2012 Regional Technical Assistance Participant Guide

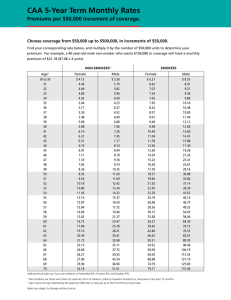

advertisement