Free Trade Accounts (FTAs)

Background

The Circular on the Implementation Rules on Separate Accounting Business in the China (Shanghai) Pilot Free Trade

Zone (Interim) and the Rules for the Prudential Management of Risks Relating to Separate Accounting Business in the

China (Shanghai) Pilot Free Trade Zone (Interim) (Circular 46) was released on May 21, 2014. The circular stated that

companies operating in the China (Shanghai) Pilot Free Trade Zone (hereinafter referred to as the “Shanghai FTZ”) would

be allowed to open free trade accounts (hereinafter referred to as “FTAs”) within the Shanghai FTZ to facilitate the free

movement of funds with outside mainland China.

Outline

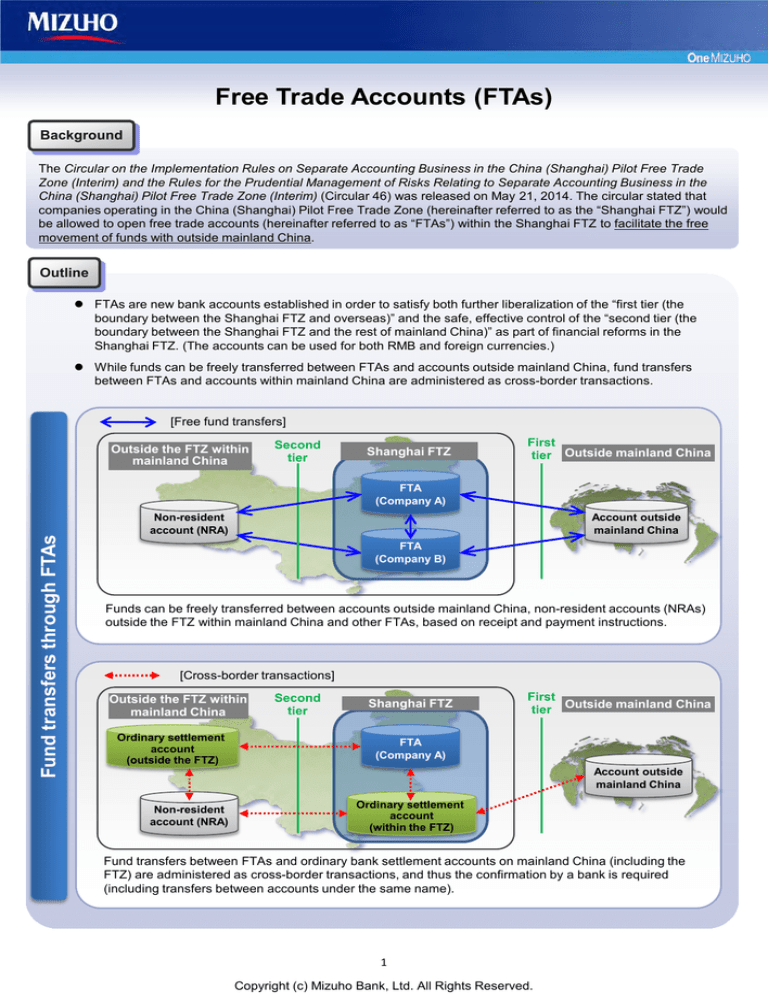

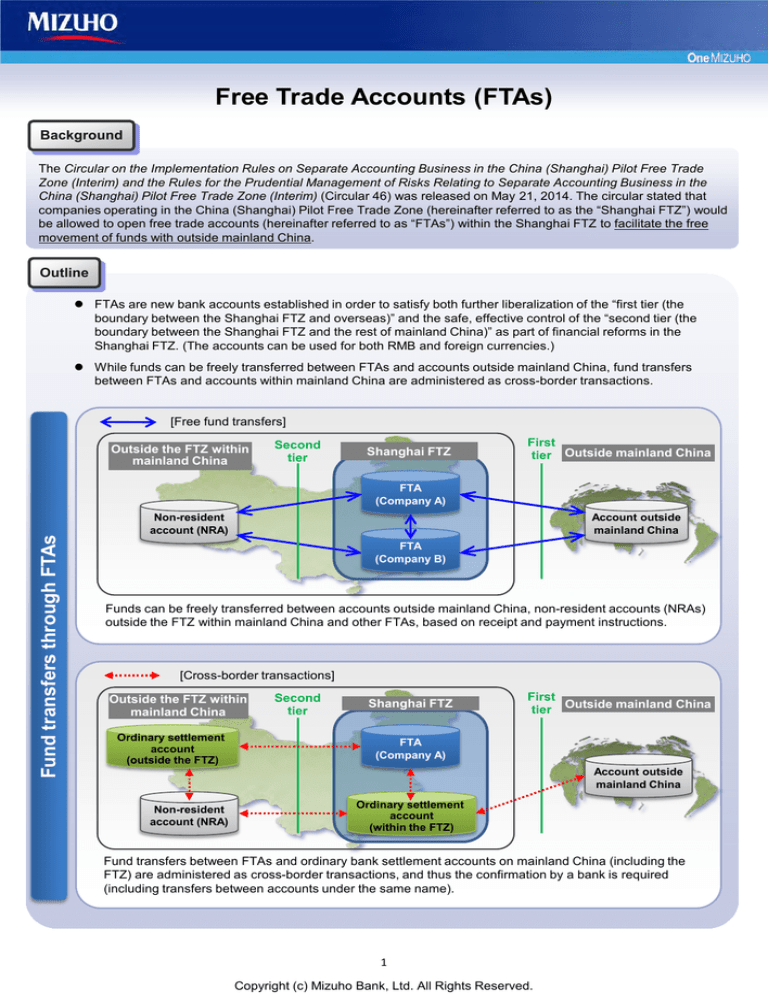

FTAs are new bank accounts established in order to satisfy both further liberalization of the “first tier (the

boundary between the Shanghai FTZ and overseas)” and the safe, effective control of the “second tier (the

boundary between the Shanghai FTZ and the rest of mainland China)” as part of financial reforms in the

Shanghai FTZ. (The accounts can be used for both RMB and foreign currencies.)

While funds can be freely transferred between FTAs and accounts outside mainland China, fund transfers

between FTAs and accounts within mainland China are administered as cross-border transactions.

[Free fund transfers]

Outside the FTZ within

mainland China

Second

tier

Shanghai FTZ

First

tier Outside mainland China

Fund transfers through FTAs

