November 2015 - Marcon International, Inc.

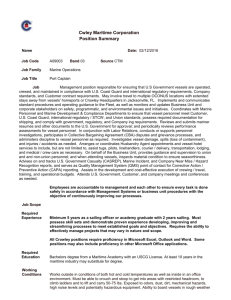

advertisement