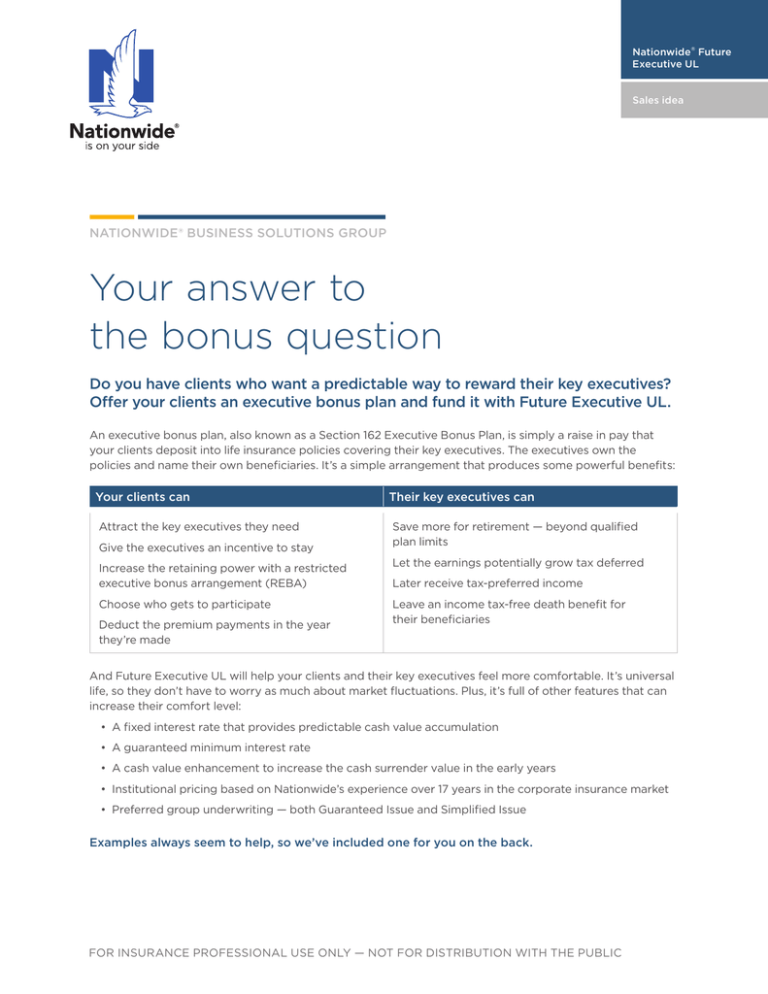

Your answer to the bonus question

advertisement

Nationwide® Future Executive UL Sales idea NATIONWIDE® BUSINESS SOLUTIONS GROUP Your answer to the bonus question Do you have clients who want a predictable way to reward their key executives? Offer your clients an executive bonus plan and fund it with Future Executive UL. An executive bonus plan, also known as a Section 162 Executive Bonus Plan, is simply a raise in pay that your clients deposit into life insurance policies covering their key executives. The executives own the policies and name their own beneficiaries. It’s a simple arrangement that produces some powerful benefits: Your clients can Attract the key executives they need Give the executives an incentive to stay Increase the retaining power with a restricted executive bonus arrangement (REBA) Choose who gets to participate Deduct the premium payments in the year they’re made Their key executives can Save more for retirement — beyond qualified plan limits Let the earnings potentially grow tax deferred Later receive tax-preferred income Leave an income tax-free death benefit for their beneficiaries And Future Executive UL will help your clients and their key executives feel more comfortable. It’s universal life, so they don’t have to worry as much about market fluctuations. Plus, it’s full of other features that can increase their comfort level: • A fixed interest rate that provides predictable cash value accumulation • A guaranteed minimum interest rate • A cash value enhancement to increase the cash surrender value in the early years • Institutional pricing based on Nationwide’s experience over 17 years in the corporate insurance market • Preferred group underwriting — both Guaranteed Issue and Simplified Issue Examples always seem to help, so we’ve included one for you on the back. FOR INSURANCE PROFESSIONAL USE ONLY — NOT FOR DISTRIBUTION WITH THE PUBLIC Here’s how this idea can work. Let’s say your client is a local paint manufacturing company. The owners know their 10 account executives are the key to their success. They already pay them very well, but they want to do more to help retain the account executives. What’s important to the client? • Helping the executives save more for retirement — they already max out on their qualified plan contributions • Getting a current tax deduction for the company • Giving the executives policy ownership and control, but also creating an incentive for them to stay with the company The solution: With your help, they set up an executive bonus plan. Each executive will get an annual bonus for 20 years, deposit it into his/her own corporate-sponsored Future Executive UL policy, let the cash value accumulate and then take income during retirement. Here’s how that would look for the oldest executive: Deposits: $10,000 x 20 years = $200,000 Withdrawals: $32,394 x 10 years = $323,940 — withdrawals are income tax-free up to basis Death benefit: If he/she dies, his/her family will receive the death benefit, also income tax free This case study is a hypothetical example and not intended to represent any specific client or client situation. The assumptions are for illustrative purposes only; actual results will vary. Illustration is based on Future Executive UL, which is not available in every state. It reflects Guaranteed Issue underwriting, rates for a male, age 45, Nontobacco and death benefit Option 2 at issue. A 4.55% gross rate of return is assumed. Annual premiums of $10,000 are paid for 20 years; withdrawals of $32,394 begin in year 21 and continue for 10 years. Call us today to help your clients reward key employees with Future Executive UL. Name: [Name] Contact Information: [Business email] [Business address] [Business phone] • Not a deposit • Not FDIC or NCUSIF insured • Not guaranteed by the institution • Not insured by any federal government agency • May lose value All protections and guarantees are subject to the claims-paying ability of Nationwide. Be sure to choose a strategy and product that are suitable for the long-term goals of both the business and its employees. Life insurance has fees and charges associated with it, which include costs of insurance and administration fees. Loans and withdrawals will reduce the death benefit. If the contract is a modified endowment contract (MEC) according to Section 7702A of the Internal Revenue Code, most distributions from the policy will be taxed on a last-in/first-out basis. Loans from a MEC are generally taxable and subject to a 10% early withdrawal federal tax penalty if taken before age 59½. If the policy lapses with a loan outstanding, it will be treated as a distribution and some or all of the amount may be taxable. Nationwide and its representatives do not give legal or tax advice. Please consult an attorney or tax advisor for answers to specific questions. Life insurance is issued by Nationwide Life Insurance Company, Columbus, Ohio. Nationwide, Nationwide is on your side and the Nationwide N and Eagle are service marks of Nationwide Mutual Insurance Company. © 2011, 2015 Nationwide FOR INSURANCE PROFESSIONAL USE ONLY — NOT FOR DISTRIBUTION WITH THE PUBLIC CLM-0499AO-BG.1 (10/15)