90%. Holdings are subject to change, and current and future holdings are subject to risk. Investing involves risk including loss of principal. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Diversification does not prevent all investment losses. To determine if a Fund is an appropriate investment for you, carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and other information can be found in the Fund’s prospectus, which may be viewed and downloaded by visiting http://www.causewayfunds.com/ or by calling 1-866-947-7000. Read it carefully before investing. Causeway Funds are distributed by SEI Investments Distribution Co. (SIDCO). SIDCO is not affiliated with Causeway Capital Management LLC. The material is not intended as an offer or solicitation for purchase or sale of any security, nor is it individual or personalized investment advice. Causeway Funds and SEI Investments Distribution Co. do not sponsor the opinions or information presented in articles, nor do they assume liability for any loss that may result from relying on these opinions or information. The Morningstar Analyst Rating is not a credit or risk rating. It is a subjective evaluation performed by the mutual fund analysts of Morningstar, Inc. Morningstar evaluates funds based on five key pillars, which are process, performance, people, parent, and price. Morningstar’s analysts use this five pillar evaluation to identify funds they believe are more likely to outperform over the long term on a risk-adjusted basis. Analysts consider quantitative and qualitative factors in their research, and the weighting of each pillar may vary. The Analyst Rating ultimately reflects the analyst’s overall assessment and is overseen by Morningstar’s Analyst Rating Committee. The approach serves not as a formula but as a framework to ensure consistency across Morningstar’s global coverage universe. The Morningstar Analyst Rating should not be used as the sole basis in evaluating a mutual fund. Morningstar Analyst Ratings are based on Morningstar’s current expectations about future events; therefore, in no way does Morningstar represent ratings as a guarantee nor should they be viewed by an investor as such. Morningstar Analyst Ratings involve unknown risks and uncertainties which may cause Morningstar’s expectations not to occur or to differ significantly from what we expected. The Analyst Rating scale ranges from Gold to Negative, with Gold being the highest rating and Negative being the lowest rating. A fund with a “Gold” rating distinguishes itself across the five pillars and has garnered the analysts’ highest level of conviction. A fund with a ‘Silver’ rating has notable advantages across several, but perhaps not all, of the five pillars strengths that give the analysts a high level of conviction. A “Bronze”rated fund has advantages that outweigh the disadvantages across the five pillars, with sufficient level of analyst conviction to warrant a positive rating. A fund with a ‘Neutral’ rating isn’t seriously flawed across the five pillars, nor does it distinguish itself very positively. A “Negative” rated fund is flawed in at least one if not more pillars and is considered an inferior offering to its peers. Analyst Ratings are reevaluated at least every 14 months. For more detailed information about Morningstar’s Analyst Rating, including its methodology, please go to http://corporate.morningstar.com/us/documents/MethodologyDocuments/AnalystRatingforFundsMethodology.pdf.