FTA

(Company A)

Non-resident

account (NRA)

Account outside

mainland China

FTA

(Company B)

Funds can be freely transferred between accounts outside mainland China, non-resident accounts (NRAs)

outside the FTZ within mainland China and other FTAs, based on receipt and payment instructions.

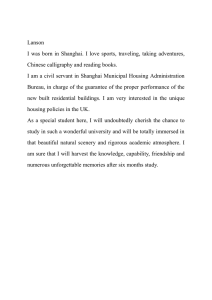

[Cross-border transactions]

Outside the FTZ within

mainland China

Ordinary settlement

account

(outside the FTZ)

Second

tier

Shanghai FTZ

First

tier Outside mainland China

FTA

(Company A)

Account outside

mainland China

Non-resident

account (NRA)

Ordinary settlement

account

(within the FTZ)

Fund transfers between FTAs and ordinary bank settlement accounts on mainland China (including the

FTZ) are administered as cross-border transactions, and thus the confirmation by a bank is required

(including transfers between accounts under the same name).

1

Copyright (c) Mizuho Bank, Ltd. All Rights Reserved.

Offshore financing through FTAs

Background

The Circular on the Implementation Rules for Macro-prudential Management of Offshore Financing and

Cross-border Capital Flows for Separate Accounting Business in the China (Shanghai) Pilot Free Trade

Zone (Interim) (Circular 8) was released on February 12, 2015. The circular stated that companies

operating in the Shanghai FTZ would be allowed to use FTAs to borrow offshore loans (foreign debt) of

up to twice the company’s capital (paid-in capital + capital reserves) from outside mainland China.

