Transpower New Zealand Limited: Managing risks to transmission

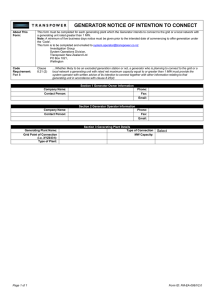

advertisement