Outline

In addition to the traditional methods of obtaining offshore financing, companies in the Shanghai FTZ can

choose one of the following three options.

(1) Foreign debt administration based on the borrowing gap (traditional method)

(2) Administration of offshore RMB-denominated loans based on paid-in capital

(launched in February 2014)

(3) Administration using FTAs (this example)

In principle, no changes are admissible after a company has selected which of (1) to (3) to use. If the

company has to change the selection for a rational reason, they need to file an application, via their

settlement bank, to the PBOC Shanghai Head Office. Only one change is permitted.

Within mainland China

Outside mainland China

Financing scheme

Account outside

mainland China

FTA

Shanghai FTZ

Financing

Repayments

2

Copyright (c) Mizuho Bank, Ltd. All Rights Reserved.

Foreign debt financing models: A comparison

(1) Borrowing gap* model

(traditional method)

Foreign companies located on

Target companies mainland China (including both

within and outside the FTZ)

(2) Paid-in capital model

(3) Macro-prudential management

model

Companies within the FTZ

(Chinese or foreign)

Companies within the FTZ with an

FTA (Chinese or foreign)

Target currency

RMB/foreign currencies

RMB

RMB/foreign currencies

Financing account

Special account

(RMB/foreign currency)

Special RMB account

(a financial institution in the

Shanghai area)

FTA

(opened at a financial institution

located within the Shanghai FTZ)

Fund usage

Usage based on actual demand

Usage based on actual demand

Usage based on actual demand

Loan period

Unrestricted

One year and longer

(including one year)

Unrestricted

Within the borrowing gap

Paid-in capital × 1 × macroprudential adjustment parameter*3

Capital*1 × offshore borrowing

leverage ratio*2 × macro-prudential

adjustment parameter*3

Upper limit to

financing

Balance management by multiplying

the amount by the following risk

factors*4

<RMB>

Accrual management for shortterm and medium/long-term

(quota not restored)

Management of

debt quota

<Foreign currencies>

Short-term: Balance

management (quota restored

after repayment)

Medium/long-term: Accrual

management

[Balance within the credit limit] =

Offshore financing balance × (1) period

risk conversion factor × (2) currency

type risk conversion factor × (3)

categorization risk conversion factor

• Foreign currency trade finance (×

20%)

• Including off balance financing

Balance management

*1: Capital = [paid-in capital + capital reserves]

*2: The leverage ratio differs for each company. For companies within the Shanghai FTZ, the ratio is “2.”

*3: The parameter is initially set at “1.”

*4: Type of risk and factor

Type of risk

(1) Period risk

(2) Currency type risk

(3) Categorization risk

Risk category

Medium/long-term loans

Short-term loans

RMB-denominated

Foreign currency-denominated

On balance financing

Off balance financing

Factor

1

1.5

1

1.5

1

0.2, 0.5

(* For details about the borrowing gap, please consult the separately listed “RMB-denominated Investment & Capital Increases.”)

If you have any inquiries, please contact the branch in charge of your account or any local Mizuho branch.

Disclaimer & Confidentiality

1. Purpose:

This publication is compiled solely for the purpose of providing readers with information and is in no way meant to

encourage readers to buy or sell financial instruments.

2. Legal, accounting and tax advice:

The information contained herein does not incorporate advice on legal, accounting or tax issues. You should obtain your

own independent professional advice on the legal, accounting and tax aspects of this information.

3. Copyright:

The information contained herein is, as a general rule, the intellectual property of MHBK, and may not be copied,

duplicated, quoted, reproduced, translated, or lent, in whole or in part, in any form or by any means for any purpose

whatsoever without prior consent.

4. Limitation of liability:

The information contained herein was obtained from information sources deemed reliable by MHBK but in no way is the

accuracy, reliability or integrity of such information guaranteed. The contents of this publication may be changed without

prior notice. MHBK disclaims any liability whatsoever for any damage arising out of or relating to this information.

3

Copyright (c) Mizuho Bank, Ltd. All Rights Reserved.